A credit score above 700 is essential as it allows you to qualify for loans with lower rates and better terms. Additionally, having a 700 credit score or higher makes your finances easier and saves money on different financial products and services. For example, some landlords and utility companies might waive a security deposit due to having a 700 credit score or higher. However, getting a 700 credit score seems complicated and can take longer if you don’t have the right credit-building strategy.

Luckily, I have put together seven clever tips to achieve a 700 credit score fast without paying thousands of dollars to credit repair companies.

Whether you’re just starting to build credit or looking to improve your current score, this guide is a roadmap to getting a 700 credit score and beyond. The same strategies will also quickly help you reach an 800 credit score if you don’t deviate from them.

Understanding credit scores

To truly achieve a 700 credit score, it’s critical to understand how credit scores work and how they are calculated.

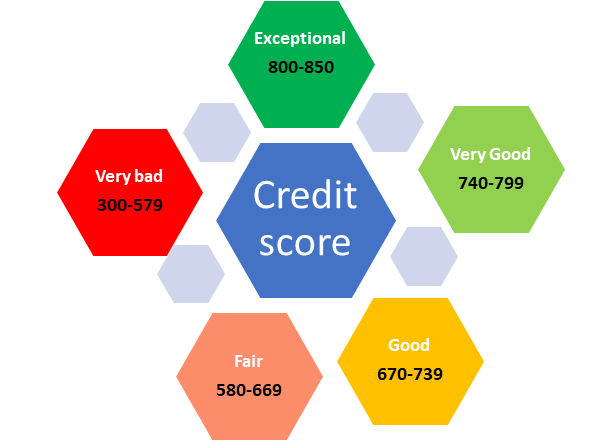

Your credit score is a three-digit number used to assess your creditworthiness. Typical credit scores range between 300 and 850. Credit reporting agencies calculate your credit score from information in your credit reports, such as payment history, utilization ratio, negative items in your report, and more.

The credit score range is divided into different ranges that determine your credit health. Here are other credit score ranges. Remember that these ranges can change based on industry and reporting agencies.

- Exceptional credit score: 800-850

- Very good credit score: 740-799

- Good credit score: 670-739

- Fair credit score: 580-669

- Very bad credit score: 300-579

When building your credit score to 700 and above, the key is not to reach a particular number. Instead, you need to get your score into one of the credit score ranges above because rates and terms are usually similar for people in the same range. For example, if you have an 805 credit score, you will qualify for similar rates and terms with someone with an 825 credit score because both of you have exceptional credit scores.

Types of credit scores

There are many credit score types, but the two most popular are the FICO score and the VantageScore.

- FICO score. Your FICO score is calculated by the Fair Isaac Corporation and ranges from 300 to 850. Most lenders prefer the FICO score as it provides a more accurate assessment of borrowers’ creditworthiness. According to Experian, your FICO score requires at least one credit account that is six months old and six months of credit activities to be generated.

- VantageScore. Similar to your FiCO score, your VantageScore also ranges from 300 to 850, and it is calculated based on information from your credit reports by the three credit reporting agencies (Equifax, TransUnion, and Experian). Unlike your FICO score, which requires at least six months of activities to be generated, VantageScore only requires you to have an open account. Your VantageScore is a generic score that can be used by many industries, which is why many consumers think it is not accurate and is usually higher than your FICO score. However, it is a great indicator of the health of your credit and offers a great view of your current credit health.

Factors affecting your credit score

Before we cover strategies to get a 700 credit score, let’s understand the factors that affect your credit score. These factors will be your guide in your credit-building journey. Here are the factors on which your credit score is based.

Your payment history

Payment history is the biggest factor in your credit score calculation as it accounts for 35% of your FICO score and 40% of your VantageScore. Lenders want to see a consistent pattern of on-time payments, as it demonstrates your reliability and responsibility as a borrower. Late payments or delinquencies can significantly lower your credit score, while a solid track record of timely payments can help boost it.

Read more: How does payment history affect your credit score?

The amount of debt you owe(credit utilization)

Another crucial factor in determining your credit score is how much you owe compared to your available overall credit limit, known as your credit utilization. It’s important to keep your credit utilization as low as possible, ideally below 7% if you want to get a 700 credit score. High credit card balances or maxed-out credit limits can signal financial strain and significantly lower your credit score. Your credit utilization accounts for 30% of your FICO score and 20% of your VantageScore.

Read more: What is the best credit utilization ratio?

The length of your credit history

How long you have been using credit helps lenders determine your reliability and discipline in borrowing. Generally, a more extended credit history is considered more favorable, providing lenders with a more comprehensive view of your borrowing habits.

If you are new to credit or have a thin credit file, building a strong credit score may take time. However, responsible use of credit over time can help establish a solid foundation. The age of your credit accounts for 15% of your FICO score, while a combination of your credit age and credit mix accounts for 21% of your VantageScore.

Read more: What is a good age of credit history to qualify for loans

New credit accounts/hard inquiries

Opening multiple credit accounts very often can signal to lenders that you are financially precarious. Additionally, each time you apply for credit, a credit check is performed, resulting in a hard inquiry on your credit reports and slightly lowering your credit score. It’s important to be selective when applying for new credit and only to do so when necessary. New credit activities account for 10% of your FICO score and 6% of VantageScore.

