Checking your credit score for free online is super easy. Many people think that you have to pay to check your credit score. This is not necessarily true. Some websites will charge you money for a copy of your credit reports and credit score information. But you don’t have to pay to check your credit score. You can check your credit score and get free copies of your annual credit reports. This article will show you exactly how to achieve all this step-by-step and with examples.

How to check your credit score for free?

If you want to get your credit score for free, you only need to find a provider that offers this service. Here are a few options for checking your credit score free online.

Get a free FICO score from the myFICO website. FICO is the company that calculates your FICO score using data from credit reporting agencies. You can access free FICO scores, FREE credit reports, and credit monitoring by opening a Free account. The free account, however, does not come with identity theft, identity restaurant, identity monitoring, etc. To get access to have access to these services, you would need to upgrade to advanced or premier memberships.

You can also log in to your online credit card account to view credit score information. Large credit card companies, such as CapitalOne, Discover, etc., also give you free access to credit score information. If your credit card does not come with a free credit score, you can still check it for free online using third-party companies.

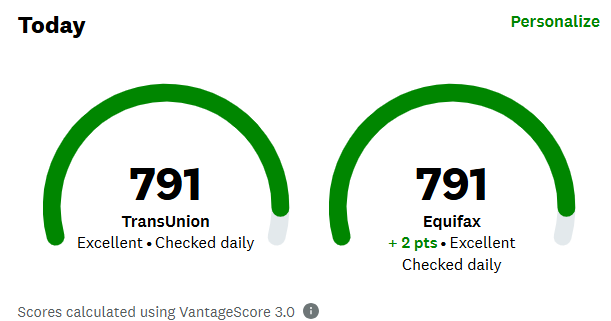

Some of the most trusted websites for getting free credit scores include CreditKarma and NerdWallet. Keep in mind that these sites give you free VangatageScores. For example, with CreditKarma, you can access your free Equifax and TransUnion credit score. For NerdWallet, you can only view your TransUnion credit score.

Another option to get the most accurate credit scores is to view them directly from credit reporting bureaus, which include Equifax, TransUnion, and Experian. Remember that while credit bureaus give you a free copy of your credit report every 12 months, you will need to pay a small fee for information about your credit score.

How to check your free credit score with Discover?

As mentioned above, Discover credit cards also come with free credit scores. If you have a Discover credit card, the following are a few steps to view your credit score inside your Discover credit card account.

- First, head to Discover.com and log into your online account. Assuming you have a Discover credit card, you should also have an online account. If you have not created an account, please sign up and make one. If you already have an account, sign in.

- Inside your account, click the Activity tab and select FICO Credit Scorecard.

