Are you trying to rebuild a bad credit score? It takes a long time, patience, discipline, and hard work to turn a poor credit score into an excellent one. Many people don’t even try to rebuild their scores because they don’t know where to begin. You have come to the right place if you have been struggling with bad credit and looking for an easy path to an excellent credit score.

This article is a step-by-step guide to rebuilding bad credit and raising your credit score.

What is a credit score?

A credit score is a number between 300 and 850 that lenders use to evaluate your creditworthiness. This number summarizes your borrowing habits, how you use your borrowed money, and, more importantly, how you pay it off.

Borrowers with good credit scores usually qualify for the best loans with lower interest rates and favorable terms. This is because a good credit score indicates that you are a financially responsible borrower; therefore, there is less risk of lending you money. Lenders usually prefer borrowers with 700+ credit scores.

Having a bad credit score, on the other hand, means the risk of lending you money is higher. For this reason, most lenders will deny you loans and credit cards.

On the other hand, the highest score you can get is 850, which is considered a perfect score. If yours is not 850, do not beat yourself up. Only a handful of individuals have this score. As reported by NASDAQ, only 1.2% of Americans have a perfect score (850). This shows you that it is almost impossible to get a perfect score, and therefore, it should not be your focus when rebuilding your score.

Five main factors affect your credit score, including payment history, credit utilization, the age of your credit, credit mix, and new account activities.

Learn More: What is a credit score, and how does it work?

What is a good credit score?

To understand the meaning of a good credit score, we need to examine the ranges of credit scores further. To make it easy, credit score ranges are grouped into smaller ranges, which make up the credit score chart.

The following are credit score ranges.

- Very bad: 300-579

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Exceptional: 800-850

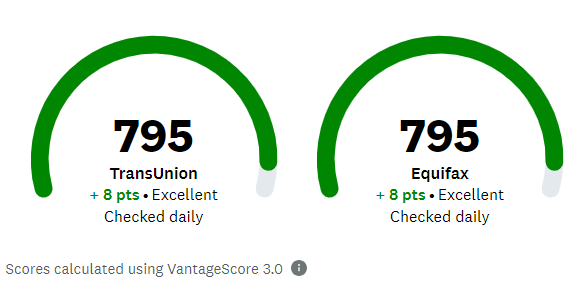

Remember that these credit score ranges vary from one reporting company to another. There are three main credit reporting companies (Equifax, TransUnion, and Experian) in the USA. Since they use different algorithms and give different weights to information in your credit report, your score will differ from one reporting company to another. For example, TransUnion and Equifax show the same VantageScore for this person.

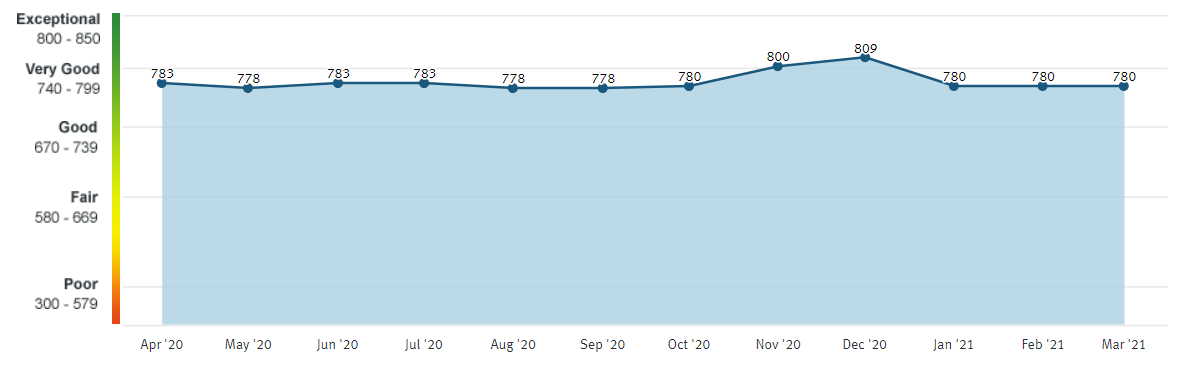

On the other hand, the credit score reported by another company is different for the same person. The following chart (from Discover) shows how our candidate score differs from the above FICO score reported by Equifax and TransUnion.

