Futures on Robinhood expire based on the Last Day to Trade (LDTT), which varies by product and exchange. The Last Day to Trade (LDTT) is the final day you can close your futures contract, and it is the day your Futures contract expires on Robinhood. For cash-settled contracts, the expiration date aligns with the Last Trading Time (LTT), meaning it’s the latest date a futures contract can be traded. For physically settled contracts, the LDTT may be before the expiration date to avoid physical settlement, since Robinhood does not support the delivery of physically settled products.

Here is everything you need to know about the futures expiration date on Robinhood and tips to trade futures on Robinhood.

When do Futures expire on Robinhood?

Typically, futures on Robinhood expire on the last day to trade(LDTT). Whether you have cash or physically settled products, all products get settled on their respective futures’ expiration date. Robinhood says that,

- “If you hold a cash-settled position through expiration, your account will receive a credit or debit based on the final settlement price.” On the other hand,

- ” If you hold a physically settled product, you’ll need to close it prior to the last day to trade (LDTT)”.

What does this mean in terms of the futures expiration date on Robinhood?

If you did not close your futures contract on Robinhood before the expiration date, the cash-settled contract will be closed automatically on the last day to trade. For physically settled contracts, you will need to close the contract before the last day to trade because Robinhood does not support the delivery of physically delivered products. So, your position will be closed by Robinhood on your behalf, and your trading account will realize a profit or a loss if you hold the position until the LDTT.

Closing your Robinhood futures contract before the last day to trade prevents you from having to deliver physically-settled agreements, such as gold and oil.

How do I know when my futures contract will expire on Robinhood?

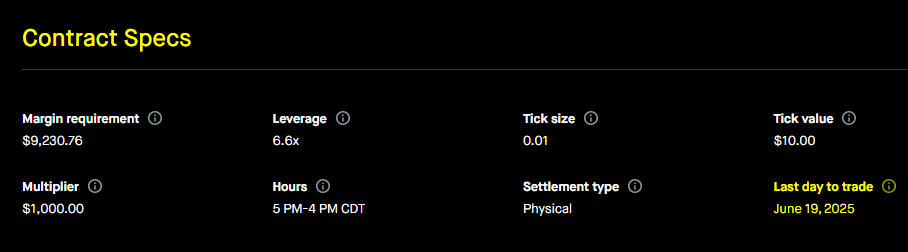

Your futures contract on Robinhood expires on the Last Day to Trade (LDTT), which is displayed on the contract detail page. The contract detail page, also known as the Contract Specs, displays margin requirements, leverage, tick value, settlement type, and the last day to trade. Please, see the image below for your reference.

Each Futures contract uses a code to define its expiration, with months represented by unique letters (e.g., F for January, M for June, Z for December). The following is a list of the letters for each calendar month expiration, as provided by Robinhood.

- January – F

- February – G

- March – H

- April – J

- May – K

- June – M

- July – N

- August – Q

- September – U

- October – V

- November – X

- December – Z

The format for a Futures symbol is: Forward slash (/) + Root symbol + Expiration month + Expiration year.

For example, an E-mini S&P 500 futures contract expiring in December 2025 would have the symbol /ESZ25, where:

/ the forward slash at the beginning indicates futures

ES is the root symbol for the E-mini S&P 500 Futures contract.

Z represents the code for December.

25 indicates the year 2025.

To determine the exact date your Robinhood Futures contract will expire, click on the “Contract Details/Specs” section. For example, the Futures contract expiration date in the above image is June 20, 2025, which is indicated as the last day to trade in the Futures Contract Specs section. That means you must close your contract by June 20th or risk it being closed automatically by Robinhood.

How to trade Futures on Robinhood?

Trading figures on Robinhood allow you to control large positions with small capital requirements, and you don’t have to worry about the PDT rule, which usually applies to stocks.

If you are new to trading futures on Robinhood, here are the steps to start trading futures on Robinhood from start to finish.

- Enable Futures Trading. If you haven’t already, you will need to enable futures trading in your Robinhood account settings.

