Yes, you can qualify for a student loan when you have bad credit or no credit history at all. If you want to apply for a student loan when you have bad credit, consider federal student loans first and apply for private loans as a last resort. This is because federal student loans do not require a credit check or a credit score. Most private student loans, on the other hand, require a credit check. So, if you have a bad credit score, you might find it difficult to qualify for a private student loan. This article will show you how you can easily get a student loan with bad credit.

Even if you have good credit, always start with federal student loans. This is because federal student loans come with lower interest rates, favorable terms, and a six-month grace period. In addition, you might qualify for forbearance or deferment on your student loan. In addition, federal student loans do not require credit checks which makes them stand out compared to private student loans.

To qualify for a private student loan when you have bad credit, you will need to use a co-signer who has an established credit history and stable income. If you want to know how and where to apply for these loans and their requirements, keep reading.

What is a student loan?

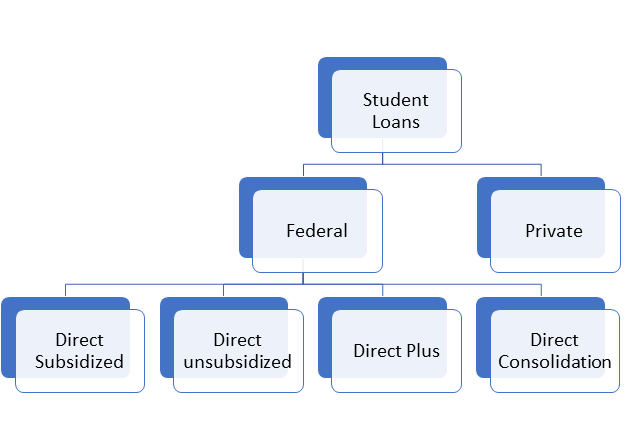

Student loans are loans specifically designed to help students cover their education and related expenses. For example, your student loan can pay for your tuition, medical insurance, books, fees, and living expenses. There are two categories of student loans (1) federal student loans and (2)private student loans.

- Federal student loans. These loans do not require a good credit history or credit check at all. In other words, you can easily qualify for a federal student loan with bad credit or no credit at all. You still need to meet the federal student loan requirements which we will discuss later.

- Private student loans. These loans are established and provided by private companies like banks, credit unions, etc, and require credit checks. Just like any other loans such as car loans and mortgages, the lender will evaluate your creditworthiness before you can qualify for a private student loan.

If you want to get a student loan with bad credit, start with federal student loans. Besides the minimum requirements for the loan, you do not need good credit to qualify for federal student loans. Once you have maxed out on your federal student loans and still need money, then consider private student loans. Although it is difficult to get private student loans with bad credit, there are tips you can use to get the money you need for college from private institutions even if you have bad credit.

What are the eligibility requirements for federal student loans?

Even if you can qualify for federal student loans with bad credit, it does not mean the government hands these loans to everyone. There are still requirements that each candidate must meet. You still need to show the need for financial aid set by the federal aid programs and meet other requirements. The following are some of the requirements for federal student loans.

- You need to be enrolled at least half-time

- Be a U.S. citizen or a qualified non-citizen

- Submit the Free Application for Federal Student Aid(FAFSA)

- Even if federal student loans do not require a good credit score and credit history, you must not be in default on another federal student loan

- You must maintain acceptable academic progress in your program

- You must focus on an acceptable degree or certification in your program

- You need a high school diploma or a General Education Development(GED) certificate

These are the basic requirements for federal student loans. There might be some variations to the requirements depending on what federal student loan program you are going with.

What are the benefits of federal student loans?

Not only the federal student loans help you take care of your education, but there are also other benefits of these loans compared to private student loans. The following are some of the key points that make federal student loans attractive and stand out compared to their counterparts.

- Fixed interest rates. Having a fixed rate means that no matter the changes in rates, you will still pay the same interest.

- No credit history requirements. Most loans require you to have a good credit history. Federal student loans do not require credit checks and you can qualify for a student loan with bad credit.

- Lower rates. Student loans come with lower interest rates compared to private student loans

- You have a repayment grace period. Most federal student loans allow you a six-month repayment grace period. The grace period allows you to find a job and get your finances together before you repay the loan.

- You will have options for Forbearance and deferment. There are times when you might need financial relief due to income constraints or other factors. Federal student loans come with options to temporarily stop making payments for some time. Keep in mind that interest rates might accrue and your progress toward paying off your loans might slow down dramatically.

