You can get a free copy of your credit reports from each of the three major credit reporting agencies—Equifax, Experian, and TransUnion—once every 12 months. The official website authorized by the federal government for this is AnnualCreditReport.com. Checking your credit report regularly helps ensure accuracy and can alert you to potential identity theft.

This post will explain how to get a free copy of your credit report from each credit reporting agency. I will show you how to download your Free Experian credit report. To get copies of your credit reports from Experian and TransUnion, follow the same steps and select these agencies on step 2 of this process.

Where do I get a free copy of my credit reports?

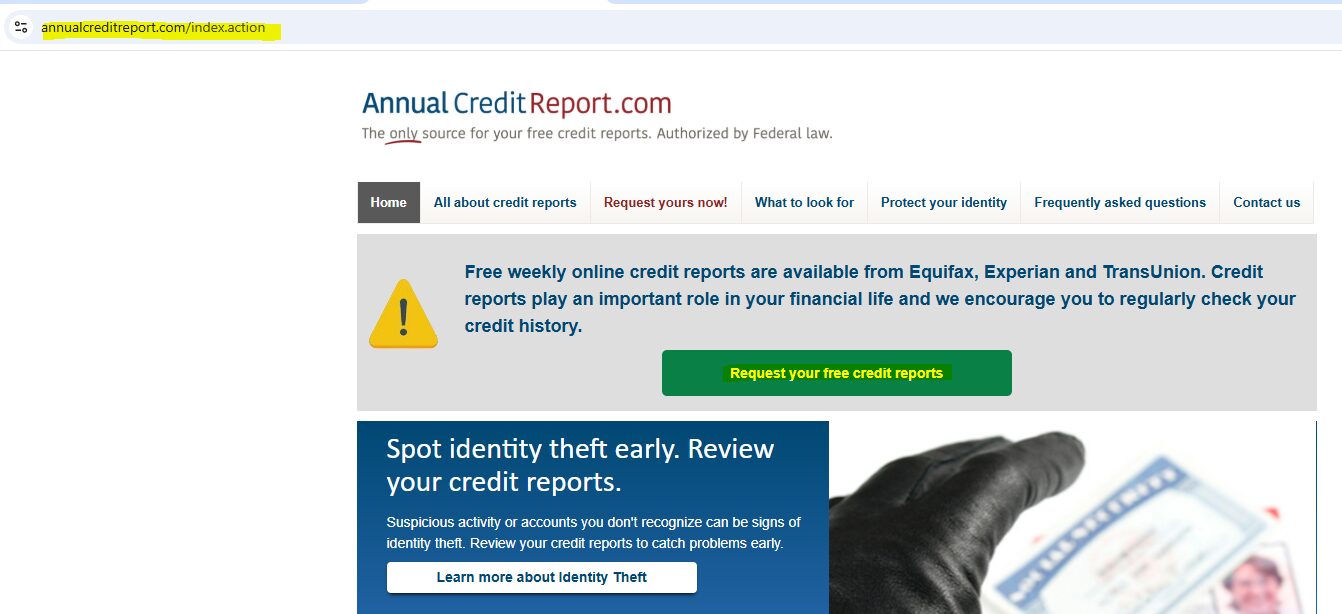

While many websites offer credit report services, if you need a free copy of your credit report, you can download it from AnnualCreditReport.com. This is a government-approved website where you can download a copy of your credit report from each credit reporting agency.

Here are the steps to get your credit reports for free online. These steps are the same for each credit reporting agency. You must repeat the same process and select a different credit bureau on step two to get the report from that particular agency.

How do I get a free copy of my credit report?

To get a free copy of your credit report online, follow the steps below.

- Go to AnnualCreditReport.com, then click on Request your free credit reports.

