Credit cards are some of the worst debts you can carry due to higher APRs and the option to make minimum monthly payments. The fact that credit cards do not help you achieve anything substantial makes credit card debt even worse. I learned this lesson the hard way, and it took me a long time to pay off my credit card debts. If you have accumulated too much credit card debt or your credit score has been dropping nonstop, this article is right for you. The good news is that you can easily pay off your credit card debts if you follow the same strategy that I used.

Yes, it’s easy to get out of credit card debt, and I’ll walk you through my personal experience with credit card debt in this article. Eight years ago, my score was very bad. It took me a lot of savings, discipline, and financial restructuring to pay off my debt. In this article, I will elaborate on tips and debt management I used to pay off my credit card debt and improve my credit score.

Note: This article is based on a personal experience.

Without further ado, let’s get started with tips to pay off your credit card debt.

1. Understanding and acknowledging my credit card debts

When I applied for a credit card, I did not know what I was getting myself into. I was unaware of the real benefits or consequences of using credit cards. I even learned about credit scores a year after I got my first credit card. A friend of mine asked me if I knew my credit score, and I asked him what it means.

I was naïve and did not care about anything related to my credit cards or scores. Whenever I had financial problems, the first thing that came to my mind was using my credit cards. I heavily used my cards when I was not supposed to use them.

When real financial problems started showing up, my cards were already 70% used up. My only choice was to use them more, and I ended up going over my credit limit. Yup! I used up all my credit limits and kept going.

I have spent more than $150 above my credit limit on some of my credit cards. If you are new to the credit card world, the total credit line means the maximum amount your credit card issuer allows you to spend.

For example, if your credit limit is $1,000, it means you can spend up to $1,000. Since credit cards are revolving credit, paying off some of your balance allows you to continue using your credit cards. In my case, I used more than $150 above that maximum value!

Was it a good idea?

What happened next, you ask? The immediate effect of my recklessness started to emerge. The interest payments on each card were in hundreds of dollars. That is a lot of money to pay on top of the principal that I used for shopping and paying for school.

It was around that time that I was thinking about getting more credit cards to help me pay off my bills. So, I went to a bank, and the bank denied me a new credit card. I asked why. The answer was that my credit score was not good.

When I got home, I checked my credit score, and I was 560 with a caption that said, “Very Poor”. At this time, I started learning about credit scores in depth. I realized that having a bad score was a bad idea for my financial stability. This is when I realized that I will not qualify for loans in the future if I can’t even get approved for a credit card.

My credit utilization, which compares how much I have spent to my total credit limit, was 100%. What made it worse was that I only paid the minimum payments, which prevented me from getting out of credit card debt. Without paying off my debt, I would not qualify for loans in the future. So, I took action.

You might also want to read bout the factors on which the credit score is based.

2. I broke down my credit card debts and evaluated how each one of them was affecting my score

My attention shifted from ignoring my credit score to how I could improve it. My first step was understanding how each of my credit card balances was affecting my score.

I listed the amount of debt on each card, the interest payment, and estimated the time it would take to pay them off. Then, I ranked them from the highest debt with the highest interest charges to the lowest debt with the lowest interest charges.

I think breaking them down helped me understand what I was dealing with. This was a good beginning for a long and rough journey. I started paying them off randomly, and at that time, I was a full-time student and working a part-time job.

My credit card debts had built up to a level where paying off the interest rates and minimum monthly requirements was not enough to make a dent in my debt. I paid as much as I could, but my debt did not go down. Plus, my score kept plummeting.

3. I started putting more money on cards with more debt

After realizing that I would never be able to pay off my credit card debts, I changed my strategy. Paying too much interest on money that I did not use productively did not make any sense. I turned my attention to reducing interest charges.

This meant putting a lot of money on cards with the most debt. By paying more money on the card with the highest balance, I started seeing my interest charges going down, along with my minimum requirements. This was a breakthrough. I put over 80% of my payment toward cards with more debt.

My main target was to improve my score, but it wasn’t moving up as much as I had hoped. With a lot of frustration, it was time to improve my strategy.

