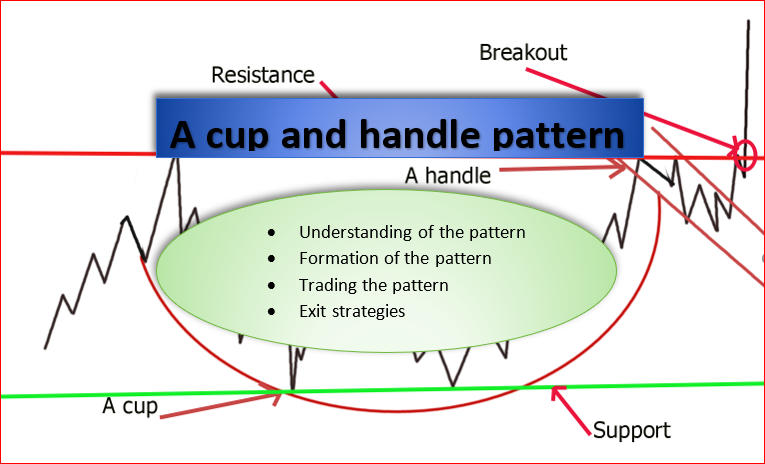

A cup and handle is a trading pattern used in technical analysis. The price charts pattern creates a images that looks like a cup in the form on U and the handle on the right side.

The handle is formed by multiple candlesticks and it can last between 1 to 6 months. In addition, the volume of the handle is relatively small and it can be considered as a pullback.

In this post, we will explore in detail a cup and handle pattern, its formation and how to trade this pattern.

Table of Contents

- Understanding a cup and handle pattern

- Trading a cup and handle pattern

- When to enter a trade when going long?

- Taking profit or exiting the trade when going long

- Can you go short on a cup and handle

- Take away

1. Understanding a cup and handle pattern

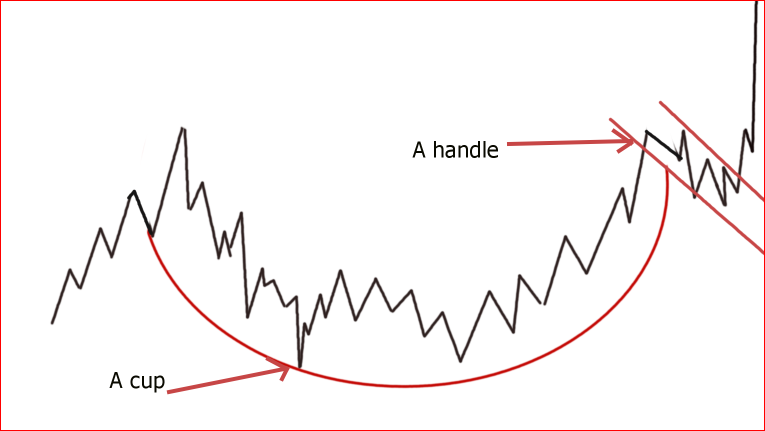

A cup and handle pattern is very powerful and can be used for longer term or shorter term. The patterns happens in a long uptrend. The retracement of the price at the resistance level marks the start of the cup formation. The price of the stock or security consolidates at the bottom sideways before picking up an uptrend direction to finish the formation of the cup.

