Investing is the most rewarding yet scary step to achieving financial goals and independence. But the good thing about investing is that you can start investing with thousands of dollars or $1. How much you invest depends on your current financial situation, financial goals, and risk tolerance. For example, if you have a lot of bad debts, such as credit card debts, prioritizing paying off some will benefit you more in the long run. As a rule of thumb, you should invest at least 10% to 20% of your gross income every month and diversify it across multiple asset classes to lower your risk. This amount also includes your long-term savings, such as contributions to retirement accounts, as they are part of your investment portfolio.

Before you move any further, I must tell you how much you start investing; it does not matter. What matters is that you need to get started. Instead of waiting to save $10,000 before you start investing, for example, invest what you have, start earning passive income, and take advantage of compound interest. Even if you have $1, invest it. Nowadays, you can even buy fractional shares of companies and build a portfolio slowly.

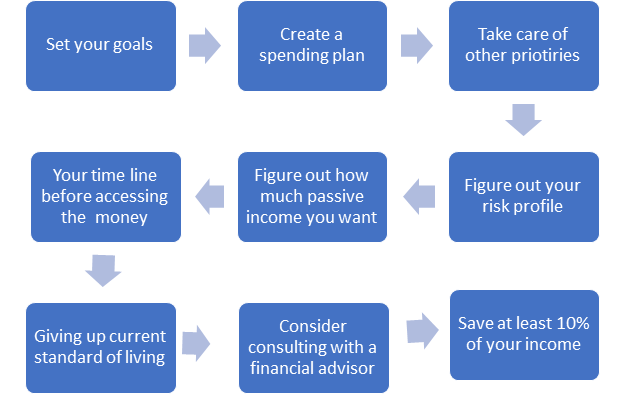

Regardless of your financial situation and investing goals, here are the steps to decide how much you need to invest and where to invest money for a higher return.

1. Set financial goals

No matter how much money you make or have, you must establish financial goals before you start investing or deciding how much to invest. Your investment goals are unique to you as they reflect your future dreams and the kind of lifestyle you want to live. The following are the most common financial goals and reasons people invest or save money.

- Travel goals

- Homeownership goals

- Funding a marriage

- Start a business

- Grow your kids’ 529 college education fund

- Earning passive income in the form of interest payouts or dividends

- Early retirement

You can see that people have different reasons for investment. For example, if I want to retire earlier, I might need to invest more heavily than someone growing their kids’ education fund. Therefore, clearly understanding your goals is crucial in determining how much you should invest. Use the SMART goals-setting strategy, which states that your goals should be specific, achievable, time-based, and relevant to your desired lifestyle. Once you determine your investment goals, you will move to the next phase.

2. Ensure you have a budget

Budgeting is a word most people don’t want to hear about. No wonder why most people struggle financially. Setting up a quick budget is non-negotiable if you are interested in investing or calculating how much money to invest. Knowing how much money you make and how much you spend helps you understand your current financial situation and if you have money left over to invest. For example, if you live above your means, you won’t have a penny to invest. So, having a budget will help you see where your money is going and where to cut back to boost your savings.

Your spending plan is a blueprint of how your money is spent monthly. How do you calculate your monthly expenses? Your monthly expense is everything that costs you money. The following list can help you evaluate your expenses, income, and remaining value after all your expenses are paid.

- List of all your bills. In this step, you will add up all your expenses including rent, utility bills, grocery, insurance, gas, entertainment, and your vending machine pop.

- Calculate income. This is a list of all your incomes from all sources, including wages, salaries, interest, dividends, loyalty, etc.

- Subtract your total expenses from your total income. Here, you subtract your expenses from your income. If the difference is negative, you are living above your means. In this case, you must take drastic measures to reduce your monthly expenses and increase your savings. Remember, the goal of a budget is to help you save money, which you can use to fulfill another financial goal, such as investing and paying off your debts. The more you can save, the more you can invest.

3. Pay off bad debt before investing

Even if you have money saved after paying all your expenses, investing all of it might not be a good financial decision while carrying bad debt. The term bad debt is used to represent debt with high interest or debts where the value of your assets does not increase over time. Bad debts cost you more than any other investments you can pursue as you pay higher interest rates. For example, the APR on credit cards can be as high as 30%. How many investments do you think to guarantee a 30% return? None.

Do you want to know how bad is bad debt? Or how bad debt can get? Imagine paying over 400% APR on your loan. That is right, not a typo. According to Paydayloaninfo.org, the average APR for payday loans is 400%. If you owe $5,000 in a payday loan, it will cost you $20,000 by the end of the year. Can you imagine spending $20,000 to borrow $5,000? Imagine carrying this loan for a year because you invested the money in stocks where you will make a 10% return.

Bad debt alone can rob you of your future and make it impossible to achieve your dreams. This is why paying off bad debt before investing is critical in your financial planning journey. Common bad debts include the following.

