A gap up is a term used when a stock opens higher than it closed the previous trading day. After the stock market closes, some stocks show increased trading activities which create gaps between the closing price and the next day’s opening price. Gap ups can be full gaps when the stocks opened higher than the previous day’s high or partial gaps if they open lower than their previous highs.

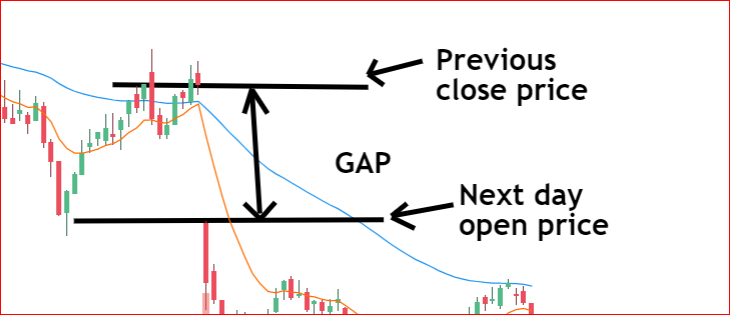

The gap will be the number of points or dollar value between the previous close and where it opened.

A gap down occurs when a stock opens lower than it previously closed. When a stock gap down, it will be an indication of a bearing movement. If many many stocks are gaping down, it may indicate a bearish movement of the stock market as a whole or a particular section of the market.

A gap up signals a bullish movement about a particular stock.

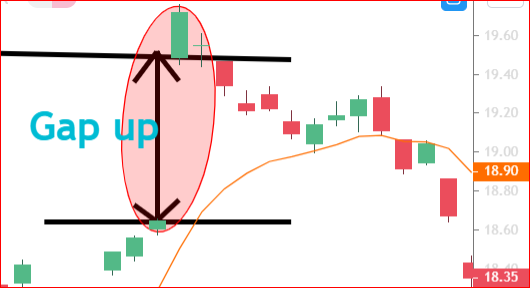

Example of a gap up

In figure 1, the stock closed at $ 18.61 per share on the previous trading day and opened at 19.45 per share the next day. This is a gap of $1.09 or 4.53% from the previous close.

Example of a gap down

As you can see from Figure 2, the stock opened much lower than it previously closed. This gap could be a result of bad earning or other bad news that changed investors’ sentiments about the stock.

Classification of gaps

There are four classification of gaps, according to Investopedia.

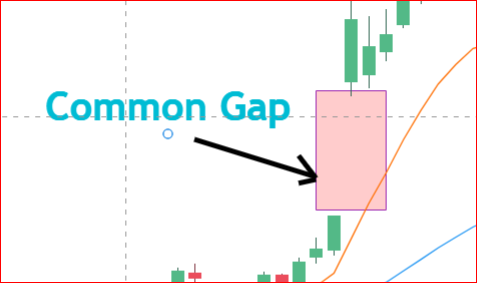

- Common gaps: The common gaps represent an area where a gap has occurred. In other words, there will be no trading activities between the close and the opening price.

- Continuation gaps: The continuation gaps occur before the end of a pattern. Buyers or sellers do not wait for the pattern to unfold. Instead, they jump into the market and buy or sell the stock ahead of time. This is due to the high anticipation of the future direction of the stock. If a bearish pattern is forming, for example, many people can decide to sell which will drop the price before the pattern is complete.

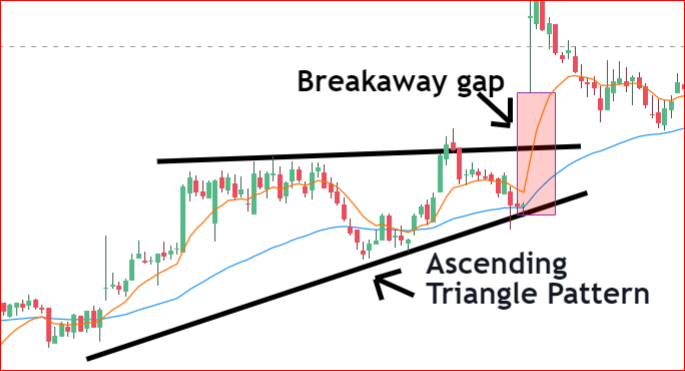

- Breakaway gaps: Breakaway gaps happen at the end of a trading pattern. In general, this pattern indicates the beginning of a trend. You can observe a breakaway gap in the figure below where it happened after an ascending triangle pattern.

- Exhaustion gaps: Exhaustion gaps happen after the price has reached a high level or a low level. After a big rally, for example, the seller may jump into the market and creates a temporally bearish condition which will create a break low of the previous level. The stock can go back up or continue in the downtrend depending on the market sentiment. The cause of this gap can be profit taking or news about the stock.

What causes stock gaps?

The following are some of the causes of gaps.

- Earning release

- Bankruptcy

- Acquisition

- Share issues

- Share buyback

- News from the FDA

- News expectations

- Market sentiments

- Other markets

- Natural causes such as a pandemic, earthquake, weather, etc.

- Political reasons

- Etc.

How to find gaps?