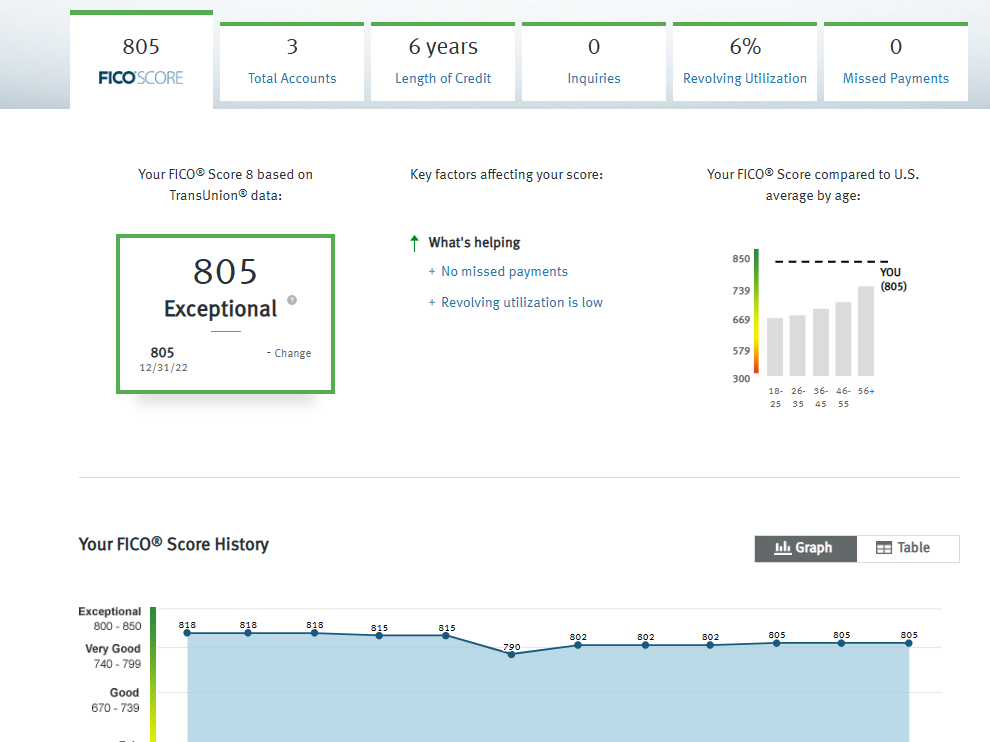

- After clicking on FICO Credit Scorecard, you will be redirected to a page with your credit score details. You will also be able to see what is affecting your score the most, how your score compares to the rest of the people, etc.

My FICO score is displayed here, and I did not pay money for this information. Even if your credit card was not issued by Discover, the process should be the same as long as your provider offers credit score information.

In the following example, we will explore how to check your credit score for free if you have a CapitalOne credit card.

How do you check your credit score with CapitalOne?

Like Discover, if you want to check your credit score for free and have a CapitalOne credit card, follow the steps below. These steps will work only if you have a CapitalOne credit card.

- First, head to Capitalone.com and log in or create an account.

You will need a username and a password.

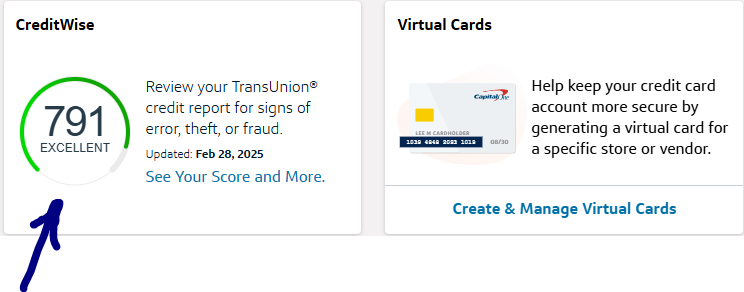

- After logging in, you should see information about your credit score when you scroll down the home page.

- Click the See Your Score and More link for your credit score information.

This credit score is a VantageScore different from the FICO score. Both credit scores are calculated using different scoring models, and the information pulled from each credit report could also differ. Hence, the difference between these credit scores.

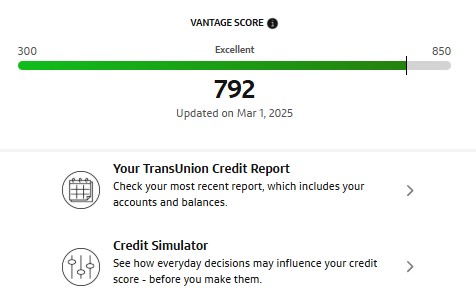

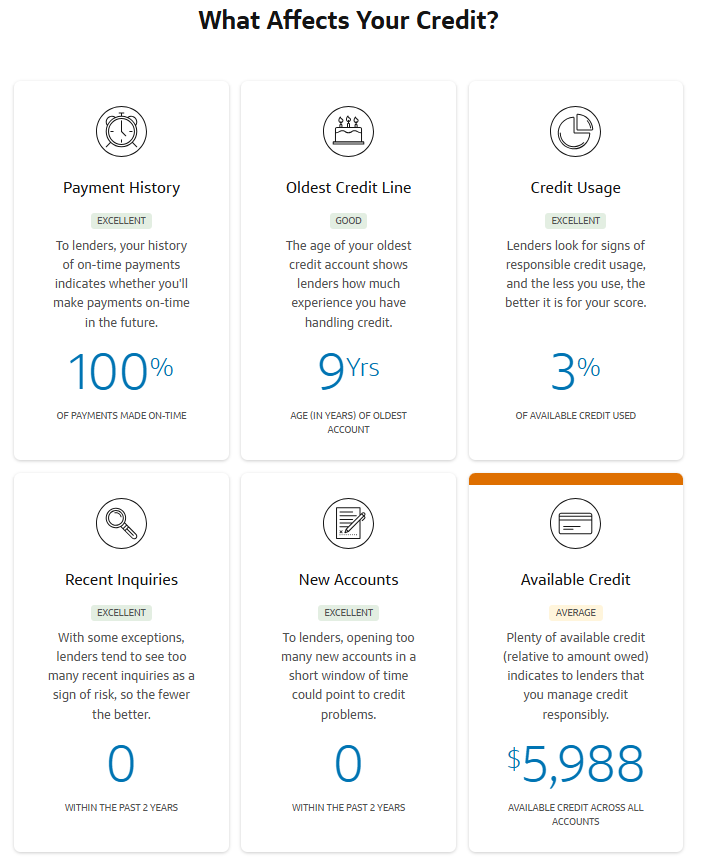

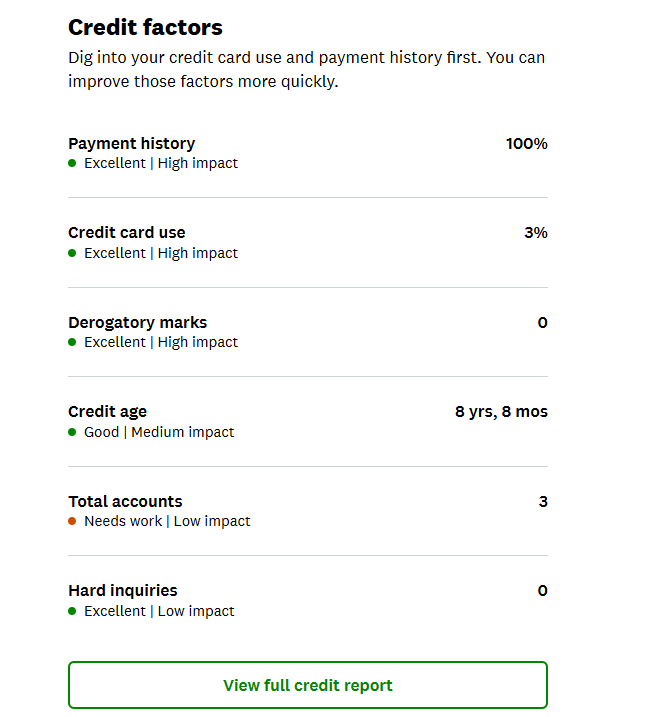

The account will also show you what is hurting your credit score or how you have been doing. You should see information about the age of your credit, payment history, inquiries, etc.

As you can see from the above picture, my payment history is 100%, meaning I have never missed a payment. My credit is 7 years old, which is considered good. In addition, I don’t have a hard inquiry and have not opened a new account in the past 2 years.

What if you don’t have a Discover or CapitalOne credit card and your card issuer does not offer free credit score information? You can still check your credit score for free using third-party websites. The following section will cover ways to check your credit score for free when your card issuers do not offer free credit score information.

How do you check your credit score for free using third-party websites online?

Many reputable online websites offer free credit scores. Since we cannot cover all of them, today we will concentrate on one website to get a free credit score.

