I usually don’t write articles about how much money I make with my investments. But today, I thought it was a good idea to write about how much money I make with CDs, given the circumstances that led me to invest in a certificate of deposit. Yes, I make $200 every month investing in CDs, and in this article, I will show you the strategies I use to make money on CDs and how you can do the same.

Earlier this year, I wanted to buy a house to achieve the American dream like everyone else.

Then, I quickly changed my mind about buying a house for two reasons.

- High mortgage rates: Rates were close to 8%

- Pricy homes: Under normal conditions, houses were and are still being sold at more than 50% to 100% over their fair market values(FMV) in some markets.

Due to these two reasons, I realized that if I buy a house, the interest charges, property tax, and homeowners insurance alone will cost me more than my current rent. That is why I figured renting for me was cheaper and more cost-effective than buying a house.

Why did I decide to invest in CDs?

When it comes to investing, there are dozens of investment options I could have chosen. Most people think about the stock market, real estate, mutual funds, bonds, lands, currencies, etc. But, all these investments are not as secure as high-yield deposit accounts such as CDs and high-yield savings accounts.

I decided to invest in CDs simply because they are secure, and I wanted to have easy access to my money in the future without liquidating my investments. Talking about safety, the FDIC insures my deposit of up to $250,000. Additionally, I might need the money to buy a house should the real estate market cool down to my liking.

Before investing in CDs, I asked myself this question: Why borrow money from a bank and pay 8% in interest if I could lend the money to the bank and earn 5%? The answer to this question was eye-opening. So, I decided to lend money to the bank instead of borrowing from the bank. With this strategy, I am making money with CDs and not paying high interest rates on expensive mortgages.

What is a certificate of deposit(CD)?

Before I tell you how I make over $200 investing in CDs, I figured I should tell you what a CD is. A certificate of deposit is a term deposit that you can open from a bank, a credit union, or an online financial institution. Unlike savings and money market accounts, CDs come with higher and fixed interest rates, and you cannot withdraw money until maturity.

Due to withdrawal restrictions, CDs pay higher interest rates than deposit accounts. Once your CD matures, you can renew it, cash it out, or let the bank renew it automatically.

You might also like to learn how to open a CD account step-by-step.

How does a bank CD make money?

The bank CD earns money by paying you a fixed interest on the money you deposit in the account. That is, you open a CD account, make a deposit, and the bank pays you a fixed rate that is compounded either daily, monthly, quarterly, or yearly. This is how I earn money with my CD deposit, and I will share more details with you in the next few paragraphs on how I make over $200 every month on a CD.

With a CD, you can choose to receive interest as a regular paycheck or reinvest it back into the account to take advantage of the compounding effect. I choose to reinvest my earnings to grow my account faster, and mine compound every month.

Since the money is locked into the account and you cannot withdraw it until maturity, the bank invests that money for a higher return and gives you the difference. That is why taking money out of your CD early triggers an early CD withdrawal penalty.

Learn more: How does CD interest work?

How to make $200 with a CD?

I promised I would tell you how I make money with CDs. Yes, I make over $200 investing in CDs, and you can, too, if you follow my strategy. You have to be strategic to make money with CDs due to the lower rates offered by banks and credit unions on deposit accounts.

According to the Federal Deposit Insurance Corporation(FDIC), the average 12-month CD rate is 1.85%. This rate is so low that to make $200 every month, you would have invested over $135,000. That is a lot of money; not everyone has that kind of money. That is why if you want to make money on CDs, you must be creative and pick the right CD account.

So, how do I make money with CDs?

