Real estate is one of the best sectors to invest money, earn passive income, and grow wealth. If you have been wondering how to invest in real estate, you have come to the right place. What makes investing in real estate attractive is that you do not need a sophisticated education or a lot of money to get started. There are many ways to invest in real estate, depending on your budget and risk tolerance.

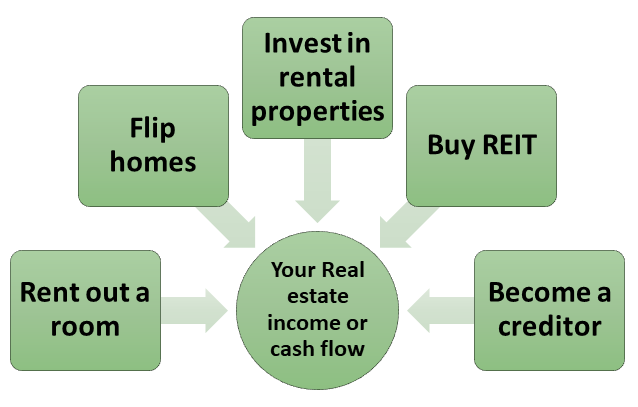

This guide is all you need if you are ready to start earning passive income from real estate investing. Here is a chart illustrating different ways to invest in real estate, which we will cover in more detail in this quick guide.

The following are the top 5 ways to invest in real estate.

1. Buy REITs (Real Estate Investment Trusts)

If you don’t have a lot of cash or don’t want to buy and manage physical properties, investing in REITs will be the best option for you. Like buying individual stocks, you can buy stocks of companies that invest in real estate without allowing you to earn a real estate stream of income without owning or managing properties.

What are REITs?

According to investor.gov, a REIT is a company that owns and typically operates income-producing real estate or related assets. These assets may include buildings, hotels, shopping malls, resorts, warehouses, apartments, etc. Owning shares of a REIT allows you to invest in real estate without buying physical property.

Most REITs are publicly traded on exchanges, and you can buy and sell their shares like other publicly traded securities. As a result, prices are transparent, and there are no conflicts of interest when investing in these REITs.

REITs are a perfect investing option if you can’t afford physical properties due to insufficient down payment or don’t want to deal with tenants and the hustle of owning properties.

2. Invest in rental properties

Are you interested in earning a steady income or a regular passive income? If you don’t, investing in rental properties is a great way to make money in real estate.

Investing in rental properties is simple. All you need to do is:

- Buy properties

- Have tenants living in them, and then

- Collect cash flows from your tenants.

Since investing in rental properties means you will hold a physical property, having a down payment usually makes the job easier. However, there are ways to finance a real property purchase entirely with debt.

Popular types of rental properties you can buy include but are not limited to condos, townhomes, single-family homes, and multifamily. Multifamily tends to be more profitable and are easy to scale. For example, investing in single-family property means you need a down payment and a mortgage for every real estate deal you close. But, if you buy multifamily such as a four-plex, all you need is a single mortgage and a single down payment.

Consider apartment complexes if you have a lot of money and know how to manage properties. These tend to cash flow better but require sophisticated management strategies.

Another benefit of investing in rental properties is the property management options. If you don’t want to manage properties by yourself, you can easily have them managed by a real estate management company in exchange for a small fee. Most property management companies charge 8 to 10% of your gross rental income.

BRRRR real estate investing method

If you are serious bout making money in real estate through rental properties, consider the BRRRR investing strategy. The BRRRR stands for Buy, Rehab, Rent, Refinance, and Repeat. This strategy allows you to continuously buy properties and lease them due to the option of refinancing. As a result, you can grow your portfolio faster.

3. Flip homes for profit

Maybe you don’t want to do anything with tenants at all. According to you, they are loud, messy, impossible to manage, calling you in the middle of the night, not paying on time, and eviction problems come with them.

You are right. Dealing with tenants is not easy at all. However, there are other ways to invest in real estate without dealing with tenants. If you like projects or have a great team around you to do the renovation, consider flipping houses to make money in real estate. With this strategy, you buy broken houses, fix them, and sell them to motivated buyers.

There is a lot that goes into it. It is recommended that you learn as much as you can to tackle some of the projects yourself. You will save on labor and material costs by fixing these homes yourself. Knowing how to fix homes will also help you catch mistakes your contractors make if you are not doing the work alone.

Another hybrid of flipping houses is the Live-in flip. With this strategy, you live in a fixer-upper while improving and later sell it for a profit.

Here are four things to know before flipping a house.

4. Rent out a room

Are you interested in investing in real estate but don’t have cash? Again, you don’t need money to invest in real estate.

Renting a room is a great way to get started with rental properties without putting money down. With this strategy, you let a tenant live in one of the rooms you are not using in your current home in exchange for a small rent. This option lets you learn about rental properties and how to screen tenants while earning you easy money. Once you have saved enough money, you can start buying bigger properties.

For example, if you have a 4B3B house and your family uses only 2B2B, that leaves you with two bedrooms and one bath you are not using. Renting out this extra space in your home will earn you a passive income without spending a penny. Even if you earn a small amount, the extra cash you make will cover some of your mortgage monthly payments or put money in your pocket if the house is fully paid off.

Even if you don’t own a house, you can still implement this technique on the house you are currently renting. Let’s assume you are renting a house of the same size and paying $ 3,200 monthly.

With two tenants paying $800/mo each, your rent will be $1600/mo. You are not living for free, but this simple trick halves your rent.

The downside of renting out a room is trust and safety. It is a little awkward and hard for some people to live with strangers in the same house. However, if this is not a big deal, rent a room.

5. Become a creditor

If none of the abovementioned real estate investing strategies work for you, you can still invest in real estate by becoming a lender.

For example, you can give your money to another real estate investor or a property developer and get paid a regular interest. Choosing this strategy is a bit risky due to the risk of default and fraud. For this reason, you will need to complete the right paperwork and only invest the money you are willing to lose.

You can also try peer-to-peer, an option where p2p lending platforms connect investors with borrowers.