What is a cash account?

A cash account is a type of brokerage account where investors must have enough funds to pay for all equities they want to buy in full. Investors with cash accounts cannot borrow money from their brokers to purchase equities, according to the U.S Securities and Exchange Commission.

With a cash account, you cannot buy stocks worth more than available funds in your account. Furthermore, you cannot short securities in the market because this is associated with borrowing shares from your broker.

In order to borrow money and short stocks, you must upgrade to a margin account.

What can you do with a cash account?

You can buy and sell stocks and other securities using funds in your account. The following are some of the many things you are allowed to do in your account.

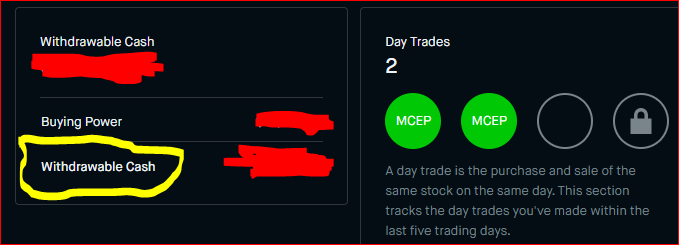

- You can buy and sell a security on the same day. In other words, day trading activities are allowed in your account. You must be careful when doing so to make sure you do not violate day trading rules.

- You can buy and sell stocks using cash in your account as long as the money is settled. When you sell stocks in a cash account, the money from the sale needs to settle before you can use it. If your broker allows you to use the same funds before they settle, you will not sell the stock until after the settlement date. It takes 3 business days for funds to settle in your account.

- If you have a combination of settled and unsettled funds in your account; you can still buy and sell stocks by using the portion of your funds that are settled. For example, let’s say that you sold a stock for $1000 today and your total account value is $1150. This means that you have $150 settled in your account. You can buy and sell shares of companies using $150 dollars you had in your account. Should you buy more stocks using the unsettled $1000? You will not be able to sell your shares until 3 days after the sale date.

- You can transfer cash from your account to other accounts such as a bank account as long as the money is settled. Your trading account will display the money that can be withdrawn from it.

Benefits of cash accounts

Your cash account will prevent you from trading on margin which can increase your chances of losing money.

Every security and stocks you buy must be paid in cash. No cash, no trading. The cash settlement time can be used to re-organize your portfolio and improve your trading methods.

In addition, You will never have to worry about margin calls and other issues related to margin accounts.

Disadvantages of cash accounts

With a cash account, you will not be able to use leverage in your trading activities. That is, you cannot borrow money from your broker. Therefore, your buying power cannot be higher than the value of your account.

You will face the waiting time for your money to settle every time you sell stocks and other securities.

There is a limit to what you can do with your account. You cannot short stocks since you cannot borrow from your broker. You can only take long positions when trading using a cash account.

Final Words

If you are new to investing and trading, it is recommended to start with a cash account. Cash accounts are safer for investors and there is a limit to how much you can lose. On the contrary, margin accounts are for experienced individuals and losses are exponential.

You can upgrade to a margin account after getting enough experience.

Sources: Investopedia.com, daytrading.com,thebalance.com,investor.gov