CDs and savings accounts are popular deposit products among consumers. These two deposit accounts come with different benefits and drawbacks you should consider when deciding which account best fits your financial goals. This article covers the key differences between a CD and a savings account and how to pick the right account that meets your savings goals and maximizes your return on investment.

A savings account is a reliable option for keeping your money safe and easily accessible but it comes with a much lower interest compared to a CD account. Savings accounts are best for short-term goals and saving for emergencies. A certificate of deposit (CD), on the other hand, does not offer access to your funds until maturity. With a CD, your money is locked in the account, and accessing it leads to an early withdrawal penalty. Typically, a CD comes with a higher interest rate compared to a savings account and it is best for long-term saving goals.

What is a savings account?

A savings account is a type of deposit account provided by financial institutions, such as banks and credit unions. Its primary purpose is to help you save money over time while earning interest on your savings. Unlike checking accounts, which are designed for frequent transactions and day-to-day expenses, savings accounts focus on accumulating funds for saving goals or emergencies.

One of the key features of a savings account is its accessibility. With a savings account, you can deposit and withdraw money as needed, providing a level of flexibility that can be crucial when unexpected expenses arise. Additionally, savings accounts often come with ATM access and online banking capabilities, allowing you to manage your funds conveniently.

Furthermore, savings accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC) for bank accounts up to $250,000 per account. The National Credit Union Administration(NCUA) insures savings accounts opened through credit unions up to the same limits. This insurance ensures that even if the financial institution fails, your money (up to a certain limit) will still be protected.

While savings accounts come with flexibility and access to your funds, the interest you earn is relatively low compared to certificates of deposit and returns from other investment options such as stocks, mutual funds, and real estate. You can get a much higher interest by opening a high-yield savings account which is normally offered by online banks and credit unions.

You might also like: High yield savings account vs. investing: Which one is better?

What is a certificate of deposit(CD)?

Certificates of deposit, commonly referred to as CDs, are financial products offered by banks and credit unions. A CD is a time deposit, meaning you agree to keep your money in the account for a specific period, called the term or maturity date. During this time, the funds are typically locked in, and there may be penalties for early withdrawal which is one of the biggest differences between a CD and a savings account.

Unlike a savings account where interest rates can fluctuate over time, CDs often provide a fixed interest rate throughout the entire term. This stability can be especially appealing if you prefer a reliable and secure investment option.

CDs come with various term lengths with different interest rates. These can range from a few months to several years, allowing you to select a duration that aligns with your financial goals. Shorter-term CDs offer lower interest rates but are ideal if you need quick access to your funds. On the other hand, longer-term CDs generally yield higher interest rates, making them attractive for individuals with long-term savings goals such as a college fund or a down payment on a home.

Additionally, many CD accounts come with a minimum deposit requirement which is usually higher than a standard savings account. On average, the minimum deposit on a CD account ranges between $500 to $10,000. If you are opening a Jumbo CD, however, you will more likely need at least $100,000 to open an account.

If you are interested in opening a CD account, here are 11 different types of CDs to choose from and how to open a CD account step by step.

Read more: How Do CDs Work: Learn How To Save And Earn Smarter

Certificate of deposit vs. savings account

When it comes to choosing between a CD and a savings account, it’s critical to consider your financial goals and needs. For example, a savings account provides easy access to your funds and you can make withdrawals whenever necessary but it comes with a low interest rate compared to a CD account. This means that if you are only interested in growing your account, a CD account will serve you better. On the other hand, a CD offers a fixed interest rate and a guaranteed return. The trade-off, however, is that with a CD, you need to commit your money for a specific period, known as the maturity date. In this case, if you need access to your money, a savings account will serve you better.