The FICO score and VantageScore are usually different because they are calculated using different models. FICO calculates the FICO score using the FICOScore model, while Equifax, TransUnion, and Experian calculate the VantageScore using the VantageScore model. As reported by myFICO, about 90% of lenders use the FICO score when assessing loan applications.

What is a credit report?

I have mentioned that every financial decision you make on your credit(s) accounts will be reported to credit reporting companies. I also mentioned three USA credit reporting companies (Equifax, Experian, and TransUnion).

All activities on your credit accounts will be reported to at least one of the major credit reporting agencies. Credit reporting companies will compile a report after receiving all account activities from your lenders. This report is what is known as a credit report. The report shows all your credit accounts, lenders, payment history, how long you owned credit, how many open accounts you have, etc.

This report shows lenders and other financial institutions where you have been, your money decisions, and, more importantly, where you stand. The information on your credit score will also be used to calculate your credit score.

Read more: Credit Report Overview: A complete guide.

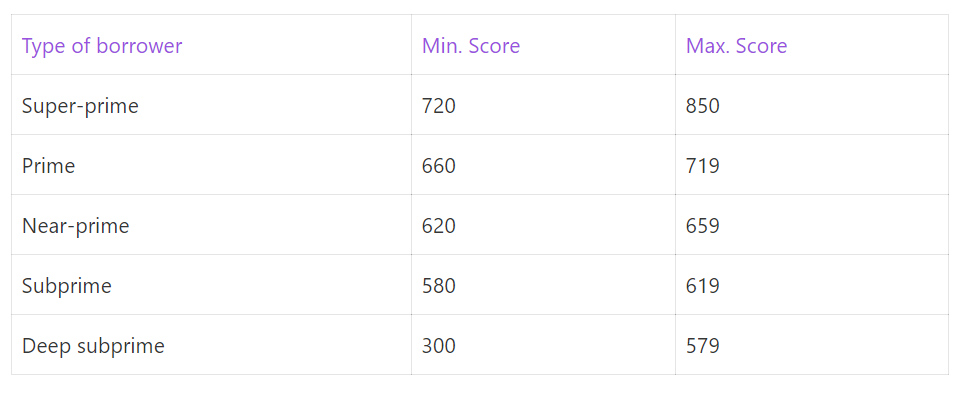

Before rebuilding your credit, let’s evaluate categories of borrowers based on credit scores.

Earlier, I pointed out that the credit score range is divided into smaller ranges, which differ from one reporting company to another. The benefit of these ranges is that they help lenders classify borrowers into different categories. For example, a borrower with a very bad credit score will be classified in a different category than someone with an excellent credit score.

The following table shows borrowers’ categories based on their credit scores.

The best type of borrower is a super-prime borrower. This is like an elite category of borrowers; therefore, being in this category should be your primary goal. Being a super-prime borrower means that you can qualify for any type of loan/mortgage out there. In addition, you will qualify for the lowest interest rate possible on the market.

On the other side of the spectrum, you have a deep subprime. Being in this category means your odds of qualifying for a mortgage/loan are slim. Of course, you can always use government-supported services that require no credit scores or ask for the lowest score possible.

For example, an FHA loan can take as little as a 500 credit score. But remember that your interest rate will be higher, and you may be required to purchase mortgage insurance. You see, qualifying for a service does not mean that your life has gotten better.

Subprime and the 2008 housing market crash!

You are probably saying: Well, I am in subprime, and I am fine or close to being fine. Not too long ago, we experienced a housing market crash. I am talking about the one in 2008 that sent millions of homeowners to the streets nationwide and brought major companies to their knees. If you did not lose a house, your family member, friend, or neighbor lost theirs. Yes, a lot of people lost their homes in foreclosures.

Many companies went bankrupt, and one particular company is still talked about today. If you guessed Lehman Brothers Holdings, Inc., you are right. This company went bankrupt, and the financial world was shocked when the news of its failure went public.

