Trading futures on Robinhood is an attractive way for investors seeking to diversify their portfolios and capitalize on market opportunities 24/7. Whether you’re new to futures trading or just exploring Robinhood’s futures platform, this guide will help you understand the basics of futures trading on Robinhood, execute trades, and the benefits of futures trading.

Robinhood offers a user-friendly interface, low commission rates for futures trading, and easy accessibility, making it one of the best platforms for beginners. But how do you start trading futures on Robinhood effectively? What are the key risks and tips to keep in mind?

In this article, we’ll cover everything you need to know, including:

- Step-by-step guide on trading futures on Robinhood

- Robinhood futures trading tips to maximize your ROI

- Examples with futures contracts

- And what you need to start trading futures on Robinhood.

Let’s get started!

What are futures?

In simple terms, futures are financial contracts between buyers and sellers that allow them to trade assets at predetermined prices on a specific future date. Typically, futures are used for speculating on price movements or hedging in various markets, including commodities, currencies, stocks, and interest rates.

At the futures contract date, the seller must deliver the asset to the buyer in accordance with the terms of the contract. When trading futures on Robinhood, you will not have the option to provide or receive physical assets. This is because Robinhood and many other brokers do not support the physical delivery of assets.

For this reason, all physically settled future contracts must be settled before the last day to trade (LDTT). This is the day your Robinhood futures contract expires. If you hold your futures until the LDTT, Robinhood will close the contract on your behalf to avoid physical delivery of the asset to the buyer.

How do futures work?

For any futures contract, three parties are involved: the buyer, the seller, and the broker. The broker is essentially a brokerage company, such as Robinhood, Fidelity, or Charles Schwab, among others.

Futures trading resembles stock trading except that they come with expiration dates. That is, each contract expires sometime in the future, and it must be settled by the expiration date, also known as the last day to trade(LDTT). For example, if you think the price of natural gas will rise in the future, you can buy a natural gas futures contract that expires in a few months. You will then have the option to hold it until the LDTT or sell it before.

If the price goes higher and you decide to settle the contract(sell), you will make money. However, if the price of the asset moves against your trade and the contract is settled at a lower price, you will incur a loss.

Here are the key points to consider when trading futures on Robinhood or any other platform.

- Seller’s obligation. The seller must deliver the asset or settle in cash.

- Leverage & margin. Futures allow traders to control large positions with a small initial investment, amplifying both potential gains and losses.

- Common futures markets include commodities (such as oil, gold, and wheat), stock indices (like the S&P 500), and currencies (like the USD and EUR).

Examples of futures contracts on Robinhood

Let’s assume you believe the price of crude oil will rise over the next three months. So, you decide to buy a crude oil futures contract that expires in three months for $80 per barrel. Each contract represents 1,000 barrels of oil.

Here are possible outcomes from this trade.

- Price Increases. If crude oil rises to $90 per barrel before expiration, you can sell the contract at the higher price, making a profit of ($90 – $80) × 1,000 = $10,000.

- Price Decreases. If crude oil drops to $70 per barrel, you will incur a loss of ($80- $70) × 1,000 = $10,000.

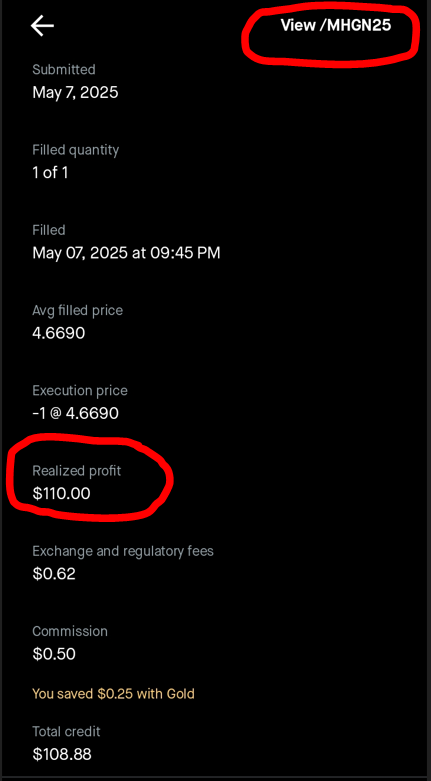

Here is a more realistic example of a futures contract settled on Robinhood.

As highlighted in the above image, I sold one contract of Micro Copper Futures (MHGN25) that I had previously purchased at a lower price, resulting in a profit of $108.80. For this trade, I paid $0.62 in exchange and regulatory fees, as well as a $0.50 commission. The total profit after fees and commission is $108.88.

