Have you ever thought about taking your money out of a Certificate of Deposit (CD) account before it matures? Life can be unpredictable, and sometimes you need to withdraw your savings early. But, before you do, it’s essential to understand the early CD withdrawal penalty and fees imposed by your financial institutions. This penalty and applicable fees can be quite costly and in most cases, they result in a loss of interest you earned on your CD account.

In this article, we’ll walk you through everything you need to know about early CD withdrawal penalties, including how they work, how much they cost, and how to avoid them altogether.

Understanding early CD withdrawal penalties

When it comes to certificates of deposit, early withdrawal penalties can be confusing. However, it is crucial to understand these fees because they can significantly impact your savings. The penalty for early withdrawal of a CD is essentially a fee charged by the bank for accessing your funds before the maturity date.

In most cases, the early CD withdrawal penalty is usually calculated as a set period’s worth of interest you earned or a percentage of your balance, and it can vary based on:

- How long your CD account has been open, and

- The length of your CD term.

For example, a bank might charge a penalty fee of 90 days’ interest for a CD with a term of one year or less. On the other hand, a CD with a term of five years or longer might have a penalty fee of 365 days’ interest. It’s essential to know the specific terms of your CD and the penalty fee structure.

Different institutions also have different early CD withdrawal penalties that come with the types of CDs they offer. According to Forbes, the CD early withdrawal penalty is usually taken as simple interest at the same rate as your CD rate. While the penalty does not affect the compounding on your interest; your bank can take a portion of your principal to cover the early CD withdrawal penalty if the accrued interest is lower than the penalty.

You might also like: How to Open a CD Account: A Step-by-step guide

How much is the penalty for early withdrawal of a CD?

While CD penalties vary based on the institution and the specific terms of your CD, many financial institutions impose fees that can be significant. For example, the early withdrawal penalty for a CD at Bank of America is 180 days’ interest on the amount withdrawn for a 1-year CD and 365 days’ interest on the amount withdrawn for a 5-year CD. These fees are slightly different compared to the early CD withdrawal penalty from Wells Fargo which are 3 months’ interest for a 1-year CD and 12 months’ interest for a 5-year CD.

On average, penalties for early CD withdrawal can range from three to six months’ worth of interest payments or a percentage of the total amount withdrawn from the CD. For example, if you have a $10,000 CD and the early withdrawal penalty is 3%, you could be looking at a $300 fee.

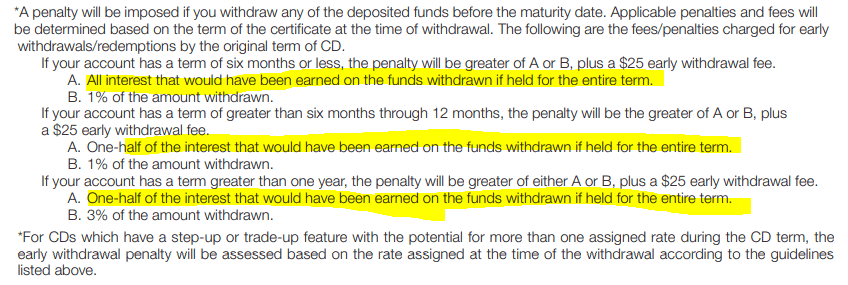

Keep in mind that some banks might impose an extra fee on top of the early CD withdrawal penalty. For example, the U.S. bank has a $25 early withdrawal fee on top of the early withdrawal penalty on its CDs.

Again, to know the specifics of your CD early withdrawal penalty, read the fine print on your CD term. This is because the wording on the interest charges for withdrawing money from your CD early can sometimes be confusing.

Example of a CD early withdrawal penalty terms

The following is a snapshot of a portion of the U.S. Bank certificate of deposit early withdrawal penalty structure.

Certificate of deposit agreement example. Source: U.S. Bank

It is essential to understand the true meaning of your CD terms to avoid a potential loss of capital from an early CD withdrawal penalty. In the above snapshot, the important words I want to emphasize are, ” Interest that would have been earned on the funds withdrawn if held for the entire term”.

What this means is that the All interest or One-half early withdrawal penalty is not one-half of the interest earned on the money you withdrew at the time of withdrawing. Instead, it is one-half of the entire interest you could have earned on those funds until maturity. In order words, the bank will calculate all interest your funds could have earned by maturing date and then take one-half of it as an early withdrawal penalty on your CD account.

Why should you worry about an early withdrawal penalty on a CD account?

If we stick with our example, you can clearly see that not only that you are losing interest earned on the money, but also, you are losing an extra amount equal to the interest you could have earned on the money you withdrew.

Meaning that in some cases, the interest earned will be less than the CD early withdrawal penalty. For this reason, the extra penalty amount that is not covered by the interest you earned will be taken out of the principal amount you deposited. Leading to a lower take home and a loss of capital.

What is the minimum early withdrawal penalty on a CD account?

While each early CD withdrawal penalty varies by CD terms and institutions, there is a minimum penalty set by the federal government. According to the 12 CFR 1030″Truth in Savings Act(Regulation DD), the minimum CD early withdrawal penalty is seven days’ simple interest if you withdraw money within the first six days after your deposit. However, there is no maximum penalty.

