What is return on sales?

The return on sales is a financial ratio that measures the profitability of a company in relation to its sales. The higher the ratio the better. More revenues increase the company’s stability, profitability, and growth. For this reason, investors and debtors favor companies with enough revenues.

How to calculate the return on sales?

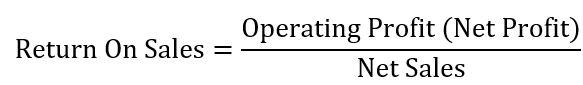

The return on sales ratio is calculated by dividing the operating profit by the net sales, according to Hubspot, and Investopedia.

In this formula,

Net profit= Revenues – expenses. This is also considered to be earnings before interest and taxes or EBIT.

Example

Let’s assume that ABC company reported net sales of $150,000 and an operating profit of $125,000 on its income statement. What is the company’s return on sales?

To answer this question, we will use the following steps.

Step 1: Available data

- Net Sales = $150,000

- Operating Profit = $125,000

Step 2: Calculate the return on sales

From these calculations, we can conclude that for every dollar of sales, the company generates 83 cents in profits.

Why does the return on sales matter?

This ratio measures the efficiency of a company in generating profits from its sales. More profits help the company to continues its operations. That is the profit helps the company to finance its projects without getting more debts.

By default a business must generate enough profits if it is to stay operational for a while.

Since this ratio measures how much profit a company is generating from its sale, a higher ratio indicates that a company is healthy, stable, and can sustain itself.

On the other hand, a low ratio shows that the company does not generate enough profits from its sales. This indicates that the company’s management team does not wisely allocate its assets and resources to maximize profits.