- Access the Futures Market. Navigate to the markets tab in the Robinhood app and select Futures. I usually search for futures in the search bar and choose futures. This shows the complete list of products available for futures trading on Robinhood. Currently, Robinhood offers 40 different products available for future trading.

- Select a Futures product from the list that you want to trade and review the contract specifications.

- Click the Trade button and choose between Buy, Sell, or Ladder.

- Enter the quantity of futures contracts you want to trade.

- Click ‘Review’ to review the details before completing your order.

- Swipe up to place your order if you’re using the Robinhood mobile app.

- Monitor your position. Track price movements, manage risk, and adjust your strategy as needed.

- Close or roll your trade. Before expiration, decide whether to close your position or roll it over to a new contract.

Robinhood Futures contract specs explained.

Each Futures contract on Robinhood has specifications that provide essential information about the contract. As I mentioned earlier, you can find the information about your futures contract expiration date on Robinhood under the “Contract Specs” tab.

But this is not the only information in the Contract Specs tab. Here is what each information means in your contract details.

- Margin requirements. This is the cash you need in your investing account that is used as collateral to open a Robinhood futures contract. Each Robinhood Futures contract has its margin requirements.

- Leverage allows you to control a large amount of money with a small amount. This way, you can amplify your profit or loss.

- Multiplier is the dollar value of each whole point price movement.

- Tick size is the smallest price movement a Futures contract makes on Robinhood.

- Settlement type. Shows how your Futures are settled on Robinhood, which can be in cash or physical form. When your Futures expires at Robinhood, a credit or a debit is issued to your account.

- Tick value represents the dollar value of each tick size.

- Hours show when Futures are open to trading on Robinhood. Futures are open Sunday at 5 PM to Friday at 4 PM and close between 4 PM and 5 PM each day.

- Last day to trade(LDTT). This is the day your Futures contract expires on Robinhood. Your contract will be closed on this date or after if you continue to hold it through the LDTT.

How do I cancel a pending futures contract on Robinhood?

If you no longer wish to proceed with the contract and the order is still pending, you can cancel it. To cancel a Robinhood Futures pending order, go to your investing tab and select the Futures order you want to cancel under the Futures section. Then, select cancel to cancel the order.

Another way to cancel a pending Futures order on Robinhood is to search for ‘Futures’ in the search bar, select ‘Futures’, choose the product with a pending order, navigate to the detail page, and select ‘Cancel the order’.

Benefits of trading futures on Robinhood

Trading futures on Robinhood comes with several advantages:

- No Pattern Day Trading (PDT) Rules. Unlike stocks, futures trading doesn’t require maintaining a $25,000 balance to avoid PDT restrictions.

- Low commissions. Robinhood offers some of the lowest commission rates in the market, making futures trading more cost-effective, especially for those with small trading accounts.

- Special tax benefits. Futures trading benefits from the 60/40 tax rule, meaning 60% of gains are taxed as long-term capital gains, potentially lowering tax liabilities. Read more about futures and options tax benefits in this article from Investopedia.

- Nearly 24-hour trading. Futures markets operate almost 24 hours a day, allowing you to react to global events and market movements.

- Leverage. Futures contracts enable you to control large positions with a relatively small amount of capital, thereby increasing potential returns (and also risks).

- Cash settlement. Robinhood supports cash-settled futures, eliminating concerns about physical delivery.

What are the downsides of trading Futures on Robinhood?

Trading futures comes with several risks and downsides that you should consider:

- High leverage risk. Futures contracts enable you to control large positions with a relatively small amount of capital, but this also means that losses can be magnified.

- Margin calls. If the market moves against your position, you may need to deposit additional funds or be forced to close your position at a loss to maintain your trade.

- Market volatility. Futures markets can be highly volatile, with rapid price fluctuations that can lead to substantial losses.

- Liquidity concerns. Some futures contracts may have lower trading volumes, making it more challenging to enter or exit positions at desired prices.

- Complexity and might not be ideal for beginners. Futures trading requires a deep understanding of market mechanics, contract specifications, and risk management strategies, making it challenging for beginners.

- Expiration and Rollover Costs. Futures contracts have expiration dates, meaning you could end up closing your contract at a loss when your Robinhood Futures contract expires.

