Are you trying to save money and yet, you do not understand the benefits of saving money? If so, you have come to the right place. Saving money is the foundation of any goal you can think of that requires money.

By having disposable money, you will achieve anything you want in your life.

In this article, I am going to show you the top 13 benefits of saving money.

1. You will achieve your financial independence faster

Millions of people around the world dream about financial independence. Yet, most of them end up failing to achieve this dream. This is because they do not learn how to save money and use proper money-saving tips.

Saving money can help you achieve your financial independence faster. Once you have the money, you will find a way to use it and generate more money through investments and other means.

However, if you do not save money, all other steps toward your financial independence will not work.

Related article: Financial Independence: 18 Tips To End Your Struggle With Money

2. You will achieve your retirement goals

Are you worried about your retirement? Well, most of us are. You are not alone. Your retirement comforts will depend on the money you will have in your account.

After you retire, you will not be able to generate an active income. This is because your physical and mental health will deteriorate dramatically. As a result, your performance will do down as well.

Unless you have investments that generate passive income for you or have enough money in the bank, your remaining years be miserable. I guess I am saying that you will work until you die.

To solve this problem, start saving money as much money as you can. If you don’t make enough money to cover your retirement, start investing all money you save to generate more.

You can also find away to increase the money you earn at your job or have a side hustle.

This is how you will be able to achieve your retirement.

>>LEARN MORE: How To Get A Raise Or A Promotion At Work?

>>LEARN MORE: 20 Ways To Make Money From Home

3. Benefits of Saving money: You will cover emergency problems

Emergencies do not tell you when they will show up. If it was the case, everyone would be prepared when they come. This is why they are called emergencies! For example, you can get into a sudden car accident while driving to work and your medical bill could be enormous.

Without money to save you during these difficult times, you will end up in financial struggles that could have been avoided if you saved money.

This is one of the best benefits of saving money. The money you save will cover all or some of your emergency expenses.

4. Benefits of saving money: You will have money to invest

The money you save will set a foundation for your investments. For example, if you have a few hundreds of dollars, you can invest them in the stock market.

On the other hand, if you have thousands of dollars, you can invest them in more expensive investments such as rental properties.

There are many investments you can get involved in and all will depend on how much money you have saved. So, start saving today if you want to invest.

5. You will have enough money for your kids’ education

Do you have children? If so, you will be paying their tuition soon or later. You will have a lot of struggle to fund their education if you did not save money.

You can solve this problem by saving as much as you can. Creating a tuition fund for your children will be beneficial. You can have a savings account designed specifically for your kids’ tuition fund.

The money in the account will grow as you add more to it. You will also earn a small percentage return on that account.

6. You can fund your wedding

Are you planning to get married in the near future? If so, you must save money for your wedding. Weddings are very expensive and you can get in a huge debt if you do not finance them wisely.

Make your wedding a saving goal and work to achieve the number you want to spend on your wedding.

For example, you can make a $30,000 wedding your goal. Depending on how much you make and the time left to reach your wedding day, you can break this number down as follow:

- Divide $30,000 by the number of years between now and your wedding date. This will give you the amount you will need to put into your wedding fund each year. For example, if you have 5 years between now and your wedding, you will need to put $6,000 in your fund each year.

- Next, divide $6,000 by 12 to know how much you must allocate in your wedding fund every month. In our example, you will need to put $500 in your wedding fund every month.

By following this technique, you will know how much you need to save for your wedding.

7. Benefits of saving money: Your savings will finance your vacation

Your vacation will cost you a lot of money than you previously anticipated. Your plane ticket, hotels, and related travel expenses will come in thousands. Everything will depend on where you go and how you get there.

You can get ready for this huge expense by saving money ahead of time. It is difficult to know how much money you need to save for a vacation. However, you can have a rough estimation of your vacation expenses.

You don’t want to go on a vacation and realized that there is not enough money to pay for everything.

The last thing you want to be is being stressed on your vacation.

>> LEARN MORE: 11 Ways To Save Money On Hotels

>> LEARN MORE: 11 Easy Ways To Save Money On Flights

8. You can go back to school if you save money

Maybe you want to go back to school. Well, there is nothing wrong with it. The only problem is that you will still have to pay for your education.

If this is the case for you, consider saving money for your upcoming education. This is because you will probably work less while in school. So, saving money earlier can help you reduce stress while continuing your education.

9. You will have a down payment for a house or a car

Owning a house is a dream of almost every person in the world. No matter the age, race, gender, etc. we all need a place we can call our own.

The biggest single expense you will encounter when buying a house is a down payment. You will need at least a 20% down payment for a conventional mortgage. Besides, you will need to cover other expenses and be able to make your monthly payments.

What about those who want to buy cars? You will still need to have a down payment on the car loan and meet your monthly payments as well.

So, to meet these requirements, you must save a lot of money ahead of time.

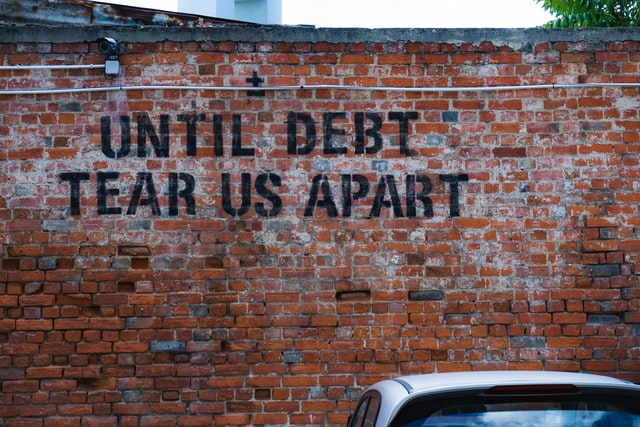

10. Saving money will help you keep your debt lower

You will have less debt when you save money. This is because you will use your savings to cover your expenses instead of borrowing from the bank, credit card, friends, and family members.

Always remember that the more money you borrow, the more debt you accumulate. As a result, the harder it will be for you to pay them off.

11. Benefits of saving money: You will have money to donate

Are you into charities and helping other people? Well, having disposable funds can help you achieve your giving and charity goals.

You can always help at your local church or volunteering organization. But, what about those places you cannot reach? Like building a kid’s school in the middle of nowhere in India, Africa, Asia, or South America?

You cannot fly to all these places just to volunteer there. And if you fly there, it will cost you more money that could have been used to cover other expenses.

Instead of flying there, you can send a few dollars to each of these places from your savings. This way, your contributions will be memorable and you will spend less.

12. Saving money can help you start a business

If you want to start a business, you will need to have a lot of money to get it up and going. Of course, you can go to your local bank and grab a business loan.

What is wrong with this idea? You will start paying interest on this loan before your business is profitable. In other words, you will be getting into more debt which will end up hurting your business and your financial standing. This is the biggest many business owners make. I mean those that failed.

It will also be difficult to find a private investor who is willing to give you money for just an idea. Investors need a track record of good performance.

This is why funding your business using money from your own savings is the smartest way to start a business. You will have enough time to go through the learning curve without paying a dime in interest.

13. Benefits of saving money: Your savings can cover your expenses when you are laid off

The economic conditions have changed in a way that none knows when they will be laid off. You can go to your job and receive a letter telling you that you no longer work there.

Getting laid off does not take your expenses away. So, how will you pay off your expenses if you are not making money?

The answer will come down to how much you have saved. Your saving will help you cover your expenses while looking for another job or creating your own.