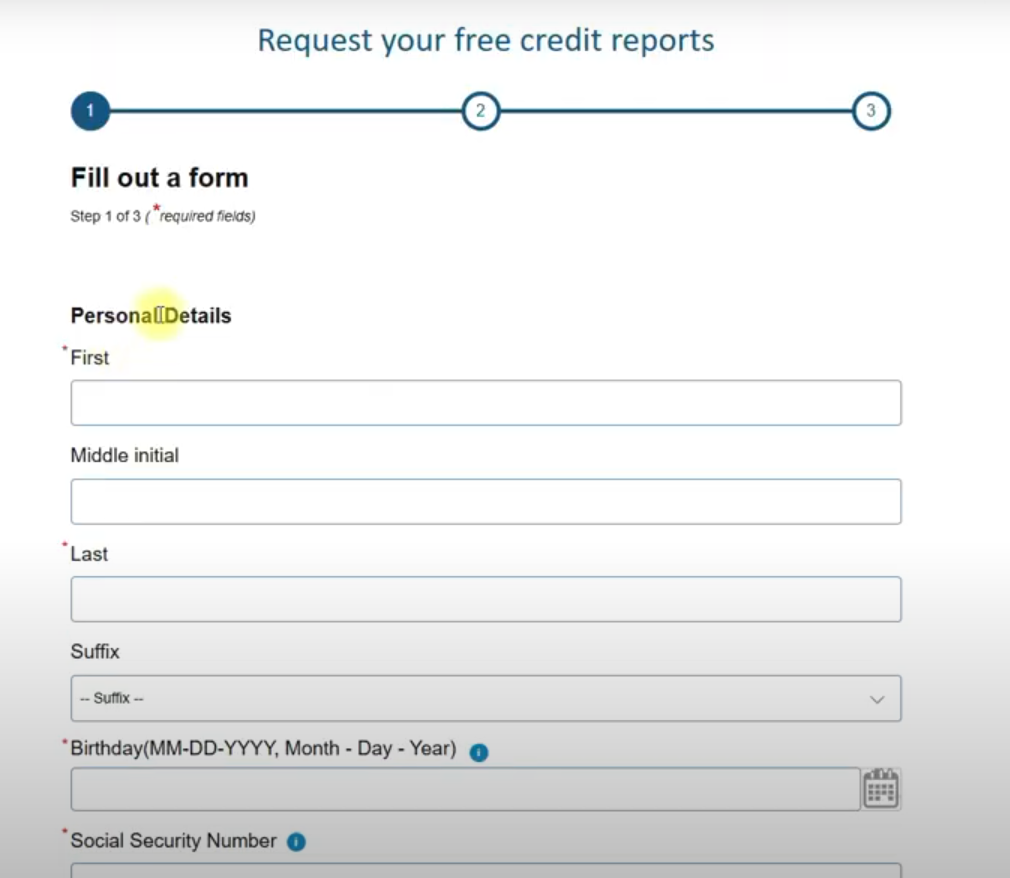

- Please complete the form. You will need your full name, address, and social security number.

- Click Submit. You will then be directed to a page to select which credit report to download.

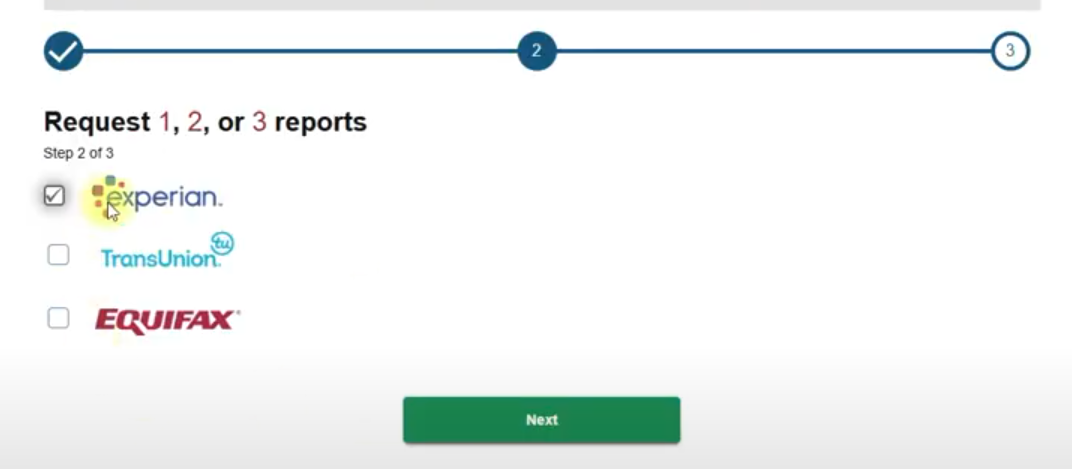

- Choose between Experian, Equifax, and TransUnion, then click Next.

