To start investing and growing wealth, you must open a brokerage account. A brokerage account is an investment account you open through a broker that allows you to buy and sell securities such as stocks, bonds, index funds, mutual funds, exchange-traded funds, and currencies. Like any other investment account, brokerage accounts do not guarantee a return, and earnings from the account are subject to tax in the year they were realized. Generally, opening a brokerage account is easy, and the entire process can be completed online.

If you are new to investing, I will walk you through the steps to open a brokerage account and give you tips on buying and selling securities such as stocks. I will also include a list of the best brokers where you can open a brokerage account.

What is a brokerage account?

A brokerage account is an investment account that an investor or trader opens with an investment firm such as a broker or a bank. The account allows investors to buy and sell stocks, ETFs, and other tradable securities. Any money you make through your brokerage account will be subjected to income tax for short-term investments or capital gains tax for long-term investments.

Most brokers don’t require a minimum deposit when you open a brokerage account. However, some brokers require a minimum deposit on certain accounts, such as margin accounts. You can deposit money in a brokerage account by doing a wire transfer, depositing a check, or transferring money from your bank account. After transferring money into the account or selling an investment, a brokerage account requires a few days for the money to settle in the account.

The settlement period is the time between when you execute a trade and when the trade is finalized. Depending on the broker, this period usually ranges between 2 to 5 trading days. Some brokers, however, allow you to use your funds immediately, depending on your account type. For example, if you have Robinhood gold, you can deposit money in the account and use it to make trades instantly.

You can open a brokerage account entirely online. Some information you need to open a brokerage account includes proof of address, social security number, proof of ID, full name, etc. You might also need to provide information about your employer and salary range.

Is it difficult to open a brokerage account?

Opening a brokerage account is not difficult, and there are many brokerage firms to choose from. The time it takes to open an account and the steps you need depend on the broker and the type of investment you want to make.

Opening a brokerage account usually takes between 15 and 30 minutes.

According to FINRA, the following are some documents you may need to provide when opening a brokerage account.

- Social Security Number or Tax ID number

- Proof of employment and financial information

- A trusted person who can be contacted

- Valid identification such as a driver’s license or a passport

Types of brokerage accounts

There are three main types of brokerage accounts you can choose from. Here are the differences between each type.

- The first is a cash account, where you must pay in full for every security you buy. For example, if you have a cash account and want to buy shares of XYZ company, you must have the full purchase price to make a trade.

- The second type is the margin account. For a margin account, you will have an option to use leverage in your trading strategies. That is you can borrow funds from your broker and take a big position size in a particular stock, for example. A margin account also allows you to short the market.

- The third type is an option account used for buying and selling options.

You can only take long positions with a cash account and not borrow money from your broker. However, you can take long and short positions with a margin account. You must understand that the risks are exponential when shorting stocks or other securities.

Where can I open a brokerage account?

There are a lot of brokerage account providers out there. The following list the best places to open a brokerage account. You can do your research on each one of them before you open the account.

If you want to trade stocks, you can read this article on buying a stock step by step.

- E*Trade. Good for trading activities, especially day trading

- Interactive Brokers. Best for advanced trading

- Webull. Suitable for beginners and interactive traders

- Fidelity investment. Good with research material and investment

- TD Ameritrade. It is good for beginners and has educational materials

- Charles Schwab. Good for an individual retirement account and research tools

- Merrill Edge. Good for rewards programs

- TradeStation. Has good platforms to use

- Robinhood is easy to use but has limited educational materials.

How do you open a brokerage account step by step?

Assuming you have researched and selected your favorite broker, the following are steps to open a brokerage account.

Before opening an account, ensure you have the documents I listed in the previous few paragraphs.

Once you have your documents, you will need to visit the website of the broker you want to open an account with. Let’s assume that you decided to use TD Ameritrade.

Here is how to open a brokerage account with TD Ameritrade.

