Buying stocks and securities has become very easy due to technology. In the past, people who wanted to trade would have to make calls and more calls.

However, the recent technology has made buying stocks very easy. You can buy stocks in few seconds while drinking coffee or tea on the comfort of your couch. This does not mean that everyone knows how to buy stocks.

In this post we will go over step by step on how to buy a stock or stocks.

Table of Contents

- Open an online trading/brokerage account

- Research stocks you want to buy and learn basic trading terminologies

- Decide how much money you want to invest and number of shares to buy

- Step by step: Buy shares in companies you decided to invest your money in

- Research more stocks to buy in the future and use a different brokerage firm if you don’t like what you have

Step 1. Open an online trading/brokerage account

To buy and sell stocks, you will need an online trading/brokerage account. There is a ton of brokerage firms out there. The one you choose will depend on how much support you get from them and commission (if applicable). Brokerage companies used to charge commission for every trade but many of them have eliminated commissions.

Brokerage companies

As I said, there are a ton of brokerage companies. The following table contain a list of the top best brokerage firms. Their qualities depend on fees (if applicable), minimum starting amount, level of research materials, etc. You can open an account with anyone of them.

| Name | $/trade | Amount Minimum | What can you do? |

| Robinhood | $0 | $0 | Stocks/cryptocurrecy |

| Vanguard | $0 | $0 | Passive investing of index funds and ETFs,… |

| Etrade | $0 | $0 | Active trading of stoks, long term for ETFs, and mutual funds,etc. |

| Charles Schwab | $0 | $0 | Stocks, ETFs, mutual funds, etc. |

| Fidelity | $0 | $0 | Index and mutual funds, stocks, research, etc. |

| Ameritrade | $0 | $0 | Active trading, stock, mutual funds, index funds, etc. |

| TradeStation | $0 | $500 | Active trading and cost-sensitive investments |

| Ally Invest | $0 | $0 | Intuitive platform and make cheap trades |

| Merrill Edge | $0 | $0 | All types of investors especially Bank of America customers |

It is important to know that we did not rank these platforms. Therefore, you will chose one based on whether you are an active or a long term trader and level of help or research material you need. However, these platforms are among the top trading platforms in the country.

Once you have chosen your brokerage firm, it is time to open an account. It does not take long the get the account up and running.

Funding your account

Now you have your brokerage account and everything is approved. The next phase will be funding your account. You will need to link your bank account to your brokerage account and transfer money you will use while trading. However, your brokerage company will need to verify your bank and it takes few business day. Once, verified, you can start transferring funds into your account.

It also takes few business days to move money from your bank account into your brokerage account.

Step 2. Research stocks you want to buy and learn basic trading terminologies

While waiting the money to appear in your account, you can do your research about a stock you want to buy. Stocks are some of the most confusing securities to deal with. They are volatile and unpredictable. This is why you need to do a thorough research before investing.

Where do you learn about stocks?

Before you buy stocks, you will need to know about the them. What is it about? Is it a good stock? What does the company do? etc.

All these questions and many more can be answered by doing your research. The first place you can learn about stocks is using your brokerage company. These firms usually provide research materials about many companies traded on them. That is not the only place though.

Places that can help you do research on your stocks and investment research:

- Investopedia

- Books

- Yahoo Finance

- Zacks Investment

- Motely Fool

- Google Finance

- Seeking Alpha

- Etc.

All these websites offer a ton of material for free. And it is important that you understand what you are buying before you buy it. You don’t want to buy apple because you own one.

After you have done your research, you know the stock you want to buy and everything is ready to go; you will move to the next step.

This phase is very important. Even if you have a ton of money in your account, it is never a good idea to use all of it to buy your favorite stock. There are chances that it will go down and lose money.

This is why you need to decide what percentage of your money you need to put in each stock.

Many investors argue about what percentage should be in each stock. It all comes to your decision. However, if you want to succeed in stock market, you will need to diversify your portfolio and put no more than 6% of your total account value in a single stock.

You need to protect your self against the market downturn. For example, if one of the stocks you own drops 50%, it means that you have lost 3% of the 6% you put in that stock. When it comes to your portfolio value, it means you lost only 3% of your total portfolio value.

However, if you put 50% of your total portfolio in one stock, and you lose 50% of it, it means that you have wrecked your account. Why? Because, you have lost 50% of money you put in that stock which is equivalent to 25% of your total portfolio value. This is a huge loss.

