While the world is falling apart, you may be searching for safe investments to protect your savings. One option that often comes to mind is opening a certificate of deposit (CD) account. CDs offer a guaranteed return due to fixed interest rates and the safety of your money through FDIC and NCUA insurance up to $250,000 per account, per depositor. But with inflation cooling down and a lot of economic uncertainties, it might be hard to decide if now is a good time to buy a CD.

In this article, we will explore if current CD rates are worth your money and the best time to add a CD to your portfolio. Additionally, will evaluate if CD rates are going up or down in response to inflation that is cooling down and how you can position yourself financially to maximize your return on investment.

Finally, we’ll explore the pros and cons of opening a CD account and provide insights on its safety and potential returns. We’ll also discuss alternative investment options to help you make an informed decision about your financial future.

Understanding Certificate of Deposits

Before you worry about buying a CD right now or if CDs are worth it, you first need to have a clear understanding of what CDs are and how they work. A CD is a type of deposit account that requires you to deposit a certain amount of money for a fixed period, ranging from several months to several years. In return, you receive a fixed interest rate, which is often higher than the interest rate you’d receive with a traditional savings account.

CDs are considered to be a low-risk investment, as your deposit is insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000. The downside is that if you withdraw your funds before the end of the CD term, you may incur an early CD withdrawal penalty.

There are different types of CDs and they come with a wide range of terms. So, before you open a CD account, do your research on different CD types and compare current CD interest rates. Some banks and credit unions may offer higher rates than others. So, it’s worth shopping around to find the best deal.

Do you want to buy a CD right now? Use the following guide: How to open a CD account: A Step-by-step guide

Are current CD interest rates worth it?

As an investor, your return on investment, portfolio growth, and the safety of your money comes at the top of your priorities. Yes, CDs offer protection of your money and guarantee a return on investment. Each CD account comes with a fixed interest rate over some time. The question is: Are CDs worth it and should you buy a CD right now?

If you are familiar with investing, you already know that investments that guarantee the safety of your money always come with low returns. That is a fact. That is why, savings accounts, money market accounts, and certificates of deposit always come with low rates compared to risky investments such as stocks, bonds, mutual funds, and real estate.

So, what are current CD rates and should you buy a CD right now?

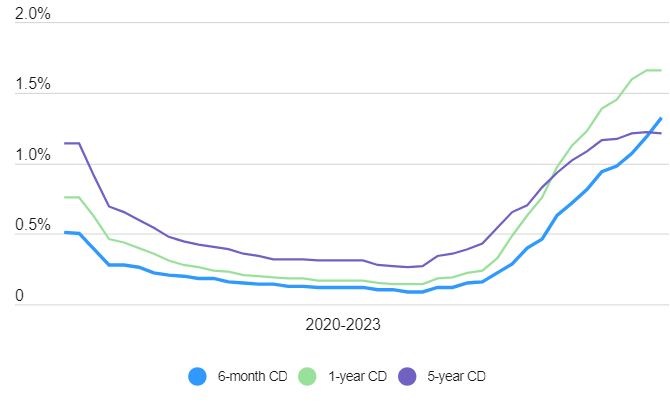

Normally, average CD rates range between 0.1% to 2% with some exceptions such as types of CD and due to economic conditions. For example, during the Covid-19 pandemic, CD rates were extremely low due to lower rates imposed by the Federal Reserve. CD rates were as low as 0.9% for a 6-month CD, 0.14% for a 1-year CD, and 0.26% for a 5-year CD.

After the pandemic, however, the rates increased drastically due to a spike in inflation. Currently, CD rates are as high as 1.26% for a 6-month CD, 1.63% for a 1-year CD, and 1.37% for a 5-year CD, according to the Federal Deposit Insurance Corporation(FDIC).

The question is, are these rates the best CD rates you can have on a certificate of deposit account? The answer is no. Historically, there have been times when CDs were much higher. For example, between 1990 to 1999, CD rates reached as high as 7.92%, and between 2000 to 2009 CD rates reached as high as 6.02%, according to data from Bankrate.

What is the trend for CD rates? CD rates are directly affected by the economic performances and interest rates imposed by the federal reserve. But there is a trend. Typically, CD rates go lower when the federal reserve reduces rates to jump-start the economy during and after a recession. Meaning that during a recession, you will earn less return while in good economic conditions, you will earn more.