Most financial institutions, however, charge a much higher penalty than the minimum. For this reason, you should check the specifics of your CD term and early withdrawal penalty and fees set by your institution.

How to calculate the penalty for withdrawing a CD early

To calculate the penalty for early CD withdrawal, you’ll first need to know the interest rate, the number of days or months on interest charges, and how often your rate is issued. Your CD terms will outline the penalty for early withdrawal, which is typically expressed as a percentage of the principal amount or a specific number of months’ worth of interest. For example, the penalty for withdrawing a 1-year CD may be equivalent to 3 months’ worth of interest.

To calculate the actual penalty amount you will pay, use one of the following options.

Calculating early withdrawal penalty when it is expressed as a percentage of the principal

Once you know the penalty percentage or amount, you can calculate the total penalty by multiplying it by the principal amount of the CD. For instance, if you have a $10,000 CD and the penalty for early withdrawal is 2%, you will have to pay a penalty of $200 when you withdraw your funds early. If your CD account also comes with extra fees, those fees will be added to $200 to get the final amount.

How to calculate CD early withdrawal penalty when it is expressed in the number of days of interest or months of interest?

To calculate the early withdrawal penalty on a CD that is expressed in the number of days or months of interest, use the simple interest formula.

Interest = Principal x Interest Rate x Time.

Where,

- Interest = the total interest earned in a number of months or days

- Principal = The amount withdrawn. Keep in mind that your principal could be the total account balance if your CD account does not allow partial withdrawals.

- Time = Number of days or months of interest

Example of how to calculate early CD withdrawals penalty

Let’s assume that you have invested $100,000 in a 1-year CD and decided to withdraw 50%($50k) early and the interest rate is 0.5%. Assuming that your CD account allows early withdrawal, you will pay a penalty only on the amount you withdrew($50k).

Let’s also assume that the early withdrawal penalty for this CD is 180 days’ of interest and your interest is calculated daily.

How much will you pay in early withdrawal penalty for this CD account if interest is calculated daily?

To solve this problem, let’s first evaluate what we have from the above CD terms.

- Principal = $50K

- Interest = 0.5% or 0.005

- Number of days’ of interest(Time) = 180 days

Penalty = ($50,000)x(0.005/365)x180 = $124

How much will you pay in early withdrawal penalty for this CD account if interest is calculated monthly? For example, let’s assume that the penalty is equal to 7 months of interest.

In this case, the

Penalty = ($50,000)x(0.005/12)x7= $146

When your certificate of deposit penalty is calculated monthly, your early CD withdrawal penalty will be $145. However, if it is calculated on a daily basis, the penalty will become $124.

Keep in mind that some financial institutions apply an extra earth withdrawal fee such as $25. In this case, you will add $25 to the penalty we just calculated which will yield $149 for 180 days of interest or $170 for 7 months of interest.

In case your bank has a minimum early withdrawal penalty for your CD, you will pay that amount if the penalty you calculated is less than the minimum penalty. For example, if your bank requires a $200 minimum penalty, this is the amount you will pay as opposed to the values we just calculated in our example.

How to avoid early CD withdrawal penalties

One of the best ways to keep your earnings and protect your savings is to avoid early withdrawal penalties at all costs. You can achieve this goal through proper planning and opening the right CD account that meets your financial goals. The following are tips to avoid early withdrawal penalties on a CD account.

- Wait for a CD to mature. Letting your CD mature is the most effective way to avoid an early CD withdrawal penalty because you will not be breaking your certificate of deposit terms.

- Opt for a no-penalty CD. While these CDs may offer lower interest rates than traditional CDs, they do allow you to withdraw your money early without facing any penalties.

- Choose a CD with a shorter term length. This way, if you do need to withdraw your money early, the penalty will be smaller because it’s based on a shorter timeframe.

- Use a CD ladder. This is when you open multiple CDs with varying maturity dates so you can have access to some of your money without penalty, while still earning interest on the rest of your funds.

- Invest in CDs with flexible early withdrawal terms. While most CDs do not allow you to withdraw your principal and interest until the maturity date, others might be flexible on their early withdrawal policies. For example, you might be allowed to take out a portion of the interest, or principal, or receive interest disbursements.

- Open a CD account with the money you can afford to put away for a while. Since the money in your certificate of deposit is locked away for a while, it is important that you invest wisely. Before you open a CD account, evaluate your short and long-term financial needs. Then, create an emergency fund by putting 3 to 6 months of your monthly expenses into a savings account. Finally, open a CD only with excess money you don’t need access to for a while.

Related: How much money do you need to open a CD?

Can a bank waive a CD penalty?

Facing an early CD withdrawal penalty can be a major challenge especially when you need your money the most. So, is it possible that your bank can waive a CD penalty?

In some cases, banks may be willing to waive the penalty for extenuating circumstances, such as death, disability, or other critical emergencies.

However, it’s important to note that this is not a guarantee and is ultimately up to the discretion of the bank. It’s always a good idea to reach out to your bank and speak with a representative if you have any questions or concerns about your CD account.

