Why do people lose money in the stock market? You probably heard that most people lose money in the stock market. This is true. As noted by Research and Ranking, 90% of people lose money in stocks.

This percentage is shocking, but unfortunately, it is true. You will likely lose money if you trade or invest in stocks. Even if the risk of losing money in the stock market is high, you can still win by following the same investing and trading strategies that successful traders and investors use.

I spent a few days writing this article to explain why people lose money in the stock market and how to avoid making the same mistake. I will show you the top 14 reasons people lose money in the stock market.

At the end of this post, you will learn the following two things about the stock market.

- Why people fail in the stock market

- What you can do differently before you bet your hard-earned money

By knowing the mistakes 90% of traders and investors make, you can claim your spot in the top 10% of winners. Sounds good, right?

Without further ado, the following are the top 14 reasons people lose money in stocks.

1. Not having enough education causes people to lose money in the stock market

Knowledge is the key to success in the stock market. People who educate themselves about the stock market increase their chances of success.

So, before investing money in the stock market, learn as much as possible. At least have the basic knowledge of the market.

For example, you must know how to make orders, the risks associated with each order, basic investing techniques and terminologies, etc. In addition, you will need to know the proper tools and software that work based on your investment strategies.

This is important because day traders must use programs built for active trading strategies. Day trading means a trader buys and sells stocks and other tradable securities within the same day. Long-term investors, on the other hand, do not need complicated software to analyze stocks and make trades.

The more you know, the better.

People who lose money in the stock market do not understand how markets work. They have no idea what moves stocks or what proper methods to use in different scenarios. Without knowledge, losers end up making losing trades.

How to avoid this problem?

To avoid losing money in the stock market, you must learn as much as possible before investing.

The following tips will help you get started with the stock market and learn the most important stock investing and trading strategies.

- Learn the basics of investing and trading. Understand how the stock markets work, what moves prices on the market, how to buy a stock, types of buying and selling orders and how to use them, rules of trading, etc.

- Learn based on your trading strategies. Whether a day trader or a swing trader, you will need a platform that helps you analyze stocks in the short term. In addition, learn as much as you can about technical analysis. A basic understanding of trading patterns, trading indicators, support level, resistance level, trend, etc., will increase your chances of success in the stock market.

- If you are a long-term investor, learn as much as possible about fundamental analysis. Learn how to evaluate companies instead of share prices. In other words, you need to know how to analyze financial reports, ratios, analyze sectors, economic conditions, etc. On top of researching companies, you must analyze their competitors.

- Start with paper money. A paper money account lets you make normal trades using fake money, learn the basics, make mistakes, and correct them. This is a perfect way to build enough experience without using your hard-earned money.

- Learn how to prevent losses and manage emotions when trading. Start with simple methods like stop-loss orders and trailing stop orders.

- Have a plan before you make a trade. Know your entering, exiting, and profit-taking strategies.

Tip: Before you play the game, you must learn its rules.

2. Too many emotions make people lose money in the stock market

The biggest enemy that many traders and investors face is their minds. Your mind tells you that a stock is worth trading and is profitable. At the same time, the same mind tells you to sell after the price has gone lower and you have lost money. Winning in the stock market is more a psychological game than the stock you buy.

If used well, the mind can make everyone a millionaire. However, if not checked, it can lead to a disaster. Many people lose money in the stock market because they fail to control their emotions.

After emotions take over, it is always impossible to make successful trades.

Emotional traders make reckless trades. They buy and sell stocks without meaningful reasons behind their actions. Losers trade with a lot of emotions.

Common emotions people face when trading stocks

The following are some of the many emotions you will face when trading.

- I need to make my money back: This emotion leads you to trade recklessly

- I am being left behind. Makes you buy stocks at premium prices

- The stock price will go much higher. Prevent you from locking in profits

- I don’t want to lose all my money. Convinces you to sell stocks at their lowest (bottom) prices

Bottom Line: Losers trade with emotions, whereas winners keep their emotions in check and stop trading once they start being emotional.

Tips to avoid emotions when trading stocks and investing in equities

To succeed in the market, you must master your mind and be in control instead of your emotions.

The following tips can help you manage your emotions and increase your chances of making money in the stock market.

- Have enough sleep

- Eat well

- Learn about the market conditions before the market opens

- Have a plan on what to trade, why you are trading them, how to trade them, etc.

- Know your risk tolerance (know how much you can afford to lose and trade accordingly)

- Avoid trading more when you are losing.

