What Is Channel Trading?

Channel trading is a trading strategy used in technical analysis that relies on support and resistance levels. This trading technique helps investors and traders to know when they should buy or sell stocks.

Understanding Channel Trading

Channel trading is drawn by two lines where the top line indicate the resistance level and the lower line indicates the resistance level.

The resistance level is a level where the price cannot break above for some time.

The support level is a level where the price cannot break below for some time.

You can visualize examples of support and resistance level in Figure 1 depicted below.

By knowing where the support and resistance levels are, investors can take long positions or short positions. If support and resistance levels continue to hold for a long, it could be a trading opportunity.

Traders can draw a channel using these levels as a guideline.

They can then take a long position at the support level and a short position at the resistance level.

Trading channel on a chart

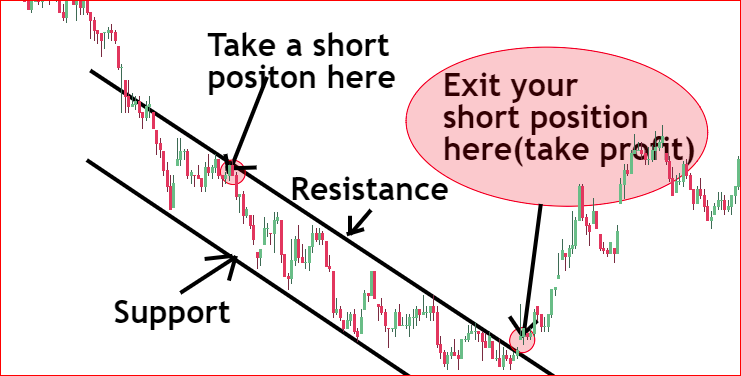

You can observe the trading channel in Figure 2 depicted below.

Channel trading is not a difficult technique to master. However, a trader who uses this technique must have a complete understanding of support and resistance levels.

The following sections will help you understand how you can find and draw the pricing channel on a chart.

Finding and drawing the pricing channel

The trading channels can happen in any direction. You can have an ascending channel as we have in Figure 2 above, a descending channel, or a horizontal channel.

To draw the trading channel, you will need at least two prices that can be connected with a line to form a support level and two prices that can be used to form a resistance level.

After finding these prices, you will then draw your support and resistance lines. These two lines will form the channel and the price will be expected to stay inside the channel until there is a breakout.

When trading using a channel, you should trade when the price is inside the channel and exit at the breakout.

How to trade using a trading channel?

You can take a long position when the channel has an ascending trend and take a short position when the channel has a descending trend.

You must understand that this is a strategy that relies on support and resistance levels.

A long position on the channel

Once you have identified and drew the channel, you will take a long position after you have a confirmation that the price has rejected the support level. You must exit your trade whenever the price breaks below the support level, especially on high trading volume.

You will put a stop-loss order a little under the support level depending on your risk tolerance. Once the price breaks below the support level, you must exit a long position before you lose a lot of money.

You will take profits when the price shows you a sign of a reversal in the trend. That is, a reversal in the trend will be a sign of a downtrend. For this reason, you must sell and exit your position after the confirmation of a downtrend.

Since it is difficult to know when a stock will shift a trend, you can use a trailing stop order. A trailing stop order will kick you out of the market when the price reverses the trend while protecting your profits.

Shorting the market on a trading channel

You can short a stock when the channel is in a descending trend. You will take a short position when you have a confirmation that the price rejected the resistance level at a high trading volume. Rejecting the resistance level will be an indication of a possible downtrend.

Your stop-loss order will be a little above the resistance level. This means that once the price breaks above the resistance level, your short position will no longer be profitable. For this reason, you must exit your short position.