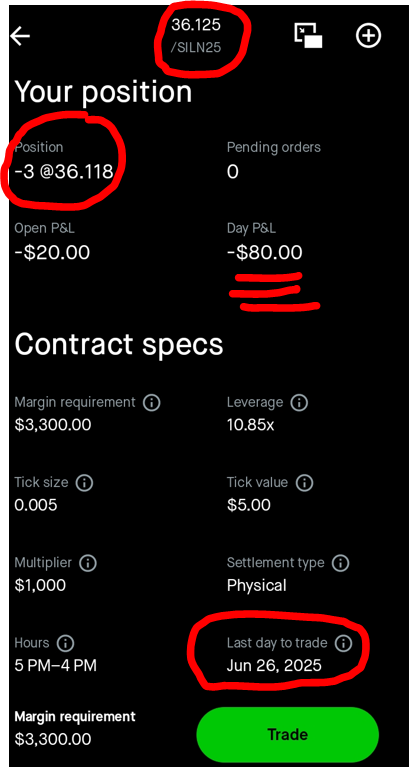

Let’s examine another example of a futures contract on Robinhood that is still open.

With the above example, I am shorting three contracts of Micro-Silver Futures(SILN25) at an average price of $36.118. So far, my unrealized loss is $80. If I decide to close my position immediately, I will incur a loss of $80. The good news is that my Robinhood contract won’t expire until June 26, 205. Therefore, I can afford to hold my trade until a later date since the price has not yet reached my stop-loss order.

More reading: When do your Robinhood futures expire, and what to do after expiration?.

How to start trading Futures on Robinhood for beginners?

Trading futures on Robinhood differs from trading stocks. Before you can trade futures on Robinhood, you must have an investment account with either margin investing enabled or options trading approved. Assuming that you have an investment account with Robinhood, here are the steps to start trading futures.

Step 1. Enable futures trading on Robinhood

Before you can start trading futures on Robinhood, you need to apply and get approved for futures trading with Robinhood Derivatives. This is a separate account inside your standard Robinhood brokerage account.

To get approved for Robinhood futures trading, follow these steps. Search for “futures trading”, then select “Apply to trade futures” and follow the instructions. You will need to complete the application, which requires information about your trading experience and investor profile, and sign the disclosures and agreements.

Once the application is submitted, you will wait for approval to trade futures on Robinhood. The approval process can take up to 5 days; however, if you already have an account and have been using Robinhood for a while with enough investing experience, it might take a few hours.

Step 2. Deposit money into your Robinhood individual investment account

While futures trading allows you to control large positions with a bit of money, you still need to have some cash before you can start trading futures. Each asset you want to trade comes with a margin requirement, which is the collateral you need to open a futures contract.

To maintain the required margin, you must have sufficient purchasing power or a sufficient amount of money deposited into your account. For example, some contracts require as little as $300 to open a position. If you are getting started with futures trading, consider micro futures, as these typically require only one-tenth of the margin requirements and minimize the potential loss.

For example, the tick value of a Silver Futures Contract(SIN25) is 0.005, and its value is $25. That means for every time the prices move up or down 0.005, you will lose or make $25. For Micro Silver Futures (SILN25), the tick size remains 0.005, but its value is only $5. This means you will lose or make $5 every time the price moves 0.005.

Step 3. Start trading futures with Robinhood

To trade futures on Robinhood, follow these simple steps.

- Go to the search bar and type in futures.

- Select futures to access all the futures available to trade on Robinhood. Currently, Robinhood offers 41 different assets you can trade, including commodities, currencies, and index funds.

- Select the asset you want to trade for futures.

- Review the contract specifications to ensure you understand its requirements and terms, including margin requirements, tick value, settlement type, leverage, tick size, and expiration date, also known as the last day to trade (LDTT).

- Click on the Trade tab.

- Choose between “Buy“, “Sell“, or “Ladder“. If you are getting started, stick to buying and selling.

- Enter the quantity of contracts you want to trade, and then select Review. If you are new to trading, consider starting with micro futures and buying contracts with lower margin requirements to minimize potentially significant losses. The key is learning how to trade futures before you can heavily invest in them. Focus on learning, rather than earning, by minimizing your losses.

- Swipe up to submit your order.

Step 4. Monitor your Robinhood futures trade

After submitting your order, you will need to monitor your trade. The expectation is that the price will move in your favor. But this is not always the case. That is why you need to monitor your trade and take action if required.

