What is liquidity?

Liquidity indicates how easy you can buy and sell shares of a stock without affecting its price. The more liquid a stock is the easier you can get in and out of the market at prices you want.

This term is used on other assets as well where it describes how fast an asset can be converted into usable cash. The more liquid an asset is, the faster it can be converted into cash. In general, cash is the most liquid asset because it can be converted into other assets the fastest.

Why is liquidity important in stock market?

Before you buy a particular stock, you need to know if it is liquid enough. This information will help you know whether you should trade the stock and good position size to take in the stock.

Without enough liquidity, you will not get all shares you want. In addition, low liquidity increases the volatility in the price. Take a look at the following chart.

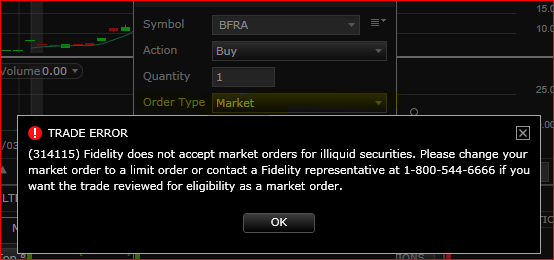

The chart above shows how a stock can be extremely volatile due to its low liquidity. You can see that the stock (ticker: BFRA) grew over 800% in a few hours. This high volatility can exponentially increase your gain or losses.

Due to a high unpredictability of the price’s movement; investors are encouraged to avoid risky investment practices when investing in low liquid securities.

For example, you are advised to never use market orders to buy or sell shares of stocks with low liquidity.

Instead of using market orders, you can use limit orders to buy and sell shares of securities.

If you don’t follow proper and low risky investment methods, your broker could stop you from buying or selling of these securities.

You can observe the broker intervention shown in a market buy errors depicted above.

How to evaluate the liquidity of a stock?

There are many ways to evaluate a stock’s liquidity. The best way is to use data from the stock itself and its market. The following are a few methods you can use to evaluate the liquidity of a stock.

1. Volume

Volume a.k.a trading volume is the number one factor you need to consider when assessing the liquidity of a stock. The volume tells you how many shares are being traded at a particular time.

It can represent a 1 minute, 5 minutes, hourly, daily, weekly, etc. The more the volume the more volatile the stock is. In order words, liquidity increases with the volume. Learn more about volume.

There are many factors that can affect the volume of a stock. For example, the trading volume of low liquid stock can increase dramatically because of FDA approval or good earnings.

You would expect the stock to go back to the general trading volume after the news fades away.

Because of this reason, you must evaluate the historical volume data of a stock before you buy it especially if you are going in for a long time.

Short term volume spike could increase the success rate of short-term traders. Everything depends on your trading strategies and how long you are willing to stay in stock.

2. Bid-ask spread

Spread is the difference between the highest price buyers are willing to pay(bid) and the lowest price sellers are willing to sell a stock for (ask).

For example, the spread will be 5 cents for a stock with a bid of $5.50 and ask of $5.45.

Why does the spread matter? A high spread indicates that there is no competition in the market. Low competition in the market means that there are no many people willing to buy or sell the stock at a particular time.

Therefore, you will not be able to fill your positions and you could be stuck with your shares once you are filled.

A small spread indicates that there is a high number of buyers and sellers who are willing to go in and out of the stock market.

This scenario will increase your chances of getting your buying orders filled at prices you want because there are enough sellers in the market.

In addition, you will sell your shares at prices you want because there are enough buyers in the market.

3. Float

The float represents the total number of shares that can be traded from a publicly-traded company. In other words, all shares of companies are not available for the public to trade.

There are shares owned by founders, insiders, families, creditors such as banks and other institutions, etc. These shares represent a percentage of the company and they are not available to the public.

If the stock has low float, it means that it has few shares to trade. Low float translates to low liquidity and this increases the volatility of the stock because it does not take heavy trading activities to move the price.

Final words

If you are an active trader, you can profit from stocks with a low float that trade on high volume.

However, if you are a trader who is in the market for a while; look for stocks and security that have enough float, low spread, and consistency in the trading volume.