Cashing out your Certificate of Deposit (CD) early could have hidden consequences and potential financial risks. Whether you’re facing a sudden financial emergency or simply looking for a better investment opportunity, it’s important to understand the implications of accessing your CD funds early. When you cash out a CD early, you pay a penalty that is usually expressed as a number of days or months of interest. Depending on your institution and the terms of your CD, you might be charged a flat rate and a fee on top of the early CD withdrawal penalty. In addition to penalties and fees, you might lose bonuses you earned for opening your certificate of deposit account when you cash out a CD early.

In this article, we will cover details of what you should expect when you cash out a CD early. Additionally, we will explore the process of cashing out a CD, the potential penalties with examples, and the alternatives to withdrawing money from your CD before maturity.

What happens when I cash out a CD early?

By cashing out your CD early, you are essentially withdrawing the funds before the agreed-upon term. However, it’s important to note that this process might not be as simple as it sounds. Most financial institutions have specific procedures and requirements in place for early withdrawals. These may include notifying the bank in advance or filling out the necessary paperwork, which can add an extra layer of complexity to the process.

Beyond potential administrative hurdles, cashing out your CD early can also result in financial penalties. Banks often impose penalties as a way to deter customers from withdrawing their funds prematurely. These penalties are typically calculated as a percentage of the withdrawn amount or as a certain number of months’ worth of interest. It’s crucial to carefully review the terms and conditions of your CD agreement to understand the exact penalties you may face.

Additional a flat fee might also be imposed on your account when you cash out a CD early. For example, your bank might charge you an extra $25 fee on top of an early CD withdrawal penalty.

While each bank has its own CD terms and penalty for cashing out a CD early, federal law also has the minimum penalties for such a transaction. However, there is no maximum penalty set by the federal law. According to the Code of Federal Regulations, if you withdraw money from your CD account within six days of making a deposit, the penalty will be at least 7 days of interest on the amount withdrawn.

Example of a penalty you pay for cashing out a CD early

If you are planning to cash out a CD early, the penalty and fees you pay will depend on your CD term and financial institutions. Commonly, most banks charge a given number of months or days of interest earned. It is also common to be charged a flat rate such as 3% of the amount you cashed out of your CD account.

Additionally, some banks impose a flat fee on top of your penalty. For example, U.S. Bank charges a $25 early withdrawal fee in addition to the penalty. It is also common to lose cash bonuses you received as an incentive to open your CD account.

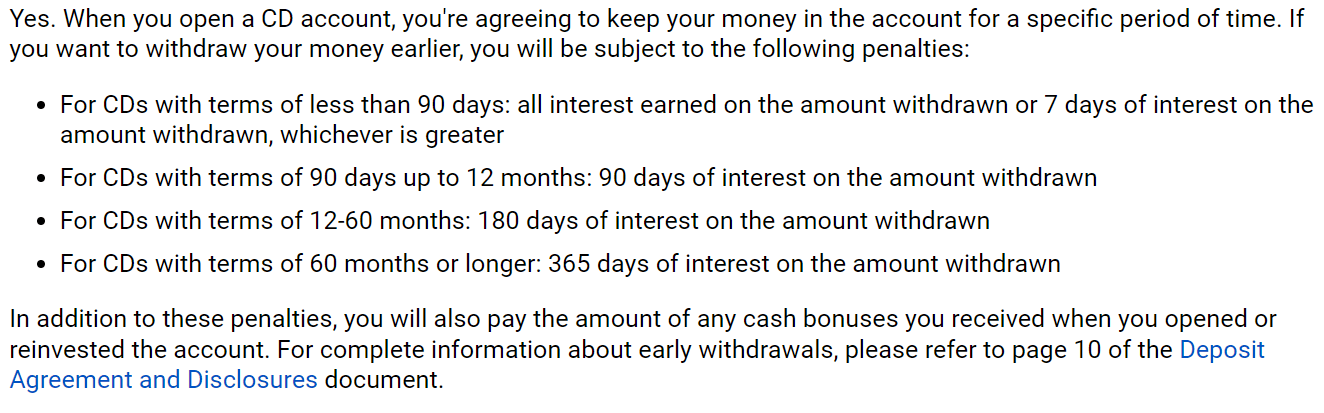

Let’s take a look at the Bank of America’s early CD withdrawal penalties depicted in the following snapshot.