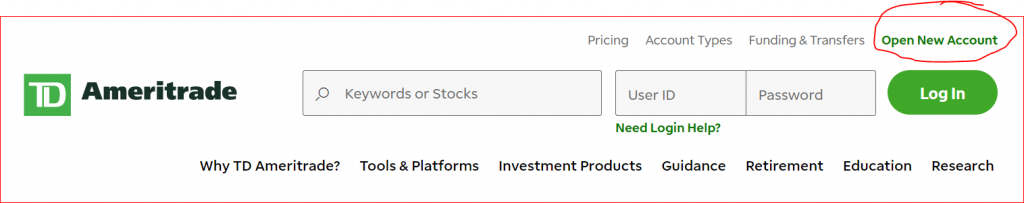

- First, go to https://www.tdameritrade.com/. This link should take you to TD Ameritrade’s home page.

- Then, click Create a new Account tab in the top left corner.

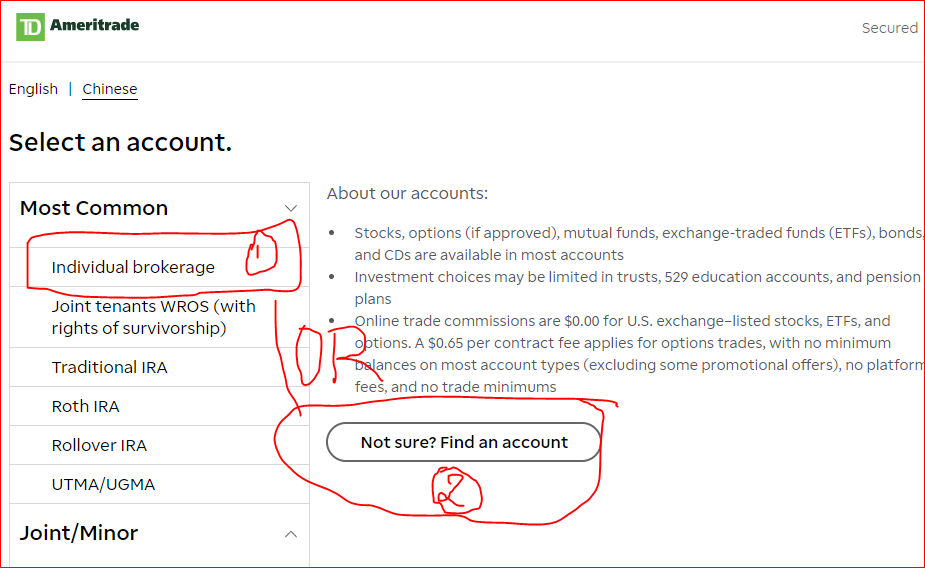

You will be taken to the next page, where you will select the type of account you want to open.

- Click on an individual brokerage or any other account you want to open. If you are unsure about the account you want to open, click “Not Sure? Find An Account.” This will ask you many questions to help you figure out your best account.

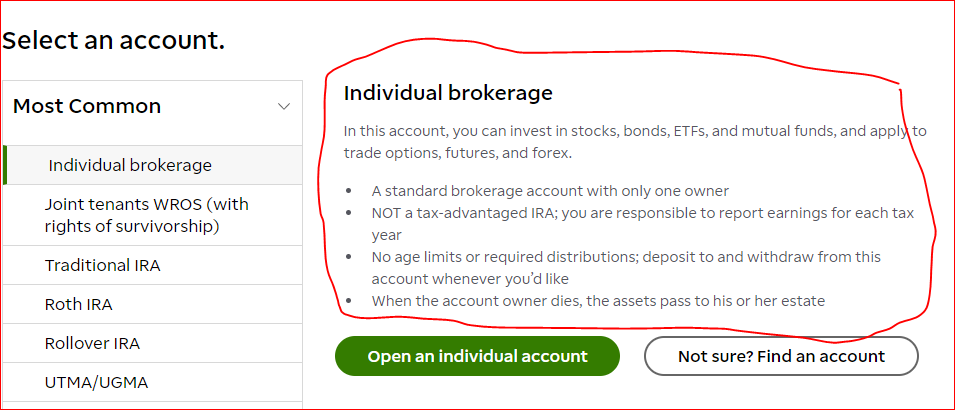

- After clicking on individual brokerage, you will be taken to the following page to learn more details of what you can do with a brokerage account you selected.