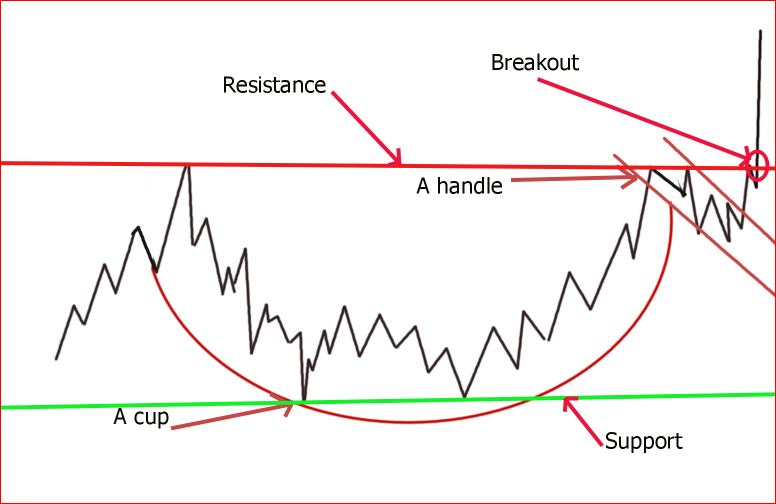

Once the price reaches the previous high, it retract or pullback to form a handle. This handle must stay in the upper side of the cup to quality as a handle in this pattern. There will be a heavy trading volume once the price breaks above the cup handle’s resistance. Therefore, the breakout on heavy volume will be an indication of a continuation in the uptrend.

2. Trading a cup and handle pattern

Figure 2 above shows the support and resistance levels on the cup and handle. The resistance level is at the top prices reached by the two sides of the cup. Therefore, traders are always on the lookout whenever the price on the handle is reaching this resistance level. The breakout happens when the price breaks above the resistance.

3. When to enter a trade when going long?

Since a cup and handle is a bullish pattern, you would get ready to take a position after the breakout. Put your buy limit above the resistance level for shares you want to buy in your favorite company.

Setting up your stop loss

It is important to use a stop loss in case your breakout was a false breakout. The stop loss will get you out of the trade if the stock does not move in the direction you anticipated. This would happen when there is enough reversal in the trend to invalidate the pattern.

For this reason, you would want to exit the trade as soon as possible to avoid major losses. It is important to understand that the cup handle will occur in the upper half of the cup to qualify as a cup and handle pattern. Therefore, your ideal stop loss will be placed at the bottom of the handle.

If the price breaks below the handle, it will be an indication of a failed cup and handle pattern and you would exit the trade. However, not everyone is willing to give up that much money on the trade. Therefore, some traders put the stop loss at the resistance level. Why? If the price breaks below the resistance level, it will be the first indication of a possible false breakout. Hence, they will get out of the trade right away.

4. Taking profit or exiting the trade when going long

Profit target is carefully calculated on the cup and handle pattern. The ideal way to calculate this number would be adding the height of the cup to the breakout point of the handle.

In order words, your price target would be the height of your cup plus your breakout price. For example. Let us say that your cup is between $55 and $52. The cup height is $55-$52 which is $2 dollars. If the breakout price is $55, you would take profit at $57 (2$+$55).

However, you don’t necessarily need to get out right away. As long as you have indications of a strong uptrend, you can stay in the trade until you reach the next resistance level where you can take profit.

5. Can you go short on a cup and handle?

The answer to this question is yes. As for any other patterns, you can go short if the bullish pattern fails and you have a strong indication of a downtrend.

There are a number of ways you can use to know that the cup and handle pattern has failed. The first one would happen if you have a false breakout. This means that the price would break the resistance and return back under the resistance with a heavy volume. This could be first indication of a reversal in the trend and therefore a failed cup and handle pattern.

The second option would happen if the price continues a decline movement and breaks below the handle. This would be an other indication of a downtrend.

If you want to go short, you would enter a trade when the handle is broken and put your stop loss at the bottom of the handle or the previous low. Some traders start shorting the stock after a false breakout is emerged. In this case, they put a stop loss at the resistance level.

6. Take away

A Cup and handle pattern comes in many forms. The U shape with a rounding bottom is more common. However, some stocks form a V like shape or close to it instead of a fully rounded bottom.

It is important to wait for the handle form to confirm the pattern. Once the pattern is formed, a trader can take position after the breakout happens.

Always use a stop loss on your trades to avoid losses from false breakouts and sudden reversal in the trend.

A cup and handle must occur in a long uptrend to qualify as a cup and handle pattern.