This website is known as CreditKarma.com. All you need to do is open an account on the website, and you can view your credit score for free anytime you want. The following is the process to open an account and check your credit score with CreditKarma. Other websites you can try include NerdWallet for a free TransUnion score and myFICO for a free FICO score.

How to check your free credit score with Credit Karma?

Using a third party, you can use the following steps to check your credit score for free online. In our case, we are using CreditKarma. However, the process should be similar to this one if you are using a different website.

- Start by visiting a reputable website that provides free credit score information. Ensure that the website is secure and trustworthy. In this case, we are using creditkarma.com. If you already have an account, log in using your username and password.

- Create an account on the website by putting in the required information. You will need personal information, such as your full name, address, and date of birth. This is for a new account. After signing up, you should be able to access your profile.

- Once your account is created, you can view your credit score for free by clicking on the dashboard. You may also be able to access other tools and resources such as credit monitoring, identity theft protection, and more.

The table above shows how my account has been performing. My payment history is excellent, with no hard inquiries or new accounts. The age of my credit is OK, but it will continue to improve as I use my credit accounts. The only thing weighing down my Vantage score is my credit utilization, currently at 3%, justifying the 6-point increase from the previous months. The number of my credit accounts is also low and not adequately mixed.

- Keep your account secure and regularly update your personal information to keep your credit score accurate.

That is how you check your credit score for free.

Why are my credit scores different?

Millions of consumers get confused because they have different credit scores. As you can see, my credit scores are also different. This could be due to several reasons. Having different credit scores doesn’t mean one is more correct than the other. This is a big problem many people struggle with. They think that a lower credit score is less accurate or wrong. This is not true.

Your credit scores may differ due to the different scoring metrics used by the credit bureaus (Equifax, TransUnion, Experian). Each bureau has its own set of criteria and algorithms to calculate a credit score, which can lead to different credit scores for each bureau.

Additionally, not all lenders report to all three bureaus, meaning some bureaus may not be getting updated information and, therefore, may not accurately reflect your current credit profile. To ensure all bureaus accurately reflect your current credit situation, checking your credit reports and monitoring your credit score regularly is essential.

Related: Why are my credit scores different?

How to get a free copy of your credit report?

Like your credit score, you can get copies of your credit reports for free. Even if you have the money and are ready to pay, you don’t need to pay to get your credit reports.

Each credit reporting agency (Equifax, Experian, and TransUnion) must give you a copy of your credit report once every 12 months. All you have to do is head to https://www.annualcreditreport.com/index.action to get a free copy of your credit report. This is the only government-authorized website to offer free credit reports.

The website offers a three-step process: you complete a request form, choose the reports you want, and request or review your reports online. After using your free copy, you can purchase extra copies of your credit reports from each bureau.

If you have chosen to get copies of your credit reports directly from each credit reporting bureau, follow the following steps.

- Start by researching the different credit reporting bureaus and their websites. Three major credit reporting agencies are Experian, TransUnion, and Equifax. Each bureau might have a different process for obtaining your credit report.

- Research the legal requirements for receiving a free copy of your credit report. Depending on where you live, you may have the right to receive a free copy of your credit report once a year.

- Visit the website of your chosen credit reporting bureau and look for an option to request a free credit report.

- Register for a new account or log into your existing account.

- Follow the instructions on the website to enter your personal information and request your report.

- Once your request is processed, you should receive a copy of your credit report.

Will my credit score go down when I check it?

Another misconception about credit scores is that people think their credit scores will go down when they check them. This is not true.

No, your credit score will not go down when you check it. Checking your credit report or score does not affect your credit score. This is because when you check your credit score, the activity results in a soft inquiry, which does not affect your credit score. Your intention in checking your credit score is for informational purposes.

This is different when your lender requests to view your credit report information. For example, if you are applying for a car loan, your lender must check your credit profile to evaluate your creditworthiness. This activity will result in a hard inquiry on your credit report and will lower your credit score.