What is buying power when trading futures on Robinhood?

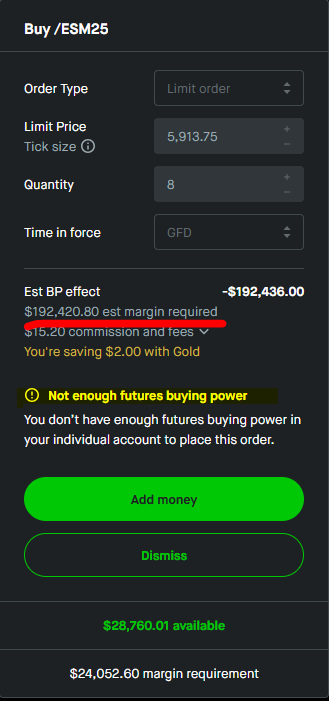

To buy and sell Futures on Robinhood, you need to have an investing account. The buying power refers to the amount you have available to trade futures on Robinhood. Each Futures contract has its specific buying power, and you can trade it only if you meet the buying power requirements.

When you attempt to trade Futures on Robinhood without sufficient buying power, you receive a message stating, “Not enough futures buying power.” You then get an option to deposit more money or dismiss the order. You can also try to reduce the number of contracts you are trying to trade to see if you meet the margin requirements. Additionally, it is essential to note that the margin requirements for all your contracts are deducted from your purchasing power.

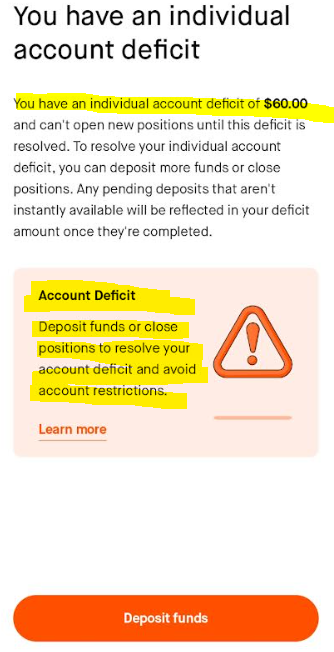

What is a margin call for trading futures on Robinhood?

Each future contract on Robinhood or any other platform comes with margin requirements. This is collateral needed to open a Futures contract. When the price moves against your trade (prices went up when you sold or went down when you bought), the value of your account will decrease. That is, you will lose money.

A futures margin call on Robinhood occurs when the value of your account falls below the required margin to maintain an open futures position. This happens because futures trading is highly leveraged, meaning that small price movements can result in significant gains or losses. The margin call will always indicate the amount you need to deposit to resolve the issue and avoid account restrictions.

For example, in the margin call below, Robinhood required me to deposit at least $60 to restore my account and avoid restrictions.

When a margin call is issued, you will have one of the following options.

- Deposit additional funds to restore the account balance.

- Reduce your position by closing one of your contracts to meet the margin requirement.

- Risk liquidation, where Robinhood may close part or all of the position if the margin call isn’t met.

Robinhood treats initial margin and maintenance margin as the same amount. This means you must always maintain enough funds to cover potential losses. If a margin call isn’t resolved, the account may be restricted to “position closing only” until the issue is addressed.

What happens when you hold your Robinhood Futures contract past the expiration date?

Buying and selling Futures contracts puts you in agreement with the buyer or seller of the product. If the position is closed before the Futures contract expiration date, the physical delivery would not take place. However, suppose you fail to close the account before the last day to trade (LDTT) and your broker facilitates physical delivery. In that case, you will need to deliver the actual commodity to the buyer or receive the commodity from the seller, depending on whether you sold or bought the contract and the contract’s terms.

Fortunately, Robinhood and many brokers do not facilitate the physical delivery of the contract. This means that you are required to close your contract by the last day to trade. According to Robinhood, if you fail to close your positions on or before the LDTT, any open futures positions will be closed by Robinhood Derivatives to avoid the physical delivery of the contract.

More investing tips

How to start investing with little money in 10 simple steps?