The equity income is the total money earned from dividends payments. Investors get access to equity income by buying dividend stocks or investing in firms (such as mutual funds) that invest in dividends paying stocks.

Dividends are paid by big and established companies that have been around for a while. Before a company pays dividends it has to be profitable.

Retail investors and institutional investors prefer dividend-paying stocks for equity income. This is because all investors do not actively participate in the market every day. By buying growth stocks from companies that provide equity income, investors secure returns from growth and dividends.

Another benefit of investing in stocks besides the dividends is the capital gain from stock growth. For example, a stock you bought for $4.5 per share could grow to $16.5 per share a year later. In this case, you would have made a capital gain of $12 per share. if you had a position size of 1,000 shares, you would have a total gain of $12,000.

What should I do with my dividends?

Your dividends are the money you earned. Like any other incomes, you can do whatever you want with it.

Many investors prefer to reinvest their dividends instead of cashing out. Any option you choose, you will still pay taxes on your returns. This is because your dividends are considered to be income, and by law, you must pay taxes on your income.

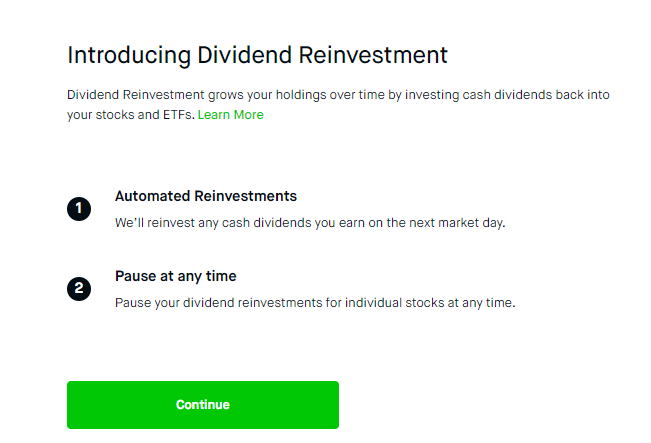

If you choose to reinvest your dividends, you must enable this option in your brokerage account (for those with online brokerage accounts).

From the image about, you can see that you will have two options when it comes to reinvesting your dividends.

The first option is to automate your dividends reinvestment. This means that all your dividends will be reinvested every time you earn them.

The other option is to pause your reinvestment. This means that you can pause the reinvestment whenever you want. Once you stop the reinvestment, the money you earn through dividends will be added to your portfolio.

Otherwise, you must let your broker or investment advisor know that they must reinvest your dividends every time they are released.

Is equity income taxable?

The money you earn every year will be taxable. This rule applies to your equity income. Your dividends and capital gains will be subjected to tax.

Before you use all the money you earned through equity income, consider putting aside your taxes if they were not taken off ahead of time. This will protect you from running out of money after filing your tax returns.