Investing is the fastest way to make money and build wealth. But, it can also be the fastest way to lose your savings and go broke. If you are new to investing, it might be difficult to build a strategy that allows you to invest without losing money. To not lose money when investing, there are three important factors you need to understand and their impact on your earnings. These factors are time, risk, and rewards.

While many people worry about what investment to buy when investing for the first time, the truth is that knowing how investing works is the first and most important thing to learn. The relationship between risk and reward is what determines the kinds of investments you put into your portfolio and ultimately, your earnings. Deviating from this principle leads to picking risky investments and eventually losing money. Time plays an important role in building wealth as your money compounds more when you invest for the long haul.

This article will go over 5 strategies to invest without losing money especially if you are getting started.

1. Know the relationship between risk and rewards

To invest without losing money, the first step is not to pick investments. Instead, you need to learn about investment philosophy.

For every investment opportunity regardless of its sector, there is always risk involved. Ignoring risk when investing is like wanting something without paying the price for it. This mentality always leads to a loss of capital. In other words, you are gambling.

So, how can you invest without losing money?

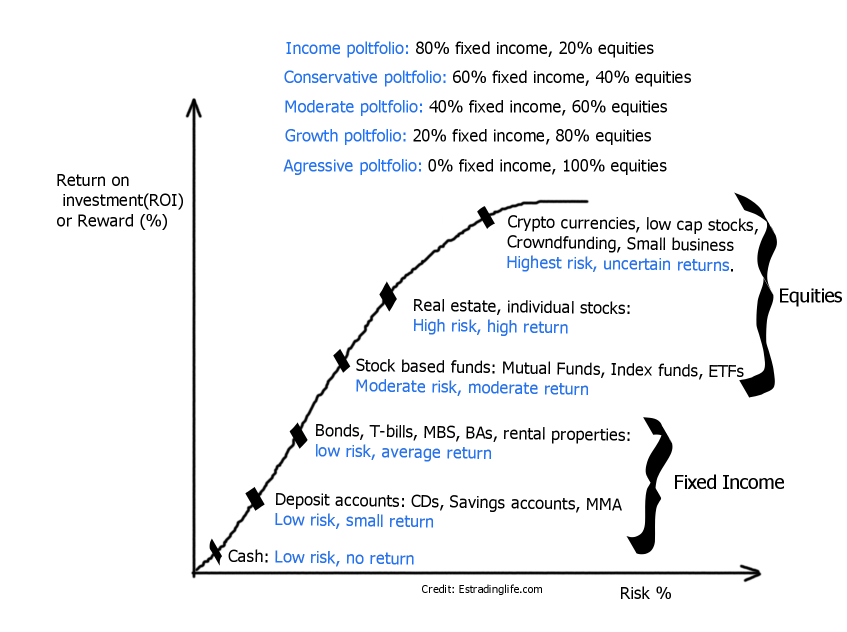

Start by understanding the relationship between investment risk levels and expected return for each category. Then, build a portfolio that reflects your risk tolerance.

The basic rule is, the lower the risk, the lower the return on investment(ROI). For example, putting $25,000 in a traditional savings account keeps your money safe but you only earn 0.46% APY which is the national average interest for savings accounts, according to the Federal Deposit Insurance Corporation(FDIC). On the other hand, putting your money in stocks will come with a higher risk but you would enjoy an ROI of 10.7% which is the average historical return on investment for the S&P 500, according to Business Insider.

How does risk and reward affect the investment you pick?

You are probably wondering why I have not told you what stocks to buy or index funds to put into your portfolio. Before you worry about these investment options, it is critical to understand how risk tolerance affects the investment you pick. Knowing the relationship between risk and rewards is the foundation of any investment strategy and many people lose money when investing for the first time due to missing this point. Instead of focusing on their ability to manage risk, people buy random investments and end up panicking during market crashes which leads to selling at huge losses.

The fact that you are reading this article is a great indication that you want to make smart decisions with your money.

To invest without losing money, first understand your risk tolerance and then build a portfolio that matches your risk tolerance.

Let’s evaluate the different types of portfolios you can form based on your risk tolerance.

