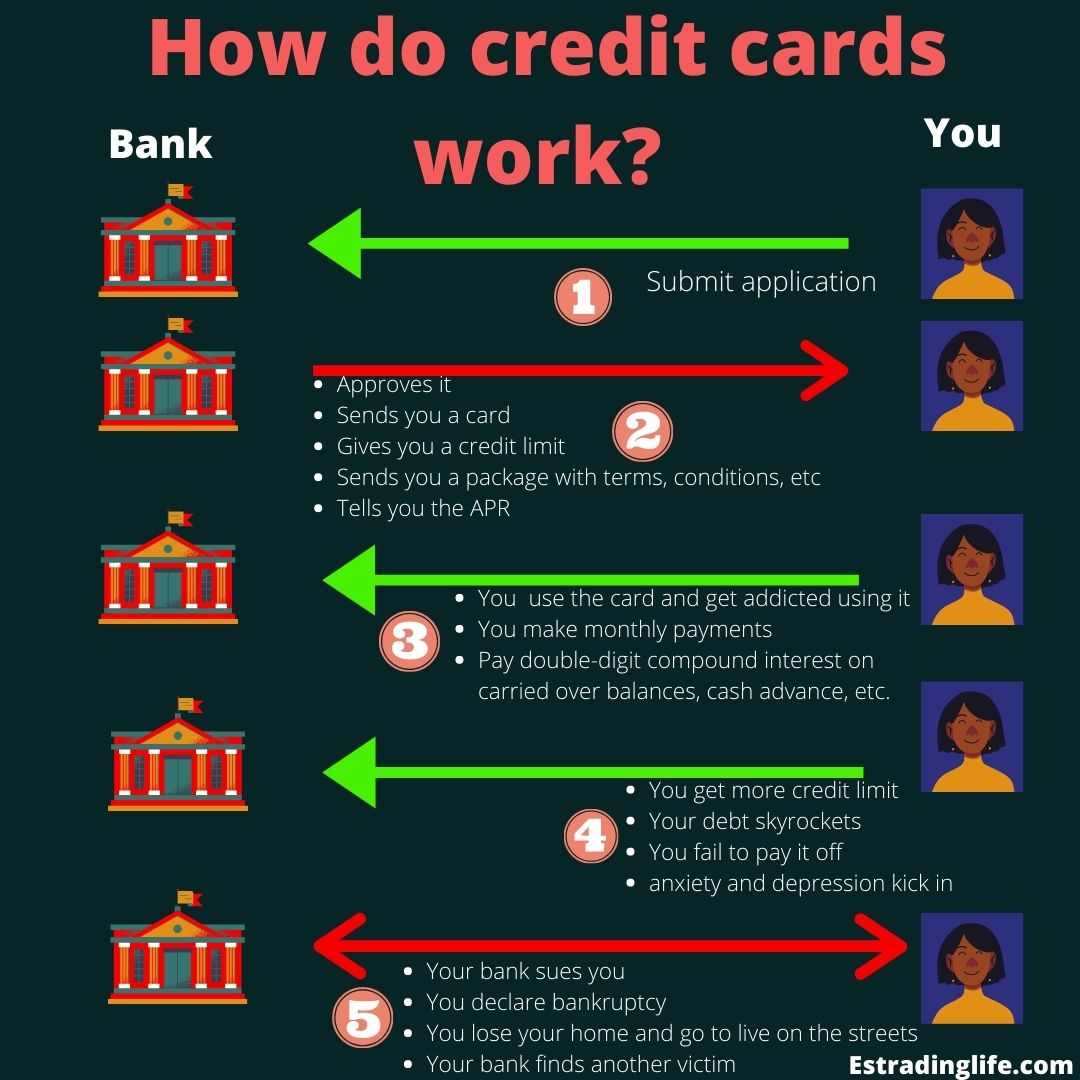

How do credit cards work? Credit cards are widely used around the world. They come with credit lines that help their users to pay for goods and services, cash withdrawals, and balance transfers.

Users must pay the required minimum payment every month. Failing to pay the minimum balance can result in charges and penalties according to the terms and conditions associated with the card.

In addition, charges will be applied on all unpaid balances at the end of the payment period.

Credit limit

Your credit limit is the maximum amount your lender allows you to use on your credit card. This amount is also referred to as a line of credit(LOC).

If you manage this amount carefully, it can help you improve your credit score. Investors like you when you do not use all your line of credit. To be safe, always use less than 30% of your total credit limit on each card.

Line of credit is different from one card to another. New users, for example, get a lower line of credit. This is because lending companies take a low risk on users they have not verified. They like giving you money but at the same time, they hate you when you fail to pay them back.

Your credit limit can be increased over time as you use your credit cards. There are two ways you can get your line of credit increased.

- You can apply for a line of credit increase: When you feel like you want a credit line increase, you can request for it. There should be an option in your account where you can request a credit line increase. After sending in your application, your lender will decide whether you are worth a more line of credit or not.

- Your lender will increase your line of credit without your request: After using a credit card for a while, your lender will evaluate how you use it. If you use them reasonably and pay on time, etc; they will increase your credit limit without a request from you.

Rates and Fees

Credit cards come with annual fees a.k.a the Annual Percentage Rate (APR).

Many institutions and banks use an introductory APR. The Introductory APR is nothing more than a low rate that institutions offer to consumers as an incentive to sign up for their cards, according to Creditcards.

Once you have approval for the account, your introductory period will begin.

The introductory period can last up to 18 months. Because of the competition, many businesses keep the introductory rate to 0% APR.

After this period, a regular APR will go in effect based on the terms and conditions associated with the card. APRs are different depending on credit cards and individuals who apply for credit cards.

According to Creditkarma, the average APR across all credit accounts is 15.09%.

You can see why companies have to give incentives for people to sign up. They know they will make their money back through high-interest charges.

On top of interest rates on the unpaid balance, credit card companies make money from you through late payment fees. Furthermore, they charge transaction fees to merchants when their customers use credit cards.

Improving your credit score and credit history

Credit cards, when used well, can help you improve your credit score. The only thing you have to do is make your payments on time, avoid overusing your credit limit, etc.

Learn more about how you can improve your credit score.

Related article: Things that can hurt or improve your credit score

In addition to improving your credit scores, credit cards can help you build your credit.

Your hard work and attention to managing your finances will not go unnoticed.

All transactions and activities in your accounts will be reported to the credit reporting companies.

There are 3 major credit reporting companies in the USA and you can visit them from the following links.

These companies will use your information to compile your credit report.

You can grab a copy of your credit report for free once every 12 months from these reporting companies.

You can learn more about how to get your credit report, dispute errors in your report, and much more, from the following related article.

Related article: Credit Report Overview

Your credit report and credit score will come in handy when you are applying for mortgages, loans, shopping for apartments, etc.

Learn more about why a credit score is important.