From the above CD terms from Bank of America, you can clearly see that the penalty you pay depends on your CD term. For example, if you have a 12-month CD, your penalty will be 90 days of interest on the amount you withdrew. But, if you have a 6-year CD, the penalty will be 365 days of interest on the amount you withdrew.

Alternatives to cashing out a CD early

Before you head to the bank and cash out your CD early, evaluate alternatives to taking money from your CD account prematurely. This option will allow you to maximize your CD earnings and prevent you from penalties and fees associated with cashing out a CD early.

The following are alternatives to cashing out a CD early.

- Take out a partial withdrawal. Some banks allow you to withdraw a portion of your CD account and charge you a percentage of the money you withdrew. This allows you to take out only the amount you need and pay a penalty in relation to your withdrawal value while leaving the remaining amount to continue growing until the maturity date.

- Take out a loan against your CD. By using your CD as collateral, you may be able to secure a loan with more favorable terms than the fee you would pay for early withdrawal. This option allows you to access the cash you need while preserving the investment potential of your CD.

- Liquidate other investments. If you have other investments that are more flexible such as stocks, you might need to liquidate them instead of cashing out a CD early. Before selling your investments, however, do the math and make sure that it is the best choice for your financial situation.

- Borrow money from friends. If you are in need of cash, borrow money from your friends or family members to avoid cashing out a CD early.

- Wait for the CD to mature. CD accounts benefit you the most only if you can wait until maturity. Before you cash out a cd early, evaluate whether you can put your purchase until maturity. For example, if you have the urge to buy a new car, you can put this purchase on hold and wait for your CD to mature.

Related: How to avoid early CD withdrawal penalties

Can you take money out of a CD whenever you want?

If you are considering investing in a certificate of deposit or have invested already, know that CDs are fundamentally different from traditional savings accounts. Unlike savings accounts that allow you to make a limited number of deposits and withdrawals per month, CDs do not come with this option. Meaning that when you open a CD, you agree to keep the money in the account until maturity. In return, you get to earn a higher fixed interest rate with the guarantee of the principal amount up to the FDIC limit which is currently $250,000 per account and per depositor.

What if you want to withdraw money from your CD? Can you take money out of a CD whenever you want?

Yes, you can withdraw money from a CD whenever you want. But, an early CD withdrawal penalty will most likely be imposed on your account. Some banks charge you a flat fee while others impose a penalty equal to a number of months of interest. For example, if you have a 12-month CD and took money out of your CD account before maturity, you might be charged a penalty equal to 3 months of interest.

Pay attention to the fine print of your CD terms

Note that the rules for cashing out a CD early can vary depending on the specific terms and conditions set forth by your financial institution. In most cases, CDs are designed to be held until maturity, which means you commit to leaving your money untouched for a specified period of time, typically ranging from a few months to several years.

There are times, however, you might need to close your CD account before maturity. In this case, your CD terms will have specific details on the penalty structure, fees involved, how to close your account, etc. So, it is important to carefully read the fine print of your CD terms and make a decision accordingly. You can also call your bank and talk to a representative about these details.

Your CD might allow you to withdraw money early without a penalty

Some CDs do offer more flexibility, allowing you to withdraw your money before the maturity date. These are known as “liquid” or “no-penalty” CDs. With these types of CDs, you can typically access your funds without incurring any early withdrawal penalties. It’s important to note that liquid CDs may offer lower interest rates compared to traditional CDs.

On the other hand, if you have a traditional CD with early withdrawal penalties, taking money out before the maturity date can result in financial repercussions. These penalties can vary in severity depending on the length of time left in the CD term and the amount being withdrawn. It’s essential to understand the specific penalties associated with your CD and factor them into your decision-making process.

Related article: 11 Types of CDs: which Certificate of Deposit is Right for You?

How do you get your money out of CDs?