Read more: 19 Best debt management strategies to lower your debt.

4. I started paying only minimum payments on cards with less debt

Even if I was putting more money on cards with the highest debts, I was not making progress. So, I decided to ignore cards with the smallest balances and only paid the minimum monthly payment required for them.

At first, I realized that there was nothing wrong with this method. Just pay the minimum payment on cards with low debt and focus your attention on the ones with more debt.

After a while, I started realizing that the debt on the cards with the lowest debt was increasing. I learned that the interest applied to each card that I had not paid was being compounded. This was a bad thing.

I was reducing debt and interest on a high balance card while building it on low balance cards. So, my score did not improve that much for this reason. The strategy was good, but not good enough to improve my credit score or even pay off my credit card debt. It was time to improve my debt management strategy once more.

5. I got another card with 0% APR on it

One of the reasons my credit card debts and interest charges stayed high was that I was still using my cards for everyday purchases. To stop increasing my interest charges, I had to use a card with no interest at all. This way, I could stop using cards with high APRs.

In addition, I knew that having one more credit account open would help my score in the long run. It was going to be a fight to get another one. Remember, the bank denied me a card because of my poor credit score? I started shopping around and luckily, I found one with a $500 credit line limit.

- This additional credit card made a huge difference in my journey to getting out of credit card debt.

- Having an extra credit card also meant more debt to my account if I did not behave. I played it smart.

After getting my new card, my credit score dropped a few points in the short term. This was due to a hard inquiry on my credit report, and the credit age was affected by the new card. In the long term, I was fine. The new card had a 0% APR, which meant that I could use the money and pay no interest for a year!

The new card helped me reduce the usage of cards with high APRs. My score improved slowly. I knew I could not achieve my goal at that speed. My payments were not enough to reduce my debt quickly. This was the main reason my score never increased as fast as I wished.

So, I needed to aggressively pay off my debts if I wanted my credit score to improve. Time to improve my debt payment strategy again!

6. I got a 2nd job to help pay down my credit card debt

It was clear to me that my most significant setback was low monthly payments. The solution was to pay more, but I did not have it. I landed another part-time job, and everything I was making was going directly to paying off my credit card debts. I saw the real difference in my credit score after getting that second job.

Now I was making more money and could afford more payments. So, I tweaked the formula a little bit. I started paying off the interest charges, minimum payment, and a little bit of the principal for every card. I still allocated more capital to cards with the highest debt.

7. I stopped using my cards but kept them open

I purposefully stopped using all cards with APRs on them, no matter how small. With this method, I ensured that my debt was decreasing as planned. This technique helped me a lot. My score rose into the 600s, and I celebrated. I used to check my Credit Karma credit score every week to see if anything had changed.

I stayed disciplined with my methods, and it worked slowly. My score improved from very poor to needing work. At this point, I knew I could do it. My next mission was to improve my score faster, which led me to the next step.

8. I lived below my means

My next mission was to cut down my expenses to allocate more funds towards debt payments. I started buying second-hand and generic brands to save more money. This helped me cut off some of my grocery and related shopping expenses. I cut my utility bills by using only what I needed. Every penny I saved was going toward paying off my credit card debt.

9. I was very patient

One of the main reasons I was able to achieve my goal was patience. I knew that I was fighting a very long battle that was winnable with patience and a strategy. Doing what I had to was the best way to approach the problem. I set my mind to the task, aware that I could accomplish it by paying it off a little at a time. I think you can do the same if you are struggling with too much credit card debt, like I did.

10. I had a lot of discipline

Another essential attribute is my discipline to stay on my course. It was a rough journey, and I could have lost it if I had not had discipline. I fought through the pain and kept reminding myself that it is doable and that once it is done, I will never worry about it again. This positivity kept me going.

Takeaways from my method.

I continued using my method, and slowly things turned around. The key was paying more money on cards that I had more debt on. At the same time, I made sure that I was paying off the minimum monthly payments, interest charges, and a little bit on the principal of cards with low debts.

