If you want to transfer a traditional IRA to Fidelity, you will first need to have a traditional IRA with Fidelity. Once you have the IRA up and running, contact Fidelity and tell them you want to transfer an existing traditional IRA to your Fidelity IRA.

You can also complete the traditional IRA transfer to Fidelity online. Transferring an IRA to another brokerage company usually takes about 3 to 10 business days depending on your current company’s rules. If your Fidelity account administrator is transferring the account for you, you will need to know information about your Fidelity IRA and the traditional IRA you want to transfer. The most important information to know is the type of account you want to transfer to Fidelity, the account number, and the company you have it with.

Here is a step-by-step guide to transferring a traditional IRA to a Fidelity IRA.

Step 1. Open a traditional IRA with Fidelity

Before you transfer an IRA from one brokerage firm to another, you will need to have an account with the new broker. With Fidelity Investments, you can easily open a traditional IRA in a matter of minutes online. To open an IRA with Fidelity, you will need some basic information about yourself such as name, social security number, address, employer, beneficiary, and linking a bank account to your Fidelity IRA.

This process is the same as opening a Roth IRA with Fidelity.

Once your IRA account is open, you will then initiate the transfer process within your account. You can also contact Fidelity Investments and have them transfer your traditional IRA to Fidelity IRA for you. But, doing it online is very easy and takes a few minutes.

Here is how I transferred my IRA to Fidelity IRA.

Related posts:

Step 2. Contact your current account administrator

To complete the traditional IRA transfer to Fidelity, you will need to know your current IRA information. Before you initiate a transfer within your Fidelity account, contact your existing IRA provider and request your account number and the type of account you have. Additionally, request a copy of a recent monthly statement or download it from the account. You will need this information when completing the transfer inside your Fidelity IRA.

Step 3. Initiate the traditional IRA transfer within your Fidelity IRA

Once you have a traditional IRA open with Fidelity and have all the information regarding the IRA you want to transfer, you can then follow these steps to transfer your IRA to a fidelity IRA.

Initiate the transfer

God to: https://www.fidelity.com/customer-service/transfer-assets. Under the investment or retirement accounts tab, click on Start a transfer.

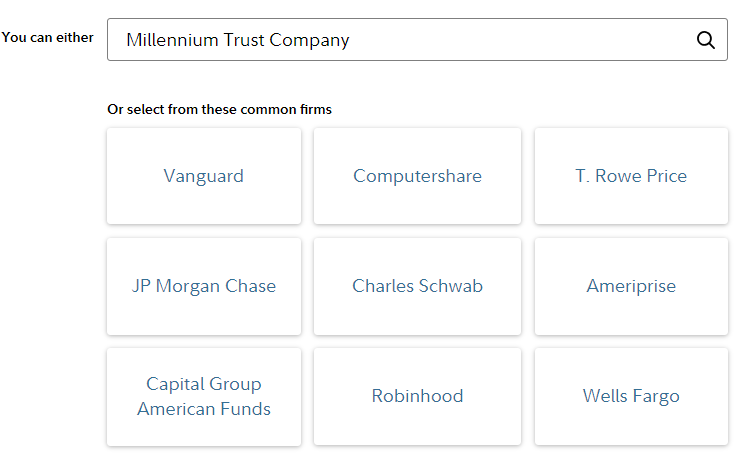

Select your current company

If your current firm is not among the following list, you can search for it in the search bar. After finding your current IRA provider, select it and click Next. For me, I selected Millennium Trust Company because I was transferring a Rollover traditional IRA to my Fidelity IRA.

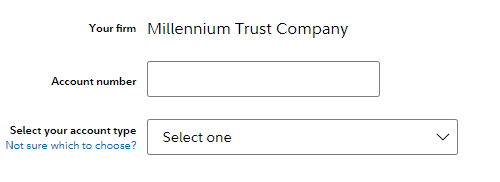

Enter information about the IRA you want to transfer to Fidelity

Enter your account number and type of IRA you are transferring. This is the same information you collected in Step 2. I selected a traditional IRA because that is what I was transferring to Fidelity. If you were transferring a different I account, you would select that exact account.

Click next. This is where you will decide if you want the money deposited into your Fidelity existing account or if you want to open a new one. I selected an existing account because I had a traditional IRA with fidelity already. If you have multiple accounts, Fidelity will show you which account is compatible with this specific transfer.

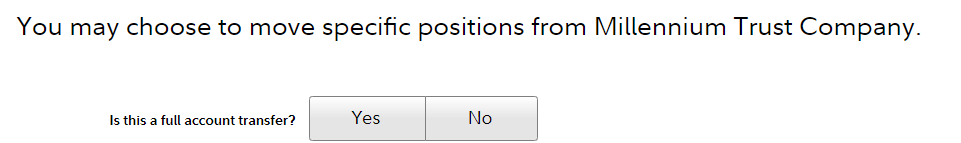

Decide the type of transfer you want

You will be asked if you are performing a full account transfer. This means your entire account balance will be deposited to Fidelity IRA. If that is the case, select yes and continue or no and specify the amount to be transferred.

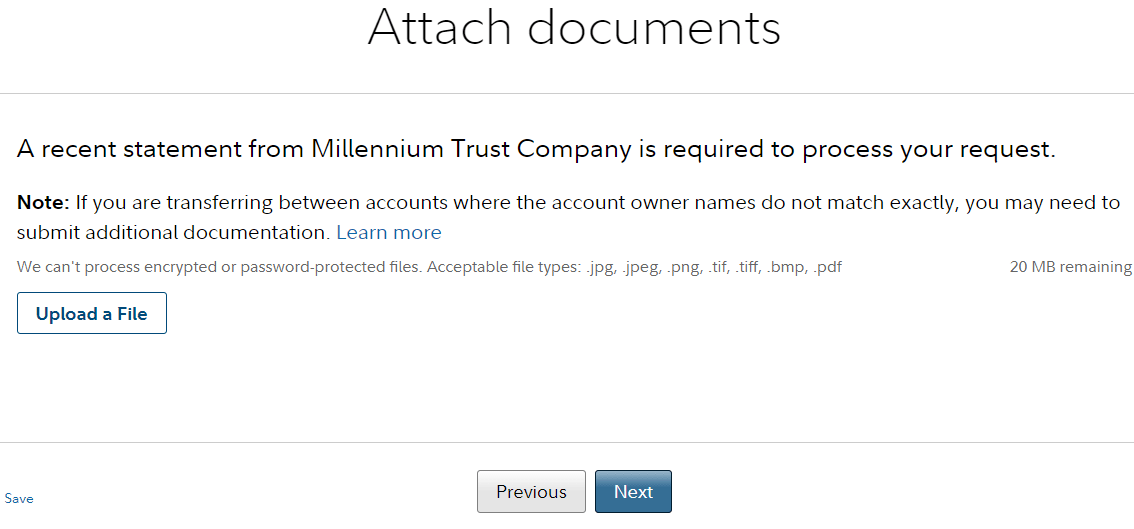

Attach the required documents(recent monthly statement)

Fidelity requires that you deposit a recent monthly statement from the account you want to transfer. You can request this statement from the company you are transferring from or log into your existing IRA and download it yourself from the documents tab. Once you have the statement, attach it to your Fidelity IRA transfer form, and then click Next.

Confirm your transfer details and sign your name

Fidelity will show you a summary of your transfer which includes the name of the company you are transferring a traditional IRA from, the type of account it is and its number, your Fidelity traditional IRA the money is being transferred to and its number, the type of transfer(full or partial), and attached documents. If everything is looking good, click on I agree and sign.

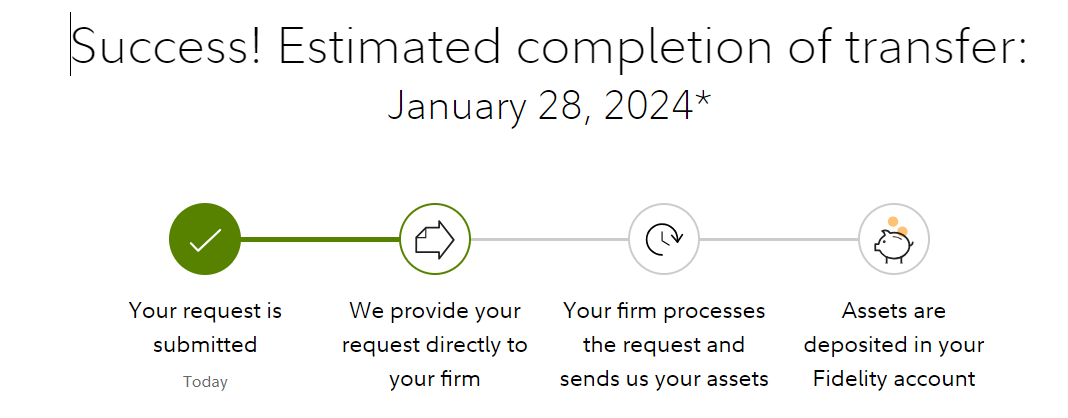

Submit the request and wait for the money to be deposited in your Fidelity IRA

After signing and submitting your form, you will receive a success message telling you the request has been submitted. The message also shows different steps Fidelity is going to follow to have your money deposited to your Fidelity IRA. These steps include providing your request to your company, followed by your company processing the request, and Fidelity depositing the money into your account. You also get an estimated time on when to expect the money in your account.

Does fidelity charge a traditional IRA to your fidelity IRA?

Fidelity does not charge a fee when you transfer a traditional IRA from another firm to a Fidelity IRA. If you close your fidelity IRA, however, you might be charged a $50 account closure fee. With a Fidelity traditional IRA, you pay no annual maintenance fee, and no commission for online US. stocks, ETFs, and Options trades. Additionally, you pay no transaction fee on most Fidelity Mutual funds, and your money grows tax-deferred until withdrawn during retirement.

Things to know before transferring an IRA to your Fidelity IRA

Transferring cash and other assets such as IRAs, to your Fidelity account is simple.

Here are a few things you need to know before transferring your retirement account, cash, and similar assets to Fidelity.

- Contact your other company and communicate with them about transferring the money

- Also ask them to give you the type of account you have such as 401(k) plan, Roth IRA, traditional IRA, etc.

- Write down your account number

- Have one or two recent monthly statements from your old company

- Ask your company if there are account closure fees or related account transfer charges

- Get ready to pay those charges. Most companies deduct account closure fees from the asset you want to transfer.

Can I transfer my IRA to Fidelity?

Yes, you can transfer your IRA to Fidelity and you can complete the entire process online for free. When you transfer assets to Fidelity, it usually takes about 3-5 business days to have the money in your account. Before you transfer your assets, however, the assets must be moved from and into a similarly registered account. For example, you can transfer a traditional IRA into a Fidelity traditional IRA but not a traditional IRA into a Roth IRA.