The Annual Percentage Rate (APR) of a mortgage or a loan, is the interest debtors pay on their loans. This interest is expressed as a percentage of the total amount owed. The interest charges include fees and other associated transaction charges except for the compounding interest.

For example, if you borrowed $50,000 and your APR is 10%, you will pay $5000 of interest.

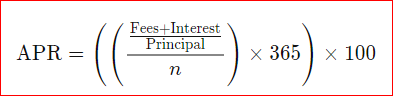

The formula of calculating the Annual Percentage Rate

The formula for calculating the APR.

In this formula,

- The interest = Total interest paid over life of the loan

- Principal = Loan amount

- n = Number of days in loan term

Always be careful with Annual Percentage rate

Annual Percentage Rates are designed to punish the borrower and benefit the lender.

For example, many people fail to pay off their credit cards’ debts because of high APRs.

To avoid paying these charges you will need to avoid accumulating loans in your financial plannings.

Form of Annual Percentage Rates (APR)

APR comes in different forms depending on the types of credit cards and moneylenders and the creditworthiness of the borrower. Lenders have different business structures that allow them to charge these interest rates.

The following table illustrates different forms of APR, according to Experian.

These averages will change form over time and from one lender to another.

| Annual Percentage Rate | Interest rate (National Average) |

| Purchases APR | 22.61% according to USNews) |

| Cash advance APR | 23.68% according to Creditcards |

| Cash transfer APR | 20.8% according to USNews |

Advice on APR

Should you find yourself having a loan or credit card? Choose a loan or cards with the lowest APR possible.

It is also important to pay off a big chunk of your loan before the lender applies the APR fee on your loan.

Sources: