Have you ever wondered what goes into your credit report and how the information in your credit report affects your credit score calculations? Reviewing your credit report regularly is a great way to improve your credit score and keep your credit profile clean. For instance, having negative items in your credit report lowers your credit score until major credit bureaus remove them. So, what is a credit report, how does it work, how do you get a free credit report, who do you dispute errors in your report, and why does cleaning up your credit report help you maintain good credit?

For those who are new to credit reporting and don’t know how to read your credit report, this will be a step-by-step guide to reading your credit report. I will also show you how to get a free copy of your credit report and dispute information in your credit report to maintain good credit.

What is a credit report?

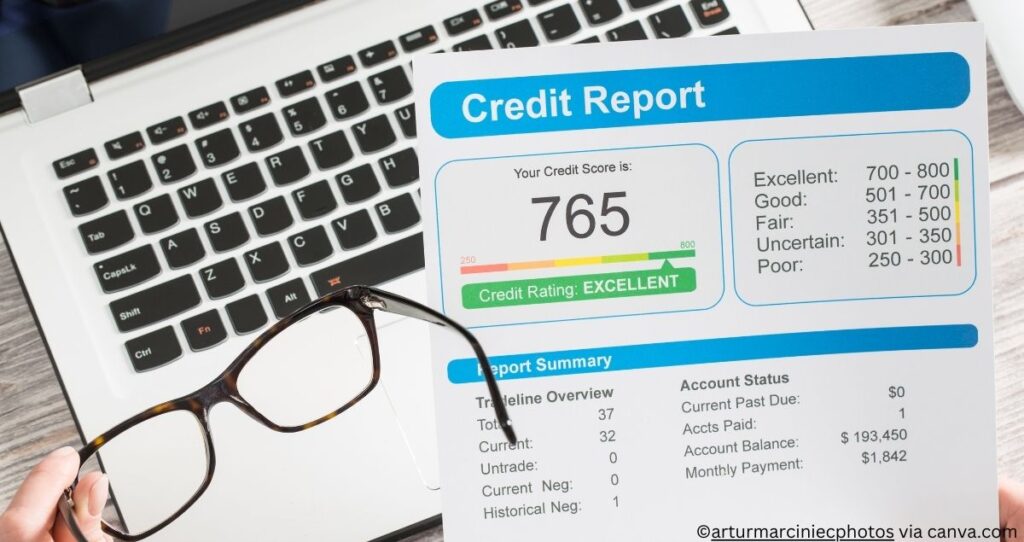

A credit report is a document with information about your account activities such as the current number of credit accounts, credit history, payment activities, the amount you owe, and the status of your accounts.

Credit reporting agencies(Equifax, TransUnion, and Experian) create your credit reports using information they collect from your lenders and the businesses you deal with. Credit scoring agencies then use information in your credit reports to calculate your credit score. Keeping your credit report clean and current is a great way to improve your credit score and maintain good credit history.

You might also like: What is a soft inquiry on credit reports and how do you remove them?

What is included in a credit report?

Your credit reports generally have all information related to credit account activities. Think of a credit report as a file/document with all credit accounts such as your lenders, how much you owe, new account activities, when accounts were opened, etc.

Here is a list of all the information in your credit report.

- Your payment history

- Late payments

- Your name and address

- Missed payments

- Your employers

- Loans, credits, or mortgages you applied for in the past

- A list of your lenders

- The value of each loan and credit accounts

- Number of accounts and credit limits

- Your credit usage history

- Credit ages

- Bankruptcies

- Accounts collectibles if any

- Foreclosures

- Other debts

How is my credit report created?

Major credit reporting agencies rely on information they collect from lenders and other business activities to create your credit reports. Any information related to your credit accounts such as loan payment activities, credit utilization, negative items, new account activities, types of loans, etc are reflected on your credit reports. Your credit report can also include information you provided to major credit reporting agencies or court records.

It is also good to know that not every lender reports information to all 3 major credit bureaus. This means one or two credit bureaus might have different information in your credit report, resulting in different credit scores.

What is a credit score and how is it calculated?

A credit score is a number that ranges from 300-850 used to assess your creditworthiness.

Credit reporting agencies use information from your credit report to calculate your credit score using credit scoring models. There are many different credit scoring models but the most used models include the VantageScore and the FICO scoring models. The three credit reporting agencies (Equifax, TransUnion, and Experian) use the VantageScore model resulting in a VantageScore. On the other hand, the FICO scoring model is used to calculate your FICO score and it is used by the Fair Isaac Corporation(FICO).

According to Wells Fargo, your information will be grouped into five categories to calculate your credit score. These categories will be assigned weights based on the credit scoring models used to calculate your credit score.

Here are five categories of information in your credit report and corresponding weights when calculating your FICO credit score.

- Payment history: 35%

- Credit usage: 30%

- Age of credit: 15%

- credit mix: 10%

- hard inquiries: 10%

Among factors used to calculate your credit score, payment history, and credit usage carry the highest weight(65%) of your credit score calculation. This is because lenders always want to know if you can repay your loans and whether or not you use credit responsibly.

More credit score guides:

What are the major credit reporting companies?

Credit reporting agencies play a major role in creating consumer reports and calculating credit scores. While many companies collect information about consumers and compile reports, the Consumer Financial Protection Bureau(CFPB) reports that there are three major credit reporting agencies. The major consumer reporting agencies are depicted below.

How do I get a copy of my credit report?

One of the fastest ways to increase your credit score is to clean up your credit reports. This includes getting copies of your credit reports, reading through them, and disputing any errors, inaccuracies, fraudulent activities, and ensuring your accounts are current.