That is why CD rates were as high as 6% in the year 2000, for example, and gradually went lower following the dotcom crash. Then, rates crashed in 2020 due to the pandemic and later rebounded in 2022. You can observe the changes in CD rates between 2020 and now in the following chart.

Are CD rates going up?

Since 2022, CD rates have been on the rise. Mathematically speaking, we went from 0.14% in January 2022 to 1.63% in July 2023 for a 1-year CD. That is a huge rebound but it was expected. Will CD rates continue to go up?

The answer to this question will depend on the nature of the economy and the response from the federal reserve. After the pandemic, the federal reserve worked tirelessly to cope with inflation. In doing so, interest rates were hiked from almost 0% to a range between 4.25% and 4.50%, according to Forbes. This increase of rates also increased rates of different financial products across different sectors including mortgages, all kinds of loans, and deposit accounts such as savings accounts, CDs, and money market accounts.

The impact of inflation on CD rates

As inflation rises, interest rates also tend to rise. The opposite is also true. The inflation rate has fallen drastically from 9.1% in June 2022 to 4% in May 2023, according to the data from Statista. This is good news for consumers and the economy in general as prices of goods and services should also follow the same trend. This also means that loans, mortgage rates, and deposit accounts’ rates will follow the same trend. The rate at which they fall might be different but as long as inflation continues to fall and remains low, interest rates will also fall.

If these conditions hold, CD rates will start to decline in response to reduced rates across different sectors of the economy.

If we get into another recession, CD rates might fall even more as the Federal Reserve will lower rates to jump-start the economy just as it did in the past. Either way, rates are expected to decline moving forward.

Is now a good time to buy a CD?

Just like any other investment, it is always hard and a bad idea to time the market. However, current CD rates are considered high in recent years. If you want to buy a CD, now might be the best time to lock in higher rates. This will allow you to keep earning higher rates, especially on long-term CDs after CD rates have fallen assuming that rates will continue to fall to reflect the changes in inflation rate.

In fact, with the uncertainty of the stock market and similar securities, CDs can provide a safe and reliable investment option for diversification purposes. While the interest rates may not be as high as they have been in the past, CDs still offer a fixed rate of return and can provide a guaranteed source of income. Are you still not sure if now is a good time to buy a CD? Consider the FDIC insurance on CD accounts, which means your money is protected up to $250,000 per account. Most investment products do not guarantee either a return or the safety of your principal.

Pros of opening a CD right now

If you are wondering if now is a good time to buy a CD, here are a few benefits to consider.

- Higher rates. One of the main reasons people open certificates of deposit accounts is the potential for a higher interest rate. CDs often offer higher rates than traditional savings accounts. Additionally, the longer the term of the CD, the higher the rate tends to be.

- Diversification. Buying a CD now will help you diversify your portfolio while earning you an income.

- CD accounts do not fluctuate. Unlike stocks, mutual funds, and bonds, CD accounts do not fluctuate in response to the market movement. So, buying a CD can provide some stability and security to your overall portfolio.

- Protection. CDs are FDIC-insured, meaning that even if the bank were to fail, your deposit would still be protected up to $250,000. Note: Make sure that you buy a CD from a bank/credit union that is FDIC or NCUA-insured.

If you are looking for a safe, low-risk investment option with the potential for high returns than a traditional savings account, now is a good time to buy CD. As long as you do your homework, the benefits will outweigh the disadvantages.

Cons of opening a CD account

While opening a CD account can be a beneficial addition to your investment portfolio, there are also some drawbacks to consider. Here are a few disadvantages of buying a CD account right now you should keep in mind.

- Lack of liquidity. Your CD funds will be locked in the account for the duration of the CD term. If you need to access your funds before the CD matures, you will likely face an early withdrawal penalty. This lack of liquidity can be a disadvantage for those who may need to access their funds at any time. You can bypass this rule by opening a no-penalty CD but you will get a lower rate.

- CD rates may not keep up with inflation. While CD rates are usually higher than traditional savings accounts, they may not be sufficient to keep up with the rate of inflation. Inflation can erode the value of your savings over time, which can be a disadvantage if you want to use your savings for long-term goals. For example, the current inflation rate is 4% while a 1-year CD offers 1.37%. In order words, your money is losing 2.63% in purchasing power even if it earns you interest.

- Lower rates compared to alternative investments. CDs do not offer as much return as you would get from other investments such as stocks, bonds, mutual funds, etc. If you are willing to take on more risk, it might not be a good time to buy a CD right now. Instead, consider other investment options available that offer higher returns.

