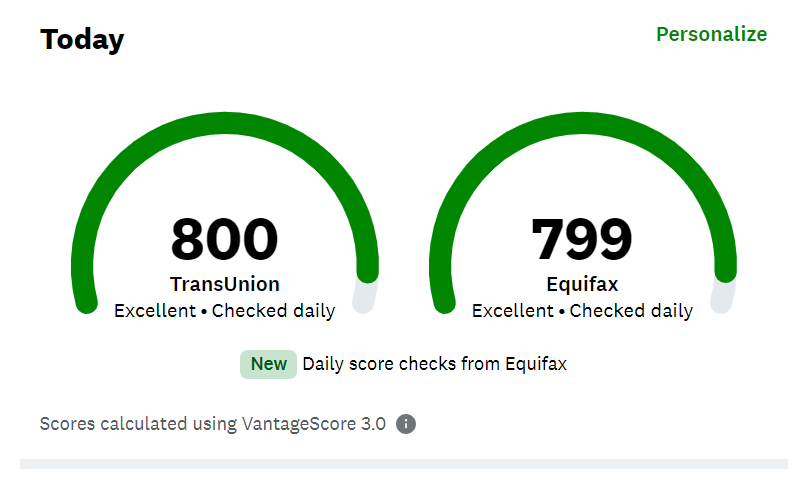

Checking your credit score for free online is easy as many websites and credit card issuers offer free credit score information. For example, Credit Karma gives you free information about your VantageScore credit score. All you need to do to get a free credit score from Credit Karma is to create an online account. After creating an account, you can check your score anytime free of charge by logging into your account.

Credit Karma gives you free VantageScore it pulls directly from TransUnion and Equifax, two of three major credit reporting agencies. If you need a free FICO score, you need to get the score from places other than credit Karma. Some of the best places to get a free FICO score include the Discover Credits Scorecard program, or having a credit card from a credit union, Bank of America, Ally Bank, American Express, Citibank, etc.

You can also get your credit score from each major credit bureau (Equifax, TransUnion, and Experian) for a small fee. While credit reporting agencies don’t offer free credit scores, you can get a free copy of your credit report from each bureau every 12 months.

In this article, I will walk you through the process of getting a free credit score online and where to view your credit score for free.

What is a credit score?

A credit score is a three-digit number ranging from 300 to 850 with 850 being the highest score you can have. A good credit score shows that you pay your bills on time, making you a less risky borrower. Lenders use your credit score to qualify you for loans and to determine the interest you pay.

Your score can also help you qualify for business opportunities and jobs, get discounts on some business services, or have your rental application approved faster.

There are many credit scores but the VantageScore and FICO scores are the most used in many industries. The VantageScore is calculated using the VantagaScoring model by the three major credit reporting agencies. The FICO score, on the other hand, is calculated using the FICO scoring model by the Fair Isaac Corporation(FICO). According to myFICO, over 90% of lenders use the FICO scores when approving loan applications.

Factors that affect your credit score

Credit scoring companies use information from your credit reports to calculate your credit score. This information is grouped into 5 categories which are listed below.

- Payment history: 35% of your FICO score

- Credit utilization: 30% of our FICO score

- Age of your credit: 15% of your FICO score

- Hard inquiries: 10% of your FICO score, and

- Credit mix: 10% of your FICO score.

knowing your credit score at all times and the factors that are weighing it down is a critical step to building an 800+ credit score. That means you need to constantly monitor your credit score and take action when your score drops or when it is not growing fast enough. For example, if you check your credit score and realize it dropped 50 points without knowing why, it will be time to get a free copy of your credit report and investigate the issue.

The following are different ways to check your credit score for free online.

Related:

- 6 factors on which credit score is based on

- Is Credit Karma score accurate: Which score is accurate for loans?

1. Check your credit score for free from your monthly statement

One of the easiest ways to check your credit score for free online is through your credit card monthly statements. Because of high competition in the credit card business, some banks and financial institutions provide free credit score information on their monthly statements.

Due to privacy concerns, however, some banks and institutions do not include your score on your statement. If yours does not include your credit score, there are other ways to get a free credit score. The next tip is usually the most effective way to get your score for free.

2. Get a free credit score from your credit card account online

If you have a credit card, it is likely that your card provider also gives you access to your credit score for free. Almost every major credit card issuer offers cardholders free information about their credit scores. Some companies give you a free FICO score while others give you a free VantageScore.

For example, Discover gives you access to your free FICO score while CapitalOne gives you free VantageScore.

