Did you know that you can get a free copy of your credit report? Your credit report has all information regarding your credit history. Lenders and other financial companies use the information in your report to determine your eligibility for loans, mortgages, employment, rent, etc. That is why you should check your credit report every once in a while and keep it updated. The question is how do you get a free annual credit report?

There are many companies that charge you for a copy of your annual credit report. However, you don’t have to pay a penny to get your credit report. There are ways you can get a free annual credit report.

By law, you are eligible to get a free copy of your credit report from each major credit reporting agency. These companies are sometimes referred to as major credit reporting bureaus or major consumer reporting companies. There are three major credit reporting companies:

- Equifax

- TransUnion, and

- Experian

Each of these credit bureaus will give you a free annual credit report once in 12 months. In order to get a free copy of your credit report, you need to request it from AnnualCreditReport.com or contact them by phone: (877) 322-8228. You can also use an online free credit report request form and mail it to the following address:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

What is a credit report and how does it work?

A credit report is a detailed and easy-to-understand document that has all information related to your credit history. Your lenders/creditors and other companies that manage your credit accounts such as utility companies, and leasing firms submit your credit activities to credit reporting companies.

Some lenders submit your information to all three major credit reporting companies. Others choose to submit your information to one or two credit bureaus. It is also possible that some creditors do not report your information at all.

After receiving your credit accounts’ activities, credit bureaus will compile your information into a credit report. The information in the report is used by lenders to determine your creditworthiness. In addition, credit bureaus use information from your report to calculate your credit score using credit scoring models such as the FICO Score model or VantageScore model.

How many free annual credit reports can I get?

Since there are three major credit reporting companies that make your credit report and you are entitled to one copy from each credit bureau; you can get three free copies of your annual credit report every year.

You can either choose to get all three annual reports at once or get one at a time. There are pros and cons to each choice.

Pros of getting all three annual credit reports at the same time:

- You can compare information reported in each report

- You can know where each lender submitted your information and those who did not submit anything

Cons of getting all three free annual credit reports

- You will not be able to monitor the progress you are making on your credit over time

- You will need to pay to get an extra copy of your reports

Pros and cons of getting your annual credit reports one at a time:

There are pros and cons to getting your credit reports at different times. For example, you can choose to get one copy every three months. This method will give you a chance to get all three copies of your reports throughout the year. What are the benefits of this strategy?

- You will have enough time to focus on your reports one at a time

- It will be easy to monitor the progress you are making in your credit activities throughout the year

- You will avoid paying for a report, should you choose to get a second copy

You can also get a free copy of your credit report from specialty consumer reporting agencies

Specialty consumer reporting agencies are companies that collect and share your information regarding your financial activities. The information that specialty consumer reporting agencies collect, includes but is not limited to, repayment history, transactions, employment history, etc.

Not every specialty consumer reporting agency will collect the same information. It will all depend on the industry and the type of specialty consumer reporting agency. For example, some reports can have only your car insurance claims, homeownership, employment, medical records, and apartment rentals.

If you want to get a free copy of your credit report from specialty consumer reporting agencies, you will need to request a report from each company. You may be eligible to get a free copy of your annual credit report from each specialty consumer reporting agency once a year. Some specialty reporting companies, however, might charge you a fee for a copy of your credit report. The following is a list of all credit reporting companies including specialty reporting agencies.

Can I get additional free credit reports after using all three reports?

It is possible that you can get extra free copies of your credit reports from major reporting companies. Your credit information changes very often as new credit activities are reported to credit bureaus. You may be eligible for an extra free copy of your report depending on changes made in your credit report or due to adverse action against you. You may be eligible for an extra free copy of your credit report if you fall into any of the following cases.

- You think your credit profile is inaccurate due to fraudulent activities

- Due to unemployment and you are planning to get a job within two months

- Your state law allows you to have another credit report

- When you get a denial notice due to a credit report from one or more credit reporting agencies. It is possible that you can apply for insurance, new credit, employment, etc, and get denied due to information in your credit report. In this case, you’ll be eligible for a free annual credit report from the credit reporting bureaus indicated in the denial notice.

Where to get a free annual credit report?

Although there are many websites that claim to give you a free copy of your credit report; there is one website that is legally approved for this service.

If you need a free annual credit report, go to the following website or call the number listed below.

- Get a free copy of your annual credit report from: AnnualCreditReport.com

- By phone: Call (877) 322-8228

If you don’t like any of the options listed above, download a free annual credit report request form from the same website and mail it to the Annual Credit Request Service office.