3. Not using risk management strategies

Loss prevention strategies are useful when trading stocks and investing in equities. No matter your trading techniques, you must always prevent significant losses.

Your loss prevention methods will depend on your risk tolerance and investing strategies. For example, a person investing money from a retirement account will have stricter loss prevention methods than financially independent or young investors.

Some loss prevention methods will stop you from trading whenever a stock moves in the opposite direction from your anticipated direction.

Novice traders forget to protect their investment accounts against major losses. They think that a stock that goes down always comes back up. Well, that is not always the case. There are times when a stock slides and hits zero value. The truth is that a stock can always make a lower low.

People who lose money in the market rely on hope instead of winning strategies. After losing 10%, they think the market is about to rebound until they lose 20%, then 40%, then 70%, etc. What happens next? They decide to sell and never come back into the stock market. What if they sold after losing only 10%? In this case, they would still have 90% to trade with.

The point here is: A small loss can turn into a bankruptcy if it is not managed.

Experienced investors and traders know that losses in the market are inevitable. For this reason, they decide how much they can lose on every trade.

Tips to avoid losing money in the stock market with loss prevention methods

Use loss-prevention methods to avoid losing more than you can afford in the stock market. Some tips may be helpful depending on your trading strategies (long-term, short-term, day trading, shorting, or going long). Check out the following prevention strategies to mitigate losses when investing in the stock market.

- Do not use market orders.

- Only use limit orders.

- Avoid highly volatile stocks such as penny stocks and gappers.

- Know your risk tolerance

- Use trailing-stop orders

- Diversify stocks in your portfolio

- Allocate your money appropriately

- Have a trading or investment strategy

You might also like learning the basics of day trading and different day trading strategies.

4. Taking big position sizes causes people to lose money in the stock market

The position size is the number of shares of a company you are holding in your trade at a particular time. A higher position size increases your profit if the security goes in your anticipated direction.

The dark side of a large position size is that you can lose money if the stock goes against you.

>>My Fact: It is possible to lose all your money on a single trade

Many people lose money in the stock market because they fail to understand the correlation between position size and potential loss. To clarify this point, we are going to use an example.

Suppose your position size in XYZ company is 1000 shares, and you bought them at $10 per share. This brings the total amount you invested to $10,000. If you lose 10% on this trade, your portfolio will drop $1000.

What if you only had 100 shares (100 shares will equal $1000 invested in the stock)? In this case, a 10% loss will reduce your account by $100. You can see that the bigger your position size, the more money you lose when the market moves against you. The opposite can also be true. A big position size will bring in more returns if the stock moves in the direction you anticipated.

Exceptional traders and investors clearly understand the role of position size in affecting their portfolios. They take a safe position to avoid major losses and yield maximum profit.

Many people, however, take large position sizes and lose money. Unless you are insider trading [It is illegal, and never do it], there is no way you can be certain about the price trend.

What is a good position size to avoid losing money in the stock market?

Consider using the following tips to avoid taking on a much bigger position size.

- Your position size will depend on your account size and risk tolerance

- As noted by Investopedia, you should not lose more than 1% on a single trade.

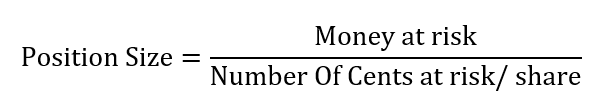

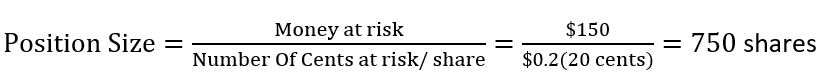

- Assuming you are risking 1%, your position size should be calculated using the following formula: [Credit: The balance]

Example: Suppose you want to invest $15,000 and are willing to lose 1% at most, or $150. If you want to buy a stock at $10 per share and are willing to lose only 20 cents per share, you will need to put a stop-loss order at $9.80.

From this calculation, the number of cents at risk is 20, and you are willing to lose $150 in total.

We will get the following position size by putting these two numbers in our formula.

Remember that this position size could be a lot due to volatility. If a stock is volatile and you have a small account, you must lower your risk. For example, instead of buying more shares, you can buy 100 shares and increase the number of cents you are willing to lose per share. Or reduce both the position size and the number of cents you are willing to lose.

Furthermore, this position size could be risky based on your investment strategies. 750 shares at $10 per share cover half the entire portfolio size (assuming you only have $15,000).

