Yes, you can lose your house if you don’t pay the mortgage. After 120 days of missing payments, the lender will initiate the foreclosure process. Before the foreclosure process begins, however, the lender will communicate with you about payment options, how to retain your home, and actions to be taken to prevent further financial stress.

To avoid losing your house when you are not paying off your mortgage, contact your mortgage lender or mortgage servicer immediately. If there is any possibility of falling behind on your payments, let the lender know about your financial situation and try to work out a plan.

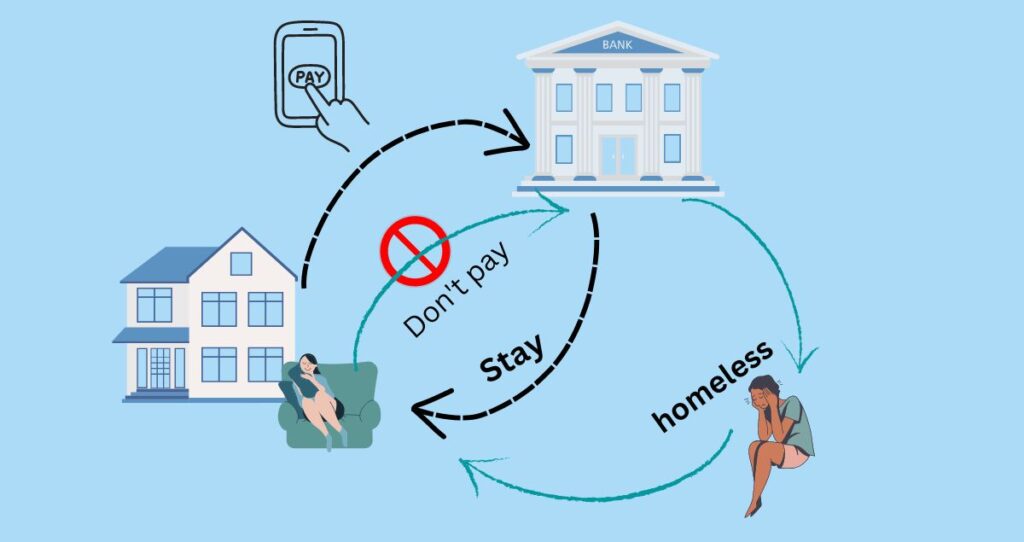

If you choose to not pay your mortgage and do not communicate with your lender or ask for mortgage assistance, you will get into default and later lose your house. Further legal actions might also be taken if you abandon the house and the proceeds from the sale cannot cover your mortgage balance.

What To Do If You Can’t Pay Your Mortgage?

Owning a home is a long-term commitment. During the duration of your mortgage, anything can happen. For example, a loss of a job, a life event such as a divorce, etc. can prevent you from making your monthly payments. These events are unpredictable and inevitable. The only thing you can do is navigate through them.

If you find yourself in a situation where you cannot pay your mortgage or think there is a possibility of missing a payment, contact your mortgage servicer or mortgage lender to discuss the changes in your finances. Yes, it is unfortunate that you cannot come up with your monthly payments. But, things can get worse if you do not communicate with your lender.

You could lose your home in foreclosure if you don’t pay the mortgage or at least work out a solution with your lender.

How many missed payments before foreclosure?

A foreclosure is expensive for both lenders and borrowers. That is why your lender will try to work with you about alternatives. Once you have missed two consecutive payments, your mortgage provider will send you a written notice about these payments, the options you have, and how to keep your house.

After your mortgage is delinquent for more than 120 days, your mortgage lender will notify you about the foreclosure. Before the foreclosure notice, the lender will review your loan modification requests.

What to do when you can’t pay off your mortgage but want to prevent foreclosure?

Once you have missed your first mortgage payment, the clock starts ticking really fast. The first thing you can do when you can’t make your mortgage payments is to apply for mortgage assistance. Your mortgage lender will send you information on how to apply for mortgage assistance within 45 days of your first missed payment.

You don’t have to wait for your lender to send you this notification. If you think you might need mortgage assistance, contact your lender ahead of time and start the assistance process. The earlier you can start this process, the higher the chance you can prevent foreclosure. This application process must be started before the 120 days period elapses. Otherwise, your lender can initiate the foreclosure process. At this point, it will be too late to refinance your mortgage and your choices will be limited.

The following are other programs to consider when you cannot pay off your mortgage but want to retain your home.

- Ask for a forbearance plan. Mortgage forbearance works great for people with temporary financial setbacks. For example, if you lose your job but are expecting to start another one in a few months, you can apply for forbearance. With forbearance, your mortgage servicer/lender will lower your mortgage monthly payments until you have restructured your finances. That is, you will pay a reduced amount until the financial setback is no longer there.

