What is income statement?

The income statement is a financial report that shows how much money a business made over a period of time, according to the U.S Securities and Exchange Commission (SEC). That is the report takes into account all revenues, total costs, and expenses that a company experienced during a reporting cycle.

Besides the income statements, businesses compile three more financial reports. These reports are the balance sheets, the cash flow statements, and the statements of shareholder’s equity.

Understanding Income Statements

In order to understand how a business spends and recovers its money and whether or not it made a profit, the income statement is compiled. The income statement calculates all revenues a business generated from its operations and all expenses incurred in the same period.

From these two values, it is then easier to estimate the earnings before tax. Once earnings before taxes are estimated, the business subtracts taxes from the earnings. The result from this calculation is the net earnings.

The net income will tell investors and credits how a business performed during the reporting period. A positive net income shows that the company can cover its operating expenses, pay off its debts, and more importantly, distribute dividends to its shareholders.

On the other hand, a negative net income indicates that the company cannot pay out dividends. In addition, the company may need to raise more capital to finance its operating expenses and pay off its debt.

How to complete the income statement?

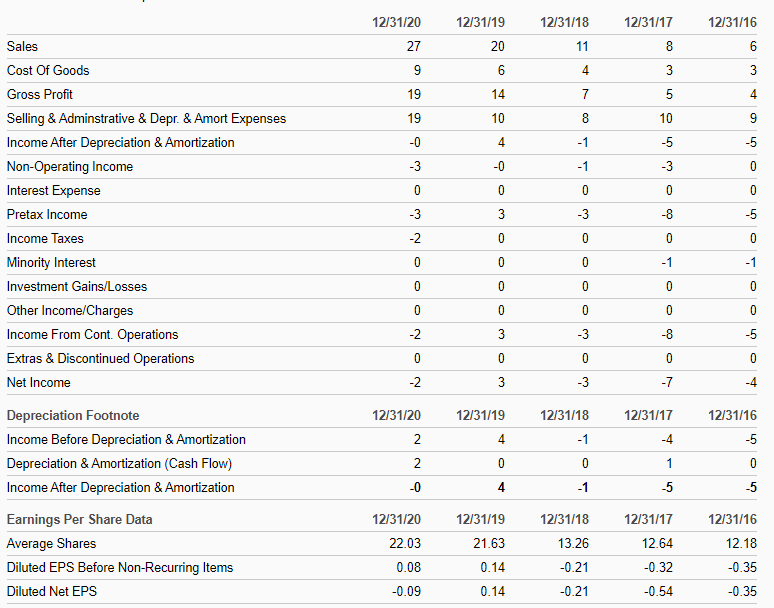

The following are major section of the income statements.

- Revenues: Revenues count for all money a company made from its business operations. The simplest way to calculate the revenues is to multiply the number of units sold by the price per unit. For example, let’s assume that a business sells baskets. If the total number of baskets sold within a year is 1,000 and each basket was sold for $20, the total revenues will be $20,000 (1,000x$20).

- Cost Of Goods Sold (COGS): The cost of goods sold refers to how much a company spent to acquire the goods or services it sold. The best way to calculate the cost of goods sold is to subtract the ending inventory from the sum of the beginning inventory and additional purchases in a given period.

- Gross Profits: The gross profit is the difference between gross sales (revenues) and the cost of goods sold(money spend to make/acquire and market goods sold). The gross profits can be used to calculate the gross profit margin ratio.

- Total Expenses: Total expenses are all expenses a company experienced during a period of time. These expenses include but not limited to general and administrative expenses, interest expenses, marketing expenses, amortization expenses, etc.

- Earnings Before Tax(EBT): After calculating all expenses, the next step is to calculate how much money a company made in a given period before taxes are applied. This amount is calculated as the difference between gross profit and total expenses. An alternative way to calculate the earnings before tax is to add the net income to the tax paid in a given period.

- Taxes: These are the taxes a business paid during a reporting period. There are many different taxes depending on the structure of the business.

- Net Income: This is the amount left after subtracting all expenses, taxes, and interest from the gross profit. The net income shows whether a business made a profit or lost money from its operations.

The income statement can also display the earnings per shares (EPS), diluted EPS, etc.

More learning resources

- Payables Turnover Ratio Definition

- Receivables Turnover Ratio Definition

- Price To Earnings (P/E) Ratio: What Is P/E Ratio?

- Price-To-Book (P/B) Ratio: What Is P/B Ratio?

- Dividend Payout Ratio And How It Works

- What Is Asset Turnover Ratio? How Does It Work?

- Price-To-Sales (P/S) Ratio: What Is P/S Ratio?

- What Is Inventory Turnover Ratio?

- Quick Ratio: What Is Quick Ratio?

- Current Ratio: What Is The Current Ratio?