Does your credit score go down when you spend your own money?

Spending your own money does not lower your credit score. This is because your credit score has nothing to do with your income, how much you make, or how much you have in your bank account. Indeed, your credit score has nothing to do with how much of your income you spend on things you want or need in life.

Your credit score is solely based on your credit account activities. In other words, your credit score is calculated based on your credit accounts, such as credit cards, personal loans, mortgages, car loans, student loans, etc. Any activity on these accounts gets recorded and reported to major credit reporting agencies. The same activities appear on your credit reports and are used to calculate your credit score.

For example, using your credit cards to buy a lot of stuff will increase your credit utilization. As your credit utilization goes higher, your credit score will go down. Why? It’s because your credit limit is not your own money. It is the money you are borrowing from your credit card issuers. In order words, the line of credit extended to you is a loan that must be paid with interest when applicable. For this reason, the more you spend on your credit accounts, such as credit cards, the higher the risk of accumulating debt. Hence lowering your credit score.

But, if you take money from your bank account and spend it, your credit score will not be affected. The money in your savings or checking account does not affect your credit score. In addition, your bank account balance or activities in your bank accounts do not get reported to credit bureaus. Anything not reported on your credit reports does not affect your credit score.

What affects my credit score?

Now that you know how to check your credit score for free, let’s examine the factors that affect it. A few factors affect your credit score, which are listed below.

Payment history (35% of FICO score and 40% of VantageScore)

Your payment history is the most significant factor in your credit score. The VantageScore and FICO scores apply more weight to your payment history with 40% and 35%, respectively. You are automatically a risky borrower if you cannot repay the borrowed money. That is the bottom line in the lending industry.

Credit utilization(30% of FICO score and 20% of VantageScore)

Your credit utilization measures how much you have spent compared to your available credit limit. For example, if you have a credit card with a $1,000 credit limit and have spent $500 of that limit, your credit utilization will be 50%. A higher credit utilization rate shows you rely on debt to cover expenses or support your lifestyle. This, in turn, makes you a risky borrower. Credit utilization affects 30% of your FICO score and 20% of your VantageScore calculations.

Age of your credit(15% of FICO score and 21% of VantageScore when combined with credit mix)

Your credit history includes how long you have been a credit user and all activities with your accounts. The longer you have been using credit and behaving correctly, the better. The age of your credit affects 15% of your FICO score calculation. The Vantage score combines the age of your credit and credit mix, which counts for 21% of your score.

Hard Inquiries(10% of FICO score and 6% of VantageScore)

When you apply for a loan or other form of credit account, such as a credit card, the lender will request that you view your credit report. This activity results in a hard inquiry on your credit report. Each hard inquiry lowers our credit score by 5-6 points. Sometimes, your score can go lower by as much as 10 points. In some instances, the impact of hard inquiry on your score will be minimal. A hard inquiry will stay on your credit report for 24 months but will not affect your score after 12 months. Hard inquiry affects 10% of your FICO score and 6% of your Vantage score.

Credit mix(10% of FICO score)

This is the mixture of different accounts you have, including revolving credit accounts such as credit cards and installment accounts such as car loans, mortgages, etc. A good mixture should consist of both credit accounts (revolving and installment accounts). The Credit mix affects 10% of your FICO score.

Total debt/total credit balance (11% of VantageScore)

The VantageScore considers the amount of debt you have on your credit accounts.

Available credit (3% of VantageScore)

The last factor on your VantageScore is the total credit available on your accounts, which accounts for 3% of your Vantage score calculation.

Related: What is a VantageScore, and how does it work?

Why did my credit score go down?

Your credit score likely decreased due to a decline in creditworthiness. This can be caused by late payments, high debt, getting too many forms of credit, or having a high credit utilization ratio. By understanding why your credit score decreased, you can take steps to repair it and prevent it from dropping further in the future.