The mailing address you can use for physical mail.

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

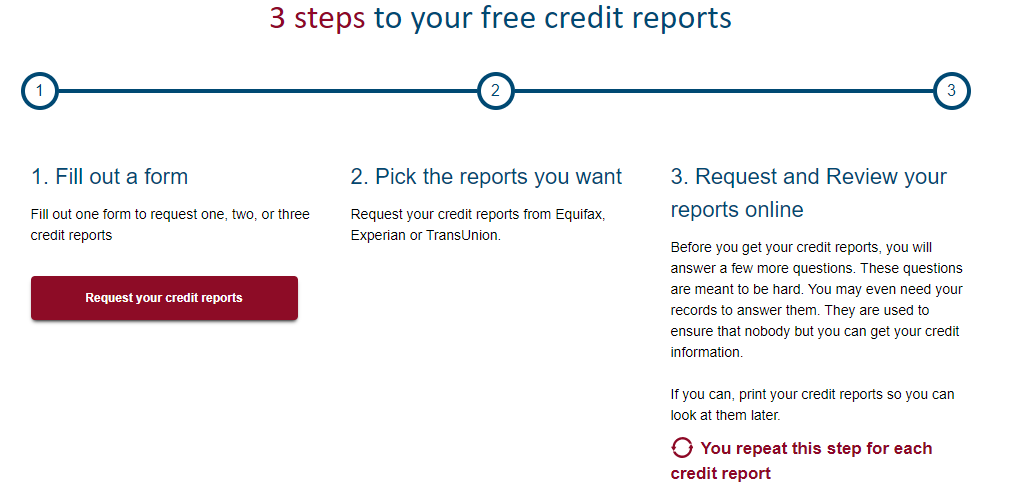

If you choose to get a free credit report online, there are three important steps you will need to follow:

- Fill out the form: The form asks for your full name, date of birth, address mostly for the last 2 years, social security number, and mailing address. This form is there to verify your information and identity.

- Pick the report you want to request: The annual credit report will give you reports from all three major credit reporting agencies which are Equifax, TransUnion, and Experian.

- Request and review your report: This is where you request your credit report and view it. If you want another report from another major bureau, you will need to repeat this step.

How much does it cost to get a copy of my credit report?

You should not pay to get a copy of your annual credit report. This is because you are entitled to a free copy of your credit report from each credit reporting agency.

If you have used all of your free copies of credit reports and do not qualify for another free copy; you may pay a fee to get an extra copy. The fee you pay will vary from each credit reporting agency. However, it should not be that expensive.

According to WalletHub, you should expect to pay between $1 to $16 for a copy of your credit report. Most credit reporting agencies bundle credit scores and credit reports together. Others charge a monthly fee and give you access to your report and credit score at the same time.

How do credit reporting bureaus get my information?

In order to put together your credit reports, major credit reporting companies need to have access to your information. So, how do credit bureaus get your information?

Lenders and other companies that manage your accounts voluntarily report your information to major credit reporting agencies. The following are some of the companies that might report your information to major credit bureaus.

- Retailers

- Mortgage companies

- Banks

- Auto lenders

- Debt collectors

- Apartment leasing companies

- Utility companies, etc,

Some information related to your accounts might be purchased from public record providers by credit bureaus. For example, major bureaus might purchase your foreclosure, bankruptcies, or tax liens.

Some information that will be shared with credit reporting bureaus, includes but is not limited to,

- Your payment history

- The dates you opened your accounts

- The account balances

- Utilization records

- Credit limits

- Bankruptcies, foreclosures, etc

- Collections information

- Tax liens

- Evictions

- Medical records

- Charge-offs

- Number of accounts you have, etc

What should you do after getting your annual credit report?

Your free annual credit report has information related to your credit history such as payment history, inquiries, etc. Since the information reported in these credit reports reflects your account activities, it is very important to make sure that no errors, inaccuracies, or fraudulent activities are in your credit reports.

After getting a copy of your credit report, you need to read it line by line and make sure that the report reflects your current financial situation. If you see errors, inaccuracies, or fraudulent activities in your reports, dispute them as soon as possible.

Estradinglife has put together a complete guide to disputing errors and inaccuracies in your credit report.

You need to continuously evaluate and clean up your credit report and clean it up every once in a while to increase the health of your credit especially if you have bad credit and bad credit score. Anything that has been reported in your credit report that should not be there, should be corrected or removed. That is how you stay ahead in this credit world.