But did you know why this company and many others closed their doors? Well, it was because it lent money to subprime borrowers. Yes, you heard me right. Companies extended billions of dollars to subprime borrowers (borrowers with bad credit), resulting in mass loan defaults nationwide. The result was catastrophic.

So, do not have a cranky face the next time you get denied a loan due to bad credit. They deny you money to protect themselves and their clients.

The good news is that I have spent countless hours putting this article together to help you rebuild your credit score. Yes, after reading this article, you should have all the resources you need to go from a very bad credit score to a very good credit score.

Know factors affecting your credit score before rebuilding a bad credit

I promised you that I would give you the steps you need to take to rebuild a bad credit score. Yes, I will give you those steps. But before I give you a step-by-step you need to take to rebuild your credit; you need to know what can affect your credit score. Doing so prevents you from repeating the same mistakes.

The following is a list of the main factors affecting your credit score.

| Payment history | 35% |

| Credit utilization(debt) | 30% |

| Credit age | 15% |

| Derogatory Marks /hard inquiry | 10% |

| Credit mix | 10% |

The table above shows that your payment history accounts for over 1/3 of your FICO credit score calculation. The reason is simple: failing to pay off the money you borrowed according to the terms and conditions of your contract automatically makes you a very risky borrower.

The amount you owe lenders will be the second most important factor affecting your credit score. Borrowing too much money increases your chances of failing to pay it off. Due to this risk, your score decreases as your debt increases. Most lenders prefer borrowers with 30% and lower credit utilization. For example, if you have a $10,000 credit limit, using no more than $3,000 is safe. However, I still think 30% is still a lot of money. My golden rule is to use no more than 10% of your credit limit. You should stay under 10% credit utilization for each card you have.

There are factors you cannot control. For example, your credit age cannot be improved. The number of years you have owned credit cannot be increased automatically. The only thing you can do is sit tight and let time pass. Other factors such as hard inquiries, bankruptcy, foreclosures, and credit mix will all affect your credit score. The effect of these factors fades away over time. For example, a recent credit card application will trigger a hard inquiry on your report. This action will knock off a few points from your credit score. However, its effect will disappear over time and not affect your score after 12 months. Remember that a hard inquiry has been shown on your report for two years.

How do you rebuild a bad credit score?

If you have reached this level, congratulations. Now, I will walk you through the steps to rebuilding your credit. How can you rebuild your credit score?

You can rebuild your credit score; the necessary steps are not complicated. So, let’s dive right into the process of repairing bad credit.

1. Check your credit score and know what is hurting it

Before you solve a problem, you need to know what the problem is and its root cause. You cannot find a solution to a problem you don’t understand. For this reason, the first step to rebuilding a bad credit score is to know your current credit score and why it is so bad that it needs some work.

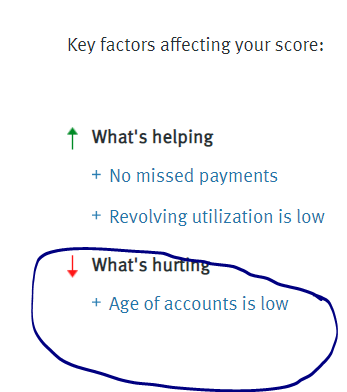

Knowing your score will help you properly adjust your finances and budget wisely. For example, if your score is 500 due to carrying too much credit card balance, establishing a budget that allows you to pay down your balance faster will be a great way to get started. Most credit score providers also detail what is helping or hurting your score.

In the following snapshot, you can easily see that on-time payments and low revolving credit utilization are helping the score, while a low credit age hurts it.

After finding out your score, evaluate how it is being affected. One or more of the factors I explained above will be the cause. Once you know what is weighing down your credit score, you can decide how to rebuild it.

2. Clean up your credit reports

Your credit report will show you everything you need to know about your open accounts and how information reported to credit bureaus affects your credit score. It will also show your payment history, credit use, age, etc.