Read more: How long do hard inquiries stay on a credit report?

Credit mix

Credit mix is another factor in your credit score calculations. A good credit mix includes revolving credit accounts such as credit cards, personal lines of credit, etc, and installment loans such as car loans, mortgages, and student loans. Lenders prefer borrowers with good credit mixes as it shows their ability to responsibly manage different kinds of credit accounts. Credit mix accounts for 10% of your FICO score and 21% of VantageScore when combined with credit mix.

Read more: What is a good credit mix to increase credit score?

How to get a 700 credit score?

Now that you understand the factors that affect your credit score, how do you get a 700 credit score? Getting a 700 credit score is easy if you follow the right strategy. However, getting a much higher credit score, such as an 800 credit score, will take time, as the age of your credit contributes 15% of your credit score. So, it takes can as many as 7 to 12 years to get an 800 credit score.

There are credit-building strategies for raising credit scores to 700 and above, and this article details each strategy.

Here is a step-by-step guide to boost your credit score to 700 and beyond.

1. Prioritize making timely payments on all your credit accounts

Payment history significantly impacts your credit score, so consistently paying your bills on time is essential. Set up automatic payments or reminders to ensure you never miss a due date. Demonstrating responsible payment behavior shows lenders that you can be trusted with credit. This will allow you to increase your credit score to 700 and beyond gradually.

2. Keep your credit utilization low under 7%

Your credit utilization ratio plays a significant role in determining your credit score. To get a 700 credit score, aim to keep your credit utilization ratio below 7%. It is even better to pay off all your credit card balances in full at the end of each month, as carrying any balance does not make sense due to higher rates. Carrying a balance on your credit cards also increases the risk of debt accumulation. So, the less balance you have, the better.

A few strategies to lower your credit utilization and get a 700 credit score are to pay down existing debt, ask for credit limit increases, or even open a new credit account if it makes sense for your financial situation.

3. Pay down your debts

If you have trouble raising your score to 700, you may have too much debt. If you do, pay off these debts as soon as you can. For example, if you have a lot of revolving debts, allocate most of your funds toward these debts.

Paying off debt also helps keep you in good financial standing by improving your debt-to-income ratio. The less debt you carry, the less likely you are to miss a payment, default on your loan, or suffer from financial stress. You should aim for a DTI ratio lower than 28%.

You might also like:

- 6 practical ways to pay off credit card debt

- How can you use the debt avalanche method to pay off debt?

- How do you use the debt snowball method to pay off debt?

4. Clean up your credit reports

Cleaning up your credit reports is essential to getting a 700 credit score. Since your credit score is calculated using information from your credit reports, it is vital to ensure that the information in your credit reports is accurate and updated.

Start by getting a free copy of your credit report from each credit bureau and read them line by line. If you see inaccurate information, fraudulent activities, outdated account info, or removable negative items, get that information updated or removed from your credit reports. You can dispute information in your credit report to credit bureaus, the company that reported that information, or both.

Read more: How do you dispute an error on your credit report?

One of the most effective ways to get a 700 credit score is to become an authorized user of a credit card account. For example, if you have a thin credit file or are attempting to rebuild your credit, you can get added to a credit card account with excellent credit activities.

When you become a user of a credit card account, you directly benefit from positive activities on that credit account. This means that all payment activities, account usage, low credit utilization, etc, also get reported to your credit reports. Hence boosting your credit score.

Before signing up for any credit card account, ensure the card provider reports authorized users’ activities to credit bureaus. Adding to an account that does not report your activities to credit reporting agencies will not help you raise your credit score.

Read more: What is an authorized user on a credit card?

6. Avoid excessive borrowing

Getting an excellent credit score requires discipline and caution in your borrowing behavior. Every time you apply for a credit account, such as a loan or a credit card, the lender runs a credit check, which causes a hard inquiry on your credit report and lowers your score by 5 to 6 points on average.

By submitting too many credit applications often, you risk wrecking your score even more due to hard inquiries in your credit reports. So, avoid excessive borrowing if you want to get a 700 or 800 credit score. Stay disciplined, apply for only credit accounts when needed, and borrow what you can afford to pay off.

You might also like: Manage your money better in 11 simple steps

7. Do not close old accounts

One of the biggest mistakes many consumers make is to close old accounts or accounts they don’t use very often, thinking it will help them raise their credit scores. While this can help you take control of your finances, closing an old credit card account might hurt your credit score. This is because that account contributes to the age of your credit, which is an essential factor in your credit score calculation.

Additionally, if you close an old account, such as a credit card, you will lose that credit limit, which might increase your credit utilization ratio and lower your credit score.

Instead of closing the account, add a small recurring payment, such as a streaming monthly bill. This will keep the account open while maintaining low utilization.

How long does it take to get a 700 credit score?

