Investing is a proven path to building wealth and attaining financial stability. When it comes to investing, however, there are many investment products to choose from. A popular investment option is buying securities that payout dividends. With this strategy, investors focus more on cash flow through dividends instead of growth.

Dividend investing is a great way to earn passive income but also diversify your portfolio. Dividends are usually paid to shareholders every quarter. The amount of dividend each investor receives depends on the number of shares they own and earnings per share(EPS).

What Is A Dividend?

Dividends are money or stocks that corporations pay to their shareholders. Every publicly-traded company is owned by shareholders. The number of shares owned by investors is different depending on their investment strategies.

Corporations choose either reinvest some of their profits or give them to its shareholders in the form of dividends.

Each share of the stock will receive a portion of the total dividend amount. The payment for each shareholder will depend on the number of shares he/she owns and the earnings per share(EPS).

How to calculate the dividend?

Corporations offer shares in the form of common shares(ordinary shares). Depending on its size, a corporation can have millions or billions of shares. Shareholders who own ordinary shares issued by the corporation receive dividends.

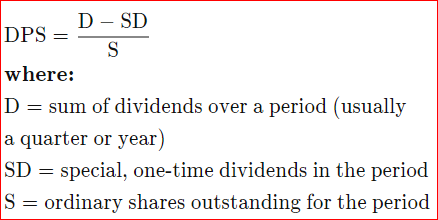

Companies calculate the total dividend available for shareholders usually every quarter. This total calculation helps the company in calculating the dividend for each share. The following formula shows how much each shareholder receives for every share they own in a corporation.

DPS stands for Dividend Per Share.

Benefits of investing in dividend-paying companies

Companies that pay dividends are profitable and more stable. This ensures consistency in dividend payout and less volatility of the stock. The following are some of the many benefits of investing your money in companies that offer dividends.

- Increased growth and profits: Investors favor companies that offer dividends because of their profitability and stability. Usually, stocks with dividends have steady growth which is good for investors. Your portfolio can grow organically without doing anything. Some investors accelerate the growth of their portfolios by reinvesting their dividends in the same stock or similar stocks.

- Tax advantages for qualified dividends: Tax rates for qualified dividends are much lower compared to regular income tax(source: smartasset.com).

- Protect your purchasing power: dividends can protect you from inflation. If your stocks do not grow at a rate that is higher than inflation, dividends can help cover the gap and keep you above the inflation rate. Over time, you will still have your purchasing power.

- Dividends can help you in the evaluation of equity: Dividends show investors that companies are profitable which is a positive sign for further growth. In addition, dividends help small investors in selecting the best stocks.