This strategy reduced credit card debt and interest charges on cards with the highest debts. At the same time, it prevented compounding interest on cards with lower debts. Getting a 0% APR credit card and getting a part-time job also allowed me to pay off my debt faster.

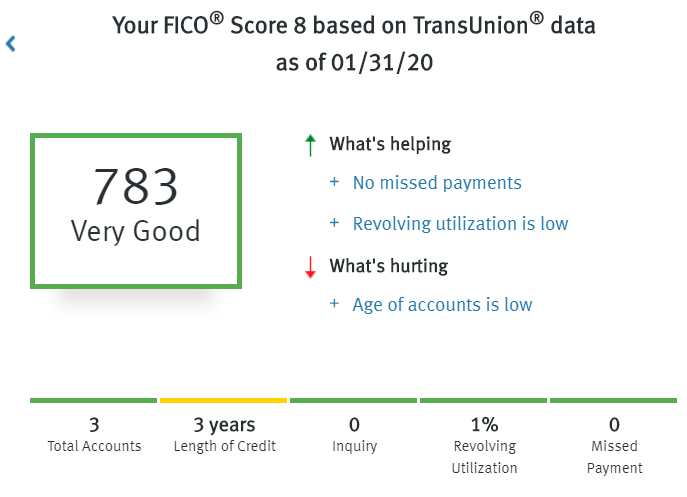

Over one year, my credit score increased from poor to excellent. Are you fighting the same battle? Be patient, have a lot of discipline, design a strategy, and make sure you stick to it. You can improve your strategy as time and conditions change, as I did. But do not give up at all. You can also apply my strategy if you find it useful. Otherwise, consider the following tips to help you get out of the credit card debt I highlighted below.

Other strategies I never used that work for some people

Next, we will examine other methods I have not used but could have been effective if applied.

1. Credit card debt consolidation

Debt consolidation is a great way to pay off credit card debt or any other debts you might have. Basically, instead of fighting with minimum payments, interest charges, and principal payments, I could have paid them off at once by consolidating them on a new credit card or a personal loan. Consolidating your debt is a great way to pay off debt, as it allows you to focus on one debt without juggling multiple debts. Debt consolidation also comes with a lower interest rate, which makes your monthly payments go further.

As we know, credit cards have one of the highest interest rates compared to other types of loans. By refinancing my credit card debt, I could have reduced my interest charges from 20% to as low as 10%. This is a huge difference in interest reduction.

2. The debt avalanche method

While paying off my credit card debt by focusing on the highest balance first was effective, I could have employed the debt avalanche method, which prioritizes paying off debts from the highest interest rate to the lowest.

To pay off your debt using the debt avalanche method, follow these simple steps.

- List your debts from the highest interest to the lowest.

- Pay the minimum payment on each debt on the list

- Add all remaining money to the first debt on the list

- Repeat this process until the first debt is paid off, and move to the next debt on the list.

- Continue this process until all your debts are fully paid off.

Read more about the debt avalanche method and how to use it.

3. Use the debt snowball method

Another effective way to pay off credit card debt is to use the debt snowball method. This strategy helps you pay off debt, starting with the smallest balance and working up to the highest balance.

To use the debt snowball method, follow these tips below.

- List all your debts from the smallest balance to the highest balance.

- Pay the minimum payment on each debt

- Use all the remaining money to pay down the smallest debt

- Once the first debt is paid off, move to the second debt and work your way up on all the debts you have on the list.

Read more about the debt snowball method and how to use it.

4. Bankruptcy

Here is the last option that I never thought of using, and I would never recommend it to anyone. Unless you have no other choice, this should not be a path to take. Whether you file for Chapter 7 or Chapter 13, there is no easy way out. You must find alternatives to paying off your credit card debt before considering bankruptcy.

Not only do you go through a lot of financial hustles with attorneys, surrendering all or some of your assets, but bankruptcy also leaves a scar on your credit history.

Read more on how bankruptcy affects your credit.

Keep in mind that by the time everything is finalized, you could have spent more money than you owed on your credit card debt. It all comes down to what proper steps you want to take and how much pain you are willing to endure.