Here are things to watch out for after opening a futures contract on Robinhood.

- Know your last day to trade(LDTT). This is the date your futures contract expires, and you must settle your contract by this date. If you don’t, Robinhood will close the contract on your behalf. Physically settled contracts must be settled before LDTT to avoid physical delivery of the assets as per the contract terms.

- Keep your eyes on margin calls. If the price moves against your trade and you run out of margin, Robinhood will send you a margin call, requiring you to either close your position to meet the margin requirements or deposit additional funds to maintain your position. That means you must take action. Otherwise, Robinhood will close some or all of your positions. Your account may also be flagged as a sell-only account until you meet the margin requirements.

- Manage your losses and take some profit. While the contract will have an expiration date, you don’t need to hold your position until that LDTT. If you have made a profit, it is advisable to lock in some of it, depending on your investment strategy. You must also manage your losses to avoid losing all your money.

Benefits of Futures trading on Robinhood

Trading futures on Robinhood offers several benefits, including the following.

- No Pattern-Day Trading (PDT) rules. Unlike stocks, futures trading does not have PDT restrictions, making it more accessible for active traders with smaller accounts.

- Extended trading hours. Futures markets operate nearly 24 hours a day, five days a week, enabling you to respond to global events in real-time.

- Diverse asset exposure. With futures on Robinhood, you can trade commodities, currencies, and stock indexes.

- Tax benefits. Futures contracts’ earnings qualify for favorable tax treatment, with 60% of gains taxed as long-term capital gains.

- Less commission. When you trade futures on Robinhood, commissions are usually lower than on many other platforms.

How much do I need to start trading futures on Robinhood?

Generally, Robinhood does not have a minimum deposit to start trading futures in your account. But Robinhood requires margin requirements for opening futures contracts. The margin requirements are not the minimum deposit. Instead, it is collateral needed for each futures contract to cover potential losses.

Your future’s account is funded through your investing account. The amount available for trading futures, also known as your futures buying power, will differ from your general investing account balance. Also, different futures contracts have varying margin requirements, which determine the minimum amount needed to trade specific contracts.

How to enable futures trading on the Robinhood platform?

While you can trade stocks and other securities on Robinhood, you must apply and get approved for futures trading with Robinhood Derivatives. This new account is separate from your investing account. Here are a few steps to enable futures trading on Robinhood.

- Once logged in to your Robinhood investing account, select account settings and search for investing or trading options.

- In the search area, type in Futures trading. Then, select the Get Futures Trading or the Apply tab.

- Complete and submit the futures trading application. The application requests information about your trading experience, personal details, and other relevant information.

- Wait for account review and approval. Although it can take a few hours to get approved for futures trading on Robinhood, it may take up to 5 days to get approved for trading futures.

- Start trading. Once approved for futures trading, start buying and selling futures.

When does my Futures contract expire on Robinhood?

Each futures contract on Robinhood expires on the last day to trade (LDTT), which is listed under your contract specifications details. Unlike options, where your contract can become worthless if they are out of money at expiration, your futures contract does not become worthless. You can still sell your futures contract by the LDTT and keep its current value by the time it is settled.

If you don’t settle your futures contract by the expiration date, Robinhood will settle it on your behalf. Physically settled contracts might be settled before the expiration date to avoid physical delivery of the asset to the buyer.

Why am I not eligible to trade futures on Robinhood?

Typically, your eligibility to trade futures on Robinhood depends on several factors, including your investor profile, net worth, income, and risk tolerance. If you have been denied to trade futures on Robinhood, it is more likely that you are new to investing and trading, have a low risk tolerance, or have a limited net worth or income.

What do I do when my Robinhood Futures contract expires?

Each Robinhood futures contract has an expiration date, which you can easily find under your contract specs. There are two ways futures contracts can be settled on Robinhood: cash or physical delivery of assets. You can settle the contract yourself by buying or selling the asset you traded before the expiration date.

If you hold your contract through the expiration date, Robinhood will settle it on your behalf.

If you have a cash-settled contract, you will receive a credit or debit on your account after Robinhood has settled your contract. On the other hand, if you have a physically settled asset, you will need to settle your contract before expiration to avoid the physical delivery of the asset, as required by the contract. Fortunately, Robinhood doesn’t accept physical delivery of assets. For this reason, your physically-settled contract will be settled by Robinhood by expiration to avoid the physical delivery of the asset.

More investing tips

When do Futures expire on Robinhood?

How to start investing with little money in 10 simple steps?