NOTE: You also have the option to buy a pre-mixed fund that matches your risk tolerance. Another option is to buy a target date fund(TDF). TDFs are made of many types of investment options such as stocks, bonds, and other investments to help you plan for retirement.

Types of portfolios based on risk and rewards

1. Income portfolio

To not lose money when investing for the first time, it is best to start with an income portfolio. I know you are probably looking for exponential ROI. But, understanding how investing works and how to manage your risk is the most important step. This means that you start with low-risk investments and improve your portfolio as you gain more knowledge and experience.

How to form an income portfolio? To create an income portfolio, use the following strategy.

- 80% fixed income: Treausre bills, bonds(government bonds, corporate bonds, municipal bonds, CDs, high-yield savings accounts, etc).

- 20% equities: convertible bonds, stocks, stock funds(mutual funds, ETFs, index funds), commodities, etc.

The income portfolio is the best investment strategy for newbies because the risk is minimal compared to other types of portfolios. With an income portfolio, 80% of your investments are made of fixed-income assets and 20% equities. This investment strategy protects your portfolio from high volatility but your return on investment is also lower.

2. Conservative/defensive portfolio

If you want to get more return on your investment, a conservative portfolio will be your next option. With a conservative option, you get exposed to more risk in exchange for an increased return.

How to form a conservative portfolio? To create a defensive portfolio, use the following strategy.

- 60% Fixed income

- 40% equities

A conservative portfolio is good for someone who wants to minimize risk while keeping ROI relatively modest. By having more equities in your portfolio, you experience more volatility than an income portfolio. But, you also get to earn more money from your investments.

3. Growth Portfolio

Just like the name suggests, a growth portfolio focuses more on assets that increase in value over time with higher yields. This portfolio is right for you if you are looking for long-term growth and can tolerate market volatility. To balance your risk, you would need to diversify your portfolio with fixed-income assets such as bonds and high-yield deposit accounts.

How to form a growth portfolio? To create a growth portfolio, use the following strategy.

- 80% equities

- 20% fixed income assets

4. Aggressive portfolio

If you are new to investing, an aggressive portfolio might not be your cup of tea. What makes this portfolio even riskier especially when you are new to investing is that your experience and investing skills will be limited to handling market volatility. For this reason, you are more likely to lose money with an aggressive portfolio than any other type of portfolio.

What is an aggressive portfolio and why should you avoid it at all costs?

- 100% Equities

- 0% Fixed income assets

An aggressive portfolio is made of 100% equities and does not include fixed-income assets. Think about putting all your eggs in one basket. What makes this portfolio risky is that it is directly affected by market volatility. If you are getting started with investing, it could be problematic to ride the wave during an economic downturn.

An aggressive portfolio will be good for you only if you can tolerate high volatility and expect high returns for the long term. Additionally, this form of portfolio should be considered for the money you are willing to lose.

5. Moderate portfolio

Another portfolio you can try if you want to invest without losing too much money is a moderate portfolio. With this portfolio, you are not exposed to too much risk which also keeps your ROI relatively moderate.

- 40% fixed income

- 60% equities

To form a moderate portfolio and protect your money, your investment picks should be 60% equities and 40% fixed-income assets. This portfolio experiences a higher volatility than a conservative portfolio but it also promises higher long-term growth. A moderate portfolio will be good for you if you want access to long-term growth but also want to minimize your risk.

2. Educate yourself about the market

The best way to invest without losing money is to know how markets work. The only way to know your investment inside out is through learning. While you don’t need to know everything about markets, you should know at least fundamentals, market cycles, equities, and asset valuation strategies. This knowledge allows you to assess the qualities of different investments and pick the best ones to increase your chance for long-term success.

For example, if you are going to invest in real estate, it is best to learn about the real estate market and put more emphasis on a particular market segment such as commercial, rental, etc. The more you know about how markets work, the higher the chances you will not lose money when you are new to investing.

3. Focus on long-term

Investing is one of the fastest ways to build wealth, but, it can also be the fastest way to lose money if you are not careful. You probably heard that 90% of people lose money when investing, especially in stocks. These statistics show that while investing is an effective way to build wealth, there is also the risk of losing money and most people lose.