Alternative investment options to CDs

Before you buy a CD, there are alternative investment options to consider if you are seeking higher returns. Real estate investments, stocks, index funds, exchange-traded funds(ETFs), bonds, and mutual funds are just a few examples of investment options that may offer higher returns than a CD account. While these investments might carry more risk, they also have the potential for greater rewards. However, it’s important to do thorough research and consult with a financial advisor before making any investment decisions.

When is a good time to buy a CD?

When deciding where to put your money, it’s important to consider all the options available to you. While a CD account can offer a safe and secure investment, it may not be the best choice for everyone. If you are looking for higher returns and willing to take on more risk, alternative investment options such as real estate, stocks, and mutual funds may be worth exploring.

So, when are CDs worth your money? Here are a few reasons why it makes sense to buy a CD.

- You are interested in safety over returns. CDs are safe but come with low returns. So, if the safety of your funds is what you seek, then buying a CD will be a good choice.

- You want a higher return than what you get from other deposit accounts. CDs offer relatively higher rates than savings accounts and money market accounts.

- You have a lot of cash that you don’t need for a while. CDs lock your money in the account until maturity. So, if you have cash that you don’t need for a while, putting it in a CD account will be a wise idea.

- You want to diversify your investment. If you have most of your money in stocks and other risky assets, buying a CD will help you diversify your portfolio.

Are CDs safe right now?

CDs are considered safe regardless of economic conditions. This is because the FDIC insures CDs up to $250,000 per depositor, per insured bank. This means that if the bank holding your CD fails, you will be reimbursed up to $250,000. CDs from credit unions are insured by the National Credit Union Administration(NCUA) for up to $250,000 per depositor, per insured account. It’s important to note that not all banks or credit unions are insured by FDIC or NCUA. So, make sure that your favorite bank/credit union is insured before you buy a CD from them.

In addition to FDIC insurance, CDs are considered a low-risk investment option because they have fixed interest rates and a guaranteed return. This means that your CD interest rate and return remain the same even if the stock market experiences a downturn or interest rates decrease.

Can you get 6% on a CD?

It’s pretty rare these days to find CDs offering rates as high as 6% but it is possible. In fact, some banks and credit unions offer promotional CD rates that are as high as 5% to 6% for a limited time. It’s always worth checking with your financial institution to see if they have any special offers available. You should also check online banks for better CD rates as these banks tend to offer high yields or higher promotional CD rates compared to traditional banks.

That being said, it’s important to remember that chasing after the highest rate isn’t always the smartest strategy. A CD with a slightly lower rate may still be a better option if it offers more favorable terms or fits better with your financial goals.

Do you have to pay taxes on a CD before it matures?

CD earnings are subject to federal income tax, which means you’ll need to include them on your tax return each year. When filing your taxes, it is important to note that you only have to pay taxes on the interest earned, not the principal amount or expected rates in the future.

The tax rate you’ll pay depends on your tax bracket and filing status. The federal tax rates range from 10 % to 37%. Additionally, some states impose their own tax on CD earnings, so be sure to check if your state does so. To determine your actual tax liability, consult with a tax professional.

Do you pay a penalty when you take money out of a CD before it matures?

In most cases, if you withdraw money from a CD before it matures, you will incur a penalty. The penalty amount varies depending on the bank and the terms of the CD. Typically, the penalty is a percentage of the interest earned and can be hefty. Some penalties may even dip into the principal amount.

Most banks charge you a penalty equal to the number of months of interest or number of days of interest. For example, you might be charged 3 months of interest on a 12-month CD if you withdraw money before maturity.

Final words

Opening a Certificate of Deposit (CD) account requires careful consideration, especially in today’s volatile economic climate. Since inflation has been falling gradually, interest rates are also expected to follow the same trend-meaning that now might be a good time to buy a CD. In order words, if rates decline due to relatively low inflation, CD rates will also go decrease.

What makes now a good time to buy a CD is that you will lock in higher rates in case CD rates go lower. Additionally, your CD account will not fluctuate in relation to market conditions. As a result, your CD will offer diversification while earning you a steady return on investment. On the other hand, if you are interested in higher earnings or need access to your funds, now might not be a good time to buy a CD. Before making a financial decision, evaluate your financial situation and saving goals.

More savings tips

How to close a CD account in 6 steps

How much money should you keep in a savings account?

20 clever ways to reduce expenses and increase savings