Getting an 800 credit score is easier than you think. You don’t even need a magic formula to boost your FICO score fast. All you need is the right strategy, discipline, and consistency. When I had a 570 credit score, I never thought I could get an 800 credit score. But, a few years later my score reached over 800 and stayed up except a few times it dropped below that mark, and now it is at 825.

What does it take to get an 800 credit score? The answer to this question is rather straightforward. You need to know how your credit score is calculated and each factor that affects your score. These factors are very important and mastering them helps raise your credit score to over 800. Even if you have a bad credit score, you can easily get an 800 credit score if you follow the strategies I will outline in this post. You don’t need to pay anyone to repair your credit. You can easily do it yourself.

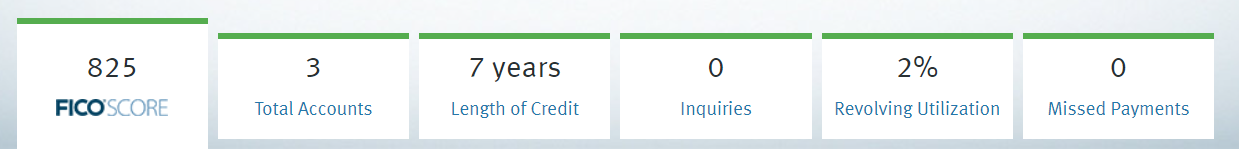

In this post, I will guide you through the steps I followed to get an 825 credit score using only 3 credit cards in less than 4 years.

Key takeaways: Get an 800 credit score the easy way

- You cannot get an 800 credit score in a few months unless you have a good credit score already. It takes time to get an excellent credit score

- You don’t need a lot of credit accounts to break the 800 credit score barrier. How do I know? The score you see in this post is mine. That is right. I was able to get an 825 credit score using only 3 credit cards and I barely use them!

- Focus on the main credit score factors first which include your payment history, credit utilization, credit age, credit mix, and hard inquiries/derogatory marks.

- Pay down your debts to improve your Debt to income(DTI) ratio

- Clean up your credit report regularly.

What is a credit score?

Before I give you the steps you need to get an 800 credit score, let’s cover the basics. What is a credit score?

A credit score is a number that ranges between 300 and 850 and it reflects your creditworthiness. The higher your score is in this range, the better your credit score and the easier you can qualify for loans with lower interest rates.

Your credit score is calculated based on information from your credit reports. A credit report is nothing other than a compiled document that shows all your credit activities submitted by lenders to major credit bureaus.

There are three major credit bureaus which are Experian, TransUnion, and Equifax.

Read more: What is a credit score and how does it work?

How many types of credit scores are there?

Generally, there are two major types of credit scores. The first one is the FICO score which is a credit score calculated based on the FICO scooring model. The second major type of credit score is the Vantage Score which is a credit score calculated based on the Vantage scoring model.

Among these two major types of credit scores, however, there are more sub-types of credit scores in each category. According to Credit.org, Experian and Equifax have 16 different FICO credit scores while TransUnion has 21 different credit scores. Again, the difference in these different credit scores boils down to specific industry requirements.

That is each credit score is optimized to meet a specific industry requirement based on the product they offer. For example, a credit score used for the mortgage industry might be different than the one used for the auto loans industry or consumer short-term loans.

Different scoring agencies apply different weights on factors that affect your credit score which leads to having different credit scores from different providers. For example, your credit score from Experian might slightly be different from your Equifax score. These differences don’t mean that one is more accurate than the other. It simply means that both scoring companies apply different weights on factors used to calculate your credit score.

However, most lenders use the FICO score as it applies more weight to payment history, credit utilization, and age of credit.

What are the factors that affect your credit score?

While your credit report has a lot of information, not every information is used to calculate your credit score. If you want to get an 800 credit score, you only need to focus on the most important information. In a nutshell, the following factors affect your credit score as shown in the following image of my credit score profile.

Factors your credit score is based on

- Payment history. This is pretty much the most important factor in your credit score calculations for both FICO and Vantage scores. Your payment history accounts for 35% of your FICO score and 40% of your Vantage score.

- Credit utilization. The next biggest factor on your credit score is credit utilization which accounts for 30% of your FICO score and 20% of your Vantage score. Credit utilization represents how much you owe compared to your available credit limit.

- Age of your credit. The age of your credit simply refers to how long you have been a credit user. The age of your credit also known as credit age, accounts for 15% of your FICO score. For the Vantage score, your credit age is combined with the credit mix for 21% of your credit score.