Before you panic, understand that most people lose money because they pick investments without understanding their risk tolerance. Others try to beat markets through day trading or buying penny stocks which is gambling.

What you can do to not lose money when investing for the first time is the opposite of gambling. Meaning, you need to buy long-term investments and know your time horizon. It is also essential to have an investment strategy that works and stick to it. For example, you can automate your investment contributions every month directly from your bank account.

Also, never take short-term gains.

The thing about long-term investment is that it works due to compounding interest. Without compounding interest, your investment would not grow as much. That is why keeping the money growing uninterrupted for a long time is the best way to invest money.

4. Reinvest your earnings(interest and dividends)

In the previous few paragraphs, I mentioned that compounding interest is the greatest vehicle for investing especially when you are getting started or when you want to maximize your ROI.

In order for the compounding effect to work, your returns must be reinvested. This means you should not cash out your interest, dividend payments, or another form of ROI you get. The more you reinvest and contribute to your accounts, the faster your portfolio will grow.

5. Diversify your investment

Another strategy you can use to invest without losing money is to diversify your investments. A big mistake many people make when investing for the first time is to become emotional about a particular investment and throw all their savings into it.

Unfortunately, this is the fastest way to lose money as you are exposing all your funds to extreme risk. If the investment you picked declines in value, 100% of your portfolio will tank, and sometimes it is nearly impossible to recover. That is why diversification is an effective strategy to invest without losing money, especially for newbies.

To properly diversify your portfolio, consider a good mixture of income assets and equities that mimic your risk tolerance. Additionally, avoid buying too many assets that are in the same sector. For example, if you have 60% equities and 95% of that equity is tech stocks, your portfolio will not be properly diversified.

Is it normal to lose money when you start investing?

Investing can be tricky when you are getting started and sometimes can lead to losing capital. Losing money when investing is inevitable. However, how much you lose depends on your investing strategies. Some of the reasons people lose money when investing, include but are not limited to, not understanding the markets, making impulsive decisions, choosing high-risk investments, experiencing unexpected market downturns, etc.

All these risks, however, can be mitigated as time goes by with a lot of research and practice. To invest without losing money, focus on understanding your risk tolerance and pick investments that match your risk profile. You can also use a financial advisor to help you establish a portfolio that maximizes your ROI while keeping your funds safer.

Why do most people fail at investing?

Most people fail at investing primarily because they are driven by immediate gratification without understanding the long-term perspective. They focus on the go-get-rich-quick schemes rather than investing for the long term. Additionally, people often make decisions based on emotions rather than facts and data. This mistake leads to buying when the market is high out of excitement and selling during market lows out of fear.

Furthermore, people lack the necessary research, understanding, and knowledge about what they are investing in. They do not take time to learn about the market dynamics or to understand the fundamentals of the stocks they invest in. The lack of diversification also exposes people to high risks.

Finally, people lose money when investing because they neglect the importance of having a clear financial plan or strategy which leads to buying investments from news and word of mouth.

Related: 14 Reasons people lose money in stock market

How to invest with little money?

Are you trying to invest money for the first time but don’t have enough? The truth about investing is that you don’t need a lot of money to get started. No matter how much money you have, you can still invest and enjoy a decent return on investment.

Here are tips to invest a little money.

Identify your investment goals

The first thing you need to do when investing a small amount of money is to identify your investment goals. Ask yourself why you’re investing. Is it for retirement? For a house? For your child’s education? Knowing why you want to invest will help you manage your funds properly without compromising the quality of your life.

You might also like: 9 important steps to build a financial plan that works

Start small

The thing about investing is that it does not matter how much you start with. What matters is your investment strategy and how often you contribute to your portfolio. If you have little money and want to invest without losing money, starting small might be your best choice. There are lots of investment platforms that allow you to start investing with as little as $5. You might also avoid paying commissions depending on your investment picks.

Use Robo-advisors

Robo-advisors use computer algorithms to manage your investments. They usually require lower minimum investments and fees compared to traditional investment advisors, making them a good option for beginners or those with lower incomes.