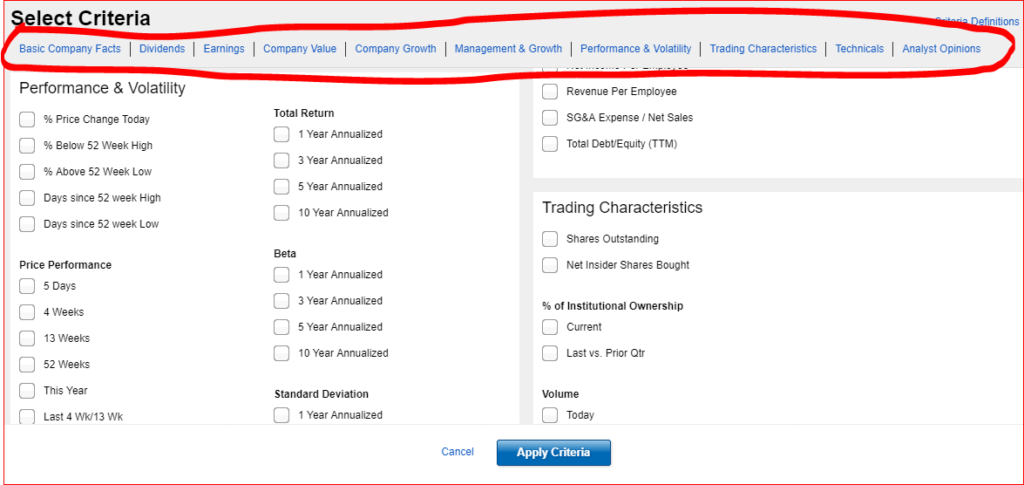

The best way to spot gaps is to use stock screeners. The screener will allow you to filter stocks based on your preferences.

For example, you can screen them based on percentages or dollar amount.

You can also screen stocks based on their movements in the extended-hours trading. A stock that grew 30% or more in the after-market or pre-market, will most likely gap up when the market opens the next day.

The same will apply for gap downs. If a stock lost a huge percentage in the aftermarket or pre-market, it will most likely have a gap down when the market opens.

You will use the stock screener based on your trading strategies. For example, if you like shorting, you may consider looking for stocks with bad news. If a stock is trading lower in the pre-market due to bad news, it will most likely go much lower when the market opens.

Stock screeners from one trading platform to another. If you are a long term investor, a screener like the one above could be more helpful. However, if you are a day trader, you may consider using a platform that shows you the pre-market and aftermarket movers or short-term price movements, in general.

Is it safe to trade the gap?

The first thing you must understand before paying the gap is that the stock will have unusual volatility. Good news or bad news will cause a panic in the sentiments about the stock. As a result, many investors will want to own a stock if the news is good and sell the stock on the contrary.

The increased buying and selling of the stock will increase the trading volume. The increase in the trading volume and the overly optimistic or pessimistic sentiments about the stock will increase volatility.

If you are not an experienced trader, you could make or lose a lot of money when playing the gaps.

For this reason, playing the gap is risky to novices and less risky to those who know what they are doing.

How to trade the gaps?

There are many ways to trade the gaps.

Some traders buy the stock in the extended hours hoping that the price will continue to move in the gaping direction. That is an uptrend for a gap up and a downtrend for a gap down.

Others use technical analysis to determine the bottom level or top-level before they take a position. Once these levels are reached, they take their position and exit when the price reaches their exit levels.

In order words, they take long positions when they think that a gap up reached the bottom of its pullback; or take a short position when they think that the stock is overbought and it is about to reverse the trend.

Risk management when playing the gap

Your risk management will determine your success in the stock market. You must always use proper trading techniques regardless of your trading strategies.

The following are some of the tips you can use to successfully minimize your risks when trading the gaps.

- Avoid Market orders: A market order means that you are willing to buy or sell a stock at wherever the price is. Of course, the trading platform is built in a way that you will receive the best market price possible. However, due to the high volatility associated with gaps; your order can be filled at a much higher or lower price than you wanted. As a result, it will be difficult for you to be profitable.

- Use limit orders: A limit order guarantees that you buy or sell a stock at a price you want. The bad news is that your order may not be filled or you may not get all shares you want.

- Use stop-loss orders: A stop-loss order is one of the most important orders you should embrace. This order will kick you out of the market when the stock you are trading moves against you. Hence, protecting you from losing a lot of money in the market. If you don’t want to sell all your shares, you can sell a portion of your position size.

- Use trailing-stop orders: There are chances that the price will not reach the limit sell order you specified. This means that a winning stock could turn into a losing stock and wipe out all your returns. You can outsmart the market and use a trailing stop order to lock in some of the gains you have on a winning stock. A trailing percentage or dollar amount will follow the price and turn your order into a market order when the price drops that percentage or dollar amount from its previous high. Thus, locking in some profit before the stock tumbles much lower.

- Take a small position size: A big position size will earn you exponential returns if the stock moves in the direction you anticipated. However, you will lose a ton of money if the opposite happens. To avoid wrecking your portfolio, take a small position size. Your gains will not be too much, but your losses will be manageable.