One of the greatest ways to save money is to have saving money challenges that allow you to stay on the right path and avoid quitting temptations.

I know saving money is not that easy especially when you are surrounded by people who don’t save at all. In addition, saving money becomes harder when your income is tight and your budget does not allow you to stash a few bucks on the side.

I used to struggle with the same issue myself until I started practicing these 2 saving money challenges I am going to share with you. These saving money challenges helped me turn my life around and became the master of my finances.

Well, at least by now I can say that I no longer have to worry about when I am going to be paid, getting kicked out of my apartment because my account is dry, or simply waiting for the next paycheck to put food on the table.

These money saving money challenges can help you save money that is needed for a big purchase like:

- A downpayment for a house

- Buying a car

- Starting college

- Wedding

- Investment

- Proposal ring

- Travel and many more

It could also be something simple such as saving money for a donation or building an emergency fund.

So, if you are interested in saving money challenges that are sometimes fun, you have come to the right place. Keep in mind that some of these challenges will directly be impacted by how much you make per month and your lifestyle. You can easily save 50% of your income with these challenges especially the second one.

Related: 4 ways to save for emergency fund fast

What is a saving money challenge?

A saving money challenge is a rule you set for yourself or for others to help you save a predetermined amount at a given time. In order to achieve your target amount, you must decide how much you can safely put away each time you save.

Saving money challenges vary in contribution sizes depending on the purpose of the challenge. For example, a person who has a small income and wants to save money for a house downpayment must be aggressive and how they use these saving money challenges.

At the same time, a person who has a large income can easily save enough money for a downpayment with ease. Well, assuming that they are not buying a house that is too expensive.

So, let’s dive into these 2 saving money challenges.

