Each credit card account you have comes with its own credit limit. As you use your credit cards, your credit issuers will eventually increase your credit limit automatically. If your card issuer does not increase your credit limit automatically, you can request a credit limit increase. The question is, how will requesting a credit limit increase affect your credit score and credit in general?

Requesting a credit limit increase can hurt your credit and credit score. After submitting your credit increase application, your car issuer can treat the request as a new account application. That is the creditor will check your credit profile which will result in a hard pull or hard inquiry on your credit report. A hard pull on your credit report will lower your credit score by about 5 to 6 points.

Some lenders will not request to view your credit profile. This will result in a soft inquiry on your credit report and will not affect your credit score. The effect of a credit limit increase on your credit and credit score will depend on your lender.

This article will go over the details on how requesting a credit limit increase affects your credit.

What is a credit limit?

When you get approved for a credit card, the car issuer will give you a credit card. Each credit card will come with a maximum amount you can spend on the card. The available credit on your credit card will be your credit limit. After spending all your credit limit, you will have to pay some of the money you spent before you can use your credit card again.

For example, let’s assume that you have a credit card with a credit limit of $3,000. This means that you can use your card and spend up to $3,000. Once all credit limit is spent, you must pay off some of the balance in order to use your card again. If you spend all available credit on your credit card, your credit utilization will be 100%.

Having a higher credit utilization means that you rely on debt to cover your expenses. A higher utilization also shows that you probably don’t have enough income to support your daily financial needs. Hence, making you a risky borrower.

A higher utilization rate lowers your credit score(FICO score or Vantage Score) and affects your credit.

As you use your credit card and pay it off, your lender could automatically increase your credit limit. For example, your lender can increase your credit limit from $3,000 to $4,000.

How does requesting a credit limit increase affect your credit score and credit in general?

If your lender does not increase your credit limit automatically, you can request your credit limit to be increased by the lender. Keep in mind that when you submit a credit limit increase application, your lender might request to see your credit profile. This will result in a hard inquiry on your credit report and a slight decrease in your credit score.

You should expect your credit score to decrease no more than 10 points.

Other credit card issuers, however, might increase your credit limit without viewing your credit profile. The effect of this activity will be a soft inquiry which will not lower your credit score.

Even if you end up with a hard pull, your credit score could benefit from a credit limit increase.

This is because once your credit limit goes higher, your credit utilization will go lower. A lower credit utilization automatically increases your FICO score.

How to increase your credit limit?

There are many ways you can have your credit limit increased. The following are ways to increase your credit limit.

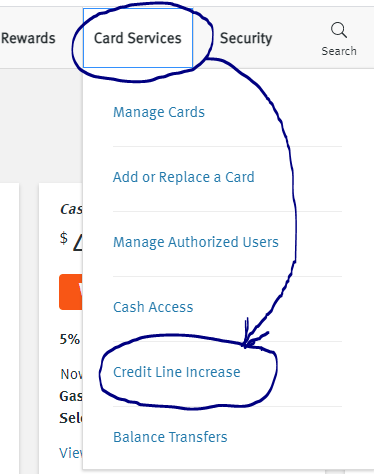

- Request credit limit increases online. Most lenders have an option inside your account where you can request for credit limit increase. It will take a few steps to complete the whole process. This action could result in a hard pull on your credit report and your credit score could go lower as a result.

- Call your lender. An effective way to boost your credit limit is to call your lender. A simple phone call can seal the deal. Keep in mind that you must be a great credit user. Otherwise, your lender might decline your request.

- Let your lender increase your credit limit automatically. As you use your credit cards, your lenders will constantly evaluate your activities. If you are responsible and make your payments on time, your credit limit will be increased automatically. An automatic increase of your credit limit will not affect your credit or your credit score.

- Update your income. Most credit card issuers never increase your credit limit because you did not update your income. So, if your income went higher, go ahead and update your income on your profile. Your card issuer might increase your credit limit according to these changes.

Related: How to increase credit limit? Credit line increase

When is the best time to request a credit limit increase?

Since requesting a credit limit increase might affect your credit and lower your credit score; you must have a valid reason to request a line of credit increase. The following are a few reasons you might want to request for credit limit increase.

- You have been using your credit card for a while. There are credit card issuers who take a while before they can increase your credit limit. If you have been using your credit card for a while and responsibly, consider requesting a credit limit increase.

- You are anticipating an expensive purchase. Instead of taking out a personal loan, you can request a higher credit limit to help you cover an expensive purchase.

- You have a higher credit utilization. A higher credit utilization affects your credit score by 30%. By getting a credit limit increase, your credit utilization will go lower. Hence, boosting your credit score and improving your credit.

Do credit bureaus know when I request a credit limit increase?

Requesting for a credit limit increase can result in a hard pull on your credit report. That is the lender requested to view your credit profile and submitted this activity to three major credit reporting agencies(Experian, TransUnion, and Equifax).

Credit bureaus know about your crit account activities only when your lender reports your information. A hard pull will result in a temporal reduction of your credit score. Fortunately, an extra credit limit will result in lower credit utilization and will directly increase your credit score.

Related: How do credit bureaus get your information?

What credit limit is good for you?

The answer to this question will depend on many factors and will vary from one person to another. Credit card limits can be as low as $200 or as high as $50,000. A person who is struggling financially might want a higher limit to cover their expenses. However, it does mean a higher limit is good for them.

In order to qualify for a higher limit, you’ll need to check almost every box at an excellent level. That is you must have an excellent credit score, have a higher income, have a solid credit history, and have the lowest debt to income(DTI) ratio.

As the limit goes higher, lenders apply stricter restrictions to make sure that you will pay them back. Credit card debts are some of the worst consumer debts, and lenders are aware of this information. That is why they do not approve you for a higher credit limit that easily.

According to Experian, the average credit limit for 2021 was $30,365. If your credit limit is higher than this value, it means your limit is higher than the average limit among consumers. Any limit above the average is considered high. Whether a higher limit is good or bad, is subjective to individuals’ financial conditions.

The risk involved in requesting a credit limit increase

Although it might be beneficial to request a credit limit increase, there are risks involved with higher credit limits.

The simplest way to treat credit cards is to treat them like debt. Your credit limit is not just the money you can spend. It is actually debt and consumer debt is one of the hardest debts to recover from. If you are not careful, you might end up spending all your credit limit and getting deeper into debt.

Most people tend to spend more money when their incomes go higher or when their credit limits are increased. You should avoid this trend because it leads to financial struggles down the road.

The more credit limit you get, the more spending temptation. By spending more money, you automatically increase your credit utilization and lower your credit score. On top of this, high credit utilization on a higher credit limit means that your balances are also higher which makes them harder to pay off.