- Hard inquiry. A hard inquiry appears on your credit report when you apply for a loan. An inquiry simply means that the lender is requested to view your credit profile. Hard inquiries account for 10% of your FICO score and 6% of your Vantage score.

- Credit mix. Your credit mix simply refers to the type of credit accounts you have. A good credit mix should have revolving credit such as credit cards and installment loans such as car loans. Credit mix accounts for 10% of your FICO score.

In the following section, I am going to show exactly how to get an 800 credit score starting from the credit score factors I mentioned above.

Related post: What is a VantageScore and how does it work?

How to get an 800 credit score step by step?

As I promised earlier, it is easier than you think to get an 800 credit score. Here is a step-by-step guide to getting an 800 credit score the easy way.

1. Avoid late payments and similar negative items on your credit reports

Among the factors that affect your credit score, your payment history is the biggest factor on your credit score. Payment history alone accounts for 35% of your FICO score which is a big chunk of your credit score calculation. If you want to get an 800 credit score, focus on your payment habits first. Pay all your bills on time before their due dates and avoid carrying on revolving credit.

A single late payment on your credit report can drop your credit score more than 100 points and it will stay on your credit report for 7 years. This means it will take you many years to recover from a late payment and lose the opportunity to raise your credit score to 800. You should never have a late payment on your credit report if want to get an 800 credit score.

In addition to paying your bills on time to avoid late payments on your credit reports, you should also avoid similar negative items. Common negative items on your credit reports include collection accounts, incorrect balances, mistakes, fraudulent activities, foreclosure, bankruptcies, derogatory marks, etc. Here is a full list of negative items on your credit reports and how much they affect your credit score.

Negative items usually knock off more than a hundred points from your credit score, especially for foreclosure, bankruptcy, collection, or charge-offs. Additionally, negative items stay on your credit score for 7 years except for bankruptcy which takes 11 years to fall off your reports, and hard inquiries which take 2 years to automatically fall off your credit report.

What to do when you find negative items on your credit reports?

To increase your chances of getting an 800 credit score, you should always check your credit reports regularly. In case you find negative items, dispute the item to major credit bureaus(Equifax, Experian, and TransUnion). You can also dispute the incorrect information from the company that reported the information to major credit reporting agencies. Keep in mind that valid items such as late payment might not be removed until after 7 years. Here is a guide to dispute errors, inaccuracies, and removable negative items from your credit report.

But, any errors, fraudulent activities, outdated information, incorrect balance, etc, should all be disputed immediately after finding them. The faster you get your credit reports cleaned, the faster your credit score will go up.

Related articles:

How to avoid late payments on your credit reports?

As I said earlier, you need to avoid late payments and similar negative items on your credit reports if you want to get an 800 credit score.

To avoid negative items and delinquencies on your reports, here are a few tips I found useful.

- Set up automatic payments. Keeping up with your payments might be difficult especially if you have many credit accounts. To avoid missing a payment or paying late, set up automatic payments and double-check if payments are going through each month. If even you forget to check, your bills will still be paid on time.

- Use reminders. Another strategy to avoid late payments to get an excellent credit score is to set up reminders. Putting your payment due dates in your calendar and setting up reminders is a great way to ensure your bills are paid in full and on time.

- Prioritize your bills. Knowing what bills to pay off first is essential. To avoid late payments on your credit reports, pay off the bills that get reported to credit bureaus such as a mortgage, credit cards, etc. If you can’t them in full at least pay the minimum requirements.

- Communicate with your lender. If you are falling behind on your payments, talk to your lender as soon as possible. Your lender might make adjustments to your payments such as changing the terms of your loan which can make it affordable.

- Do not carry a balance on your accounts. Another great way to avoid late paying and easily reach 800 credit score, is to not carry a lot of balance. When you pay all your bills in full, especially on credit cards, it reduces the chances of missing a payment and improves your credit utilization ratio which raises your credit score.

Read more:

- How to avoid late payments on your credit report

- Will my credit score go down when I make the minimum payments?

- How to avoid repossession of your car?

2. Lower your credit utilization and improve your Debt-to-income ratio

The second tip to get an 800 credit score is to lower your credit utilization ratio and improve your debt-to-income ratio. Your credit utilization ratio is the money you owe on revolving credit accounts such as credit cards to your total credit limits. The credit utilization accounts for 30% of your credit score. The higher your debt-to-credit ratio gets, the lower your credit score goes.

Example of credit utilization

For example, if your total credit limit is $5,000 and you owe $2,500 on your credit cards, your credit utilization will be 50%. Having such credit utilization will prevent you from reaching an 800 credit score.