What happens if you withdraw a CD early?

Typically, when you withdraw money from your CD account before maturity, you end up paying an early withdrawal penalty and applicable fees. The penalty you pay will depend on your CD term, the time in effect, and your institution. If you have a no-penalty CD, however, there will be no penalty charges.

The consequences of early CD withdrawal may not seem significant on a small-value CD in the short term, but it can be a lot, especially if you have multiple CDs. For this reason, it’s crucial to carefully consider your financial goals and needs before opening a CD.

What is the downside of opening a CD?

While the safety and predictability of CDs can be enticing, there are also downsides to consider. One of the potential downsides of opening a CD is the lower interest rate compared to other investment options. CDs typically offer lower rates than stocks or mutual funds, which may not be ideal for investors seeking higher returns.

Unlike savings accounts where you can make deposits and transfers up to 6 times a month, CD accounts do not come with these options. After you have made a deposit, the money will be locked in your CD until the maturity date. This makes CDs less liquid compared to similar deposit accounts.

Withdrawing money from a CD also comes with a penalty unless you have a non-penalty CD. This means that not only that you earn a small return, you could potentially lose most of it or more if you withdraw the money before maturity.

Related post: Pros and cons of investing in CDs: Are CDs worth it?

How do I avoid tax on CD interest?

If you’re planning on investing in a certificate of deposit (CD), maximizing your earnings should be a top priority. One way to do this is by avoiding taxes on your CD interest. Unlike some other types of investments, CD interest is taxable at the federal level. However, there are ways to minimize or even eliminate this tax burden.

An effective strategy to avoid tax on a CD interest is to hold your CD in a tax-advantaged account, such as an Individual Retirement Account (IRA) or 401(k), according to Forbes. This can help you defer taxes on both your investment earnings and your contributions until retirement, depending on the type of account you choose.

Can you withdraw interest from a CD without penalty?

When considering withdrawing funds from a CD prior to maturity, it’s important to know the potential penalties and timelines involved. You might be wondering if you can withdraw interest from a CD without a penalty.

The answer is usually no but it depends on the term of your CD and your interest payment selection. Withdrawing interest from a CD prior to maturity is generally considered an early withdrawal and may be subject to penalties. It’s best to check with your bank to see what their policy is regarding early withdrawal of interest.

However, if you have elected for the interest to be accumulated in the account, the accrued interest could be withdrawn in the future without a penalty, according to Deposit Accounts.

While it may be tempting to withdraw earned interest, however, it’s important to remember that CDs are designed to be long-term investments and withdrawing interest early may potentially lower the overall return on investment.

When does it pay to withdraw your CD early?

It’s no secret that the goal of investing in a CD is to maximize your returns. As a result, it’s generally advisable to avoid early withdrawal, which may result in incurring a penalty. However, there are instances where early withdrawal may be necessary or even desirable.

The following are times and conditions when it pays to withdraw your CD early.

- When you can get a higher yield due to rising interest rates. If you purchased a certificate of deposit when rates were lower and they have gone much higher ever since it might be wise to withdraw your CD early and buy other CDs with higher returns. For example, if you have purchased a short-term CD at 0.5% and rates spiked to 2.5%, liquidating your CD could be beneficial. Before you take an early withdrawal make sure that your overall return from purchasing other CDs will make up for the loss you are taking.

- Taking advantage of alternative investments. Investing money is all about managing risks while maximizing your profits. If you have invested money in a CD and currently earning a meager APY, it could make sense to withdraw your money when a more profitable investment comes along.

- During emergencies. Emergencies can occur at any time without notice. So, if you find yourself struggling to cover an unexpected emergency such as a medical bill, home repair, funeral, etc, consider selling your CD before taking on higher-interest loans.

- It pays to withdraw your CD early to pay off higher-interest loans. By default, CDs pay much lower than the interest you pay on almost every loan. So, if you have too much debt with higher interest rates such as credit cards, personal loans, and car loans, you can take money out of your CD early to pay off these loans. At the end of the day, it would not make financial sense to earn 1% on a CD while you are paying 20% on credit card debts.

Why is CD, not a good financial investment?

While CDs may appear to be an attractive option for investors looking for a safe place to park their money, they may not be the best financial investment for everyone.

One reason why CDs may not be the best investment is their relatively low-interest rates compared to other investment options. For instance, investing in the stock market, bonds, or real estate offers higher returns compared to what you get on a CD account. Additionally, the penalties for early withdrawal associated with CDs can eat into any potential gains, making them less appealing.

Another factor to consider is inflation. If the annual percentage yield (APY) on a CD is lower than the rate of inflation, the purchasing power of the CD’s returns will decline over time. This means that while your initial investment may be safe, you may not be able to buy as much with your returns in the future.

Despite these potential drawbacks, CDs can still be a good option for those looking for a low-risk investment with a guaranteed return. However, it’s important to carefully consider all factors before investing in a CD.

More saving tips

How much money do you need to open a CD?

How to open a CD account: A Step-by-step guide