Good till canceled order is a type of order to buy or sell the specified number of shares that stays active until it is filled or canceled, according to SEC. This order does not last forever. Brokerage institutions usually put a limit to how long the order will last and the limit vary from one broker to another.

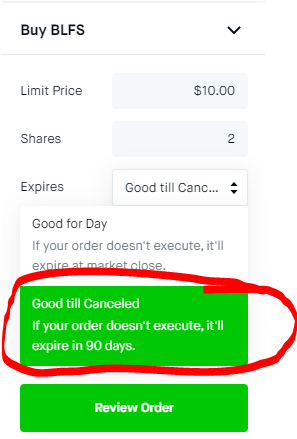

For example, good till canceled order to buy shares of stock in a company can last 90 days with Robinhood. This means that if your order is not filled or canceled within 90 days from the day it was placed, the order will expire.

Please, check the snapshot of good till canceled order with Robinhood in the image to the left.

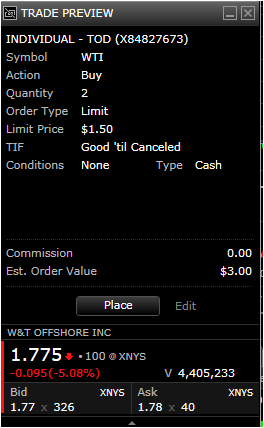

There are brokerage firms that do not specify the duration of good till canceled orders. A good example is the following order (on the right side) taken from Fidelity Investments

As a trader, it is your responsibility to know how to use trading and investment platforms.

If the duration of the order you are placing is not specified, you must call your broker and ask them.

There are brokers who give you a choice to decide your own time limit and customize your order. This means that you will specify the date or time you want your order to expire.

Consider using this option for more flexibility in your trading experiences.

Benefits of good till canceled orders

- Your orders will be filled at a price you want. This means that if the price does not move in the direction you anticipated, your order will not be filled.

- You will have a chance to make trades even if you are not actively in the market

- The order will be canceled without your interventions. This is will give you flexibility and save you time.

- It is very convenient

Disadvantages of good-till canceled order

- There are chances that your order will not be filled. Since you are placing an order to buy or sell shares of a stock at a particular price and time interval, the order will not be filled if the price does not reach the price you want.

- You could end up with a bag of shares at the wrong time. If the company you want to buy ends up in big trouble, investors will be pessimistic about the company. As a result, the company’s shares will tank. And it may take a while to recover. There are also chances that it will not recover at all depending on the severity of the news. If your good till the canceled order was filled, you may end up with a losing position.

- Your order could be partially filled. Your good till canceled order will most likely be a limit order. Limit orders ensure the price but do not guarantee the position size.