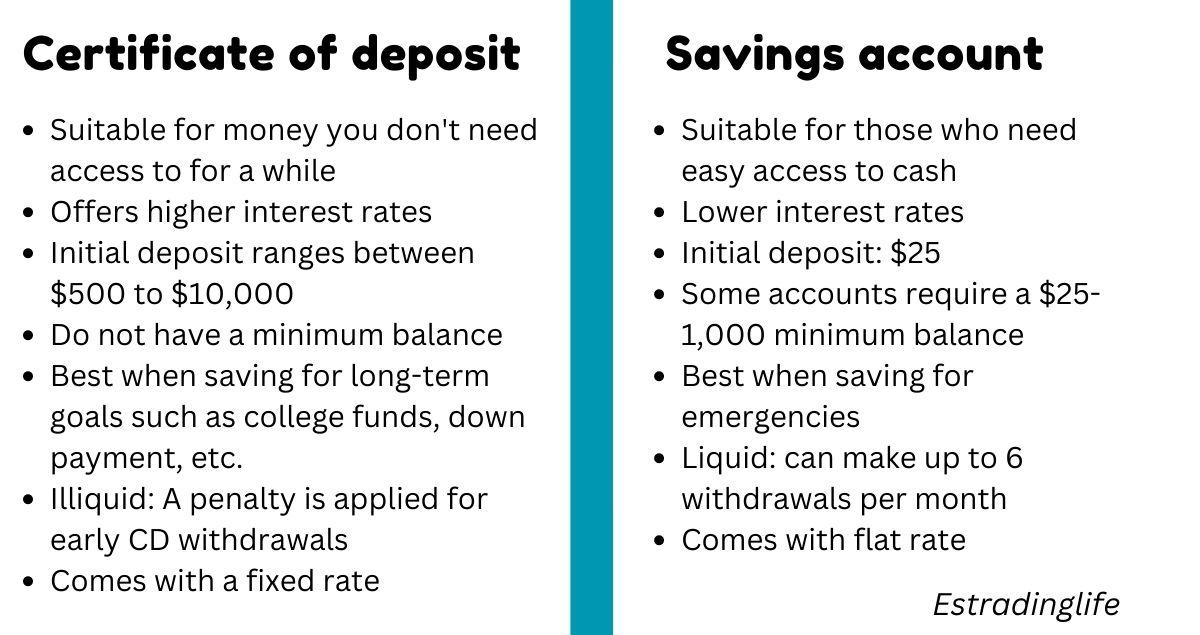

CD vs. savings account

When does it make sense to open a savings account over a CD account?

If you anticipate needing to access your funds or want the flexibility to deposit and withdraw money regularly, a savings account may be a more suitable choice. Savings accounts allow easy transactions, providing you with the reassurance that your money is readily available.

To maximize your return on investment(ROI), open a high-yield savings account which is offered by online banks and credit unions. These accounts come with more competitive rates than normal savings accounts.

When does it make sense to open a CD account?

Due to the restricted access to funds in a CD account, a certificate of deposit is a better option for those who have surplus funds they can afford to lock away for a set period, without needing immediate access. CDs can be a smart choice if you’re saving for a specific financial goal, such as a down payment for a house or a child’s education, and you want to ensure that your money grows steadily with a fixed interest rate.

Pros and cons of a CD account

Certificates of Deposit come with advantages and disadvantages you should consider when comparing a CD vs. a savings account. Here are the pros and cons of certificates of deposit you should know.

Pros of certificate of deposit

- Higher interest rates. CDs typically offer higher interest rates compared to savings accounts.

- Fixed and guaranteed rates. Unlike savings accounts where interest rates can fluctuate based on market conditions, CDs offer a fixed rate of return for the term. With a CD, you can easily calculate how much you will make by the time your CD matures.

- Great for long-term financial goals. With a CD, your money is locked away, making it less tempting to use it for impulsive purchases. This makes CDs a great option for those who want to save for a specific purpose, such as a down payment on a house or a dream vacation, and need the discipline of not being able to access their funds easily.

Cons of certificate of deposit

- Lack of liquidity. Unlike savings accounts, which allow you to withdraw funds at any time, CDs have a fixed term, ranging from a few months to several years. Once you commit your money to a CD, you won’t be able to access it without paying penalties.

- Your rates do not change. This means that if interest rates rise in the future, you won’t be able to take advantage of those higher rates until your CD matures. This could potentially result in missed opportunities for increased earnings.

- Lower rates compared to alternative investments. Even if CDs offer higher rates compared to savings accounts, these rates are still lower compared to returns from stocks, mutual funds, real estate, etc. This means that a CD account can help you diversify your portfolio but CDs alone cannot help you build wealth.

- Higher minimum deposit compared to a savings account. While you can find a CD that requires as little as $100, most CD accounts require a minimum deposit that is between $500 and $10,000. This deposit is too high compared to savings accounts which usually require $25 to open an account.

Read more: Pros and cons of investing in CDs: Are CDs worth it?

Pros and cons of a savings account

A savings account is critical in your financial planning. Not only that you can rely on your savings account to save for emergencies and achieve short-term goals, but you can also earn interest on your deposit.

Here are the pros and cons of savings accounts you need to know.

Pros of a savings account

- Savings accounts are liquid. Unlike CDs, savings accounts allow you to access your funds whenever you need them which gives you a greater level of financial flexibility. Whether you need to pay for unexpected expenses or seize an investment opportunity, having easy access to your money can be advantageous.