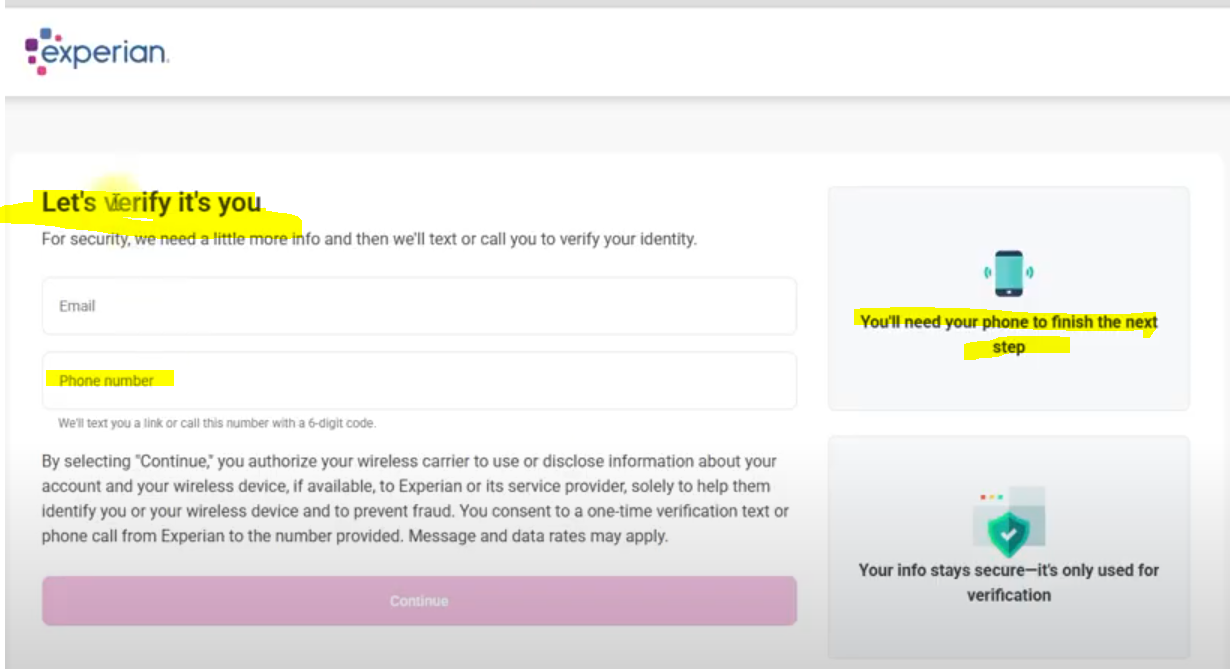

- Click next. You will then be required to verify your identity. To complete this step, you need a phone number or an email address to get a verification code/link. Follow your email or instructions in the test message once the link is sent to your phone.

After this step, your credit report will be accessible immediately.