Most financial experts suggest a credit utilization of 30% or lower. To easily get an 800 credit score, you need to have a much lower credit utilization. Keeping your credit utilization ratio under 7% is essential to securing a place among individuals with excellent credit scores in the country.

If you can afford it, keep your credit utilization under 5%. Why 5%? This is because carrying only 5% on your credit cards improves your credit score but also makes it easy to pay it off and reduces the chances of accumulating too much debt. Additionally, having less debt improves your debt-to-income ratio.

For example, you can see that my current credit utilization is 2%. Having such a low credit utilization without late payment on my credit reports is what helped me get an 825 credit score.

Related: What is a good credit utilization if you want to get an 800 credit score?

Debt to income ratio matters

Just like your credit utilization ratio, your debt-to-income ratio is another factor that is related to how much debt you owe. The DTI ratio is the ratio of your monthly debt payment to your monthly gross income. Having a higher credit utilization increases your DTI ratio which lowers your credit score.

To get an 800 credit score, you need to lower your DTI ratio. If for example, you have a 28% DTI ratio, you will easily qualify for a loan. But, if you need to raise your credit score to 800, your DTI ratio must be much lower. For example, my credit utilization is 2% of my total credit limit and that is the only debt I carry for now. This also means that my DTI ratio is almost zero since this is the only debt I have.

3. Open your first credit account as soon as possible

The age of your credit is a major factor that affects your credit score. The truth is that having an 800 credit score takes time. While there are strategies to increase your score fast, doing it slow without even thinking about is the best way to get an 800 credit score. Learn how you can increase your credit score in 30 days.

The age of your credit simply refers to how long you have been a credit user and it accounts for 15% of your credit score. For example, the length of my credit history is 7 years and I have only been using three credit cards. What this means is that I have been using my credit cards for 7 years and my credit history is solid. That is how you get an 800 credit score.

If you don’t have a credit account already, open an account as soon as possible. You cannot have an 800 credit score with a thin credit file. The sooner you open your first account, the sooner you will start building credit age and having a credit history.

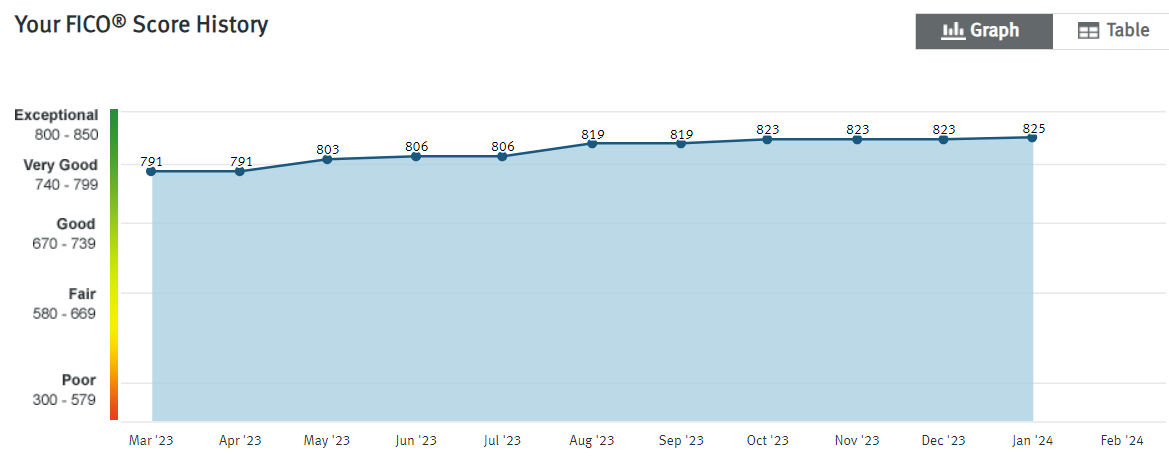

From the graph above, you can see that my credit score has been above 800 for almost a year. There are times when my score dropped below 800 but it did not stay down for a long time. Having a strong credit history helped me bring my score back to over 800 in no time.

Again, it is because I stayed disciplined enough to pay my bills on time, keep my credit utilization low, and be a good credit user for a while.

4. The credit mix/mixture of your credit also affects your score

Your credit mix is another factor to consider when you want to get an 800+ credit score. Lenders prefer borrowers who can handle different types of credit accounts. That is why having a good mixture of different types of accounts can easily help you build your credit score to 800 with ease. The credit mix accounts for 10% of your credit score.

A credit mix represents the different types of an account you have on your credit reports. A good credit mix is one made of revolving credit accounts such as credit cards and personal lines of credit, and installment loans such as a car loan and a mortgage.