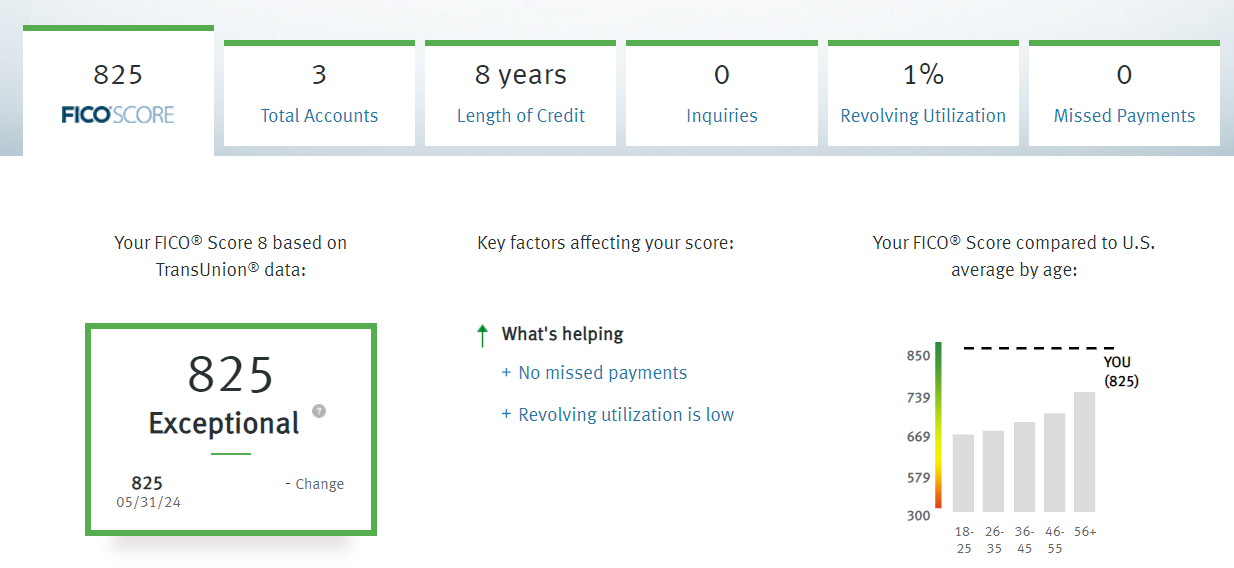

If you have a Discover credit card, here are steps to check your FICO score for free through your Discover online account.

- Go to discover.com

- Log into your account using your username and password.

- If you don’t have an account, create one by clicking the Register an Account button.

- After logging into your account, click on the Activity tab.

- At the bottom of the list, click on FICO® Credit Scorecard

You should see a page that looks like the following with your FICO score on it.

You should then see your FICO score information including all factors affecting your score. This information will include the age of your credit, how many accounts are on your credit reports, credit usage, payment history, and much more.

If you do not use Discover, create an account with your credit card provider and follow their steps. You can also call the card issuer and ask if they offer free credit score information.

What are other companies to get a free credit score online?

Discover is one of the best places to check your FICO score. If you don’t have a Discover credit card, there are other ways to check your credit score for free online.

Here is a list of other credit card issuers with free information about your FICO score. You will need a credit card account with these institutions to view your credit score for free.

- American Express credit cards: For a free FICO score

- Ally Bank: To check FICO score for free

- Bank of America: For free FICO score information

- Citibank credit cards: Gives Free FICO score

- CapitalOne: To check free VantageScore

- Some credit unions: FICO score

3. Purchase your credit score from one of the 3 major credit reporting bureaus

While you can get a free copy of your credit report from each major bureau, they don’t come with a free credit score. However, credit bureaus charge a small fee for credit score information.

Here is a list of all three major credit reporting agencies.

Each of these companies will give you a free copy of your credit report once in 12 months, according to the Federal Trade Commission (FTC).

Your credit report has all information related to your credit account activities such as the number of accounts, how much you owe, your lenders, the age of your credits, credit utilization, and personal information such as names, addresses, etc. To get a free credit report from each bureau, go to https://www.annualcreditreport.com/index.action and click on Request your free credit reports. This will open a new tab where you complete a credit report request form and pick the report you want to review.

After getting a copy of your credit reports, read it thoroughly and dispute any errors, inaccuracies, and fraudulent activities. While you don’t get a free credit score from credit bureaus, your credit report can give you an overview of your credit accounts which are essential in calculating your credit score. Memberships with credit bureaus usually come with free credit scores. Again, being a member costs you money, and as a consumer, it does not make sense to pay to view your credit scores if there are other ways to view them without paying.

4. Get a free credit score from Credit Karma

Another great way to check credit scores for free online is to create a free account on one of the many websites that offer credit score information. Credit reporting companies and third-party websites collaborate to provide users with free access to their credit score data. Before creating an online account, however, make sure the website is legit to avoid scams.

Credit Karma is among the greatest places to check your credit score online for free.

With Credit Karma, you don’t have to buy memberships or pay fees to access your credit score information. All you have to do is create an account and check your credit score for free as many times as you want. Credit Karma shows your VantageScore from Equifax and TransUnion.

While some people might argue that Credit Karma’s credit score is not accurate, this argument is not true as Credit Karma pulls its credit score information directly from TransUnion and Equifax. Additionally, the term accurate does not hold special meaning as credit scores vary based on information on your credit reports and the scoring models used to calculate them.

Why do I have different credit scores?

When you check your credit score for free or a fee, you will notice that you have different credit scores. This is because credit scoring agencies don’t use the same scoring models. For example, the FICO score is calculated using the FICO scoring model while the VantageScore is calculated using the VantageScore model.

It is also good to mention that even VantageScore from each credit reporting agency might not be the same. This is because each bureau has its proprietary algorithm for credit score calculations. Additionally, not every lender reports to all credit bureaus. This variation in scoring models and information in your credit reports leads to different credit scores.

Each credit score, however, is accurate as it represents information in your credit reports. The FICO or Vantage score you see online, might not be the same as your lender sees as different lenders use different score models tailored to their specific industries. However, as long as the information in your credit reports is accurate and up to date, the discrepancy between the score you see and what your lenders view will be minimal.

Extra credit score tips

Is Credit Karma score accurate: Which score is accurate for loans?

Why is having a high credit score better than a low one?

What are soft inquiries on a credit report and how to remove them?