From an investment point of view, this is a huge concentration of capital in one security and does not fit diversification and asset allocation strategies.

5. Failing to diversify causes people to lose money in the stock market

You probably heard this: “Never put all your eggs in one basket.” Diversification protects your portfolio if one of your stocks or sectors you invested in crashes.

People who lose money in the market fail to diversify their portfolios properly. They put all their money in a single sector or related sectors. This hurts their portfolios very badly when those sectors crash. More importantly, it is likely that some of the companies they hold will go bankrupt during the crash.

For example, putting all your money in oil stocks and ETFs would not be a good idea. If the oil market crashes, your portfolio will not survive, and it could take a very long time before these stocks bounce back.

6. Greed makes people lose money in the stock market

If you are an experienced investor or trader, you already know the impact of greed on your portfolio. On the other hand, if you are new to trading, you probably haven’t learned it yet. But it is not too late.

According to Merriam-Webster, greed is a selfish and excessive desire for more of something than is needed. Many people forget to exit their positions, even when their trading indicators and patterns tell them to. Imagine having every reason to close a trade but still not doing it because you want to make every dollar.

Greed turns winning trades into losing ones; many people learn this hard.

Instead of focusing on their profit and how to keep it, losers focus on how much they could make if the stock goes up. This behavior is very dangerous and can cost many people their fortunes.

To fight greed and protect your portfolio, consider using the following tips.

- Have exit strategies

- Lock in profit

- Set up limit orders on each trade

- Focus on protecting your profit instead of how much you could make if the price increases.

- Use a trailing stop order. This order will sell the number of shares you specified if the price drops a certain percentage or dollar amount.

- Focus on small gains instead of huge ones.

7. The get-rich-quick schemes Cause people to lose money in stock market

You may have seen those ads that tell you how some random traders made millions of dollars on a few trades. And they want you to buy their courses to be a millionaire.

If they have a winning method and always succeed, why would they spend countless hours creating those courses? Why can’t they continue to make millions using their secrets?

People who lose money in the stock market fall for these schemes. They pay thousands of dollars and later face reality. Without a chance to recover what they have already lost on courses and in the stock market, they continue to blindly invest more money in the market, hoping their dreams will come true.

You can win a lottery in the market, and many people have done so. However, if you want long-lasting success, you must quickly forget the idea of getting rich.

To be honest, there is no single trick you can use to get rich quickly in the stock market. You must behave, be patient, and watch every step. The more discipline you have when investing and trading, the higher the chances you will succeed. Your ability to have a strategy, stick to it, and keep your emotions in check will make all the difference.

8. Not locking in profits causes people to lose money in the market

Unless you are a long-term investor, your primary job as a trader is to lock in profits. Yes, a small profit is much better than none. Small profits also add up to a huge sum if a trader is consistent.

Locking in a profit is different from exiting your entire position. You can sell some of your shares for a profit and leave a few in the stock. If the price continues in the trend you anticipated, you will still make a profit.

However, if the price goes against you, you can exit your remaining position and still make a profit. Even if the price moves lower than you paid, you can still make a small profit or lose less money.

To illustrate this concept, we are going to use an example.

Suppose you bought 1,000 shares of a stock at $10 per share. The stock went up 10%, and you sold 800 shares. The next day, the stock plunged 20%, and you decided to sell your remaining shares.

Let’s see if you made a profit or lost money on this stock.

First, you bought 1,000 shares @ $10 per share. Total cost = $10,000

The stock grew 10%, and you sold 800 shares. The stock moved from $10 to $11 per share. So, selling 800 shares for $11 per share brought $8,800 into your pocket.

The next day, the price dropped 20%, and you decided to sell your remaining 200 shares. The price moved from $11 to $8.8 (20% of $11 is $8.8). Selling 200 shares at $8.8 per share bought you $1,760.

So, let’s calculate how much money you spend after closing your entire position.

Gross return = $8,800+$1,760 = $10,560

The difference between your total cost and total return is $560$ ($10,560-$10,000).

Congratulations! You made a profit of $560.

What if you did not sell 800 shares after the 10% growth and decided to sell all your shares after the 20% drop? In this case, your total gross sale will be $8.8 X 1,000 shares = $8,800. You lost $1,200 ($8,800-$10,000 = -$1,200). Without locking in, profit costs you a fortune.

9. Buying when they should be selling

The stock market moves in cycles, with booms and bursts. Many people put their money in stocks when they are going up, getting excited and fighting the fear of being left out. People who lose money usually take positions when it is already too late.