- Lower minimum deposit requirements compared to CDs. Many banks require $25 to open a savings account which is much lower compared to hundreds or thousands of dollars in minimum deposit requirement for CDs. A lower minimum deposit makes savings accounts more accessible to individuals who don’t have a large sum of money to invest upfront.

- Fewer restrictions on deposits and withdrawals. Savings accounts allow you a limited number of withdrawals and transfers every month without penalties. This level of freedom can be appealing if you prefer more control over your savings.

Cons of a savings account

- Lower interest rates compared to CDs. While savings accounts can still earn you interest, the rates are much lower compared to those from CDs. This means that while your money is accessible, it may not grow as quickly or earn as much in interest as it would in a CD.

- Need consistent savings for more returns. Unlike CDs where you make a single deposit, a savings account relies on your discipline to save consistently usually every month. Without a structured commitment, it can be easier to spend your savings or neglect regular deposits.

CD vs. savings account: Which one is better?

CDs and savings accounts are both popular choices for individuals looking to grow their money, but making the right choice requires weighing the pros and cons of each. Here is how to pick the right deposit account for your financial situation.

If you have cash that you don’t need access to for a long time and want to earn a higher interest, choose a certificate of deposit. A CD will also be a good choice if you want to save for a specific goal such as a down such as a vacation or college tuition.

If you want to earn a return on your savings but still need access to your funds, choose a savings account. For example, it will be wise to deposit your emergency fund in a savings account instead of a CD account. This is because you can easily access your funds from a savings account during emergencies without paying a penalty. A savings account will also be a great choice when you don’t have enough cash to meet a CD minimum deposit requirements.

Is it better to put money in a CD or savings?

When it comes to deciding between a CD and a savings account, one key factor to consider is the potential returns on your investments. While savings accounts often offer lower interest rates compared to CDs, it’s essential to weigh the potential returns against the limitations and restrictions associated with a CD.

If maximizing your returns is a priority, it may be worth considering the higher interest rates offered by CDs. These higher rates are usually a result of the fixed-term commitment involved with a CD. By locking your money away for a specific period, you have the potential to earn a more substantial return on your investment. Alternative to CDs are high-yield savings accounts which you can open from reputable online credit unions and banks.

While CDs offer higher rates, they also come with limitations and restrictions. For example, you will not have access to your funds until maturity and if you access it early, you may face penalties for early withdrawal.

This is why a savings account comes into play. In case, you want to maintain access to your funds while earning interest, a savings account will be the best choice. You can also have a combination of a savings account and CD at the same time. For example, you can put your emergency funds in a savings account, and deposit your long-term goal savings in a CD account. All these accounts can also be opened with the same bank.

Are CDs safer than savings accounts?

When it comes to safety, both CDs and savings accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC), which means that even if the bank fails, your deposits are protected up to $250,000 per depositor, per account category. Accounts opened through credit unions are insured by the National Credit Union Administration(NCUA) for the same amount. Whether you open a CD or a savings account, your deposit will have the same level of safety as long as your institution is insured by FDIC or NCUA.

Read more: Is a CD safer than a savings account: Which one is better?

Are CDs safe if the market crashes?

CDs do not experience the same volatility that stocks, bonds, real estate, and other investments experience when the market crashes. This is because CDs come with fixed rates that stay the same regardless of market conditions.

In the event of a market crash, CDs can offer a haven for your money. While the value of other investments like stocks and bonds may plummet, your CD will remain untouched. This is because CDs are not directly tied to the stock market or subject to market fluctuations.

Additionally, CDs are often considered a low-risk investment because they are insured by the FDIC/NCUA up to $250,000 per depositor, per insured bank. This means your principal investment and accrued interest are protected up to this limit.

CD vs. savings account: Which one pays more interest?

CDs offer higher interest rates compared to savings accounts. This is primarily because CDs require a commitment to leave the funds untouched for a specified period. Some financial institutions also offer higher rates as an incentive to attract investors willing to lock in their money for a predetermined time frame. These types of CDs are known as Special CDs, Promotional CDs, or Bonus CDs and they offer a much higher interest rate than traditional CDs.The rates you earn will also vary from one institution to another, the type of CD, and its term.

On the other hand, savings accounts generally have lower interest rates than CDs due to their flexibility and liquidity. Savings accounts are designed for quick access to your funds when needed, making them ideal for emergency funds or short-term savings goals. Some high-yield savings accounts, however, offer competitive rates similar to or close to what most CDs offer.

Final words

Before opening either a savings account or a certificate of deposit, evaluate your financial situation and saving goals. If you prioritize liquidity and flexibility, a savings account might be the better choice for you. On the other hand, if you have a long-term saving goal and don’t mind locking your funds away for a specific period, a CD can potentially provide higher returns.