Do you struggle to manage your credit card spending? You’re not alone. In fact, according to the Federal Reserve of New York, Americans collectively owe over $1 trillion in credit card debt. Credit card spending is a slippery slope that can lead to financial stress and hardship. But with the right tools and strategies, you can easily keep track of credit card spending and take control of your finances.

In this comprehensive guide, we’ll share practical and effective tips and advice on how to keep track of your credit card spending, the best apps to help you manage your money effectively, and how to avoid overspending and build financial resilience.

Why tracking credit card spending is important?

To effectively manage your credit card spending, it is important to understand why tracking your expenses is crucial to your finances. Tracking your expenses allows you to identify areas of overspending and make adjustments to your budget accordingly.

Additionally, tracking your credit card spending helps you stay within your credit limit and avoid potential fees or penalties. Furthermore, keeping your credit card spending low allows you to maintain a low credit utilization which is essential in building a good credit score and keeping a healthy credit.

By keeping track of your purchases, you can also ensure that you’re not falling victim to fraud or identity theft. Overall, tracking your credit card spending is an essential part of financial management and can ultimately lead to a healthier financial future.

In the following section, we will explore different ways to keep track of your credit card spending and provide tips for avoiding overspending.

You might also like: 6 effective ways to pay off credit card debt

How to keep track of your credit card spending

Keeping track of your card spending can be a big challenge especially when you have too many credit cards. If you only have one or two credit cards, a simple Excel sheet would take care of the problem. But, if you have dozens of credit cards, a budgeting app might be great for managing expenses from all these credit cards. This is because the app can combine all accounts and show you an overall spending structure or show you spendings from each account.

The strategies you can use to keep track of your credit card spending will depend on how many cards you want to track and your options. The following are different ways to track credit card spending.

1. Keep track of your credit card spending inside your credit card account

One of the easiest ways to track your credit card spending is by using online banking tools provided by your credit card issuer. Many credit card companies offer online account management, which allows you to view all of your transactions in one place. This way, you can quickly and easily review your spending and identify any areas you may need to cut back on.

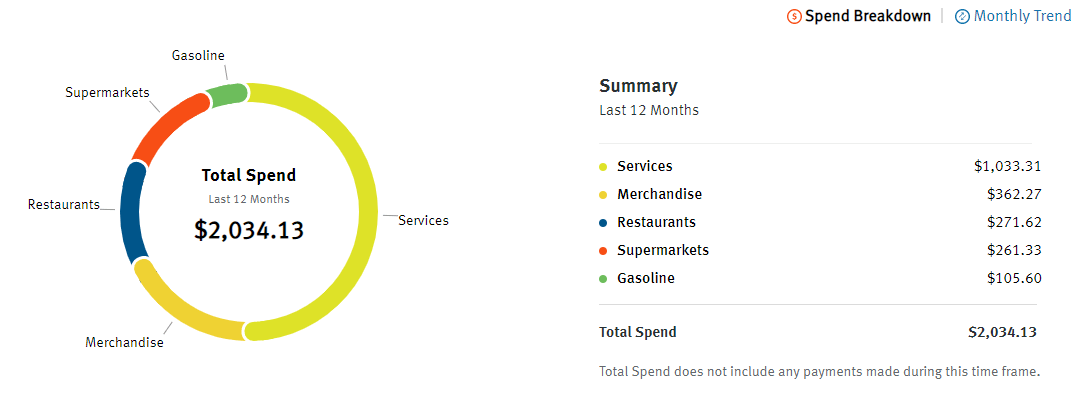

Credit: Discover

The above chart shows a breakdown of my credit card spending for the last 12 months. You can clearly see that about 50% of my expenses were in the services category which includes phone payments and related services. The next biggest expense on my credit card was restaurants which accounted for 17% of overall spending. The account also shows each expense, how much it was, the company’s name, and its address. However, I cannot show you these details for security reasons. Other expenses on my credit card spending include gasoline and supermarkets with 6% and 12% respectively.

And if you click on each category of expenses, you will see more details about those expenses.

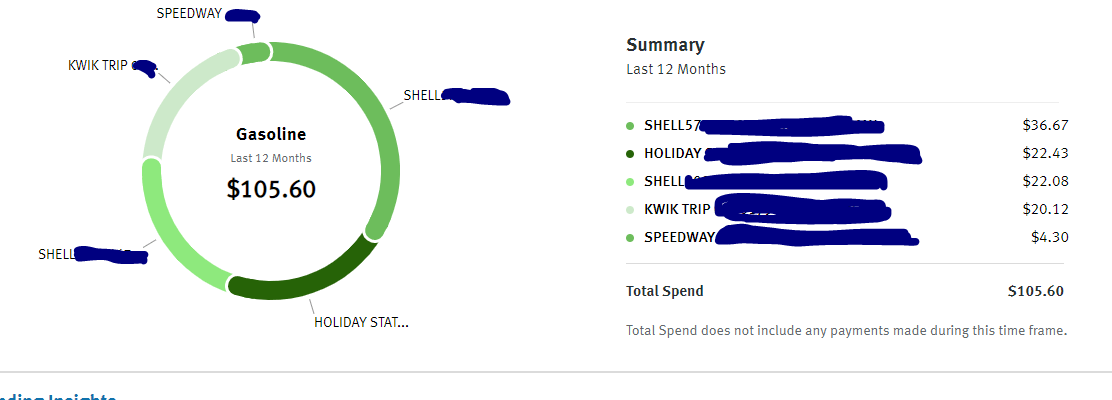

For example, if we click on the gasoline category, we can easily see where each transaction was made and how much it cost. If you click on each transaction, you will see how much it was, the date, and the address of the purchase. This is important because if you did not make the transaction, you can easily spot it and report it as fraud to your credit card issuer.

