What is P/B ratio?

The price-to-book ratio a.k.a market-to-book ratio or P/B ratio is a financial analysis ratio that compares the market value of a company with its book value. As noted by the balance, the book value of a company is the difference between a company’s assets and its liabilities. The price-to-book ratio helps investors to compare the net assets and the company’s share price.

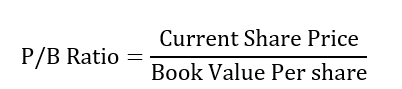

How to calculate the P/B ratio?

The price-to-book ratio is calculated by dividing the most recent stock price of a company by the net book value per share. As noted by the Corporate Finance Institute (CFI), the following is the formula of the price-to-book ratio.

The Price-to-book ratio can also be calculated by dividing the market capitalization of a company by its total book value.

P/B Ratio = Market capitalization/total book value

Example of price-to-book ratio

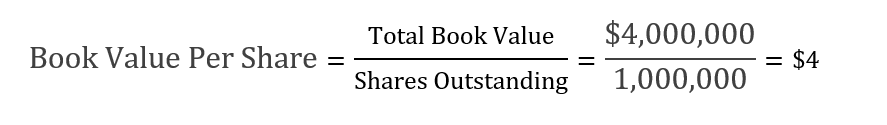

Let’s assume that an XYZ company has 1,000,000 shares outstanding and is currently trading at $20 per share. Let’s also assume that the company has $4,000,000 in shareholder‘s equity. What is the price-to-book ratio of the XYZ company?

Solution:

Step 1: What we have

- Share price(stock price) = $20 per share

- Shares outstanding = 1,000,000 shares

- Net book value = $4,000,000

Step 2: What is needed and formula

P/B ratio = current share price/book value per share

Before we calculate the price-to-book ratio, we need to know the book value per share.

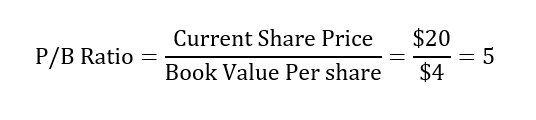

Now that we know the book value per share ($4), we can go ahead and apply the formula of the price-to-book ratio.

Interpretation of price-to-book ratio

From our example, we find that the price-to-book ratio is 5. What does it mean?

This number means that investors pay $5 for every dollar of book value. In other words, the price-to-book ratio is used to indicate how much investors are paying for every dollar of book value.

- P/B ratio = 1: Indicates that the price per share is equal to the book value per share. In other words, investors spend $1 to acquire $1 in book value.

- P/B ratio< 1: This Will indicate that the company is undervalued. In general, undervalued stocks are usually associated with higher risks which justifies the reason their stocks trade at huge discounts. For this reason, companies whose price-to-book ratio is less than one reflect bad investments.

- P/B ratio >1: A higher price-to-book indicates good sentiments towards a company. Hence justifying the reason stock is trading at a premium price.

More learning resources

- Quick Ratio: What Is Quick Ratio?

- Current Ratio: What Is The Current Ratio?

- Debt To Equity Ratio Or Debt-Equity(D/E) Ratio

- Profit Margin Basics And Definition

- Sale-To-List Ratio

- What Is Asset Turnover Ratio? How Does It Work?

- Dividend Payout Ratio And How It Works

- What Is Inventory Turnover Ratio?

- Current Ratio: What Is The Current Ratio?