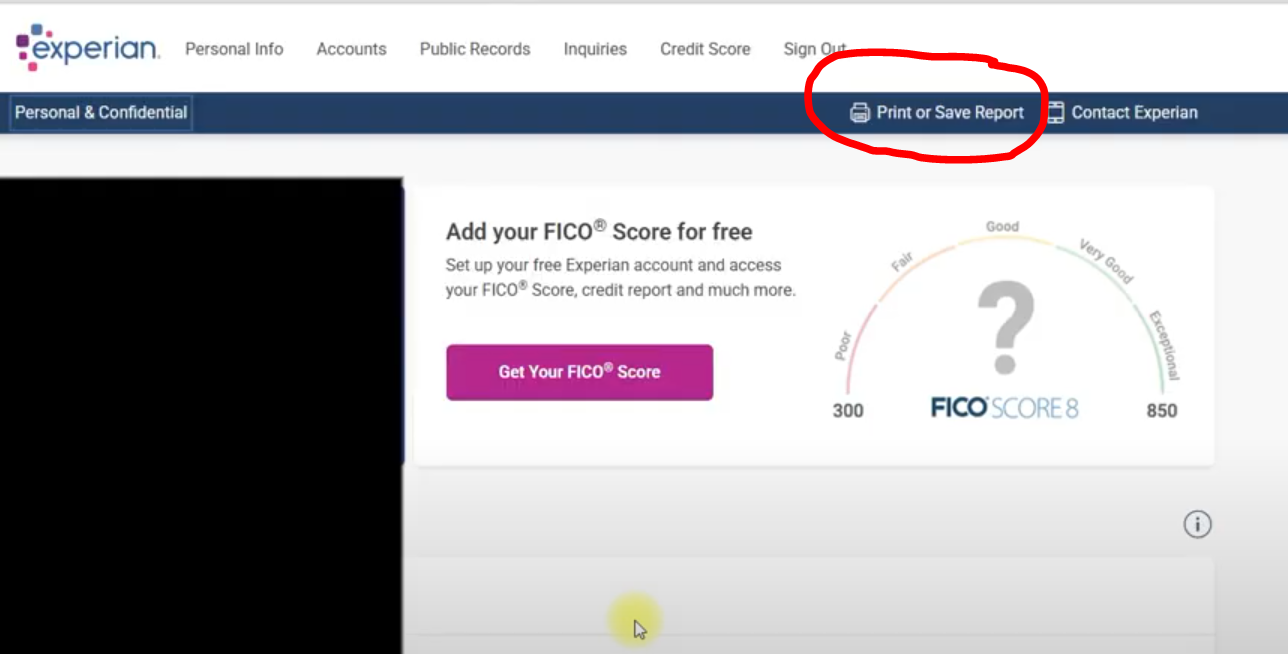

- Click on Print or save Report on the top right corner to download a PDF copy of your credit report.

Your credit report will be open in another window and ready for your review.

How do I get a free credit report by mail?

If you cannot download a free credit report online from each credit reporting agency, you can still apply for the report by mail. You must download the credit report request form online, complete it, mail it to the address provided below, and wait 15 days for your credit report to be mailed to you. Please, take the following steps to request a free credit report by mail.

- Download the request form from AnnualCreditReport.com.

- Print, complete, and mail the form to the following address: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

- Allow 15 days for the report to arrive.

How do I get a free copy of my credit report by phone?

If you can’t get a free copy of your credit report online or by mail, applying via phone is also possible. To request your credit report on the phone, follow these steps.

- Call 1-877-322-8228

- Complete the verification process over the phone.

- Your credit report will be mailed to you within 15 days

What do I do after getting a free copy of my credit report?

Getting copies of your credit reports helps you verify if the information in your reports is current and accurate. Your credit reports are also the first step in repairing your credit and building a strong credit history.

Here are a few things to do next after getting a free copy of your credit report.

- Check for errors in the report. Look for incorrect personal information, accounts you don’t recognize, or inaccurate payment history. Even small mistakes can impact your credit score.

- Look for signs of identity theft. Unauthorized accounts or unfamiliar inquiries could indicate fraud. If you suspect identity theft, report it immediately to the authorities and the credit bureaus.

- Understand your credit score factors. Your credit report doesn’t include your credit score, but it provides the data that impacts it, like payment history, credit utilization, and account age. Evaluate how you are doing on these factors.

- Make a plan to improve your credit. If your report shows high debt, late payments, or other negative marks, consider ways to improve your credit, like paying bills on time and reducing credit card balances.

- Monitor your credit regularly. Reviewing your credit report at least quarterly helps you stay on top of changes and protect your financial health.

What do I do if I find errors in my credit report?

If you find errors in your credit report, dispute them with the credit reporting agency that generated your credit report. Here are the steps to dispute the mistakes, fraudulent activities, and inaccuracies with credit reporting agencies.

- Contact the credit bureau that generated your credit report. You can dispute errors online, by mail, or by phone.

- Provide supporting documents with all details. Include copies of documents that support your claim, such as billing statements, identity verification, etc.

- Write a dispute letter explaining the issue. In your dispute letter, describe the mistake and why you think it is, and request that it be corrected or removed.

- Notify the company that reported the error to the credit bureaus. If the mistake comes from a lender or creditor, contact them directly to dispute the information with them as well.

- Wait for results from the investigation. The credit bureau must investigate and respond within 30 days. If they correct the error, they’ll send you an updated report.

- File a complaint if needed. If your dispute isn’t resolved, you can file a complaint with the Consumer Financial Protection Bureau.

Here is a complete guide to submitting a dispute to credit reports, including address and contact information.

How often should I get a copy of my credit report?

Checking your credit report regularly helps you catch errors, monitor for identity theft, and maintain your financial health. So, how often should you review your credit reports? If you don’t want to pay for your credit reports, the best option is to use the free copies you get from each credit reporting agency.

The only catch is that each bureau can only give you one copy of your annual credit report every 12 months. In this case, the best option is to space out your requests throughout the year, getting one report from a different bureau every few months, to keep an ongoing view of your credit history. For example, you can get an Experian credit report in the first quarter, an Equifax credit report in the second quarter, and a TransUnion credit report in the third or last quarter.