What is capitalization rate?

The capitalization rate a.k.a cap rate is a metric used in real estate to measure the expected rate of return on a real estate investment. To understand the future profitability and potential growth of a real estate investment; investors rely on return estimation metrics such as the cap rate.

Investors can also use the cap rate to evaluate similar properties in the same location. However, it must not be the only method investors use when making crucial investment decisions.

While the cap rate gives a great approximation of future returns based on current income; it does not use leverage, according to Investopedia. This is why investors must use other methods to support conclusions from the cap rate.

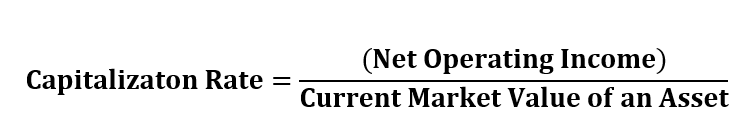

What is the formula of cap rate?

The capitalization rate is calculated from the net operating income and the current market value of an asset.

Net Operating Income: The net operating income is the income generated by a real estate property after deduction of all expenses.

Current Market Value: The current market value is the value of the property in the market place. In order words, the current market value indicates how much a property can be sold for at the market.

>> Related article: Fair Market Value(FMV)

>> Related article: Intrinsic Value: What Is The Intrinsic Value?

Importance of capitalization rate

The capitalization rate helps investors to understand the future profitability of a real estate investment. In addition, this rate can give investors a rough estimation of how long it will take them to recover their investment in the property.

Investors can also use the cap rate to compare similar properties in the same area. For example, if I want to buy a new apartment complex, I can estimate its returns by evaluating similar properties built in the same area.