What is the meaning of a commodity?

Commodities are raw materials such as oil, gas, gold, etc. that are used every day by consumers in commerce.

What drives the prices of commodities?

The prices of commodities increase or decrease based on conditions in the market. These conditions happen due to two economic principals of commerce which are supply and demand.

- Supply: In general terms, supply represents the total number of goods and services available for consumers at a specific price and time.

- Demand: The demand represents the total amount of goods and services needed at a specific price and time. Source: merriam-webster.com

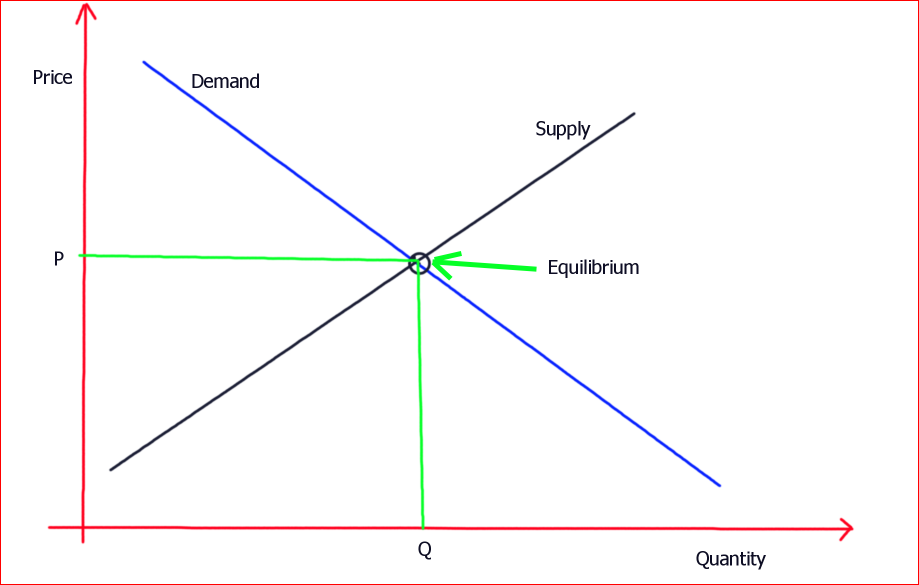

The supply and demand curve is used to determine how these two important economic terms affect the prices of goods and services.

When the supply of goods and services increases, their prices go down. The reduction in prices can trigger more demand because products will be cheap.

On the other hand, when the supply of goods and services goes down, prices increase. The increase in prices affects the demand because products become expensive. Consumers solve their problems using alternative products and services.

Learn more about supply and demand

Is it a good idea to invest in commodities?

There are risks involved with all investments. However, investing in commodities may be riskier because their prices are affected by external factors. Some of these factors are difficult to predict like epidemics, natural disasters, bad weather, etc.

Investors must understand that the disruption in prices of one commodity can affect other commodities related to it.

For example, the shortage of chicken meat can increase the prices of chicken flavored products, beef, pork, or fish. This is because people will replace chicken with its alternatives.

Categories of commodities

There are four main categories of traded commodities. Source: investopedia.com

- Metals

- Energy

- Livestock and meat

- Agriculture

If you choose to invest in commodities, you must understand all factors that can affect their supply and demand. This is how you can maximize your returns on investment and protect yourself when markets tank.