2. Track your credit card spending manually

Another option is to track your credit card spending manually by keeping a log of all your purchases in a notebook or spreadsheet in Excel. While this may seem time-consuming, it can be an effective way to gain a better understanding of your spending habits. You can categorize your expenses, such as groceries or entertainment, and compare your spending in each category over time. This can help you identify areas where you’re overspending and make changes to your budget as necessary.

3. Track your credit card spending using an online tracking app

If you prefer to use technology to track your spending, there are many apps such as Mint available that can help. These apps sync with your credit card accounts and categorize your purchases automatically. This allows you to easily see where your money is going. Some apps even provide alerts when you’re approaching your credit limit or when you’ve exceeded your budget in a specific category.

The best apps to help you track your credit card spending

Although there are a ton of online sites and mobile apps to manage your credit card spending; the following are some of the best credit card spending app trackers you can start with.

- Mint. One popular app for tracking credit card spending is Mint. This app allows you to link all your credit cards and bank accounts in one place. This gives you a chance to view your overall financial picture. Mint also categorizes your spending automatically, so you can easily see where you’re spending the most money. In addition, Mint provides alerts when your spending reaches a certain threshold or when you have an upcoming bill due.

- Goodbudget. This credit card spending app allows you to manage your spending and categorize them in a way that makes sense. Allowing you to make changes to spot overspending and save more.

- You Need a Budget (YNAB). This app is for serious budgeters. The app gives you categorized expense reports and helps you create a budget that is suitable for your lifestyle but also allows you to lower your expenses and save money.

By using an app like Mint, YNAB, or Goodbudget, you can gain greater control over your credit card spending and avoid the pitfalls of overspending.

Tips for avoiding overspending on your credit card

One of the biggest concerns when it comes to credit card spending is overspending. It’s easy to get carried away with the convenience of credit cards and find yourself with a high balance that you can’t pay off. Luckily, there are a few tips to help you avoid overspending on your credit cards.

- Have a budget. First and foremost, it’s important to have a budget. This will help you understand how much money you have coming in and going out each month. When you know your budget, you can create a plan for how much you can safely spend on your credit cards each month. Stick to this plan and avoid going over your budget.

- Avoid impulse shopping. Another important tip is to avoid impulse purchases. Before making a purchase, take a step back and ask yourself if you really need it. If it’s an impulse purchase, consider waiting a day or two before making the purchase. This will give you time to think it over and decide if it’s really worth it.

- Keep track of your credit card balances. It’s also a good idea to keep track of your credit card balances. This will help you avoid overspending by knowing how much you can spend before going over your credit limits. You can do this by checking your balance online or through a mobile app.

- Set up a spending limit for every credit card. Another effective way to avoid overspending on credit cards is to set up a spending limit for every card. Once the limit is reached, stop using the card.

- Set up alerts. Most credit card companies allow you to set up alerts to notify you when you’ve reached a certain spending threshold. This can help you stay on top of your spending and avoid overspending.

- Avoid large purchases with your credit card. A single large purchase can put stress on your credit card limit. To avoid overspending on credit cards, use your credit cards on small purchases.

- Use a credit card on things you can buy with cash. An effective way to avoid overspending on credit cards is to purchase things you have cash for. That is if you have the cash to purchase something, buy it with a credit card and use your cash to pay off the credit card. This will allow you to build your credit history, improve your credit score, and take advantage of rewards such as cash backs, miles, and points. But, if you don’t have the cash to purchase something, do not purchase it using credit cards. It simply means that you cannot afford it.

- Pay your credit card balance in full. Not only that paying off your credit card balance in full save you money in interest charges and fees, but it also prevents you from getting into credit card debt. For this reason, develop a habit of not carrying credit card balances to the next payment period.

Related: How to avoid overspending on a credit card?

The benefits of tracking your credit card spending

Keeping track of your credit card spending can be a valuable tool in managing your finances. By tracking your spending, you can see where your money is going and make adjustments to your budget to save more money.

By default, these are some of the worst financial products on the market due to higher annual percentage rates(APRs). In addition to high APRs, most credit card interests are compounded making it harder to pay off higher credit card balances or get out of credit card debts. That is why it is crucial to track your credit card spending to make sure that you do not accumulate a lot of credit card debts.

Furthermore, credit utilization of revolving credit accounts such as credit cards accounts for 30% of your FICO score. Tracking your credit card spending allows you to keep your credit utilization low and maintain healthy credit.

The bottom line

In a world where credit card spending can easily spiral out of control, it’s more important than ever to manage your finances effectively. By tracking your spending, using the right tools, and staying disciplined, you can take control of your finances and enjoy the benefits of a well-managed credit card. Remember, the road to financial success is not always easy, but with the strategies outlined in this guide, you can easily stay focused, and organized, and reach your financial goals.