- Consider a short sale. A short sale is a process of selling the house for less than you owe on your mortgage. For example, if you owe the lender $300,000, the lender might let you sell the house for $280,000 which is less than you owe. Hence, the term short sale. The lender will choose to take less than you owe in an effort to recoup some of the losses on the house. Lenders also choose this option when they realize that there is no green light in their finances which could also be triggered by a market downturn.

- Check for mortgage repayment eligibility. The repayment plan can help you pay past-due late fees, charges, and related payments. Instead of paying the entire past-due amount in full, you can work out a plan to pay these balances in small installments.

- Check if you are eligible for a mortgage modification. With the loan modification, the lender agrees to change the terms of the loan to make it affordable for you. For example, if you bought a house when interest rates were higher or locked in a shorter-term loan, you can ask for a lower interest rate or switch to a longer term for affordable monthly payments.

Related: How to avoid foreclosure on a home?

What happens if you stop paying your mortgage and walk away?

Although paying off your mortgage for 30 years and sticking to its terms is very difficult, walking away from the mortgage is much worse. The contract you signed with your mortgage servicer/lender requires you to pay the principal, interest, charges, and fees. Walking away from this contract automatically violates its terms.

The question is can you lose your house if you don’t pay the mortgage? The answer is simple and straightforward. Yes, you can lose your home when you stop making your mortgage payments. Walking away from a defaulted property is equally bad. Once you stop making mortgage payments, the lender will foreclose on your home and sell the property in an auction. The proceeds will be used to cover your mortgage balance.

Most properties sold in auctions usually sell for less than their fair market values (FMV).

Banks are not in business for holding and selling homes. Instead, they are in business for offering mortgages and collecting interest from people like you. So, keeping real estate-owned properties in their portfolios costs banks money. That is why lenders sell foreclosed properties at a discount.

So, if the foreclosed home is sold for less than you owe, the lender might sue you for the remaining balance. This is why it is important to communicate with your mortgage lender and work out a payment plan that works. Walking away won’t take your debt away. Your debt must be paid off or settled in some way. You can also refinance your mortgage when you think you are paying more than you are supposed to pay or when your debt has become expensive.

Can a mortgage be forgiven?

Your lender will not forgive all your mortgage balances. But a portion of your mortgage could be forgiven under different circumstances. For example, if you can no longer afford your mortgage payments you can apply for a short sale. The lender might agree to forgive the difference especially if it is a small amount. You can also negotiate to pay a portion of the remaining balance.

It is also possible that your lender might lower your mortgage balance depending on your unique situation. Your payments could also be lowered through loan forbearance for a period of time until you get back on your feet.

Lenders are in business to make money in interest, fees, and charges. If you cannot make payments as agreed, the bank will start losing money. Every time you miss a payment or simply default on your mortgage, the lender loses money.

For this reason, banks generally cannot forgive your entire mortgage balance. But they can forgive a small portion of it. Forgiving all your mortgage balance means that the bank lost its money. Without making money, the bank would not exist.

My mortgage is too high what can I do?

If your mortgage is too high, don’t just stop making payments. You should also avoid paying a little bit of it and chill. You will lose your house if you cannot pay your mortgage. That is not paying your mortgage or paying less than you are supposed to will lead to default and eventually foreclosure.

When you realize your mortgage payment is too high, contact your lender and discuss the issue. You might qualify for loan forgiveness, short sale, loan modification, repayment plan, etc.

In order to avoid losing your home, consider the refinancing route before missing payments. Mortgage refinance is a process where you replace your existing loan with a new one. Maybe you had an adjustable-rate mortgage (ARM) and now rates have skyrocketed. Or maybe you signed up for a shorter term (10-year or 15-year fixed-rate mortgage (FRM)) and now you have lost one of your jobs. No matter the reason, you can refinance your mortgage and secure a lower interest rate with favorable terms. The worst thing you can do is do nothing.

How does foreclosure affect your credit score?

Besides losing your house in foreclosure if you don’t pay your mortgage, the foreclosure will also have a negative impact on your credit score. Once a foreclosure is reported on your credit reports, your credit score will tank at least 100 points. In some cases, your credit score can lose as many as 160 points from foreclosure.

Besides knocking off more than 100 points from your credit score, the foreclosure will stay on your credit reports for 7 years. But their effect on your credit score will fade away over time.

During this period, you might not be eligible to apply for loans until a grace period has passed. Most loans require 2 year waiting period before you can qualify for a loan after foreclosure. Other loans require three, four, or more years before you can apply.

The bottom line

Missing payments on your mortgage can leave devastating consequences on your finances. Not only that you can lose your house if you don’t pay the mortgage, but your credit will also take a hit. The best course of action is to monitor your finances and contact your lender before missing a payment or when you see there is a sign of financial struggles in the near future. You can also refinance your mortgage to further lower your monthly payments.