Many online reporting companies charge a fee to get a copy of your credit report. But, there are also ways to get a free copy of your credit report.

According to the Federal Trade Commission (FTC), every person is entitled to a free credit report once every 12 months.

You can download a free copy of your credit report from each major credit bureau (Equifax, Experian, TransUnion).

To get a free copy of your credit report, submit your application on this website: Annualcreditreport.com: This is the only website authorized to provide free credit reports, according to FTC. You can also call the following number to get a copy of your credit report. 1-877-322-8228.

When applying for a free copy of your credit report, you will provide the following information to verify your identity.

- Full Name

- Date of birth

- An address

- Social Security Number (SSN)

What are the common errors in credit reports?

Errors on your credit report can be grouped into 4 major categories including the following.

- Balance Errors. These are usually related to wrong credit limits or incorrect account balances.

- Reporting of accounts errors. These errors can include duplicated debts, accounts reported as open or closed when they are not, authorized users reported as owners, incorrect dates, etc.

- Identity error. Identify errors include wrong personal identity information, name conflict with individuals who have similar names, or identity theft.

- Data management errors. Data management errors in your credit report can be duplicated accounts on different creditors or outdated information.

Can I dispute errors in my credit report?

Mistakes in your credit reports are common due to several things. These errors can be due to reporting issues, inaccurate balances, incorrect identity, or data management issues.

If you notice an error in your credit report, dispute it to the credit bureaus and the lender. Yes, you have the legal right to dispute anything in your report such as wrong information or errors. The following are reasons you need to dispute the information in your report.

- There are errors in the reports such as mixed credit files, personal information, account information, etc

- There is inaccurate information that businesses reported about you

- Maybe the reported information is not complete

- There is something that does not make sense in the report

- Fraud information or identity theft.

How do you dispute errors in your credit report?

Disputing errors in your credit report can significantly increase your credit score. So, how do you dispute incorrect information to major credit bureaus? In simple terms, you submit a dispute form and letter to the agency that reported incorrect information and the lender where the information came from and get a response within 30 days.

Normally, there are three ways to dispute errors in your credit reports.

- Dispute the errors to the company or business that provided your information to the credit reporting company. For this method, you need to write a dispute letter to the furnisher (the business that provided your information to the reporting company) explaining why you think there is a mistake in the information provided to the credit reporting company. Please, use the following instructions by the Consumer Financial Protection Bureau when preparing your letter.

- Dispute errors to credit reporting companies. Another way to dispute errors in your credit reports is to submit a dispute letter to major credit reporting agencies(s) that reported the error.

- Dispute errors to credit bureaus and your lender. The third option is to submit a dispute letter to major credit bureaus and your lender.

What is the contact information for disputing errors in your credit report

The following is a list of all three major credit bureaus, dispute forms, and information you need to submit a dispute letter.

| Company | online | By mail | Phone |

| TransUnion | Use this link | Dispute form: FORM Address: TransUnion LLC Consumer Dispute Center P.O. Box 2000 Chester, PA 19016 | (800) 916-8800 |

| Equifax | Use this link | Address: Equifax Information Services LLC P.O. Box 740256 Atlanta, GA 30348 | (866) 349-5191 |

| Experian | Use this link | Dispute form: FORM Address: Experian P.O. Box 4500 Allen, TX 75013 | (888) 397-3742 |

Gather all the information you need ahead of time to make the dispute process seamless. This information includes gathering all evidence and supporting documents, having a dispute letter professionally written, and having proof of identity.

The following is some of the information you need to submit in your dispute letter, according to the Consumer Financial Protection Bureau(CFPB)

- Full contact information

- Your credit report confirmation number

- A detailed reason for the dispute

- The nature of your dispute such as if you need information to be corrected or removed from your report.

- A dispute letter with a copy of the report highlighting the errors

- Explanation of each error(s)

Here are a few things to remember when disputing errors in your credit reports.

- Follow specific information and instructions from each reporting company you want to dispute. Also, verify their website for updates as their address, phone, and requirements may change over time.

- Your report may have specific instructions on how to dispute errors. The phone number, address, or form might differ from what is listed here. Please, follow the instructions (if any) from your credit report.

What happens after I dispute errors in my credit report?

After disputing errors in your credit report, involved parties will work together to process your dispute.

Your credit reporting agency (Equifax, Experian, or TransUnion) will contact the businesses (banks, lenders, credit card providers, etc) about the dispute.

The furnisher will then double-check the information and resubmit updated information to the credit reporting agency.

Your credit reporting company will then update all information in your report and respond to your dispute.

The time it takes to correct errors in your report differs from one credit reporting company to another. Factors that affect how fast your dispute is processed depend on how fast and efficient businesses work together to resolve the issue. According to Experian, it usually takes up to 30 days to complete your dispute process from the date a dispute letter and form were received.

Why are my credit scores different?

Having different credit scores does not mean one is more accurate than others. For example, your VantageScore from Equifax, TransUnion, and Experian might not be the same. Being different, however, does not mean some of your credit scores are wrong.

Typically, a few factors lead to having different credit scores. The variation in your credit scores might be due to different information in your credit reports. Not every lender reports to all three credit reporting agencies. This leads to different information in your credit reports and credit scores.

Another reason you have different credit scores is that each credit reporting agency has a proprietary scoring model. Each model applies different weights to information in your credit reports leading to differences in credit scores. For example, your FICO score and VantageScore are always different because both models have different weights on information in your credit reports.

Errors in your credit reports can also result in different credit scores. For example, if one of your credit reports was not updated on time and still reports a late payment that was supposed to be removed, your credit score will still be affected.