While having a good credit mix is great to get an excellent credit score, it is not mandatory. For example, I was able to raise my credit score to over 800 only with credit cards. That is right. I never had an installment loan on my credit reports and I was able to get an 800 score in under 4 years and my score stayed up ever since.

The point here is that you don’t need to take on more loans hoping to improve your credit score. It does not work that way. At the end of the day, taking on unnecessary loans will only increase your DTI ratio and eventually hurt your credit score if you cannot pay them off. But, if you still need to get another loan such as a car loan, personal loan, or a mortgage, it will for sure help you boost your score in the long run.

5. Do not borrow excessively to avoid hard inquiries

Every time you apply for a loan, a hard inquiry appears on your credit reports, and your credit score usually drops by a few points. What this means is that trying to borrow money might indicate a potential financial hardship or lack of financial means.

While a single hard inquiry might not have a big on your credit score, multiple hard inquiries will significantly lower your score. Each hard inquiry stays on your credit reports for 24 months but it only affects your score for 12 months. That is why if you want to get an 800 credit score, you need to avoid excessive borrowing. As a rule of thumb, do not have more than 1 hard inquiry on your credit reports in any consecutive 12 months.

Again, getting an 800 score means you have to be careful in some of your financial decisions. Most people with 800 credit scores and higher tend to borrow less and focus on utilization accounts they have by the books.

6. Stay consistent

The path to 800 credit score is very easy but without consistency and discipline, you can easily lose the opportunity to get an excellent credit score. To ensure high success, all factors and credit score tips that I mentioned in this article should be followed no matter your financial situation.

For example, missing a payment even for one month can push you back many years before you can get to an 800 credit score. This is because a late payment drops your credit score by more than 100 points and it stays on your credit reports for 7 years. It would take many years to regain all the points you have lost and recover from such a negative item on your credit report.

For this reason, you have to have discipline and be consistent with all credit score strategies I mentioned in this post to avoid causing major delays in your credit score-building journey.

7. Do not close old accounts

A big mistake a lot of people make when building their credit scores to 800 is to close old accounts. For example, if you have an old credit card you are no longer using, you might be tempted to close the account. Unless you have a meaningful reason to close the account such as paying annual interest on the account you are not using, you should never close an old credit account when you are aiming for an 800 credit score.

In the same way, getting a new credit account triggers a hard inquiry which accounts for 10% of your credit score, closing an old credit account can also hurt your credit score. This is because the account you close might easily lower the age of your credit which accounts for 15% of your credit score or affect your credit mix which accounts for 10% of your credit score.

The best thing you can do is to keep the account open and use it to pay a small monthly bill. For example, instead of closing an old credit card, use the card to pay a $10 streaming service fee to prevent your credit card issuer from closing the account due to inactivity. This way, you will continue to benefit from the age you established on the card and maintain a good credit mix.

8. Become a credit user of an excellent credit card account

This credit score tip benefits you more when you have a bad credit score, have a thin credit score, or want to repair your credit. Having a thin credit score refers to having little to no account activities on your credit reports.

If you have a bad credit score, are repairing your credit, or don’t have enough credit activities, consider being an authorized user of a credit card account.

By becoming an authorized user of a credit card account, you benefit from that history which helps jumpstart your credit score. Before you get added to someone’s credit account, make sure that activities on the account get reported to major credit reporting agencies(Equifax, TransUnion, and Experian).

If the card issuer does not report authorized users’ activities to major credit bureaus, they will not appear on your credit reports and your score will not benefit from these activities.

How long does it take to get an 800 credit score?

Achieving an 800 credit score does not happen overnight and the time it takes can vary widely depending on an individual’s credit history. For someone starting with a low credit score, it could take several years of consistent and responsible credit activities to reach an 800 score. If you already have a fairly good credit score in the 700s, it might take anywhere from a few months to a few years to reach 800, assuming that you stay consistent with your account activities.

Factors such as payment history, credit utilization, length of credit history, types of credit used, and recent inquiries can all impact how quickly you can raise your credit score to 800. The key to getting an excellent credit score is to maintain good financial habits, including paying your bills on time, keeping revolving credit balances low, and regularly checking for any inaccuracies in your credit report.

How many people have an 800 credit score?

The specific number of people who have an 800 credit score varies depending on demographics and geographic location. Moreover, credit scores are private financial information, making it difficult to obtain precise figures. However, according to Fair Isaac Corporation (FICO) as reported by Lexingtonlaw, about 23% of American adult consumers have a FICO score of 800 or higher.