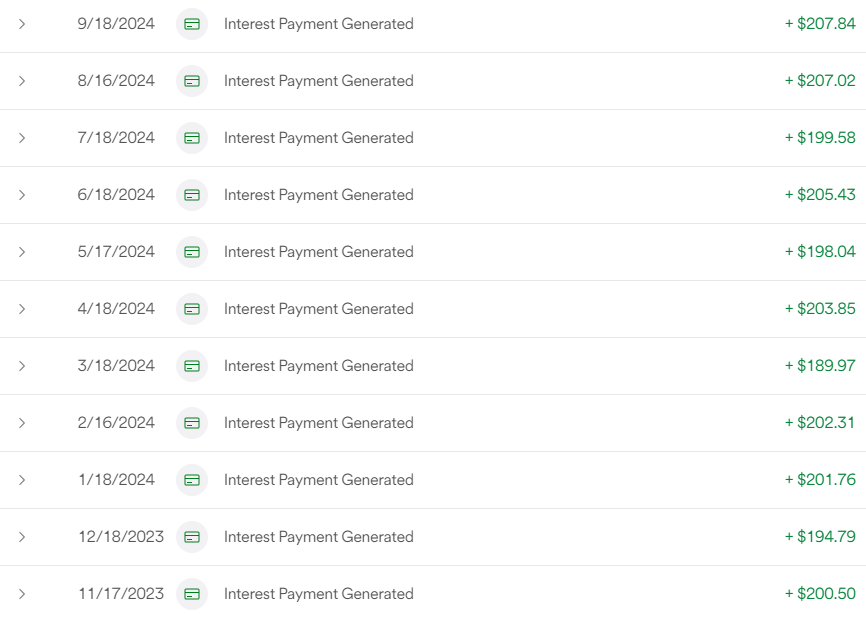

In the following snapshot, you can easily see that I have been making about $200 every month on my CD account. The funny thing is that it only took me 15 minutes to set up the account and start earning money from my certificate of deposit. Since then, I have done nothing to the account except watch my money grow.

Since my interest is compounded every month, I expect my return on investment(ROI) to increase over time as I reinvest my earnings back into the account.

As you can see, I did not invest hundreds of thousands of dollars to earn $200 monthly from CDs. How did it do it? I purchased the right CD. That is right. All CDs are not created equal. The only way to make decent money with a CD is to pick the right CD type. There are about 11 types of CDs you can choose from. For more details on different types of CDs and how to pick the right CD, read about them here: 11 Types of CDs: Which certificate of deposit is right for you?

What type of CDs do I buy?

As I said earlier, not all CDs are created equal. Additionally, CDs do not pay the same interest rate. To make money with CDs, you need to buy the right certificate of deposit. Longer-term CDs tend to pay higher rates. The interest on certificates of deposit also varies by institution and CD type. For example, a jumble CD will pay you a higher interest rate. However, you must deposit at least $100,000 to open a Jumbo CD account.

To make the highest return on my CDs, I only buy one type, called a special or promotional CD. As the name says, a special CD is a type of CD banks and credit unions offer you to open an account as a new customer. It is the sample principle that applies to credit cards. You know most credit card companies give you about 6-12 months 0% intro APR so that you can open an account? Special CDs also operate the same way.

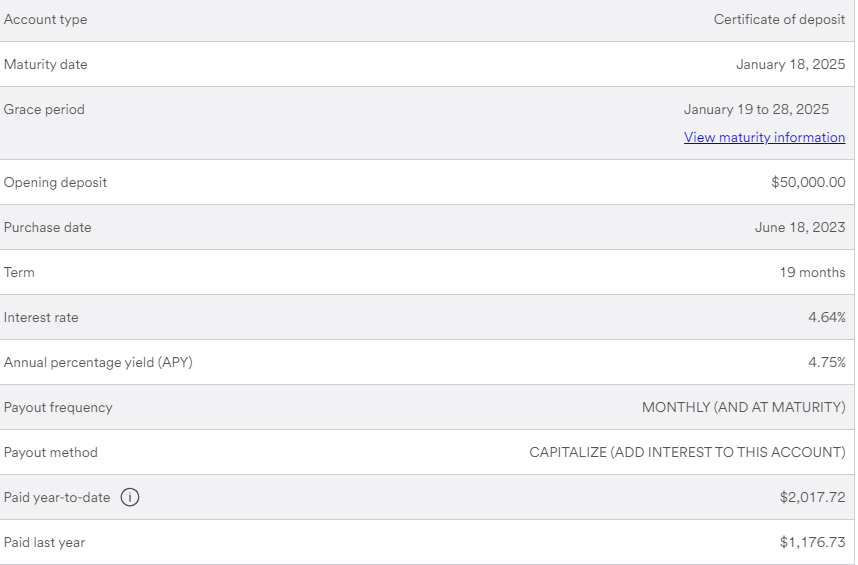

These CDs tend to offer much higher rates than traditional CDs. You can earn as much as 5% or more with special CDs. According to FDIC, the average CD rate is about 1.81% as of Oct 2024, while my CD pays me 4.75% APY. As you can see, there is a huge difference between how much traditional CDs pay and how much money you can make with a Special CD.

How much interest does my CD pay?