You need to check your report to ensure all information reported is consistent with your activities. One mistake on the report can slow down your effort in rebuilding a bad credit score. If you find mistakes in your report, dispute them with the credit reporting bureaus that report it. Fixing the mistakes in the report alone can boost your credit score by as much as 50 points or more, depending on what was removed.

You can get a free copy of your credit score from each credit reporting agency once every 12 months. Get a free copy of your annual credit reports from https://www.annualcreditreport.com/index.action. This is a government-authorized website to free credit reports to consumers from the top 3 major credit reporting agencies in the U.S.

Related: How do you get a free annual credit report?

3. Open a credit account/get a credit builder loan

Opening a new credit account will help you rebuild your credit faster, as it can help improve your credit utilization. To avoid extra debt and necessary fees, open a credit card account with no annual fee. This will help you use the cards without paying interest on the balance until the actual APR kicks in.

You probably think having more credit cards will reduce your credit score. In the short term, you will most likely lose a few points due to a hard inquiry on your report. However, the inquiry will not affect your score for over 12 months. In the long term, you will have more active accounts that will help you improve your credit score faster. More open and active accounts show lenders that you are responsible for borrowing money and managing debt. Having a good credit mix will also help you tremendously.

A new credit account will also increase your credit limit. A boost in credit limit will reduce your credit usage. For example, if you have used $800 out of $1,000, your credit usage is 80%. If you get another credit card with a credit limit of $1,500, your new credit limit will become $2,500. Assuming you have not used your credit cards since our first calculation, your new credit usage will be 32%. This reduction in credit usage will boost your credit score.

If you can’t qualify for a new credit card account, try a credit builder loan. These loans are designed for credit building and most lenders, especially online lending agencies offer these loans. You can also try a secured credit card where a security deposit is required when opening an account. What makes these credit cards effective when rebuilding credit is that you get a lower credit limit and your deposit is usually reimbursed back when you close an account without outstanding balances.

4. Make a debt repayment budget

Finally, the steps you probably don’t want to hear about: Budgeting. Budgeting is essential in repairing your credit and raising your credit score. This is because rebuilding a bad credit score requires better finances, which is usually possible when you have a budget.

Your credit score is bad, probably because you overused your credit cards, violated the terms of your lenders, and did not pay them off on time. A lack of a budget usually leads to overspending and falling behind on your monthly bills.

A budget will show you where you are overspending and where to lower expenses to pay down your debt much faster.

If you have trouble creating a budget, this article details the steps to creating a practical budget.

5. Pay your bills on time

This is probably the most important step in rebuilding a bad credit score. Your payment history accounts for 35% of your credit score calculation. So, focusing on this single element will help you boost your score faster and prevent you from losing further points.

Have you been missing your payments? If so, pay every credit card balance and other loans on time. If you cannot pay your credit card balances in full, at least try to meet the minimum monthly payments on each card. This rule applies to other loans and credits you have. Your payment should be submitted before the due date to avoid missing a payment and paying higher fees.

Related: 11 easy ways to reduce credit card debt

6. Reduce your credit utilization

Your credit utilization is the second most crucial factor affecting your credit score calculation, accounting for 30% of your FICO score. Credit utilization refers to how much you have spent out of your total credit limit. A credit limit is the amount your lender allows you to spend on each card. For example, if you have a credit card with a credit limit of $1,000, you can only spend up to $1,000. Once you reach your limit, you must pay some off before using the card again.

Why is it a bad idea to use most of your credit limit? Even if your lender gave you $1,000 on your card, he doesn’t want you to rely on it. Spending a huge percentage of your credit limit shows lenders that you do not have other sources of income that could help you cover your expenses. You are either not financially stable or financially responsible, and therefore, you are a risky borrower. Being a risk borrower means your credit score will not improve, and it will be harder to qualify for loans and credit cards.

7. Rebuild a bad credit score by paying off the revolving account balance

If you have fallen behind on your payments, make a drastic plan to help you catch up. Pay off your revolving balances as fast as you can. Remember that credit card interests are the highest in the lending industry. So, every penny you do not pay off makes your debt grow due to compound interest. So, to avoid this issue, ensure all revolving account balances are fully paid off.

