What is a stop-limit order?

A stop-limit order is an order that uses a combination of a stop order and a limit order to buy or sell a stock when its price reaches a predetermined price level. When the target price is reached, the stop-limit order will become a limit order to buy or sell all or a specified number of shares in a stock.

This is different than a stop-loss order where the order becomes a market order to buy or sell all or a specified number of shares in a stock.

For the stop-limit order, a trader will need two different prices. The first will be the stop price that will convert a stop-limit order into a sell or buy order. The second price will be a limit price which will be your execution price when the price reaches it.

In short, the stop-limit order will become a limit order when the stock price reaches the stop price. Next, the limit order will be executed once the price reaches the limit price.

Example of a stop-limit order

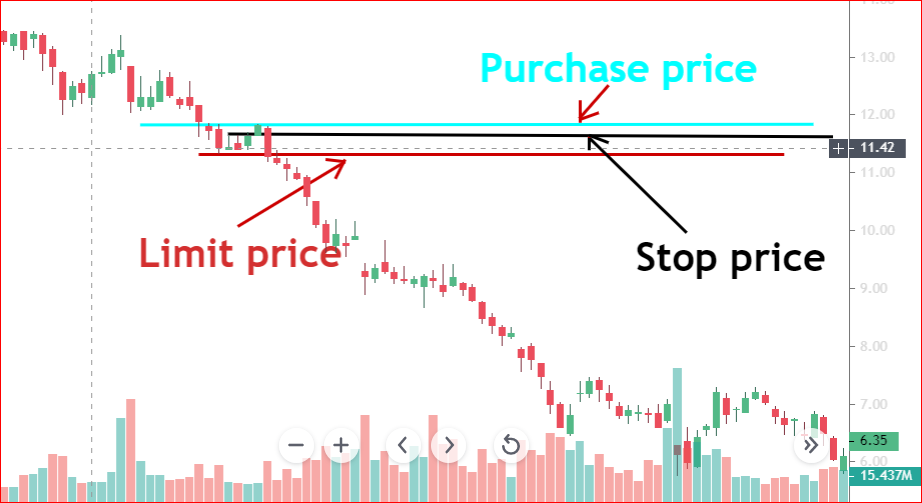

Let’s say that you took a long position in a stock that was trading at $11.80 per share as shown in the following chart. To protect yourself from major losses, you used a stop-limit order to sell all your shares if the price goes against you.

You set up your stop price at $11.60 per share and your limit price at $11:30 per share. Please, see the illustration of this scenario on the following chart.

What do these numbers mean?

To understand what these numbers mean, we will need to go back to the beginning. You bought shares of a stock at $11.80 per share. Since you don’t know where the price will go from there, you decided to use a stop-limit order to protect your portfolio.

In order words, you know that there is a possibility that the price will go down. So, you told your broker to convert your stop-limit order into a limit order if the price goes down and reaches your stop price. That is, if the stock price declines and breaks $11.60 per share, your order will become a limit order.

Furthermore, If the price continues to decline and reaches $11.30 per share, your limit order will be executed at $11.30 per share or better. In other words, your shares will be sold at a price equal to $11.30 or more.

Benefits of using a stop-limit order

The order will guarantee you the price. You will sell your shares at a price you specified or better. If the price goes below the limit price you specified before the order is executed, your shares will not be sold. For this reason, you will keep your position until the stock price goes back up to or above the limit order, expired, or you cancel it.

This order will also help you do other activities. You can go on your vacation without worrying about losing a lot of money in the market. The stop-limit order can kick you out of the market if the price plummets.

Disadvantages of a stop-limit order

Like a limit order, your shares will be sold at a price you specified or better when you use a stop-limit order. This will ensure that you get the price you want per share. However, there is no guarantee that your order will be executed.

If for example, the price slides really fast, there is a high chance that the price can break bellow the limit price before all or some of your shares are sold. If this happens, your order will stay active until you cancel it, expires, or the price goes back up.

Unless the price moves back up and reaches the limit price or above for the order to be executed, you will continue to lose money.

Even if the price goes to zero, your order will not be executed!

Before you use this order, make sure that you fully understand how it works and the drawbacks associated with it.

Should I use a stop-limit order?

A stop-limit order is like an advanced version of a limit order. If you use a stop-limit order, it will become a limit order if the stock price reaches the stop price. From there, the process will be the same as a limit order.

For this reason, it does not make sense to use a stop-limit order.

I recommend using a limit order instead. This order will help you buy and sell shares at prices you want or better. However, you may risk having your orders partially filled or not filled at all. The pros and cons of limit orders are the same as stop-limit orders.

Final Words

Always use limit orders when trading. This will ensure that your orders will be filled at the prices you want. Remember that the purchase price will determine the winning and losing trades.

At the same time, you must understand that there are chances that your orders may be filled if you use limit orders.

Due to the high risks of losing your entire capital or more in the market, it is important to use stop-loss orders and invest only what you can afford to lose.

Happy trading and investing !