- Income-driven repayment options. When paying off your federal student loans, you might have the option to make payments that align with your income.

- The interest rates could accrue after graduation. Private loans charge you interest from the day you sign the contract. Some Federal student loan programs start applying interest on your loan only after graduation.

- No need for a co-signer. Unlike private loans where you need a co-signer to qualify in case you have bad credit; federal student loans do not require a co-signer to get approved for the loan.

How to apply for federal student loans?

To apply for federal student loans, you will need to complete and submit the Free Application for Federal Student Aid(FAFSA). This is a free online form that must be submitted before you can get the funds. Once your application has been accepted, the school you are trying to attend will send you a financial aid offer which you can accept or deny. The offer will also include a federal student loan. Since your federal student loan is a loan that must be repaid with interest, you will be required to undergo entrance counseling and sign the Master Promissory Note(MPN). After this point, you will agree to use the funds you have been approved for and repay them with interest.

How much can I borrow in federal student loans?

The amount of Federal student loans you can qualify for depends on your level of education and profession.

- Undergraduate students can borrow between $5,500 to $12,500/year in Direct Unsubsidized Loans and Direct Subsidized Loans.

- Graduates and professionals can borrow up to $20,500/year in Direct Unsubsidized Loans.

- Parents of an undergraduate dependent can qualify for a Direct PLUS loan to help finish the cost of their children’s college education.

Where to get private student loans?

Private student loans are like other forms of loans except that they are designed for college. To qualify for private student loans, you will need to apply directly to the lender that offers student loans. If you use a bank, you might need to start from there to increase your approval odds and get a reasonable interest rate. You can also shop around and get pre-qualified from multiple lenders.

Before you apply for a private student loan, it is important to maximize your federal student loans first and get private loans to supplement your federal student loans. This is because federal student loans come with better terms, lower interest rates, a grace period, and no credit check needed for student loans. So, you can easily qualify for federal student loans when you have bad credit. Federal student loans also come with loan deferment or forbearance which makes them stand out compared to private student loans.

You can start with Subsidized Loans if you are an undergraduate or graduate student. If your student loans are not based on financial needs, you can then go for Unsubsidized Student loans for the same educational levels. Parents can also qualify for Direct PLUS to help them cover the educational requirements of their undergraduate dependents.

Why do private lenders check your credit?

Unlike federal student loans where a credit check is not necessary; private student loans require an established credit history, good credit scores, or a co-signer to qualify for them. Private lenders minimize risks by extending credit to borrowers who are more likely to pay their loan amounts with interest. That is why a credit check is required when getting private loans.

Lenders rely on your credit history which shows your payment history, account balances, credit utilization, how long you have been using credit, etc, to help them assess the risk involved in lending you money. If you pay your bills on time and follow the terms of your credit accounts without derogatory marks on your credit reports such as bankruptcies, foreclosures, and collection accounts, you will have good credit. Your credit score (FICO score or VantageScore) will also be good. For this reason, you will easily qualify for private student loans and get favorable terms.

If you have bad credit, however, most lenders will deny you credit. The risk of losing money from lenders’ side goes higher as the health of your credit deteriorates. People with bad credit are more likely to miss payments, borrow too much, and accumulate too much debt. That is why you will more likely be denied credit when you have a bad credit history. If you have bad credit and want to secure private student loans, you might need to rely on a co-signer to get approved for the loan.

You might also like: 13 tips on how to build credit fast and improve your credit score

How to get a private student loan with bad credit?

To get private student loans with bad credit, you will need to use a co-signer. Your co-signer is an individual who vouches for you and takes responsibility for the loan on your behalf in case you fail to pay back your loan. Instead of using your credit which is bad, the lender will utilize the co-signer’s credit profile to assess your eligibility for the loan.

A co-signer with an established credit history, good credit score, and reasonable income will get you the loan you want. In addition, having a co-signer with a good credit score will help qualify for a lower interest rate on your loan.

You might also need a co-signer if you have not reached an appropriate age. For example, most lenders require applicants to be at least 18 years of age before they are approved for student loans. Others require as low as 16 years of age.

What are other things private lenders look for before they approve you for student loans?

Besides having a co-signer when you have bad credit, you will also need to meet your lender’s loan requirements. The fact that you need money for school, there are certain requirements you must meet even if you have good credit, and some of these requirements are listed below.