Related article: The real reason many people are struggling with debt

8. Do not apply for loans and credit cards very often

Avoid sending in credit card and loan applications very often. The lender will evaluate your creditworthiness for each application you send in by viewing your credit reports. This will appear on your credit profile as a hard inquiry. Hard inquiry knocks off a few points from your credit score. If you use your credit accounts responsibly, you can regain all these points.

A hard inquiry will stay on your credit score for up to two years. However, it will not affect your credit score after 12 months. If you send in applications for new cards very often, you will wreck your credit score instead of building it. To avoid multiple hard inquiries on your credit reports, only apply to loans you qualify for. A good rule of thumb is never to have more than one inquiry in consecutive 12 months.

Learn more about hard inquiries/hard pulls and how they affect your credit score.

There are times when you will no longer handle the pain and might need support from loved ones. For example, if you work hard and a month later your credit score increase only 5 points, you will be disappointed. That is why asking friends for help might be a great idea. For example, if you have a friend or family member with excellent credit, you can ask them to become authorized user of their account.

As an authorized user of a credit card account, you will get direct benefits from the account, allowing you to repair your credit fast.

10. Rebuild a bad credit: Have discipline and patience

Rebuilding a bad credit score is not going to be easy. It will not happen overnight, either. For this reason, you will fight a never-ending emotional battle with yourself. You will feel frustrated over and over again.

Remember that good things come at a cost when you hit this level. It took you many months or years to destroy your credit, and it will take you an equal amount of time or more to rebuild it. So, hang on tight and continue making your payments, minimizing your credit card usage, etc.

If you recently opened an account, you should not expect to have a perfect score in a few months. This is because the age of your credit accounts for 15% of your FICO score and it comes with time. You need a track record of using credit to have a good credit score. That is how lenders will judge you. If you have been an excellent borrower for a very long time, lenders will expect you to continue on that path. So, sit tight.

How long does it take to rebuild a bad credit score?

Rebuilding a bad credit score can take months or years depending on information on your credit reports. Factors that will influence how fast your rebuild bad credit evolves around 3 main points.

- The reason your score is in bad shape. Before you start rebuilding your credit score, you must know why it is down in the first place. Knowing where you are getting hurt will help you understand how to fix the problem. For example, if your score is badd due to missed payments and related negative items such as foreclosure or bankruptcy, you must start paying on time and reduce your credit usage. If you owe several thousands of dollars, paying them off will take a long time. Hence extending the time it takes you to rebuild your credit score. Some negative items also remain on your credit report for 7 to 10 years which, increasing the time it takes to repair bad credit.

- Measures you have taken to rebuild it. These will be a set of rules and execution plans you set in place to help you rebuild your bad credit score. If your measures are strict enough, you will rebuild a bad credit in no time. On the other hand, if you do not make an effective plan, you may find it difficult or impossible to rebuild your score.

- How effective are you in following your own rules? Having effective plans and regulations does not mean your job is done. After all, your ability to respect and follow your own rules will make all the difference. There are a lot of people who say they want to rebuild their credit scores but never achieve this goal. So, they make plans, talk about them, and start paying. A few months later, you hear them saying, I can’t do it, it is difficult, I cannot afford it, etc. You can rebuild a bad credit score if you can’t discipline yourself.

From these three points, we can simply conclude that the time it takes to rebuild a bad credit score varies from one person to another. What you should do is get started and discipline yourself throughout the process.

What should you do after rebuilding your bad credit score?

After rebuilding your credit score, you should always avoid repeating the same financial mistakes that led to bad credit. You don’t want to build your score to 800, only to go back to 500 one year later.

Being smart about money, knowing what affects your credit score, and making decisions accordingly will help you keep your score on top. One way to maintain a health credit is to pay your bills on time, lower your credit utilization, and avoiding too much debt. You should also continue learning and make yourself a better and responsible person. The more you learn and understand credit, the easier you will navigate your financial journey.

BONUS: It is easier to drop your credit score from 800 to 500 than to build it from 500 to 800.