- Credit card debts

- payday loans

- Personal loans

- Personal lines of credit cards

- Car loans

- Private student loans

If you carry some high-interest loans, prioritize paying them off before investing. Paying off debt automatically lowers the interest you pay on the loan. The money you are not paying in interest automatically becomes your savings. That is how you make smart financial decisions.

4. Understand your risk profile

Risk tolerance is a term thrown around randomly, but it means a lot when investing. You can decide how much to invest without evaluating your risk tolerance. Your risk tolerance is one of three major factors determining the type of investments you buy and how much to invest. Other factors include your investment horizon and financial goals.

So, what is risk tolerance?

Investing money comes with the risk of losing your money as asset values fluctuate over time. In the worst-case scenario, some assets, such as stocks, become worthless.

Your risk tolerance represents how much risk you will take for your desired reward. In other words, how much are you willing to lose to make money investing? How would you feel if one of your investments goes to zero and you lose it all? Risk tolerance allows you to build the right portfolio mix and diversify your assets to give you the most returns while maintaining risk within acceptable limits.

For example, building a conservative or an income portfolio might be a great idea if you don’t like too much volatility. This is because these two types of portfolios have more fixed-income assets than equities.

Since all investments are subject to risk, your investment amount also depends on your risk tolerance. Even if you have saved $5,000 by the end of the year, it might not be a good idea to invest it all in stocks when you lose your mind during a market correction or recession.

Also, know that your risk tolerance is unique to yourself. For example, just because your friend is comfortable losing $5,000 in the market does not mean you are also OK with losing it. Also, pick an investment that matches your financial goals and risk tolerance.

5. How much passive income do you want?

Knowing your goals requires knowing how much money to invest and where to invest it. Some of your goals could be financial goals such as retirement savings, earning passive income, etc. To earn passive income, you must buy fixed-income assets such as bonds and dividend stocks or deposit the money in fixed-income deposit accounts such as CDs. How much should you invest in fixed-income assets and equities? It depends on how much passive income you want.

If, for example, you want to earn $1,041 monthly in passive income to pay for your rent, you will need to invest $250,000 in fixed-income assets at 5%. knowing how much passive income you need or the return on investment you desire helps you calculate how much to invest at an expected return and the types of investments to choose.

6. Know your investment horizon

Knowing your investment timeline is an essential factor in your investment decisions. Depending on your investment goals, you could wait and access your investment after you retire or collect cash flows from your investments every month. This depends on your investment type. For example, a person who invests in high-dividend stocks will have a different cash flow structure than those who invest in rental properties.

Or, if you want to maximize a comfortable retirement, you might prioritize retirement savings and acquiring long-term investments. Knowing the timeline helps you understand how much and where to invest it. Are you interested in growing investments in retirement savings accounts? If so, you can contribute a maximum of $24,000 for 2025 and up to $7,000 in an IRA if you are under 50. That is how much you can invest in your retirement accounts from your paycheck.

Diversifying your portfolio into different industries, such as real estate, stocks, and bonds, can give you access to your short- and long-term cash flow.

7. Sacrifice your current standard of living for a better future

Investing is hard for many people, not because it is too complicated to understand. Instead, it requires an individual to have a set of standards and stick with them no matter what happens to their personal lives or investment structures.

If you choose an investing path, you will need to have rules, and you must stick to them. For example, you must be frugal to raise money for your investment. In addition, you will need a lot of discipline and avoid rush decisions when your investments are not performing as desired. Once you make peace with this condition, you are ready to move to the next phase.

8. Hire a financial adviser in your area (optional)

Sometimes, it will be challenging to determine how much you need to invest or where to invest it. If this is the case, you can hire a financial adviser to help you establish a financial plan based on your risk tolerance and invest your money wisely. The adviser can help you understand the markets you are in, your requirements, the initial starting capital in your desired area, restructure your portfolio, track your progress, etc.

9. Save at least 10% of your income

Many financial advisers suggest saving at least 10% of your income. This money can be saved in savings or investment accounts that guarantee the principal. Of course, it is always better to put money into something that generates an income, no matter how small. If you keep your money in a zero percent return savings account, you will lose your money through inflation. That is why you should consider putting your money into high-yield savings accounts, money market accounts, bonds, or certificates of deposits.

These savings can help you build an emergency fund, an essential element in your financial independence journey. To be saved, save at least three to six months of your monthly expenses in emergency funds. Once you have reached the correct savings account, boost your investments by acquiring more assets, opening a brokerage account, or increasing your retirement contributions.

10. Invest 10% -20% of your gross income.

I mentioned that you don’t need a million dollars to invest. You can invest more money if you have it. But, if you have a few dollars, you can still invest it and slowly build a portfolio. The goal is to invest as much as you can afford without putting stress on yourself. Slow and consistent investing is always the best way to invest.

How much can you afford to invest? Always invest 10% to 20% of your gross income each year. For example, if you made $100,000, you should aim to invest between $10,000 to $20,000 by the end of the year. This money can be invested in several investments, including stocks, bonds, real estate, fixed-income assets, etc. You must also contribute to your retirement savings accounts due to maximum tax benefits and employer match.