- Co-signer. You need a co-signer to qualify for a private student loan when you have bad credit.

- You must be eligible for the school. Before the lender signs off the loan, you must prove that you are eligible for the school you are trying to add.

- The program or school you are going to must also be approved. Lenders also require that you add accredited schools, programs, and career paths that will yield a job. Your chances of getting a job after graduation increase your likelihood to pay off your loan which lowers the risk of defaulting on your student loans.

- You need to be a U.S. citizen or a qualified non-citizen

- You need proof of high school completion or GED. Before you attend college or secure a student loan whether private or federal, you must have proof of high school completion.

- Your co-signer needs a stable income. In case you are using a co-signer, he/she will need to have an income that can cover the loan in case you default on your student loan.

- Meet the age requirements. Most lenders require you to be at least 18 years old. Others require as low as 16 years.

What to look for when getting private student loans?

At the end of the day, you will need to repay the loan with interest and possible fees. Before you sign up for any loan, you need to know your monthly payments after graduation. If the amount seems a bit higher compared to the job you are expecting to have, avoid the loan and consider alternatives. You also need to evaluate some of the following factors.

- Interest rate. As a borrower, your job is to qualify for the lowest interest rate possible. In case you have bad credit, you might need to use a co-signer who has good credit to qualify for lower rates.

- Co-signer release. Having a co-signer means that he/she will be responsible for the loan when you fail to pay it off. Some lenders, however, have an option where a co-signer can be let go after a given period. Check with your lender for this option and confirm how many months or years the co-signer will be responsible for the loan.

- Terms of the student loan. The terms of the loan will automatically dictate how much you pay in interest. Shorter terms help you pay off the loan faster but can be aggressive to many people especially those with lower incomes. Longer terms on the other hand come with lower monthly payments but cost you more money in interest charges. Always remember that the longer you hold the loan, the more it costs you.

- Fees such as origination fees, and late fees. You need a loan with minimal fees.

- Pre-payment penalty. Some lenders charge you a fee known as a pre-payment penalty when you pay more than you are supposed to pay in a given period. So, choose a lender who has no pre-payment penalty.

How to build a credit history while in college?

Being in college is an opportunity to learn as much as you can in your career of choice. It is also a chance to prepare yourself for life after graduation. Unless you are planning to buy everything with cash, you will need to borrow money. For example, you might need to get a car loan to go to work after graduation. Buying a house could be an option for you as well. Which means you will need to get a mortgage.

To qualify for these financial products, you will need to have good credit. Building credit after graduation can sometimes be intimidating and hard due to increased expenses and more responsibilities. That is why if you can, try to build credit while you are in school. This will allow you to qualify for any credit you want after school.

The following are some of the tips you can use to build credit while you are in school.

- Get a student credit card. Student credit cards are some of the basic credit cards to help you get started with credit. Any activity on the card will be reported to the three major credit reporting agencies(Equifax, TransUnion, and Experian) which in turn will make your credit reports and calculate your credit score. As long as you are responsible for the card, you will build outstanding credit while you are in school. Student credit cards also come with lower credit limits which prevent you from accumulating credit card debts while you are in school.

- Become an authorized user of a credit card. An authorized user of a credit card is a person who gets added to an existing credit card account. As an authorized user of a credit card, you will get your credit card which you can use however you want. Any activity on your own card and the account will help you build credit faster with little to no effort.

- Get a secured credit card. Secured credit cards are some of the best credit accounts for people who are new to credit or those with bad credit. Before you can open a secured credit card account, you will need a deposit that will be paid back to you either when you close the account or gradually as you use your card responsibly. The deposit will be used as collateral and help determine your credit limit.

- Pay interest only on your loans. Even if you don’t have to start paying off your loan until after graduation, you might need to start building a credit history by only paying interest on that loan.

- Report your rent, utility, and phone, cable bills to major credit bureaus. You can easily improve your credit by reporting these payments to major credit bureaus. These activities will appear on your credit reports and show that you pay off your bills on time.

The bottom line

You can get a federal student loan when you have bad credit. This is because federal loans do not require you to have a good credit score or any form of credit activity. You can also get private student loans when you have bad credit but the process and approval chances are harder than with federal loans. To get federal student loans, you will need to submit the FAFSA application online. For private student loans, on the other hand, you will need to apply directly to the lender. Always, make sure that you have all the required documentation when applying for either federal loans or private loans.