Once you decide how much money you want to invest in each stock, you will calculate how many share of each stock you can afford with it.

Now you can move to the next step.

To buy shares, you will need to log into your brokerage account and choose trading option. I use Fidelity investments and Robinhood. However, all brokerage companies work the same way. The following are step by step on how to execute a trade using Fidelity Investment.

- Click on Accounts and Trade tab located on top left corner of your account. A drop down will pop up.

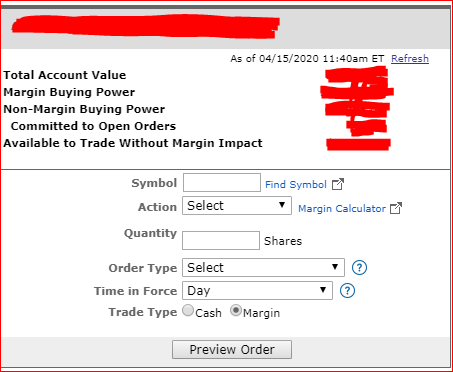

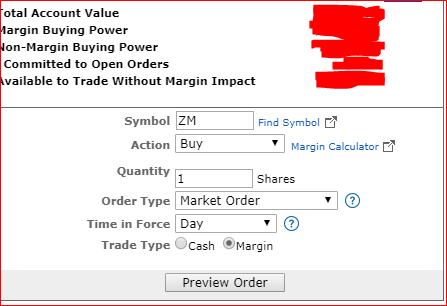

- Select Trade. This will open an other window with trade options. Look at Figure 1 below for more details.

This small window will have steps you need to follow in order to execute your trade.

- Type the ticker of the company you want to buy in a box in front of Symbol

- Click on a drop down in Action and select buy

- Enter the number of shares you want to by in Quantity

- Click on a drop down on Order Type. There are many order types. Market order means you want to buy now at whatever price the market is at. Limit order, means you specify an exact price you want to pay on shares of this company. Your order will be executed at that price. It could take longer or go faster depending on whether the stock moves in that direction or not. There are many other options. Choose the one that you want.

- Select the drop menu in front of Time in Force. Here you specify how long you want your order to last if it is not filled right away. For example, you can choose day. This means if your order is not filled at the of the current trading day, it will be canceled.

- Select Cash or Margin depending on which one you want to use. You will have cash and margin options only if you upgraded your cash account to margin account. If you never applied for margin account, you will only have cash.

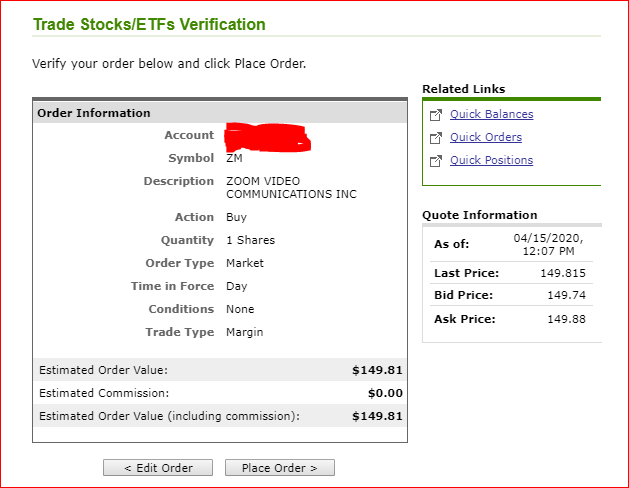

- Select Preview Order. This is where you review your order and edit it before you submit it for execution

After clicking preview, another window will open for your review before execution. Once you are satisfied with your trade you will submit it and wait for it to be filled.

- Click Place order and wait for your order to be filled

Once the order is filled, you will get a confirmation about the order. It will include how many shares filled and the price they got filled at.

Once your shares are filled, you become an investor into that company.

You will go through the same process when selling shares of a company. The only difference is that you will select sell instead of buy in the order details.

Step 5. Research more stocks to buy in the future and use a different brokerage firms if you don’t like what you have

Now that you have become an investor, your battle is not over yet. To succeed, you will need to continuously do more research and manage your portfolio by buying more good stocks and selling struggling ones.

You can also change your brokerage company and go with another one or use multiple. It depends on what you want to achieve in your trading activities.