It is always a wise idea to evaluate both the earning per share(EPS) and the diluted earning per share. Diluted earnings per share (EPS) is a metric used to evaluate the quality of EPS if all convertible securities are exercised, according to Investopedia.

What are the convertible securities?

The convertible securities include the following:

- Stock options

- Warrants

- Convertible debentures

- Convertible preferred shares

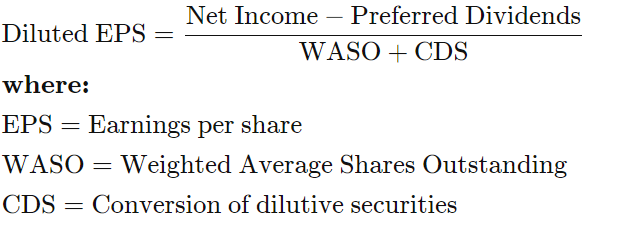

Diluted EPS formula

The diluted EPS is calculated by subtracting the preferred dividends from the net income and then divide by the sum of the weighted average share outstanding and the conversion of dilutive securities.

The dilutive securities are those securities that can be converted into shares of common stock, according to Accounting Tools.

What is the difference between EPS and diluted EPS?

The earning per share only considers the common shares of the company. On the contrary, the diluted earnings per share consider all convertible securities.

The EPS is calculated from basic income minus the preferred dividends and divide by the number of outstanding shares. On the other hand, outstanding shares are not considered when calculating the diluted EPS, according to Fool.