What is a good APR for a credit card? Many people struggle with the dilemma of APRs and how to get around them. There are many sectors and each sector has many credit cards with different APR ranges. This makes it difficult to pinpoint one number and call it a good APR for a credit card. If you apply for a credit card, your approval APR will depend on how you have been handling credit and the industry rates.

For example, a person with a good credit history and good credit score will qualify for the better APR in a given industry. On the other hand, if your credit history is wrecked and you have a bad credit score, you should expect to pay the highest APR on credit cards you qualify for in any industry.

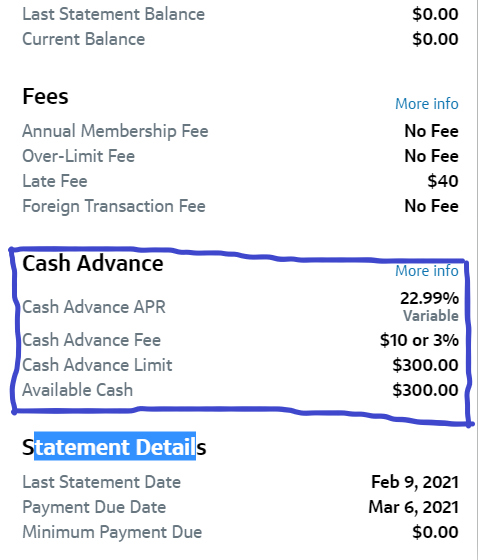

Credit card activities could also lead to different APRs. For example, a cash advance will most likely have its own APR. And this APR is always high. Lenders do not want you to treat your credit card like a debit card. So, they charge you a high rate whenever you withdraw cash from a credit card.

The APR you will pay on your credit card will depend on two main factors: (1) prime rate and (2) your creditworthiness.

- Prime rate: According to Bankrate, the prime rate is the interest rate banks and lending institutions charge their most trusted borrowers(clients). Banks trust these clients because they have proven to be loyal, have the best credit history, and more importantly, are less likely to default. That is why they receive the lowest interest rate when borrowing money. The APR on your credit card will be calculated based on the prime rate. Bad credit history and credit score will lead you to pay a high-interest rate. That is you cannot be trusted with the money. For this reason, you will pay the highest interest rate to balance the risk banks are taking by giving you money.

- Creditworthiness: Every time you apply for a credit card, the lender will look at your profile to judge your creditworthiness. In other words, the lender will need to know if you can be trusted with the money and your ability to pay it off. One way to find out is to look at your credit profile. Some of the aspects that will be evaluated include but not limited to the following: All loans you have or had, payment history, credit use, credit score, how often you apply for credit, your income, etc.

What is a good APR for a credit card?

What is a good APR for a credit card? Since the APR will vary based on the type of card, industry, the creditworthiness of borrowers, and the prime rate; it is difficult to decide what a good APR will be. Each person will be judged differently and the APR they get approved for will depend on the points we discussed above.

The best thing to do is to get approved for a low-interest rate in any industry. The only way to achieve this is to work on your financial habits, borrowing, and spending behavior, and improve your credit score. With these points fully worked on, you should get approved for a reasonable APR compared to other borrowers in the industry.

It is always a good idea to compare your APR to the average APR in the nation. According to WalletHub, the average APR for existing accounts is 14.75% whereas new accounts get approved for 18.24% on average. If the APR you just got approved for or currently paying is higher than these numbers, you are paying an interest that is higher than the average in the country.

On the other hand, if your APR is lower than the percentages above then you are paying a low-interest rate compared to the average rate. In this case, you can safely say that your APR is ok but probably reasonable or good if that gives you peace of mind.

The point here is to try to secure a low-interest rate. Having an APR that is equal to the average or lower should be your starting point. Anything above the average APR will put you in the red.

Should I worry about APR?

APR is the interest you pay on money you have not paid off during the payment period. For example, if you have a credit card balance and decided to only pay off a small percentage of it; the remaining balance will be carried over to the month.

In this case, you will pay interest on the balance you carried over. Other charges may apply based on your payment behavior. All these activities will not look good on your credit and will harm your credit score.

Should you worry about APR? Of course yes. As a borrower, the APR will not benefit you. Only your lending institution will benefit from it. You should always try to secure a lower annual percentage rate. The more interest you pay on the money you have borrowed, the harder it will become to pay it off. A high interest rate will overshadow the reason for borrowing.

Many banks, investment institutions, and individual borrowers go bankrupt not because of the money they borrowed. Instead, the interest increases the loan and surpasses the business’s capacity to pay it off. Hence, filing for insolvency. You should pay attention to how much interest you pay regardless of how much you borrow.

What if I am planning to pay off everything every month? Is the APR going to matter?

Since the APR will apply on the balance you carried over, you will not be affected by it if you pay off all your balances during their payment time periods. That is you will have $0 carried over to the next month. If you can achieve this, then the APR will not affect your finances.

Should you just get a random card with the highest interest charges because you will pay off all your balances each month?

This is not a good idea regardless of how you look at it. Even if you will make all your payments, you should always apply for the card with the lowest APR. This is because you never know what will happen to you in the future. It is possible that you can afford to make those payments now. However, if you get laid off a few months from you, you will become like everyone else.

That is you will not be able to make all your payments and the APR will be applied automatically.

Consider the APR as a monster that is lurking in the background waiting for you to make a mistake so that it can devour you. As you know anything is possible in this world. You can easily make a mistake, lose a job, get into an emergency that sucks all your money, etc. For these reasons and many more, you should always avoid cards with the highest APR.

How to qualify for a low APR?

The APR you qualify for will depend on your creditworthiness and the type of card you are applying for. In addition, some cards have high APR ranges whereas others have low APR ranges. To qualify for the lowest APR on each range or for any credit card, you must do your homework.

The following are tips you can use to increase your chances of getting a low APR.

- Make all your payments on time

- Improve your credit score and know what it is at all time

- Review your credit report for errors and have them corrected if you find any

- Watch how much you spend. Your credit utilization will say a lot about you

- Do not apply for many credit cards very often to avoid hard inquires.

How to minimize the amount you pay in APR?

There are many ways you can use to minimize the amount you pay in APR. These reasons will depend on many factors and some of them are included below.

- Start with a card that has 0%APR: Although most credit cards have APR, they don’t always start with that high APR. How would banks attract new customers if they start charging you on your first day? Some lending institutions offer 0%APR for like 6 months, a year, or more. Once this period ends, the actual APR kicks in. So, if you want to pay no interest on the balance you carry over, this could be a strategy to help you. NOTE: You must pay off all your balance on the card before the APR kicks in. Otherwise, you could pay a huge interest when you have a large balance by the time the APR starts.

- Pay off all your balance: You must always pay off all your balance each month if you want to avoid interest on your credit cards. As long as you pay off every penny you owe on the card, the APR will not be applied. To succeed at this game, put on your calendar when each card is due and make sure that you have the money to pay it off.

- Regulate how much you spend on credit cards: Your credit cards come with a credit limit. A credit limit is an amount your lender allows you to spend on each credit card. Once you have used all that money, you must pay off all or some in order to use your card again. The more money you spend the more you owe the lender. Spending too much of your credit limit reduces your chances of paying it off on time. This leads you to carry a balance to the next payment period and pay APR on it. So, to avoid this issue, always use a small percentage of your credit limit. Borrowing less money means you will owe the lender less money and it will be easy to pay it off. Even if you end up carrying some balance to the next payment period, the interest charges will be less since the balance is small.