Consider Mutual Funds or ETFs

Mutual funds and Exchange Traded Funds (ETFs) are investment options that allow you to pool your money with other investors to invest in a diversified portfolio of stocks, bonds, or other assets. They usually require lower initial investments compared to buying individual stocks or bonds. Additionally, stock-based funds are less volatile than individual stocks which makes them less risky especially when you are new to investing.

With a small amount of money, you can still invest in the stock market by buying individual stocks or fractions of stocks. Instead of buying whole shares of expensive stocks, for example, consider investing in fractional shares. For example, if a share of xyz costs $100 and you have $50, you can still buy 50% of that share.

Put your money in a high-yield savings account or a CD

While you won’t get rich by putting your money in a high-yield savings account, it can be a safe way to grow your small investment. Plus, you have the benefit of being able to access your money at any time. Most banks and credit unions give you as much as 5% APY on high-yield savings accounts and special CDs.

Automate your investments

Another way to invest with little money is to make it automatic. By setting up automatic transfers from your checking or savings account into your investment account, you can ensure that you’re consistently investing. Every dollar you invest counts toward a much bigger plan.

Invest in an IRA

If you have less money to invest and want to not lose money, consider investing in an individual retirement account (IRA). These types of accounts offer tax advantages that can help grow your investment over time. Additionally, IRAs do not have minimum investing requirements. What to keep in mind, however, is that there is a limit to how much you can contribute to your IRA. For 2023, your maximum IRA contribution is $6,500 or $7,500 if you are 50 or older.

Don’t Forget to Diversify

Diversification is an effective strategy to help you invest without losing money. By spreading your money across different types of investments and sectors, you can reduce risk and potentially increase your returns.

Educate Yourself

A wise man once said that knowledge is power. This principle applies in every aspect of life including investing. The more you know, the better decisions you can make and the more confident you’ll feel in your investment choices. Market dynamics and industry trends also affect your investment strategies. So, educating yourself about changes and trends in different industries is an effective way to invest your money and grow your portfolio.

How can I grow my money fast?

Investing is all about maximizing your returns while keeping your risk minimal. If you are looking for ways to grow your money fast through investing, the following are tips you can use.

Set your financial goals

Financial goals are what differentiate winners and losers. Goals allow you to put your money in proper accounts which is essential in managing your finances and growing your wealth. For example, a retirement saving goal helps you know how much money to save each month for this goal. People without financial goals are usually the ones who end up spending every penny they make and live paycheck-to-paycheck.

Pay off your debts

Many people never grow their money due to having too much debt. Being in debt not only forces you to realize all your income which leads to paying too much tax, but it also costs you too much money in interest charges. You cannot grow your money fast when you are losing it at a rate of 20%+ APR in interest charges. That is why the fastest way to grow your money is to get out of debt.

Related: How to use the debt avalanche method to pay off debt?

Invest in high-growth assets

To invest without losing money and grow your account fast, invest in industries or sectors that are experiencing high growth, such as technology or renewable energy.

Invest in real estate

Real estate often appreciates over time, providing a consistent return. Consider buying rental properties, investing in a real estate investment trust (REIT), or flipping houses.

Start a side business

Use your skills or hobbies to create a side business. This could be anything from freelance writing to starting an online store. A successful side business can greatly increase your income which in turn allows you to invest more and grow wealth.

Boost your skills

Invest in yourself by learning new skills or enhancing existing ones. This can lead to better job opportunities and higher income.

Save and budget your money

Saving is one of those financial principles that are ignored by millions of people which justifies why many of them are struggling financially. The truth is that saving is an effective way to take control of your finances and avoid living paycheck to paycheck. The more you save, the more you have to invest. Creating a budget can also help you understand where your money is going and identify areas where you can cut back.

Diversify your investments

Don’t put all your eggs in one basket. Diversification reduces risk and increases potential returns.

Reinvest your earnings

Whether your income is from investments or a business, always reinvest a portion of your profits. This compounds your earnings, which helps you grow your money faster.

Try peer-to-peer lending and crowdfunding

These platforms allow you to lend money to individuals or invest in small businesses in exchange for a significant return.

Maximize your employer retirement benefits

Make sure you are taking full advantage of any employer-matching contributions to your retirement account. Contribution more to your retirement also gives you direct or indirect tax benefits which is essential in building wealth and keeping your money.