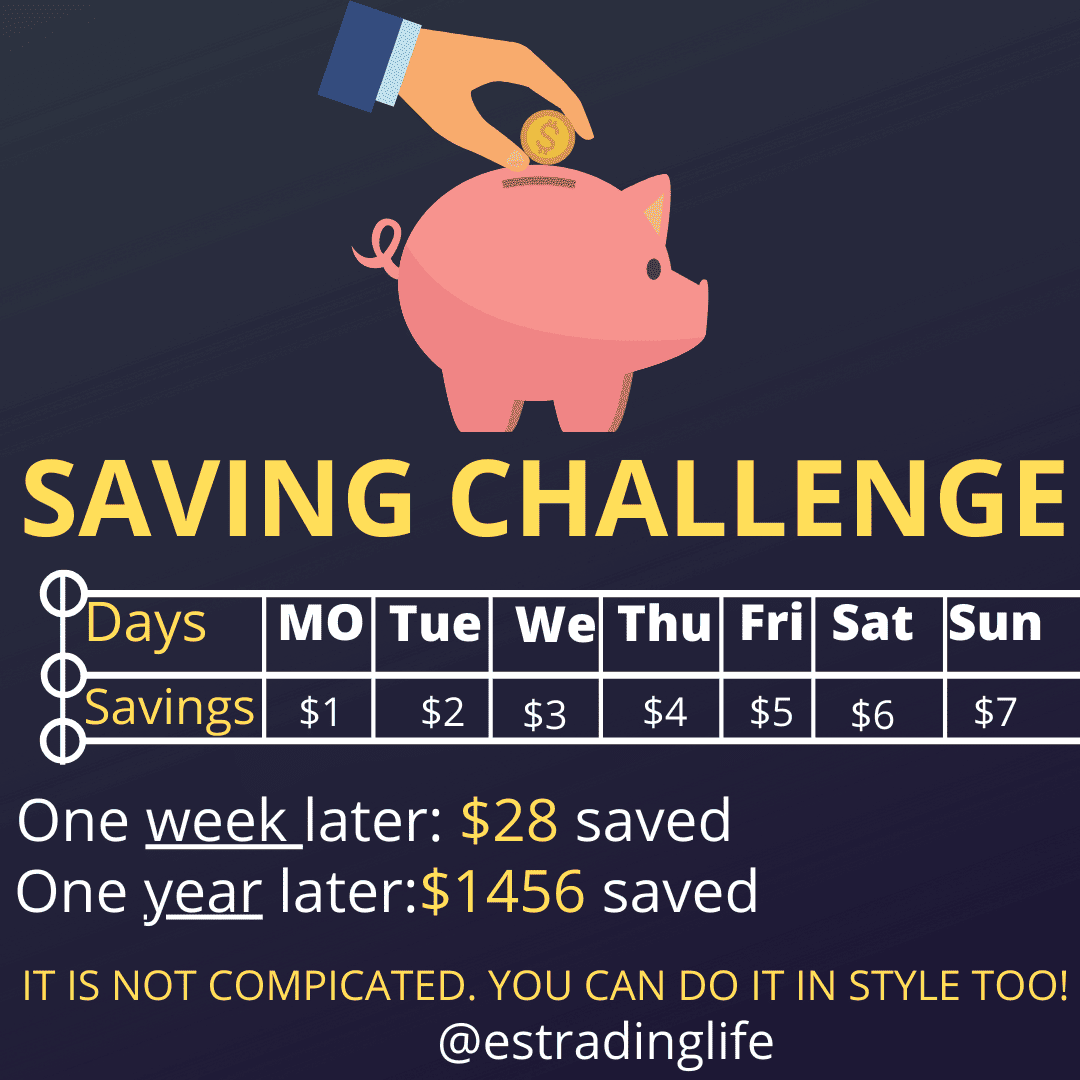

Saving money challenge No. 1: Save $1,456 per year or more

This saving money challenge is probably the easiest and most fun challenge you can think of. The process of using this challenge is simple and self-explanatory and it will work better for the following people.

- Need to save a small amount: The purpose of this challenge is not for those who want to save a ton of money in a year. Instead, it is for those who want to save like $1,500 a year that can be used for Christmas gifts, college funds for your child due in the next 10 or so years, a donation, or something similar in terms of cost.

- Those struggling to save: It is not easy to save money and many people struggle financially due to the lack of saving strategies. If you have been having trouble saving your money, this saving money challenge can be your guide. It does not require a lot and it is easy to practice.

How does this challenge work?

Just like it is illustrated in the above image, you need to save a dollar amount equal to the day of the week. For example, if you are on Monday, you will save $1. On Tuesday, you will need to say $2, and so on. This process will continue until you reach Sunday where you will save $7. You will then repeat this process until a year is over.

This saving money challenge is easy and fun at the same time. You don’t need to save thousands of dollars every day. Putting a few dollars away every single day will add up to a large sum.

If you want to save more money with the same saving money challenge, increase how much you put away per day. For example, you can choose to start with $10 and add one more dollar each day. This system will yield $4,368 at the end of the year.

You can modify this saving money challenge in ways that work for you. If you think this challenge is not enough for you, the following money-saving challenge will help you save a lot more money.

Saving money challenge No. 2: Save 50% of your paycheck for an entire year

If you think that the first saving money challenge is not challenging enough, take it to the next level with this one instead.

This challenge is for those who want to save money for a large purchase just like I illustrated above. I used both money-saving challenges to save for my travels and down payment.

With this saving money challenge, you will need to save 50% of your paycheck whenever you are paid.

This might sound easy but it is hard for most people. As harsh as it sounds, millions of people have almost nothing in their savings accounts. A report from Fool published in 2020, showed that the average savings balance account for Americans was $3,500.

If you are one of the people with an average saving account balance of $3,500, it can prove difficult to save half of your paycheck. This is because you are used to spending most of your money, and therefore, you need to make some serious financial adjustments to reach success with this money challenge.

How to save half of your income?

Saving half of your income is not like any other saving money challenges. This saving amount goes beyond savings most people attempt. It can be difficult to afford to put away 50% of your income on top of all other expenses you have.

So, how can you do it? The best way to save half of your income is to first create a tight budget especially when your income is very small. Having a small income simply means that you must get rid of most of your expenses to boost your savings. There is no other way.

When it comes to putting away 50% of your income will still be difficult even if you reduced your expenses.

What you can do to save half of your income is to automate your savings.

Related: 8 clever ways to live on a tight budget

A winning strategy to save 50% of your income is: Automation

You can afford to put away 50% of your income once or twice. But, you might find it challenging to repeat this process dozens of times a year.

The world is full of temptations and your chances of losing on this saving money challenge will increase.

The best solution is to automate your savings into a savings account directly from your company.

Instead of receiving your full paycheck in your hands and then saving half of it, have the portion you want to save directly deposited in your savings account. This way, you will not see that money in your hands which will reduce your temptations to spend it. You cannot spend the money you did not see.

This money-saving chellenge can help you save more money if you have other financial means to cover your expenses. The key here it to automate it. The more you want to save, the harder it will be to keep up with the challenge. So, stick to automation.