If you find yourself needing to access the funds in your CD before the agreed-upon maturity date, you may be wondering how exactly you can go about getting your money out. The process will typically involve contacting your bank or financial institution to initiate the withdrawal.

First and foremost, it’s crucial to understand the specific penalties associated with your CD. Early withdrawal penalties can vary in severity depending on factors such as your CD term and the amount you wish to withdraw. Your bank or financial institution will be able to provide you with the details of these penalties. So it’s essential to reach out to them for clarification.

Once you have a clear understanding of the penalties, it’s important to carefully evaluate whether the need for immediate access outweighs the long-term benefits of keeping your investment intact. Consider the potential impact on your overall financial goals and weigh it against the penalties you may incur. This will also include factoring in the interest you will lose by not keeping the money in your CD account.

If you think cashing out of a CD account is your best move, let the bank know where the money should be deposited. You can either have the money transferred to another account or get a check.

Related: How to close a CD account in 6 steps

How long does a CD take to mature?

The maturity period of a CD can vary depending on the terms you agreed upon when you opened the account.

Typically, CDs have fixed terms ranging from a few months to several years. For example, a 6-month CD will take six months to mature while a 12-month CD will take a year to mature.

It’s important to note that once you’ve deposited your funds into a CD, you won’t be able to access them until the CD reaches its maturity date. This fixed time period allows the bank or financial institution to use your money for investments and loans, and in return, they offer you a fixed interest rate.

The length of time it takes for a CD to mature can have implications for your financial goals. If you have a short-term goal, such as saving for a vacation or a down payment on a home within a few months, a shorter-term CD may be more suitable. On the other hand, if you’re looking to invest your money for a longer period, such as saving for retirement or a child’s education, a CD with a longer maturity period may be a better option.

You might also like: When a CD matures, should you Reinvest in a new CD or cash out?

Do you get a grace period after your CD has matured?

After maturity, CDs often come with a grace period that is usually between 5 to 10 days. The grace period allows you to make a decision on what to do with your CD account. The grace period also varies depending on your CD term and financial institution. Usually, shorter CD terms come with shorter grace periods while longer CDs come with longer grace periods.

For example, Bank Of America gives you 1 calendar day to renew or close your CD if your CD term is between 7-27 days. On the other hand, when your CD term is 28 days or higher, you get 7 calendar days to renew or close your CD account after maturity.

After maturity, you can choose to cash out your CD and get a check, invest the money in a new CD, or let the bank automatically renew your CD account. Keep in mind that you might not get the same rates when your CD is renewed automatically as most banks give you a rate being offered at the time of renewal.

For example, if you had a 1-year special CD at 5%, your bank will not automatically renew your CD account at 5%. Instead, you will get the current rates being offered by the bank for its 1-year CDs.

Related: When a CD matures, should you Reinvest in a new CD or cash out?

When should you break a CD?

While the money in your CD account should stay there untouched until maturity for maximum profit; there are times when you should break a CD. If the terms of your CD no longer align with your financial goals, it might be ok to break a CD and put your money elsewhere.

Here are a few reasons it might make sense to cash out a CD early.

You just had an emergency. Unexpected financial emergencies may arise, such as medical bills, urgent home repairs, or sudden job loss. In these situations, having access to the funds in your CD can provide the necessary liquidity to address these immediate needs.

You invested in a longer-term CD but need cash sooner. For example, you may have purchased a 5-year CD with the intention of using the funds for a down payment on a house. If you find your dream home earlier than anticipated, breaking the CD early can provide you with the necessary funds to seize the opportunity.

You want to invest your money elsewhere for higher returns. If you have a low-yield CD and come across a better investment opportunity, breaking the CD and reinvesting the funds elsewhere might be a wise move. This could apply if interest rates have significantly increased since you opened your CD, and you have a chance to earn higher returns by reallocating your funds. However, make sure to carefully assess the potential gains against the penalties associated with breaking the CD, as well as any risks involved with the new investment.

More saving tips

Is now a good time to buy a CD?

How to close a CD account in 6 steps

11 Types of CDs: Which certificate of deposit is right for you?