Losers buy on top and freak out when they see a pullback.

This is dangerous and very easy to lose.

Tips to avoid buying stocks at the wrong times

It is too late to take a position when a stock goes up. This is true because rallies generate enormous profits for many who buy at the bottom or middle of the trend.

Excessive profits lead to pullbacks or reversals in the trend. Buying after a huge rally increases the likelihood of losing money.

Instead of buying on top, consider buying at the pullback, given that your trading indicators and patterns suggest continuing the trend.

In addition, consider shorting stocks after huge rallies instead of going long.

10. Selling when they should be buying

Like the previous point, people who lose money in the market sell when they should buy. Sometimes, a stock will experience a pullback before continuing in its current trend. Yes, pullbacks are inevitable.

Those who buy when they are supposed to sell panic and exit their trades on small pullbacks. Not only do they buy at the wrong time, but they also sell at the wrong time.

People who make money in the market are masters of market cycles and forces that move prices. They understand the power of supply and demand in the market. They understand that no matter how hot a stock is, it will always experience pullbacks within the trend. Therefore, they do not panic on pullbacks.

Another point is that losers hold losing stocks to the bottom and then sell. Yes, they sell when they are supposed to be buying.

This does not make sense. If you have lost 90% of the money invested in a stock, why would you sell it at that loss? There is nothing else to lose.

Exception: If a company announces bankruptcy, it will make sense to exit your position regardless of what is left of your money.

11. People lose money in the stock market because they Invest based on rumors

If you go online right now, you will see countless people telling you that the stock will experience 30% or more growth. They will also try to justify their reasoning based on false facts.

Nobody knows where the price will go, so all these claims are false. These are rumors, and many novice traders and investors fall for them.

Instead of buying and selling based on proven methods, losers just read countless tips from random people who claim to be experts online.

It is very important to know the current condition of the markets, sectors, economy, etc. Reliable sources provide the most reliable information.

12. People Fail to recognize or understand market cycles

The stock market experiences general movement based on economic conditions, political situations, natural phenomena, etc. These factors can cause major changes in the trend of stocks and other securities.

The power of supply and demand creates natural cycles. For example, the stock market occasionally experiences a correction.

Some markets or sectors also follow cycles depending on seasons. For example, some stocks do well in the summer, whereas others do well in the winter. This means the stock will most likely go up for companies that do well in the summer due to expected revenues. At the same time, the same stock could go lower in the winter due to fewer revenues during the cold months.

Investors and traders who succeed in the market understand these cycles and make trades accordingly.

For example, a trader can take a long position in the summer and short the same stock in the winter if the company experiences higher revenues in the summer.

Many people do not understand these cycles. As a result, they buy and sell at the wrong time, losing their retirements in the stock market.

13. Investing more than they can lose

Success is not guaranteed in the market. Things can sometimes go wrong, and winning stocks can quickly become losers.

For example, a stock can tank 80% in a few minutes due to a failed medical test. Even if a trader has used loss prevention methods, there are times when major losses cannot be prevented.

This is because gaps are sometimes inevitable in the market. If a stock you own experiences a gap in the direction you did not anticipate, you will be in a deep loss that will take months, even years, to recover (if you are lucky).

Gaps (gap up or gap down) is a term used when a stock or other tradable security opened higher (gaps-up) or lower (gap-down) than its previous close. Gaps happen due to news in the market, sector, or about the company itself.

Since these events are unpredictable and unavoidable, following the investment rule of thumb is always a good idea: never invest more than you can lose.

People who succeed in the market already understand this rule. They make investments based on how much they can afford to lose on a particular trade.

On the other hand, losers put every penny they have in the stock market and hope for the best. As a result, they lose more money when the price goes against them.

Having more money in the market creates a sense of instability, which leads to taking less profit from winning stocks.

How do you know if you are investing more than you can lose?

You will know that you have invested more money than you can lose if you become uncomfortable or afraid after hitting that buy button. At least, that works for me.

14. Holding losers for too long causes many people to lose money in the stock market

It is not fun to lose your hard-earned money in the stock market. At the same time, it is impossible to win all the time.

The only way to never lose a penny in the market is to stay out of it.

Now, you can see that losing money is inevitable. However, there is a big difference between winners and losers regarding losing positions.

Winners recognize losing positions and exit them before it is too late. On the contrary, losers convince themselves that the stock will bounce back. They hold losing positions to a level where a small and manageable loss becomes a huge loss.