The time it takes to reach a 700 credit score can vary depending on your starting point and individual circumstances. For some people, it may take as little as six months to a year to get a 700 credit score by consistently practicing good credit habits, such as making timely payments and keeping credit utilization low. Others may need more time to build a solid credit history and demonstrate responsible credit management.

The most important thing to remember is that credit building is a gradual process that requires patience, persistence, and consistency. Establishing a positive credit history over time is critical, as this demonstrates to lenders that you are a responsible borrower. Length of credit history is a crucial factor in calculating credit scores, and the longer you have a history of responsible credit use, the better it reflects on your creditworthiness.

Another factor to consider is the impact of negative marks on your credit report. Suppose you have late payments, collections, bankruptcy, foreclosure, or other negative items in your credit reports. In this case, it can take longer to improve your credit score since most of these negative items stay on your credit report for 7 years to 10 years.

Related: 13 most common negative items on a credit report

How much can I borrow with a 700 credit score?

Your credit score has a significant impact on your borrowing power. Lenders use credit scores to assess your creditworthiness and determine the interest rates and loan terms they can offer you. A 700 credit score is considered a good score, and having it can help you qualify for a larger principal.

While your credit score is used to assess your creditworthiness and the interest you pay on the loan, it is not the only factor determining how much you can borrow. For example, having an 800 credit score won’t get you approved for a $1 million mortgage if your income does not justify your monthly payment obligations. Lenders use your income to estimate how much you can afford to borrow. Lower incomes mean you won’t qualify for much money.

The loan amount you can borrow with a 700 credit score will vary depending on other factors, such as your income and debt-to-income ratio, other assets, etc. So, having a 700 credit score puts you in a favorable position, assuming you have met your lender’s other debt and income requirements.

Related: How much home can I afford?

What are the benefits of having a 700+ credit score?

A 700+ credit score is essential as it becomes integral to your financial wellness. Here are some of the benefits of having a 700 credit score.

- You get higher credit limits on credit cards. With a 700 credit score, you qualify for a higher credit limit on new credit card accounts.

- A 700 credit score helps you qualify for lower rates on loans and credit cards.

- Better credit card rewards. Consumers with 700+ credit scores usually qualify for better rewards on their credit cards.

- A 700 credit score gives you bargaining power. While most lenders can qualify you for loans with credit scores under 700, having a higher score helps you qualify for loans much faster and more money. You can negotiate better loan options or better services with such a credit score.

- Easy to refinance your loans. If you have loans you want to refinance, a 700 score can help you qualify for loan refinance.

- Your rental application gets approved faster when you have a 700 score. Some landlords also waive security deposit when you have a good credit score.

- You will land a job much faster when applying for jobs where credit scores are used in the application process.

How to raise your credit score from 500 to 700

If you have a 500 credit score, it might take some work to get to a 700 credit score and above. But it will all depend on the reason your score is this bad. For example, if your score is bad only because of a high utilization ratio, your score can go up fast as soon as you improve your utilization rate.

On the other hand, if you have a 500 credit score due to negative items on your credit reports, such as foreclosure, collections, and bankruptcy, it might take many months or years to raise your credit score from 500 to 700 and above. These negative items affect your credit for seven years or more.

You might also like to know how long negative information stays on your credit report.

Here are clever tips to raise your credit score from 500 to 700.

Get a copy of your credit reports.

The first step to raising a credit score in the 500s is to obtain a copy of your credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion. Carefully review the reports for errors or discrepancies, which can negatively impact your credit score.

If you find any inaccuracies, such as accounts you don’t recognize or incorrect payment information, be sure to dispute them with the respective credit bureaus. Also, ensure that all information in your credit reports is accurate and current.

Prioritize paying off outstanding debts, especially on revolving credit such as credit cards.

Focus on tackling high-interest debts and revolving loans first, as these can significantly impact your credit score by increasing your credit utilization. Consider setting up automatic payments and creating a budget to ensure you consistently make on-time payments.

Pay your bills on time.

While paying bills on time won’t raise your score instantly, missing a payment will definitely drop it by a lot of points. I also have to mention that paying history is the most important factor in your credit score calculations. So, always make on-time payments if you want to raise your score from 500 to 700.

To further improve your score, you may consider becoming an authorized user on someone else’s credit card. If you have a trusted family member or friend with a good credit history, they can add you as an authorized user to their account. This allows their positive credit history to be reflected on your credit report, potentially boosting your credit score.

Keep your credit utilization under 7% or 0% when possible.

Since credit utilization is the second factor in credit score calculation, maintaining a lower credit utilization will automatically improve your score. If you have large balances on your credit score and have many revolving credit accounts, such as credit cards and personal lines of credit, prioritize paying them off to maintain a lower credit utilization. Never have a credit utilization of more than 7% at any time.

Avoid applying for loans and credit cards very often

Applying for multiple credit cards or loans excessively can raise red flags and negatively impact your score due to multiple hard inquiries. Instead, focus on using and maintaining your existing credit accounts responsibly. If you must take out a loan, ensure you need the money and always get pre-qualified before applying.

More credit tips

How to Raise Your Credit Score in 30 Days?

Will my credit score go up if I pay off my car?