After reading and understanding what the account is about,

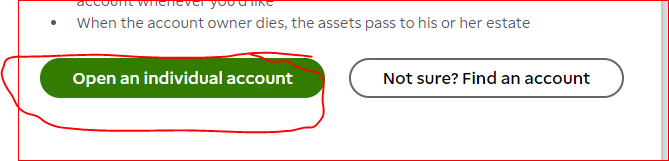

- Click on open an individual account.

This will take you to an application you need to complete. On this application, you will provide information about yourself and your financial information.

- Complete the application as required by the broker.

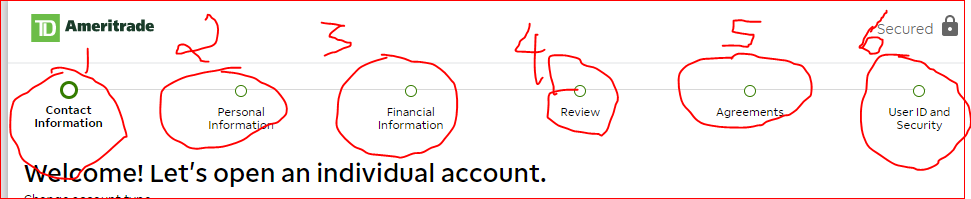

As you can see from the steps in the above snapshot, the application has six sections that must be completed step by step.

- Contact information

- Personal information

- Financial information

- Review

- Agreements

- User ID and Security

To open a brokerage account, you must complete each step and provide the required information. Once you are done, you will be taken to your newly opened brokerage account (if there are no more questions or steps left).

What do I do after opening a brokerage account?

After opening a brokerage account, you still need a few more steps to make your account usable. The account will not have funds, meaning you cannot buy or sell anything. Here are a few more things to do after opening a brokerage account.

- Know the minimum deposit requirements. Depending on your broker’s rules, the type of brokerage account you opened, and the type of brokerage account you opened, there could be a minimum balance you need before you start investing.

- Learn how to navigate the brokerage account. You must learn to navigate the account before placing orders to buy or sell securities such as stocks, options, etc. Know where the buttons are and familiarize yourself with the account.

- Deposit money in your brokerage account. Before you buy securities, you will need some form of cash. You can transfer the funds straight from your bank account, deposit a check, or wire transfer. Remember that your broker might require a few days to verify your bank information.

- Learn the basics of investing and trading. You must educate yourself about the kinds of securities you want to trade. For example, if you want to buy stocks, you must learn how the stock market works, how to place orders, risk management strategies such as limit orders, market orders, trailing stops, and key terms used in the stock market.

Benefits of a brokerage account

Opening a brokerage account can help you improve your finances and grow wealth through investing. Check out the following benefits of having a brokerage account.

- You can buy and sell stocks and other tradable securities

- A brokerage account can help grow your portfolio through long-term investments

- It has many resources, allowing you to learn about the stock market.

- You can save money to fund your retirement or college fund for your children or yourself.

- There will be no penalties for not depositing a certain amount in the account every month.

Disadvantages of brokerage accounts

- There is a chance of losing your money by making wrong investment decisions.

- You will pay taxes on the capital gain in your account

- Your portfolio will experience volatility due to conditions in the market

- There will be penalties if you violate the terms of use. For example, if you use a margin account and violate margin terms, your account can incur a margin call. If you fail to deposit the required amount to cover your margin call, your account can be locked for 90 days.

Can I open a brokerage account by myself?

Yes, you can open a brokerage account and complete the application process online. The documents you need to open a brokerage account include proof of identification, your social security number, address, and information about your income. Opening a brokerage account usually takes 15 to 30 minutes, depending on the account you want to open and the broker.

How much do I need to open a brokerage account?

Depending on the type of brokerage account you want to open and the broker, you might not be required to have a deposit when opening an account. For example, most brokers do not require a minimum deposit when opening a cash account but might require a deposit when opening a margin account. Where required, you shoudl expect the minimum deposit to be as low as $50 or as high as $2,500. Even if your broker might not require a minimum deposit, you still need to deposit money in the account before you can make trades.