To make over $200 every month from investing in a CD, you need a higher deposit amount or a higher interest rate. Unfortunately, I don’t have a ton of money to invest in CDs, so my CD rate is higher than the national average.

Currently, the interest rate on my CD is 4.64%. My annual percentage rate(APY) is 4.75%. The APY is the total interest I get paid per year, which includes the interest on my CD and the compounding effect. Since certificates of deposit offer a fixed rate, my interest will not change until the maturity date, which is Jan 18, 2025. Again, to get this high rate, I had to open a special CD since traditional CDs do not pay that much.

Key points to remember when investing in CDs

Yes, you can make money with CDs, but to maximize your ROI, you need to remember a few things at all times.

Here is a list of key points to consider if you want to make money on a CD.

- Maturity date. This is the date the terms of your CD will end, and you will be allowed to withdraw your money or reinvest it if you want. My CD will mature on Jan 18, 2025.

- Interest rate. This is the official interest you get paid on the account without a compounding effect. My CD pays me 4.64% annually.

- Annual Percentage Yield(APY). The APY is the total interest you receive on the account per year with the compounding effect. APY is always higher than the interest rate since it combines interest rate and compounding effects on the account.

- Grace period. This is the time between the maturity date and the date your bank will automatically renew your CD at the current rates the bank offers. The maturity date is usually between 5 and 10 business days. Shorter-term CDs tend to have a much shorter grace period, such as 2-3 days, while longer-term CDs come with longer grace periods.

- CD term. The term of your CD is the number of days, months, or years it will take to mature. This means you cannot withdraw money from your CD until the term of your CD ends at the maturity date.

- Payout frequency. This time represents how often the interest will be paid to your account. My CD pays me $200 every month, which implies a monthly frequency. The frequency can be daily, monthly, quarterly, or yearly.

- Purchase date. This is the date you officially opened your CD.

- Opening deposit. This is the total amount you deposited in your account

Where can I open a CD account?

You can open a CD account from any bank, credit union, or online financial institution. Before you open a CD from a credit union, however, you might need to be a member of that credit union, which simply means creating a deposit account such as a savings or checking account.

Related: Is now a good time to buy a CD?

How much does it cost to open a CD account?

There is no cost to open a CD account as the account is similar to other deposit accounts. However, most banks require a minimum deposit to the account. Typically, you will need anywhere between $500 to $10,000 to open an account. Some banks require as little as $100 to open a CD account. This deposit is not the cost of opening a CD. Instead, it is what you are required to put into the account to start earning interest on it.

Learn more: How much money do you need to open a CD?

What happens if I cash out a CD early?

Before you open a CD account or make money from a CD, you need to know the exact terms of your CD. Cashing out a CD early triggers an early CD withdrawal penalty. After opening your CD account, the money should remain untouched until maturity. Your bank will penalize you if you take the money out before your CD matures.

A typical CD penalty is several days or months of interest, depending on the type of CD and its terms. For example, your bank can charge you 90 days of interest on a 6-month CD or 12 months on a 5-year CD.

Learn more: Early CD withdrawal penalty: What you need to know

Are all CDs FDIC-insured?

Not all CDs are insured by the Federal Deposit Insurance Corporation(FDIC). As an investor, you should always put money in an institution insured by FDIC or NCUA. This is because FDIC insurance protects your deposit and interest earned up to $250,000 per depositor per account category and institution. If your bank were to go bankrupt, you would get your money back up to the FDIC insurance limits.

Your bank will tell you if it is FDIC-insured. You can also look into your CD terms to determine whether the institution is FDIC-insured. Another way to know if your bank is insured is to check the FDIC website. The website shows all institutions that are members of FDIC. Currently, there is a total of 4,610 FDIC-insured institutions and 79,819 FDIC-insured branches.

Opening a CD account with a non-FDIC-insured institution will put all your money at risk. If the bank goes under, your money will also be smoked.

Are certificates of deposit safe?

Certificates of deposit carry low risk when opened from an FDIC-insured institution. Unlike traditional investments, where your money can be lost without a trace, CDs come with a certain level of safety. Currently, the FDIC insures each depositor per bank and account category up to $250,000. If your bank were to go bankrupt, you would get your initial deposit plus interest you earned up to $250,000.

You might also like: Is a CD safer than a savings account? Which one is better?

Do you pay tax on your CD interest?

The money you make with a CD is subject to federal and state income tax in the year it is earned. Your tax rate will depend on your tax bracket, which is determined by your filing status and other income from your job and investments.